Bitcoin Theft: TOP 50 Largest Thefts on Exchanges [2011-2025]

You'll learn about the thefts that occurred on the largest crypto exchanges, how many Bitcoins were stolen, and how they happen.

Some of the most well-known cases include the KuCoin, Bybit, and Mt. Gox hacks.

Spoiler: Sometimes, the exchange owners or employees are also to blame.

Hacking of the Mt. Gox exchange

- Date of hacking: June 19, 2011

- Stolen amount: 2609 BTC ($8,750,000)

The first largest hacking and theft of bitcoins took place on the Mt.Gox exchange.

The hacker managed to hack an audit account with administrative rights. As a result of phishing, he took possession of an administrative account, stole the private keys of the hot wallet from the wallet.dat file, changed the price of BTC by 1 cent, received user accounts of Mt.Gox, created sell orders and bought 2643 BTC at an artificially created price for customers ' money.

The hacker used the exchange's software to sell all the Bitcoins nominally, creating a massive buy order at any price. Within a few minutes, the price returned to its correct user value. Accounts with the equivalent of more than $ 8,750,000 were affected.

Bitomat

- Date of hacking: July 2011

- Stolen amount: 17,000 BTC

Once, due to an accidental hanging of the wallet during a server reboot, the exchange lost the keys to all BTC wallets, which led to the loss of 17 to BTC.

In a nutshell, Bitomat used Amazon Web Services Elastic Cloud Computing to host virtual machines; an AWS warning states that if an instance is disabled, all stored data may be lost forever.

It turned out that Bitomat stores backups and the current state of its wallet on an EC2 virtual machine, so perhaps they had little chance to return the old funds from the wallets.

Bitcoin7

- Date of hacking: October 6, 2011

- Stolen amount: 11,000 BTC

On October 6, Bitcoin7 posted a message on its website informing users that hackers had attacked the exchange. Hackers broke into the Bitcoin7 servers and got full access to the main BTC storage and 2 of the 3 backup wallets.

Today, the Bitcoin7 domain offers a fraudulent service for multiplying the amount of BTC. Are you still obsessed with hackers?

Again Mt.Gox

- Date of hacking: October 2011

- Stolen amount: 2609 BTC

The failure of Mt. Gox was gaining momentum in October 2011. The exchange lost another 2609 BTC due to a programming error. Simply put, Mt Gox accidentally created transactions that cannot be redeemed. They had the wrong script structure.

Hacking MyBitcoin

- Date of hacking: August 2011

- Stolen amount: 78,000 BTC

In August 2011, the MyBitcoin exchange announced that it had been hacked. This led to its closure and the payment of 49% on customer deposits. The exchange left more than 78,000 bitcoins (equivalent to about $ 800,000 at the time) unaccounted for.

Linode

- Date of hacking: March 2012

- Stolen amount: 3000 BTC + 43000

On March 1, the Linode web hosting was hacked, which led to the theft of 3,000 BTC from Slush and 43,000 BTC from the Bitcoinica exchange. At this point, security became the main concern of the BTC community.

Although people wanted to carry out their economic activities in cryptocurrency, they were concerned about the security of their money.

Bitcoinica

- Date of hacking: August 2012

- Stolen amount: 18,457 BTC

The theft of 43,000 BTC from Linode was not enough, and another 18,457 BTC was stolen from Bitcoinica reserves. CEO Zhou Tong was barely able to prevent the loss of another 30,000. The site was immediately closed for security reasons.

Vitalik Buterin, being at that time a writer and co-founder of Bitcoin Magazine, wrote:

"Unfortunately, given the financial stress that Bitcoinica was already under after the Linode theft two months ago, even this smaller loss turned out to be the straw that broke the camel's back."

And Vitalik was right, read the diagram below.

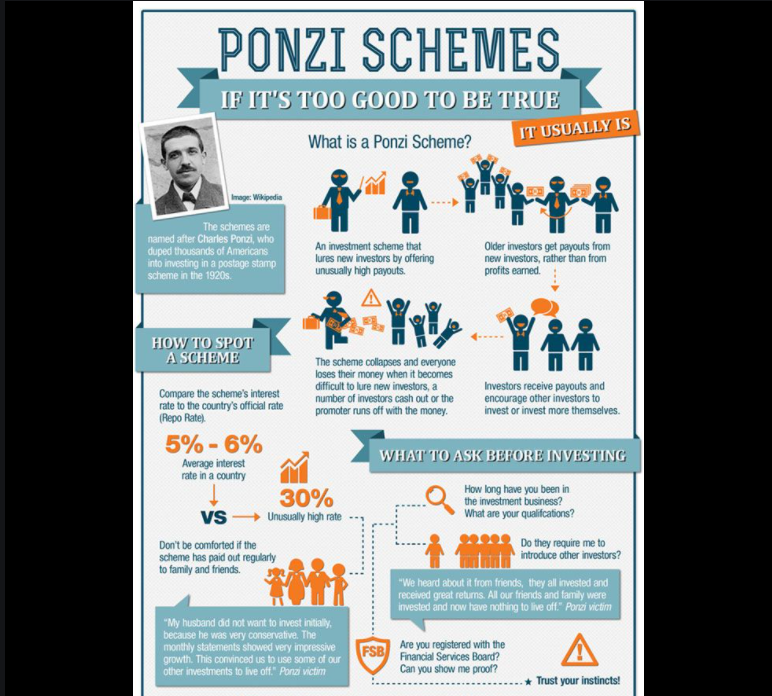

The "Ponzi" pyramid from Bitcoinica

- Date of hacking: August 2012

- Stolen amount: 40, 000 BTC

In early August 2012, a lawsuit was filed in a San Francisco court against Bitcoinica-a bitcoin trading exchange-for about $ 460,000.

In 2012, the Bitcoinica exchange was subjected to a hacker attack three times, which led to accusations that this place neglected the security of customers ' money and deceived them in withdrawal requests.

