DefiLlama guide: 6K+ Protocols, 464 Chains, 19K Pools for earning

You will learn how to stay ahead of the market by independently finding DeFi projects where you can profitably provide liquidity, farm yield, and select profitable staking for your assets in the networks you need.

By the end of this article, you will know exactly how to maximize passive income and outperform the market using DefiLlama.

What is DefiLlama

DefiLlama is a kind of encyclopedia, showing liquidity, fees, revenue, and transaction volumes across thousands of protocols. In this sense, DefiLlama is like a crystal ball, displaying the best yields across the entire DeFi space in real-time.

The aggregator updates every minute and is also used to track the total value locked across different blockchains and protocols. This is called Total Value Locked, or TVL.

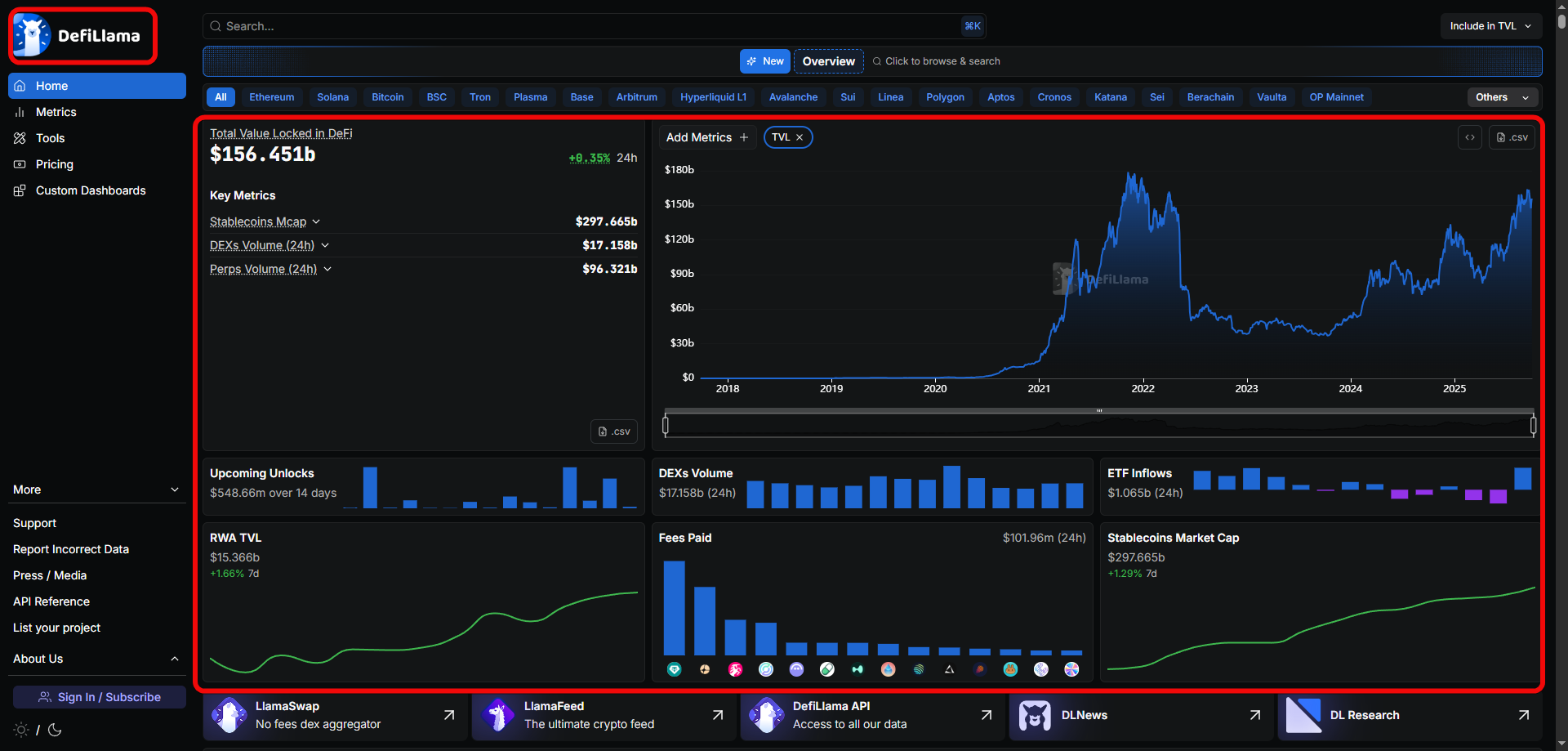

The DeFi Market Overview tab.

It's a kind of DeFi market weather board, and to understand it, you need to know the key metrics.

