Ethereum vs. Solana: 5 Differences – Which Network is Better?

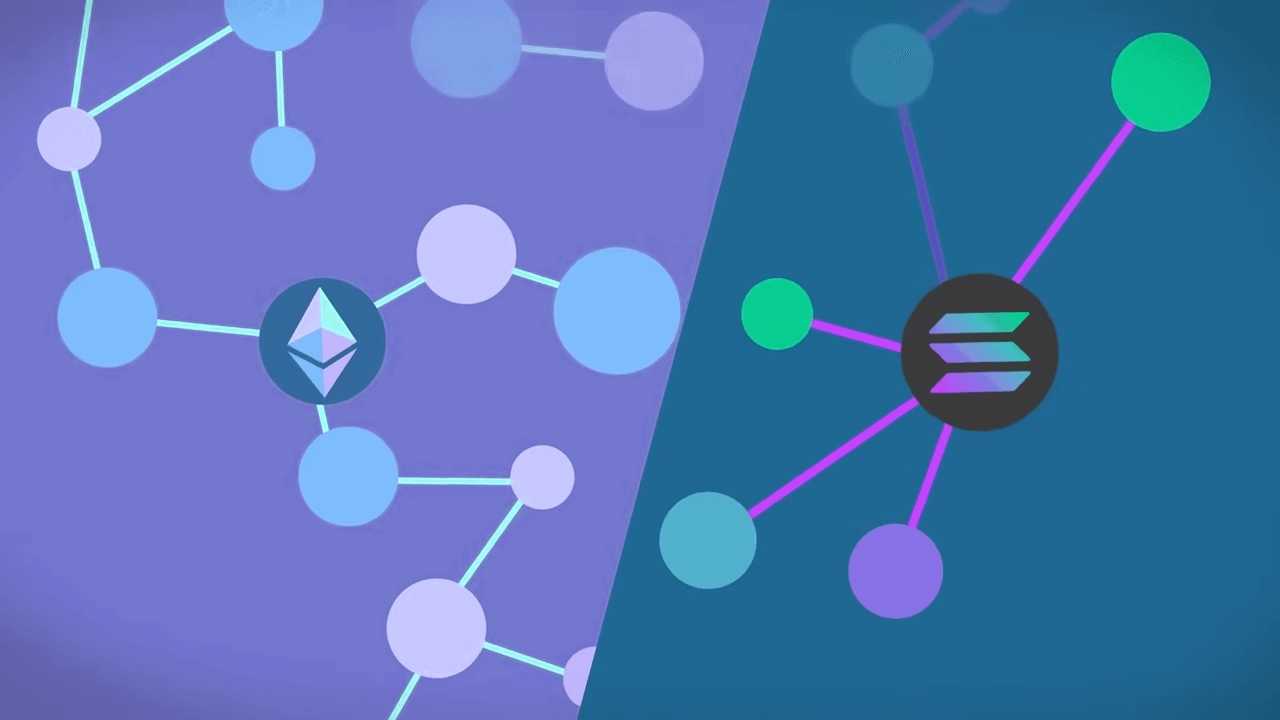

Ethereum and Solana are popular blockchain networks that support decentralized applications, but they work differently—Solana is optimized for speed, while Ethereum balances speed, security and decentralization.

| Criteria | Ethereum | Solana |

| Launch year | 2015 | 2020 |

| Consensus | Proof-of-Stake | Proof-of-Stake + Proof-of-History |

| Speed | 13–15 TPS | up to 65 000 TPS |

| Fees | ~ $0.08 - variable, can be high | ~ $0.002 - almost always low |

| Scaling | Layer-2 solutions (Optimism, Arbitrum, etc.) | Already implements parallel execution |

|

Number of |

over 1 million | about 1 000 |

| Native token | ETH | SOL |

| Support for smart contracts and dApps | yes | yes |

The takeaway: Ethereum launched five years earlier, so its developers did not foresee today’s scaling problems. High fees and slow transactions forced the community to build auxiliary Layer-2 networks that sit on top of Ethereum. These roll-ups cut costs and boost speed, but they also complicate the user experience.

Let’s dive deeper, starting with Ethereum as the original smart-contract pioneer.

Ethereum: the smart-contract pioneer

Smart contracts are self-executing programs that run without intermediaries.

Ethereum went live in 2015 after the concept was introduced by its founder, Vitalik Buterin.