At the end of August 2012, the owner closed an operation called "Savings and Trust in Bitcoin", leaving about $ 5.6 million in debt on a bitcoin basis; this led to allegations that the operation was a Ponzi scheme. In September 2012, the US Securities and Exchange Commission launched an investigation into this case.

BTC-e

- Date of hacking: July 2012

- Stolen amount: 4,500 BTC

Here is the first proven story when exchange operators become greedy and profit from money that does not belong to them.

Alexander Vinnik, the operator of BTC-e, was arrested mainly for money laundering, but also for hacking computers. He was one of the employees who carried out DDoS attacks, stole API keys, initiated Liberty Reserve deposits and entered large amounts of dollars into the system, which were quickly sold for BTC.

BTC-e.com it was considered the gold standard of reliability.

Bitfloor

- Date of hacking: September 2012

- Stolen amount: 24,000 BTC

In September 2012, the Bitfloor exchange also reported that it had been hacked, stealing 24,000 bitcoins (worth about $ 250,000). As a result, Bitfloor suspended its work. In the same month, Bitfloor resumed operations; the exchange's founder said that he had reported the theft to the FBI and that he planned to pay the money to the victims, although the repayment dates are unclear.

Instawallet

- Date of hacking: April 3, 2013

- Stolen amount: 35,000 BTC

On April 3, 2013, Instawallet, a web wallet provider, was hacked, resulting in the theft of more than 35,000 bitcoins, which were valued at $ 129.90 per bitcoin at the time, or almost $ 4.6 million in total. As a result, Instawallet suspended its activities.

Vircurex

- Date of hacking: October 2013

- Stolen amount: 1454 BTC

In 2014, the exchange declared bankruptcy after losing significant reserve funds. Part of the losses came from "two alleged hacks that occurred in mid-2013."

As a result, Vircurex froze the withdrawal of BTC, LTC, FTC and TRC. At that time, the company announced that it would start paying users using its profits. The exchange returned a small amount of cryptocurrency to several of its clients, but most of the funds owed remained on the exchange.

Silk Road (trading platform)

- Date of hacking: October 2013

- Stolen amount: ~1,606 BTC

The Silk Road is located in the Tor network, it can be called an alternative on eBay or on Amazon, but also for the sale of illegal goods such as heroin, weapons, pornography, etc. All payment transactions were made in BTC, and Silk Road was an intermediary connecting users and charging commissions for their illegal transactions. During the two years of the market's existence, the total volume of transactions amounted to 9.5 million . BITCOIN .

Soon the FBI became interested in the "Silk Road". In 2015, the company's founder, Ulim Ross Ulbricht, was sentenced to life in prison for many crimes, including hacking attacks and conspiracy to launder money.

The story does not end there, since the secret service agent who conducted the case himself eventually stole the "dirty" BTC.

Inputs.io

- Date of hacking: October 2013

- Stolen amount: 4100 BTC

In October 2013 Inputs.io, an Australian bitcoin wallet provider was hacked and 4,100 bitcoins, worth more than $ 1 million at the time of the theft, were stolen. The service was launched by the operator TradeFortress. The Coinchat associated with this Bitcoin chat has been taken over by a new administrator.

Global Bond Limited

- Date of hacking: October 26, 2013

- Stolen amount: 5,000,000 USD

On October 26, 2013, the Bitcoin trading platform in Hong Kong, owned by Global Bond Limited (GBL), lost 30 million yuan ($5 million) from 500 investors.

BitCash

- Date of hacking: November 2013

- Stolen amount: 484 BTC

On November 11, the Czech cryptocurrency exchange was subjected to a hacker attack that emptied the wallets of 4,000 users.

The servers of the websites were hacked to conduct a phishing attack using fraudulent emails on behalf of BitCash to deceive users. The fake emails claim that BitCash allegedly resorted to an American recovery company to return the BTC that was stolen.

The recipients were asked to send 2 BTC to the wallet address to return their BTC. However, the BTC address specified in the text of the email was not used by the exchange and did not conduct transactions.

The Final Fall Mt. Gox

- Date of hacking: February 2014

- Stolen amount: 390,000,000 USD

Mt. Gox, a Japanese exchange that handled 70% of all global bitcoin traffic in 2013, declared bankruptcy in February 2014 when, for unclear reasons, about $ 390 million worth of bitcoins went missing.

For 2 years (2012-2013), the hacker emptied wallets, but Mt. Gox interpreted the expenses as deposits, crediting up to 40,000 additional BTC to some users.

The CEO was eventually arrested and charged with embezzlement.

Flexcoin

- Date of hacking: March 3, 2014

- Stolen amount: 600,000 USD

On March 3, 2014, Flexcoin announced that it was closing its doors due to a hacker attack that occurred the day before. In a statement that now occupies their homepage, they announced on March 3, 2014 that:

"since Flexcoin does not have the resources, assets or can not otherwise cope with the hacking, we are immediately closing our doors. Users can no longer log in to the site."

Poloniex

- Date of hacking: March 4, 2014

- Stolen amount: 12.3% of all BTC (97 BTC)

Hackers were able to use the faulty Poloniex withdrawal code.

Shortly after the hack, Poloniex suspended its activities for some time and announced on the forum that the funds of all Poloniex holders would be reduced by 12.3%. This was done because many users would simply withdraw their funds.

Mintpal

- Date of hacking: Autumn 2014

- Stolen amount: 3894 BTC

MintPal was considered one of the best trading platforms until the management changed in the fall of 2014. The company was sold to Moopay executive director Ryan Kennedy, known under the pseudonym Alex Green.

During the internal work, he stole 3894 BTC and bankrupted the exchange. It is noteworthy that a few months after the withdrawal of funds, Kennedy was sentenced to 11 years in prison for rape, and the sentence did not contain a clause about the theft of $ 1.5 million in BTC.

Bitstamp

- Date of hacking: January 4, 2015

- Stolen amount: 19,000 BTC

The first licensed cryptocurrency exchange in Europe, Bitstamp, which is regulated by the Luxembourg Financial Supervisory Authority (CSSF), was hacked in January 2015. Hackers sent a malicious file to the internal email of employees.