Although development is ongoing, the network is considered mature and serves as the settlement layer for a large share of the crypto economy. Most top-100 stablecoins and tokens are issued on Ethereum or its Layer-2s.

Its rapid popularity created a serious scalability bottleneck.

Network congestion led to slow confirmations and sky-high gas fees, opening the door for alternative designs. One of the most prominent challengers became Solana.

Solana made transactions cheap and fast

Solana began in 2017 when former Qualcomm engineer Anatoly Yakovenko proposed a method to reach centralized-exchange-grade speed in a decentralized network.

The project first raised USD 25 million, then another USD 314 million—an unusually large war chest after main-net launch.

Initially positioned as a decentralized NASDAQ, Solana later expanded into stablecoins, payments and NFTs.

Bottom line: ETH arrived five years earlier and captured market share, but it struggles with scaling and high fees.

Let’s compare the technical differences.

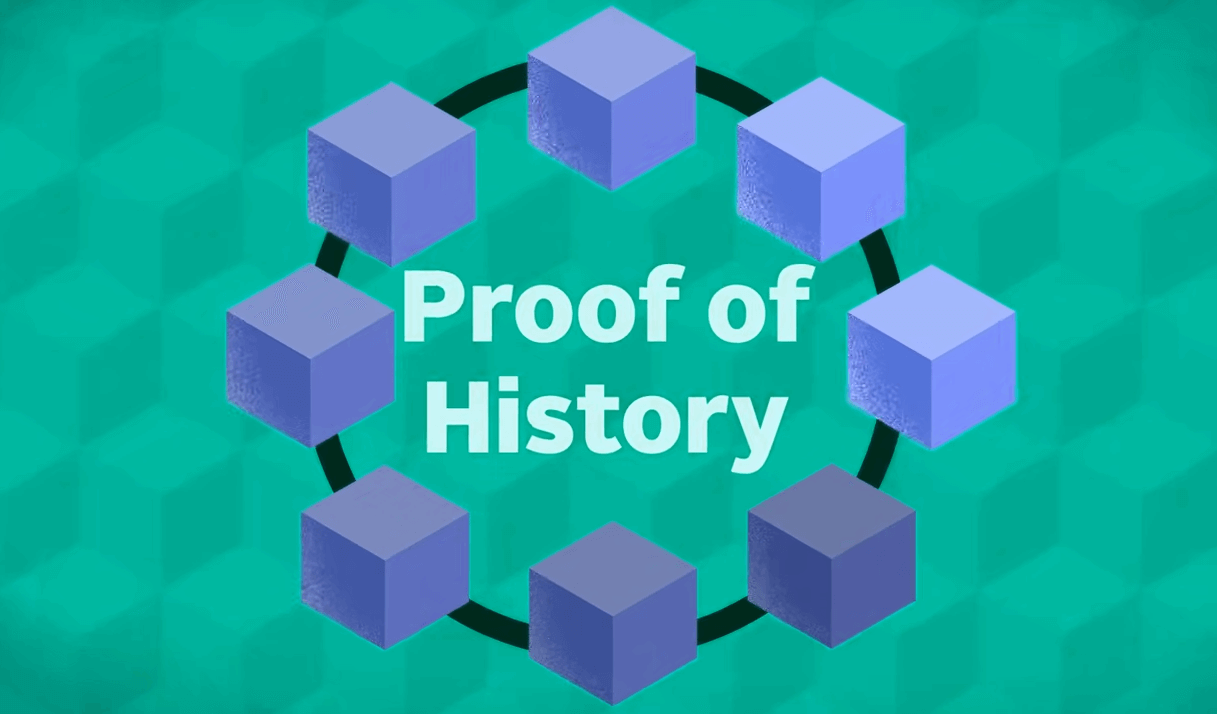

Different consensus mechanisms

The main distinction between Solana and Ethereum lies in how they agree on the truth.

- Ethereum relies on

Proof-of-Stake: the more ETH you stake, the higher the probability of being chosen to propose the next block. - Solana couples PoS with

Proof-of-History—a cryptographic timestamp that acts like a decentralized clock, allowing validators to process transactions in parallel without waiting for each other.

Takeaway: from a purely technical angle Solana’s validation scheme is newer and faster.