One of the Bitstamp employees ignored security rule No. 1 - do not open files from strangers and clicked on a link on a device that has access to the exchange's BTC wallet. As a result, 19,000 BTC was stolen, or about $ 5,100,000 on the day of the theft.

Well, we continue, because the most interesting hacks are still ahead!

LocalBitcoins

- Date of hacking: January 2015

- Stolen amount: 17 BTC

17 BTC does not seem to be a large amount compared to the compromised exchanges above; however, it is another argument in favor of paying attention (and allocating money) for cybersecurity.

Nikolaus Kangas, vice president of LocalBitcoins, explained:

"The attacker used access to LiveChat to distribute a kind of Windows executable file, which was probably a new kind of keylogger software that has not yet been detected by virus protection mechanisms. If the user installed this executable file using social engineering, the attacker managed to gain access to various accounts of these victims."

Three users lost funds during the hack. The company said that one of the possible reasons for the fraudulent withdrawal was the lack of 2FA. Again, 2FA is a reliable security measure that should be applied on every cryptocurrency exchange platform.

796

- Date of hacking: January 2015

- Stolen amount: 1,000 BTC

What seemed to be a mistake turned out to be a well-thought-out and accurate attack. At the end of January, the server of the Chinese cryptocurrency exchange 796 was hacked. According to the explanation, the hacker gained access to the submodule and forged the clients ' output addresses with his own.

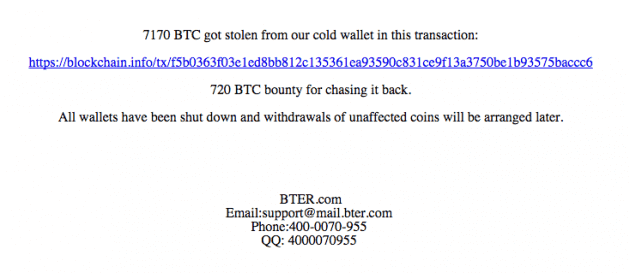

Bter

- Date of hacking: February 15, 2015

- Stolen amount: 7,170 BTC

Another attack related to an employee error occurred in China. The small Bter exchange was hacked several times. The exchange employees themselves organized the largest robbery. In February 2015, 7000 BTC was stolen from a cold wallet. After that, all the company's activities were suspended, and only a couple of years later, the management of Bter resumed withdrawing funds from its assets.

KipCoin

- Date of hacking: July 14, 2015

- Stolen amount: 3000 BTC

As the owner of the exchange platform, do you immediately admit the violation or delay the news until the investigation gives you more detailed information? The owners of KipCoin chose the second option.

Remember Linode hosting? In 2015, it became clear that in June 2014 it was hacked again, which led to the hacking of the KipCoin server. Hackers changed the password of the Linode account, excluding the owners ' access to it; this led to a change in the root password for KipCoin Linode, as hackers gained control of the entire platform.

For a month, the exchange administration tried to restore control, and they succeeded (surprisingly, nothing bad happened during this month).

But this does not mean that the hackers have left, they have disappeared. In October 2014, hackers gained access to the funds because the exchange did not change its BTC private keys.

KipCoin decided not to disclose this information immediately in connection with a similar BitStamp hack and took all necessary measures to file an official statement to the police.

Cryptsy

- Date of hacking: July 14, 2015

- Stolen amount: 11,325 BTC and 300,000 LTC

The American exchange Cryptsy declared bankruptcy in January 2016, allegedly due to a hacking incident in 2014; a court-appointed receiver later claimed that the CEO of Cryptsy himself stole $ 3.3 million.

According to the official version, in July 2014, an attacker under the pseudonym "Lucky7Coin" inserted a Trojan code into the code of the Cryptsy exchange. The hacker gained access to the BTC and LTC keys. As a result, the criminal (s) received 13,000 BTC and 300,000 LTC.

Interestingly, the exchange's administrators were familiar with the fraudster. The attacker sent an email two months before the break-in, posing as Jack and saying that the previous owner of this alias had died.

The company's owner, Paul Vernon, was accused of destroying evidence of illegal activity and stealing 11,000 BTC. Cryptsy customers believe that the currency could have been laundered through another exchange-Coinbase.

Cointrader

- Date of hacking: March 28, 2016

- Stolen amount: unknown

Hacking or Exit scam? This is a question that users often ask when the exchange unexpectedly closes.

On March 28, Cointrader joined the graveyard of allegedly hacked exchanges by sending its users the following message:

"Dear Cointrader customer,

A recent internal audit revealed a shortage of bitcoins in our wallets, which led to a delay in the withdrawal of funds. This issue is currently being investigated, and we intend to restore the balance of funds in your account as soon as possible. We sincerely apologize for this annoying inconvenience and will keep you informed about the progress of work on this issue. In the meantime, we have suspended deposits, withdrawals and trading activities until this issue is resolved.With respect,

"Cointrader.net" - support"

The close was followed by a low daily trading volume - only 81.43 BTC for the next 6 months. The number of affected users was not reported.

ShapeShift

- Date of hacking: March 14, 2016

- Stolen amount: 469 BTC + 5800 ETH + 1900 LTC

The ShapeShift story is a great example of the work of an insider or a disloyal employee.

On March 14, an employee stole 315 BTC from the company. When the theft was discovered, he was fired. However, the losses did not stop there: on April 7, an additional 97 BTC, 3600 ETH and 1900 LTC disappeared. The site was disabled and incident response measures were taken, and then an additional 57 BTC and 2200 ETH were stolen!

The report says:

"Since no direct evidence of a specific attack vector was found during the digital forensic investigation, an analysis of the available facts was carried out to identify all possible attack vectors that correspond to the facts. It was noted that the attacker managed not only to compromise both infrastructures quickly enough, but also to identify his IP addresses equally quickly."

Gatecoin

- Date of hacking: May 16, 2016

- Stolen amount: 4,320 BTC (250 BTC and 185,000 ETH)

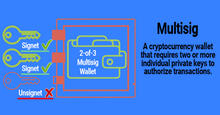

Gatecoin was one of the first regulated cryptocurrency exchange platforms. She offered to purchase ETH-based tokens for voting and financing development proposals during the crowdsale for The Dao, and after the hack, she promised to create a portal for withdrawing DAO-related tokens and paper currencies. The exchange was well-known and significant at that time, so it is not surprising that it attracted the attention of intruders.

Gatecoin stated:

"Earlier, we reported that the funds of the crypto assets of most customers are stored in cold wallets with multi-signatures. However, a malicious external party involved in this violation managed to change our system so that ETH deposit transfers bypassed the multi-network cold storage and got directly into the hot wallet during the violation period. This means that the losses of ETH funds exceed the 5% limit that we have imposed on our hot wallets."

In May 2016, the Gatecoin exchange temporarily closed after a hack led to the loss of about $ 2 million worth of cryptocurrency. Subsequently, the site resumed its work in August 2016 and is gradually compensating for the damage to its customers.

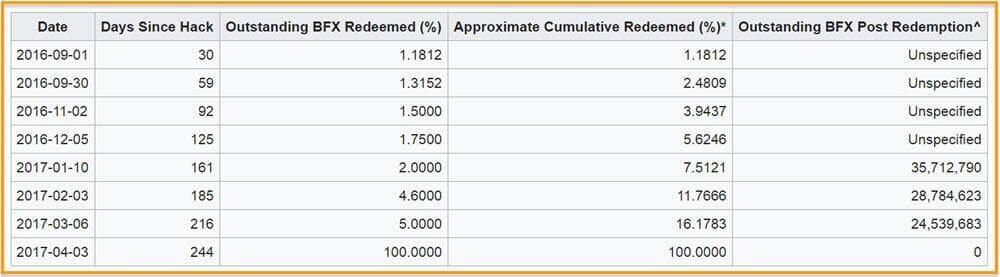

Bitfinex

- Date of hacking: August 2016

- Stolen amount: 120 000 BTC

The Hong Kong-based company has stated that it is the most reliable and secure cryptocurrency exchange, where wallets with multiple identifiers are selected for each client. It turned out to be just a matter of marketing.

In August 2016, cybercriminals stole 120,000 BTC. The main leak of funds occurred through the BitGo processing service, with which Bitfinex collaborated.

It was the second largest Bitcoin hack ever made after Mt. Gox.

But the good thing is that Bitfinex issued BFX tokens for victims that could be exchanged for dollars, and, consequently, most of their investors returned their money slowly and steadily according to the schedule below.

And below we will look at the remaining most daring hacks of cryptocurrency exchanges!

QuadrigaCX

- Date of hacking: June 2016

- Stolen amount: 67,000 ETH

Some errors do not harm the users of the cryptocurrency exchange, but its owners. Due to a programmer error, the Canadian exchange platform lost 67 thousand ETH.

In an official statement, QuadrigaCX explained that the error occurred after updating Geth (wallet and client for Ethereum-author's note). Speaking in technical terms:

"The programmer called a function in the splitter smart contract with a corrupted transaction data payload, which was the result of an inability to prefix a certain value with 0x (which is necessary to specify a string encoded in hexadecimal code)."

Bithumb - hacking the first

- Date of hacking: June 29, 2017

- Stolen amount: $ 8,700

On June 29, the exchange employee's computer was hacked and it was confirmed that the users ' personal data had leaked.

Later, users reported losses of 10 million won ($ 8,700) in cryptocurrency.

Nicehash (a market for selling hash mining power)

- Date of hacking: December 2017

- Stolen amount: 4700 BTC ($80 million)

Nicehash was not an exchange, but a cryptocurrency miner with an integrated market; however, the story also belongs to the list of cryptocurrency thefts.

People rented out their computing power to those who wanted to mine crypto currency without investing in equipment. It turned out that people paid for coins that went directly into the pockets of hackers.

The Slovenian company gave an additional comment:

"It is important to note that our payment system was hacked, and the contents of the NiceHash bitcoin wallet were emptied. We are working to verify the exact number of stolen BTC. It is clear that this is a matter of deep concern, and we are working hard to correct this in the coming days. In addition to conducting our own investigation, the incident was reported to the relevant law enforcement agencies, and we are cooperating with them as a matter of urgency."

In December 2017, hackers stole 4,700 bitcoins from the Nicehash platform, which allowed users to sell the hashing power of video cards. The value of the stolen bitcoins was about $ 80 million. This is one of the largest hacks in the history of BTC.

In August, the company announced the return of 60% of the stolen coins. And on December 19, 2019, NiceHash froze the program of payments of funds for victims of hacking in 2017. – There is no money, but you are holding on, as they say.

Coincheck

- Date of hacking: January 26, 2018

- Stolen amount: 523,000,000 NEM

Another major hack occurred at CoinCheck, the leading Japanese cryptocurrency platform. Hackers outside the country infected the exchange's internal network with a virus that was transmitted by email, and this allowed them to steal private keys.

As a result, 523 million NEM coins worth $ 533 million were stolen at the time of the theft.

The incident occurred due to the neglect of storing this cryptocurrency, since the Coincheck exchange did not use smart contracts with multiple signatures, and all coins were stored on the same wallet.

Bithumb - hacking the second

- Date of hacking: June 19, 2018

- Stolen amount: Cryptocurrencies worth $ 30 million

The site did not provide details of the attack. However, a few days before the hack, Bithumb said on Twitter that they were "transferring all assets to a cold wallet to create a security system and update" their database.

BitGrail

- Date of hacking: February 2018

- Stolen amount: 17,000,000 NANO

More than $ 170 million in 2018 was stolen from the Italian cryptocurrency exchange BitGrail.

According to the owner Francesco Firano, 17 million XRB (Nano / RaiBlock) were withdrawn from accounts as a result of"unauthorized transactions".

Representatives of Nano denied this information and stated that there were no errors.

It is worth noting that the remaining tokens stored on the exchange were not affected.