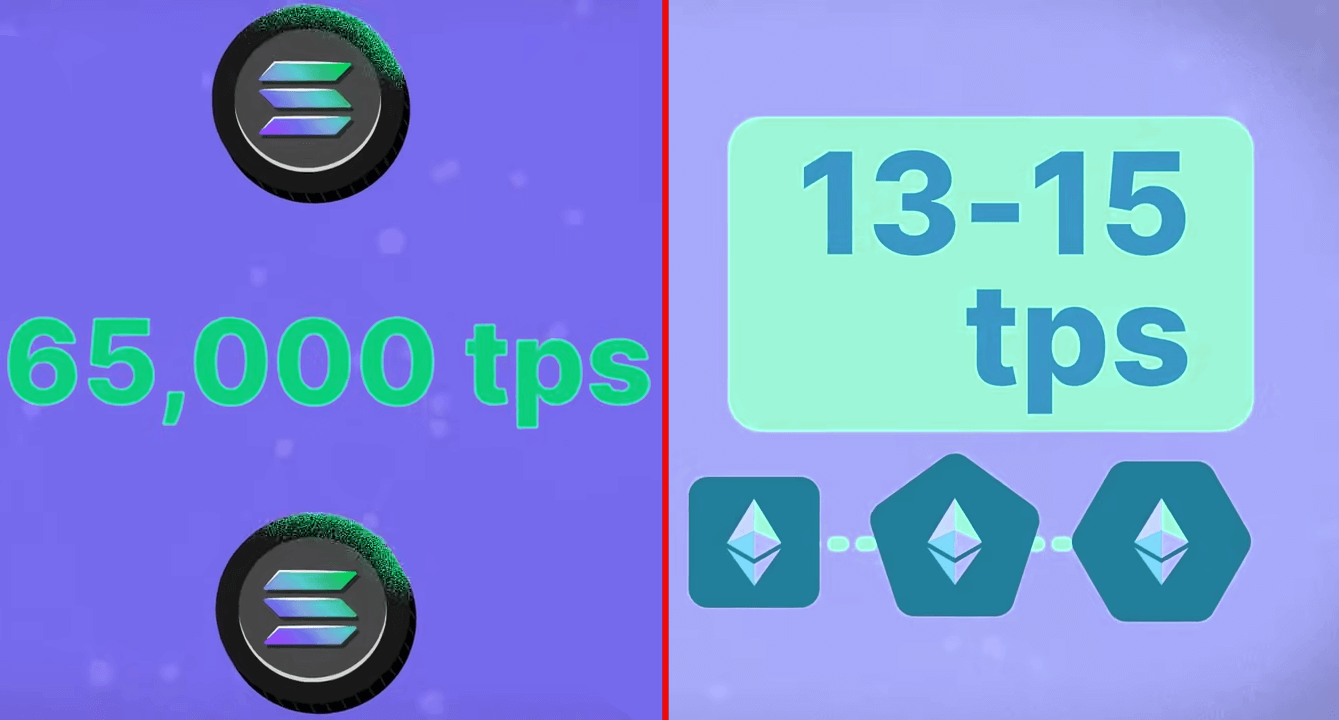

Transaction volume and fees

Solana’s architecture lets it process up to 65 000 transactions per second thanks to parallel execution, keeping fees below a cent. Ethereum, using a more sequential design, tops out at 13–15 TPS; gas prices spike whenever demand exceeds this narrow bandwidth.