After the attack, BitGrail declared itself bankrupt.

CoinSecure

- Date of hacking: April 9, 2018

- Stolen amount: 438 BTC

As we already know, the exchange's employees can take advantage of their position and receive significant amounts. In April 2018, the Indian exchange Coinsecure lost 438 BTC or $ 3.5 million.

The company's owners assume that CoinSecure CSO (security director) committed a hack when extracting BTG. The suspect denied his guilt and claimed that:

"the funds were stolen during some kind of attack."

Coinrail

- Date of hacking: June 10, 2018

- Stolen amount: 1927 ETH, 2.6 billion NPXS, 93 million ATX, 831 million DENT + a significant number of six other tokens

Despite the fact that Coinrail is a small exchange in South Korea, it was a tempting target, given the amount of money passing through it. Hackers found out and stole 1927 ETH, 2.6 billion NPXS, 93 million ATX, 831 million DENT coins and other tokens.

The authorities did not give many details and called the attack a "cyber invasion", as a result of which many ERC-20 tokens were stolen from the exchange.

Zaif

- Date of hacking: September 14, 2018

- Stolen amount: 5,966 BTC

The hack led to the theft of $ 60 million in BTC, BCH and MonaCoin. Oddly enough, the exact number of stolen BCH is unknown, which inspires the Zaif exchange to improve security measures in the future.

Zaif has already opened a criminal case with local authorities; apparently, due to the fact that the hacker got unauthorized access to the funds, perhaps the employee himself became a fraud?

MapleChange

- Date of hacking: October 28, 2018

- Stolen amount: 913 BTC

A small Canadian exchange called MapleChange has had a modest trading volume of about $ 67,000 per day since its launch in May 2018. In October, they claimed that they were hacked or suffered from an error that led to all customer deposit funds being withdrawn.

On October 28, they made a strange statement that they had to delete all their social media accounts during the investigation. Without details about their team or whether they are allowed to work under the law, the "hacking" smells like an organized scam and an exit scam.

Pure Bit

- Date of hacking: November 2018

- Stolen amount: $ 30,000,000 (ICO + 13,000 ETH)

Pure Bit raised more than $ 30,000,000 in an ICO to create a cryptocurrency exchange in South Korea, but then they made a fraudulent transaction.

Pure Bit even tried to go further and sell some of the stolen funds on UpBit. Fortunately, UpBit quickly froze the account, knowing that the funds are fraudulent.

Pure Bit's website is now unavailable, and its KakaoTalk account has been renamed to a phrase that roughly translates to " I'm sorry."

QuadrigaCX

- Date of hacking: December 2018

- Stolen amount: 26,350 BTC

One of the most mysterious hacks in our list of cryptocurrency thefts occurred in December 2018.

The owner of QuadrigaCX, Jerry Cotten, died suddenly; he was the only one who had access to the exchange's cold wallets.

Interestingly, at the time of the announcement, users had been trying to withdraw funds for several months, and rumors of bankruptcy spread quickly.

When the audit and consulting company Ernst & Young started the audit, they found that there had never been more than 100 BTC on the cold wallet. QuadrigaCX has started bankruptcy proceedings, having owned more than 26,000 BTC of its customers.

There is a conspiracy theory that Jerry Cotten is still alive and that the QuadrigaCX case is nothing but a scam.

HitBTC

- Date of hacking: January 2019

- Stolen amount: unknown

It is important to note that the HitBTC hack occurred before the annual Proof Of Keys event.

Users complained on Reddit and on other social media platforms, saying that the HitBTC exchange blocks all attempts to withdraw funds.

Cryptopia

- Date of hacking: January 13, 2019

- Stolen amount: at least 19,390 ETH

The first message from Cryptopia was that they went for an unscheduled maintenance to solve a technical problem. Later, the exchange clarified on Twitter that they had suffered from a security breach.

Cryptopia said they had reported the hack to the relevant New Zealand authorities. The full amount of the lost funds is unknown; however, 19,390 ETH were transferred to an unknown wallet. Since Cryptopia was a fairly small exchange, the possibility of internal theft is one of the versions.

Cryptopia. Act 2

- Date of hacking: January 28, 2019

- Stolen amount: 1675 ETH

After the January 13 hack, Cryptopia was re-hacked 15 days later. This confirms that the exchange no longer controlled its wallets.

Coinmama

- Date of hacking: February 2019

- Stolen amount: 450,000 thousand emails and user passwords.

Coinmama is one of the largest crypto exchanges, serving a total of 1.3 million active users.

On February 15, their customer base was hacked, which led to the leak of more than 450 thousand user emails and passwords.

We can only assume how confidential data could have been used: to gain access to cryptocurrency exchange accounts or to sell on the black market for other purposes.

Bithumb - hacking 3

- Date of hacking: March 29, 2019

- Stolen amount: 3 million EOS ($12.7 million) and 20 million XRP ($6.2 million)

Bithumb is going for a record. The site was hacked for the third time in two years.

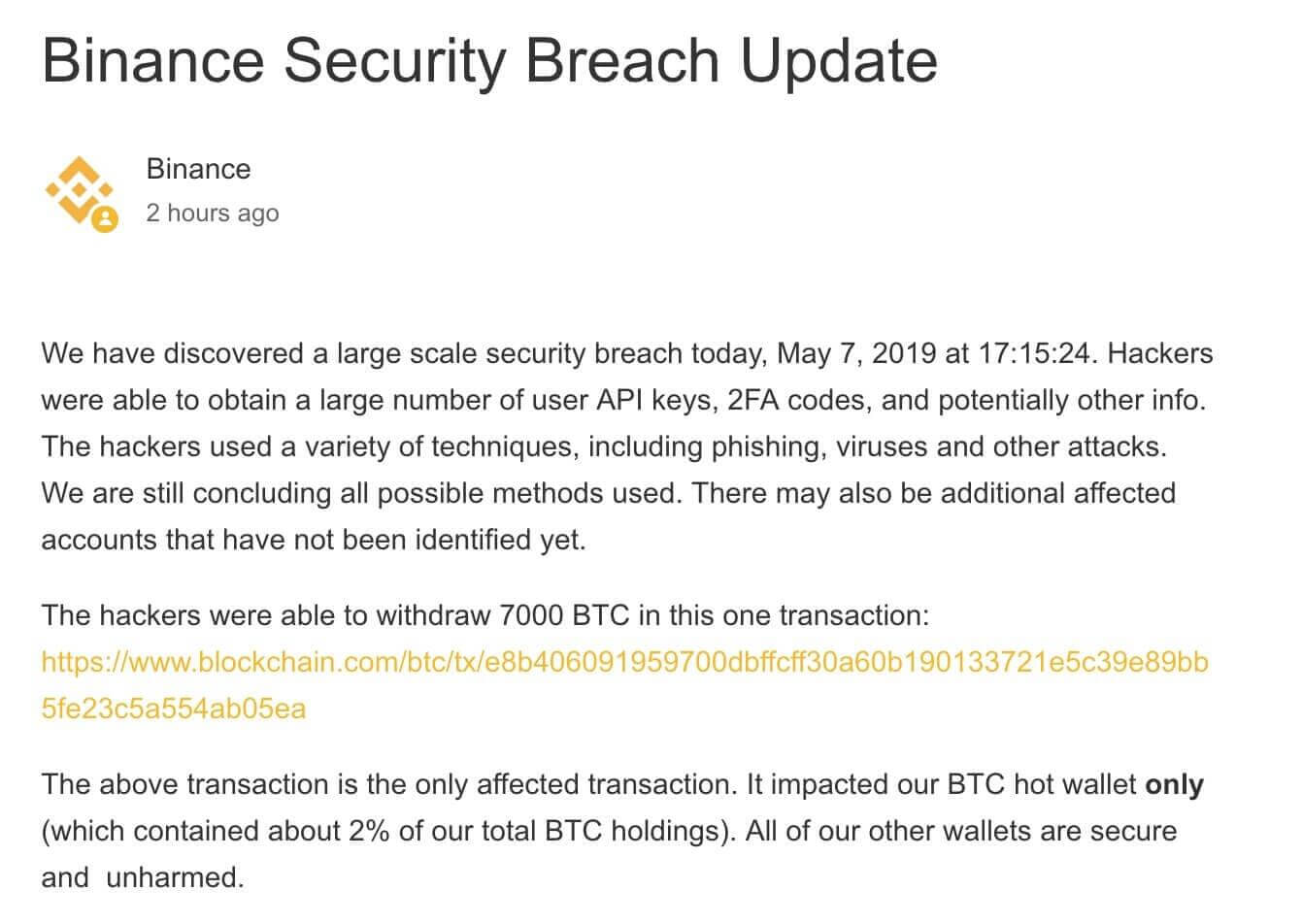

Hacking Binance

- Date of hacking: May 7, 2019

- Stolen amount: 7000 BTC ($40 million)

The Binance cryptocurrency exchange is the most popular exchange in 2020. However, on May 7, 2019, Binance was hacked and lost about 7,000 bitcoins.

At the time of the hack, it cost about $ 40 million. However, the Binance exchange has announced that they will cover all the lost funds from their funds, and no user will be affected by this hack.

"We discovered a major security breach today, May 7, 2019, at 17: 15: 24. Hackers managed to obtain a large number of user API keys, 2FA codes and, possibly, other information. Hackers used various methods, including phishing, viruses and other attacks. The attackers were able to withdraw 7000 BTC in one transaction."

They also noted that other information that could potentially relate to the theft of customers ' personal data was compromised. One of the possible solutions for recovering funds was a hard fork of the BTC network.

Altsbit

- Date of hacking: February 6, 2020

- Stolen amount: 6,929 BTC, 2,321 ETH, 1,066 KMD, 414,154 VRSC, 3924082 ARRR ($70,000)

According to the exchange's Twitter page, on February 6, hackers managed to gain access to the trading platform's hot wallets overnight, which allowed them to steal "almost all" of the funds available to it. Using the funds stored in cold wallets, the exchange will reimburse users for all remaining coins.

Pancake Bunny

On May 20, 2021, the decentralized exchange (DEX) "Pancake Bunny" was hacked. Their internal BUNNY token was stolen.

The actual damage was accurately calculated and amounted to $ 45 million (at the exchange rate of the cryptocurrency at the time of the hack).

The hacker was able to steal 6.9 million BUNNY tokens and immediately began selling them on exchanges! Because of this, the BUNNY token fell by 95%!

PancakeBunny was able to get back to work very quickly, and in the next 90 days (after the hack) they promised to return 100% of the stolen funds! In addition, PancakeBunny promised to compensate the owners of BUNNY for the difference in the market capitalization at the time of the theft and the current value.

PancakeSwap

The decentralized crypto exchange PancakeSwap was attacked by hackers on March 15, 2021.

Cream Finance said that its DNS (domain name service) was " hacked by a third party." PancakeSwap's Twitter account then confirmed that it had been attacked using the same mechanism.

"DNS interception" is when an attacker redirects traffic to a malicious server.

This is now confirmed.

— PancakeSwap #BSC (@PancakeSwap) March 15, 2021

DO NOT go to the Pancakeswap site until we confirm it is all clear.

NEVER EVER input your seed phrase or private keys on a website.

We are working on recovery now.

Sorry for the trouble. https://t.co/JN7TXlo9od

Unlike a traditional exchange, where assets are traded through a central authority (for example, Coinbase or Binance), a decentralized exchange uses smart contracts (in fact, just code) that allow money to move directly between traders. Decentralized exchanges, as a rule, fall under the category of DeFi protocols.

It is important to note that PancakeSwap smart contracts were not hacked. This attack affected only the front-end part of the website.

Africrypt

A pair of young South African brothers, Amir and Rais Kadji, developed Africrypt in 2019. This cryptocurrency trading platform managed to attract a massive amount of Bitcoin from investors in a short period, with the brothers promising substantial returns on investment.