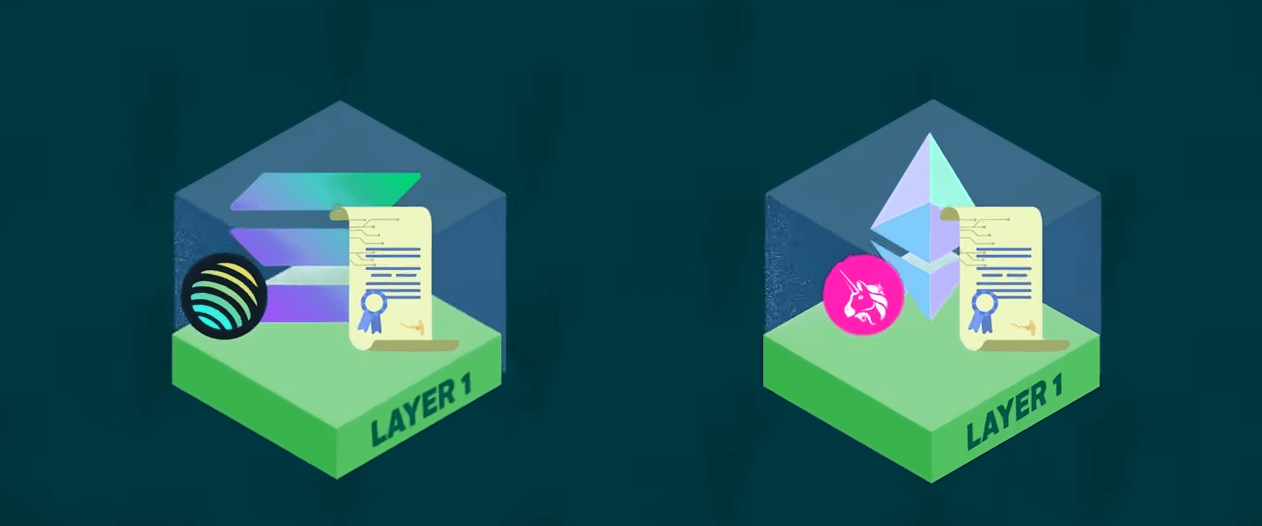

Ethereum counters with Layer-2 roll-ups such as Optimism and Arbitrum. These separate chains batch thousands of transactions off-chain and later anchor the proof to Ethereum, restoring affordability while inheriting its security.

Conclusion: Solana wins on raw speed and transaction cost.

Decentralization and security

Ethereum is widely viewed as more decentralized—and therefore more secure—with over one million validators. Solana’s validator set is roughly one thousand strong.

Solana’s blazing speed comes at the expense of a smaller validator pool and, by some measures, lower fault tolerance.

Verdict: Ethereum prevails on decentralization (1 million-plus ETH validators vs. ~1 000 on Sol).

Ecosystems and future outlook

Both chains host vibrant DeFi, NFT and gaming ecosystems. As the first mover, Ethereum still locks the largest total value (TVL) in on-chain protocols.

Solana, however, often rivals or even exceeds Ethereum in daily active addresses, transaction count and network revenue. Low fees have also carved out a sizeable share of the NFT minting market.

Wallet-wise, Ethereum enjoys a wide selection headlined by MetaMask; Solana counters with Phantom and a growing list of multi-chain wallets.

Final score: Ethereum leads in capital deposited, signalling investor confidence.

Common ground

Both are Layer-1 blockchains that run independently, support smart contracts and power open economies.

Each has a native token—ETH and SOL—used to pay for computation and to secure the network via staking.

Q&A

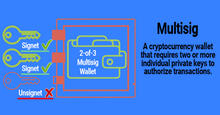

Is Solana compatible with Ethereum?

No. They are separate networks. Use bridges to move assets between them.

Will Solana replace Ethereum?

There will be no single winner, just as there is no single smartphone brand or operating system. The two projects follow different philosophies:

- Solana is the Usain Bolt of blockchains, trading some resilience and decentralization for maximum speed.

- Ethereum chooses a more balanced path, sacrificing some throughput for security and decentralization.

Both ecosystems will evolve, compete and likely coexist, offering users a spectrum of trade-offs among speed, cost, security and decentralization.

Which is better: TON, Solana or Ethereum?

From a developer standpoint Ethereum’s EVM remains the most mature environment for tooling and data persistence.

| Criteria | Ethereum (EVM) | TON |

| Data storage | Data lives forever; you pay gas only when you change it | Rent-based storage: every transaction pays rent proportional to idle time; contracts with zero balance can be frozen |

| Token creation | One registry contract with a simple address → balance mapping |

Each wallet gets its own balance contract; the master contract merely routes messages |

| Gas & throughput | 15 TPS base layer, expensive gas when congested |

Up to million TPS via sharding and parallel message processing |

| Dev complexity | Familiar synchronous code, huge community and libraries | Must design asynchronous logic, track message chains, store external snapshots |

Ethereum sacrifices performance for developer simplicity; TON does the opposite, delivering high throughput at the cost of more complex engineering and extra storage risk.

As for Solana, comparing only programming languages, Rust is miles ahead of Solidity and is widely used outside blockchain as a modern, fast language.

Disclaimer: nothing in this article constitutes financial advice. It is provided for educational purposes only.