But that was not meant to be, as Africrypt turned out to be nothing more than a Ponzi scheme.

Amir and Rais Kadji vanished in 2021 with over $3.6 billion in Bitcoin, committing one of the largest crypto crimes of all time.

South African authorities are still investigating the incident, trying to locate Amir and Rais Kadji along with the enormous sum of money that disappeared with them.

CREX24

In early 2023, the cryptocurrency exchange CREX24 simply closed down – it absconded.

It didn’t announce its closure; it simply wiped its website along with all the users’ funds!

This exchange is yet another example of a scam trading platform!

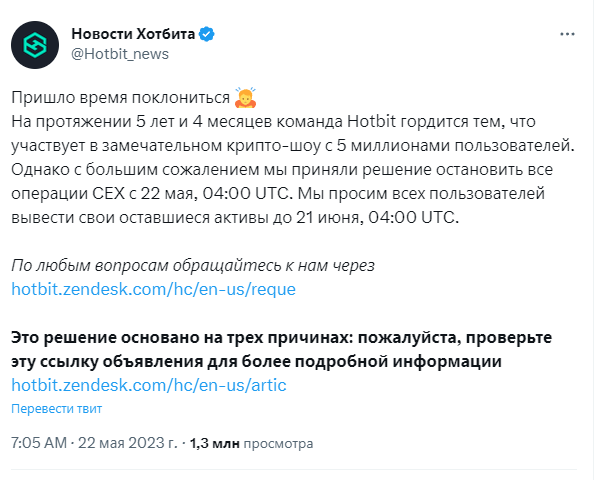

Hotbit

In May 2023, the cryptocurrency exchange Hotbit announced its closure.

At first glance, it might seem like a normal announcement—the exchange decided to shut down, declared the closure, and provided a deadline for fund withdrawals... But of course, there’s a catch, otherwise this trading platform wouldn’t have made it into this article.

Hotbit didn’t just close down—Hotbit ABSCONDED!

The issue is that Hotbit set a minimum withdrawal amount (for each cryptocurrency) of 100 USDT!

This means that users with balances (for example, in BTC or any other coin) totaling less than $100 won’t be able to withdraw their funds, effectively gifting them to the exchange!

The exchange simply decided to profit at the expense of its users and “make a graceful exit”.

Once again, this is a blow to the reputation of the entire cryptocurrency industry, as many of these users were newcomers who had deposited around $20, $50, etc.—merely hoping to try trading, hodl-ing (and more)—only to be left with nothing!

This is yet another chapter in the story proving that storing coins on an exchange is DANGEROUS!

HTX

On September 25, 2023, the cryptocurrency exchange HTX was hacked.

5,000 ETH were stolen!

However, the hack was not fatal for the exchange, as it managed to recover $8,000,000!

Four Dragons

On February 22, 2024, the Kyrgyzstani exchange Four Dragons was hacked.

Approximately $100 million in funds were stolen!

Official representatives of the Four Dragons exchange stated that the security breach and coin theft would not affect their obligations to clients and partners.

“Operational activities continue as usual, despite the loss of some liquidity,” stated the exchange’s representatives in an official statement.

During the investigation, the stolen funds were found on 17 BTC wallets. It is reported that all these wallets belong to the exchange WhiteBit.

However, the exchange provided an official response:

“All of the listed 17 BTC wallets do not belong to WhiteBIT. WhiteBIT provided Kyrgyzstan law enforcement with information regarding these addresses, to which, according to the statements of the affected exchange, the stolen USDT was converted.”

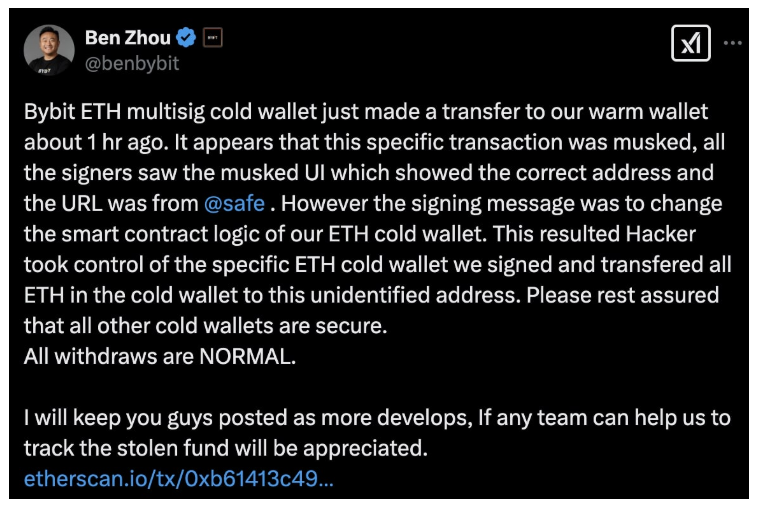

Bybit

On February 21, 2025, one of the largest cryptocurrency exchanges, Bybit, was hacked!

Hackers stole $1.4 billion in Ethereum.

At 16:44 (CET), Bybit CEO Ben Zhou announced the hack of Bybit’s cold wallet. In the explorer, you can see a transaction of $1.4 billion to an unknown account, after which funds were distributed to dozens of wallets in batches of 10,000 ETH (approximately $22 million each).

On-chain data shows that the hacker has been actively liquidating the stolen funds over the past hour.

"All the other cold wallets are secure. All withdrawals are operating normally," stated Bybit CEO Ben Zhou.

The company stated that the incident occurred while it was transferring funds from its “cold” wallet to its online “hot” wallet.

"Unfortunately, this transaction was altered through a sophisticated attack that disguised the signing interface, displaying the correct address while simultaneously changing the underlying logic of the smart contract," the company said

It is reported that prior to the hack, Bybit held reserve assets totaling over $16 billion. Zhou stated that the company has already secured interim loans to cover 80% of the stolen ETH.

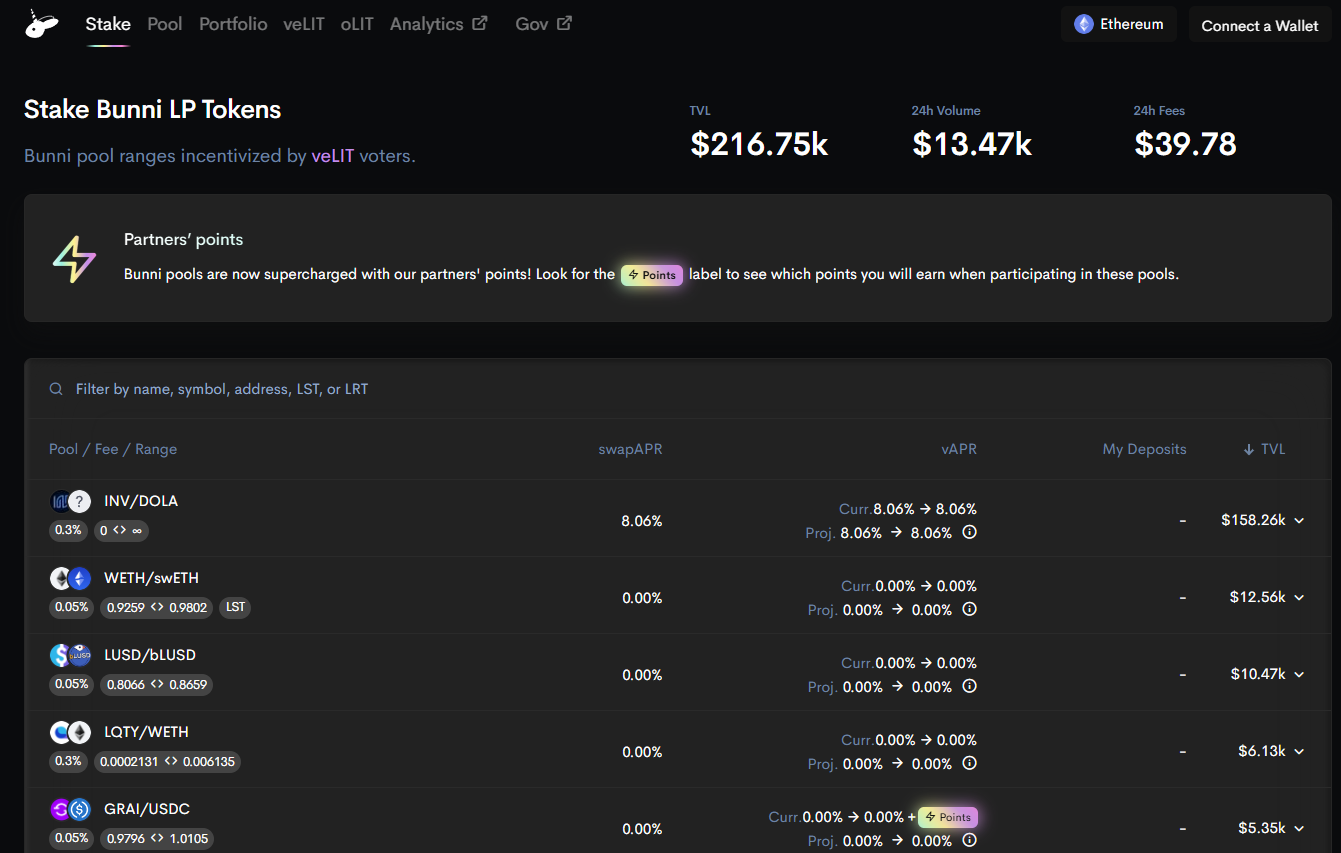

Bunni

On September 2, 2025, the decentralized exchange Bunni (DEX), powered by Unichain and Uniswap V4, fell victim to a massive hack.

Thanks to the successful attack, the attackers managed to steal about $8.4 million.

The hack affected assets on both Unichain and Ethereum.

The attackers withdrew funds in:

- ETH

- USDC

- USDT

Then, all assets from Unichain were converted to ETH in a matter of hours in transactions of approximately 100 ETH via the Across Protocol (bridge).

The total amount of funds blocked on the platform is $50.6 million, of which:

- 32.8 million on Unichain

- 17.4 million on Ethereum

This means that the attack affected a significant part of the platform's liquidity.

Conclusions and recommendations

The skills and knowledge of criminals are being improved, and the methods of committing thefts are becoming even more sophisticated.

It is quite difficult to return the stolen cryptocurrency, because unscrupulous experts involved in fraud sometimes find themselves among the owners of the cryptocurrency exchange.

That is why, before each user starts investing money, it is worth getting acquainted with the company's team and the security history of the exchange. This information can be found on the "Cryptocurrency Exchanges" page on our portal. Please note that we are removing any negative reviews!

Now you have the answer to the question "which cryptocurrency exchanges were hacked". We went deeper and tried to recall all the cryptocurrency thefts and scams that have ever occurred since the appearance of BTC.

Remember that it is risky to leave money in places where the solvency is not transparent. The public addresses of the exchange wallet and the monthly income numbers should always be published on the company's website. This way, you will always be able to track how the business is going. The spirit of blockchain is transparency and honesty.

The moral of the story

| Exchange | The amount of hacking |

| Mt. GOx | 2609 BTC | +750,000 BTC |

| BitFloor | 24 000 BTC |

| Poloniex | 97 BTC |

| Bitstamp | 19 000 BTC |

| Bitfinex | 120 000 BTC |

So the moral of this story is to keep your cryptocurrencies under your control, and not on centralized exchanges.

We say this because most of these hacks occurred due to careless handling of private keys.

We understand that in the early days of Bitcoin, people did not know about this. But now, there are many available training materials about private keys and hardware wallets, for example, about such as Ledger Nano S.

And Bytwork.com it is part of this educational activity. So stay with us and everything will be fine for you!

Additionally

There is very little information about some exchanges, which is why, for the completeness of this article, we attach an additional list of hacked exchanges:

Did we miss any major hacks? Let us know about them in the comments!