Key Metrics TVL, Chains, and Protocols

TVL

The main indicator on the site is the Total Value Locked, TVL. Each protocol also displays its own TVL.

Higher TVL generally indicates a more reliable protocol.

Protocol Rankings

Scroll down the page – here you will find all protocols, sorted by TVL, meaning by the market value of assets locked within them.

In the aggregator's interface, the protocols list will always be at the bottom, regardless of the filters selected!

It's important to remember that if a protocol is dominated by, for example, Ethereum, a change in TVL might not reflect an inflow or outflow of liquidity, but simply the price fluctuation of the native token.

Each protocol belongs to a specific category, and we recommend familiarizing yourself with these categories in more detail below.

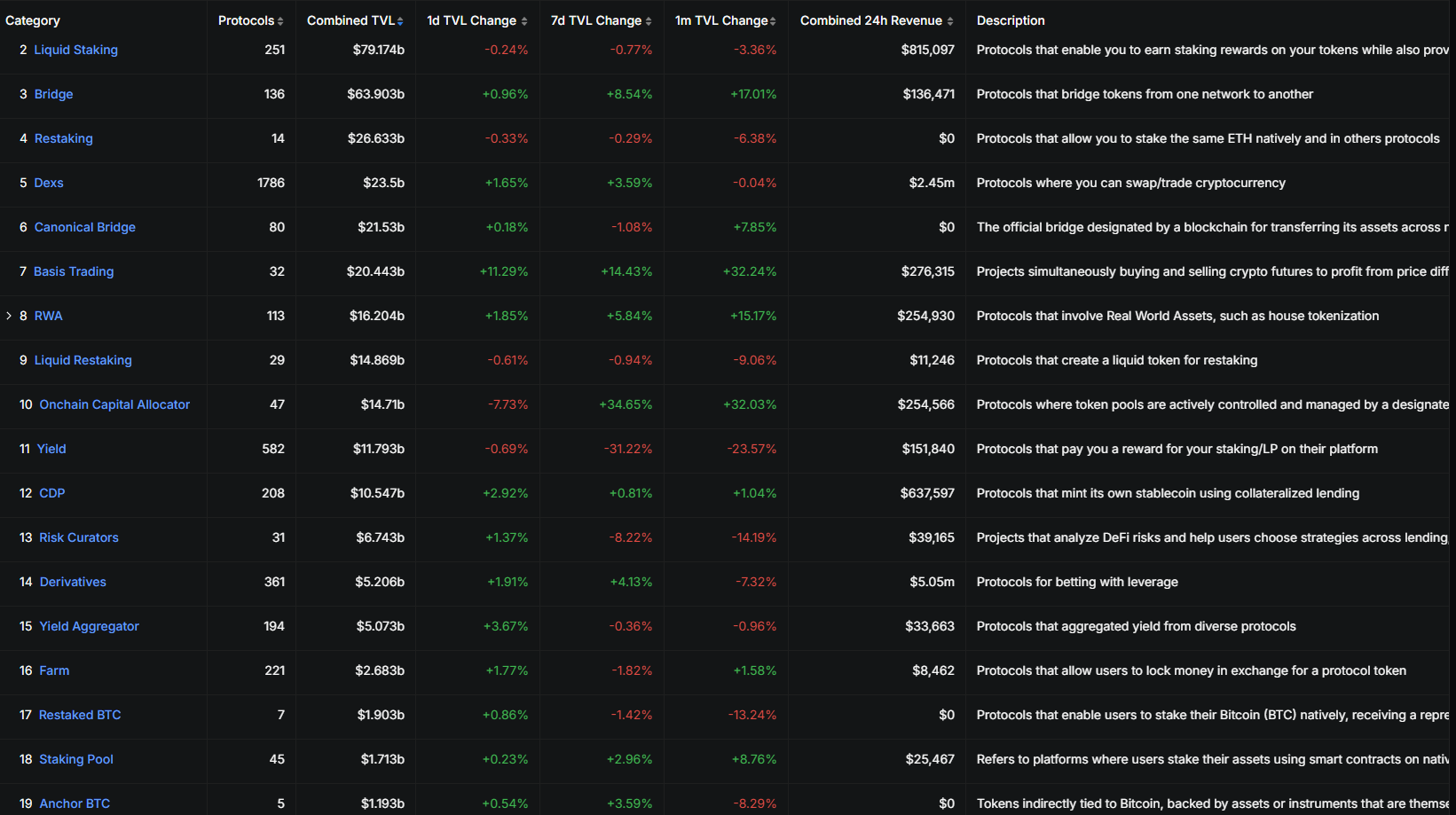

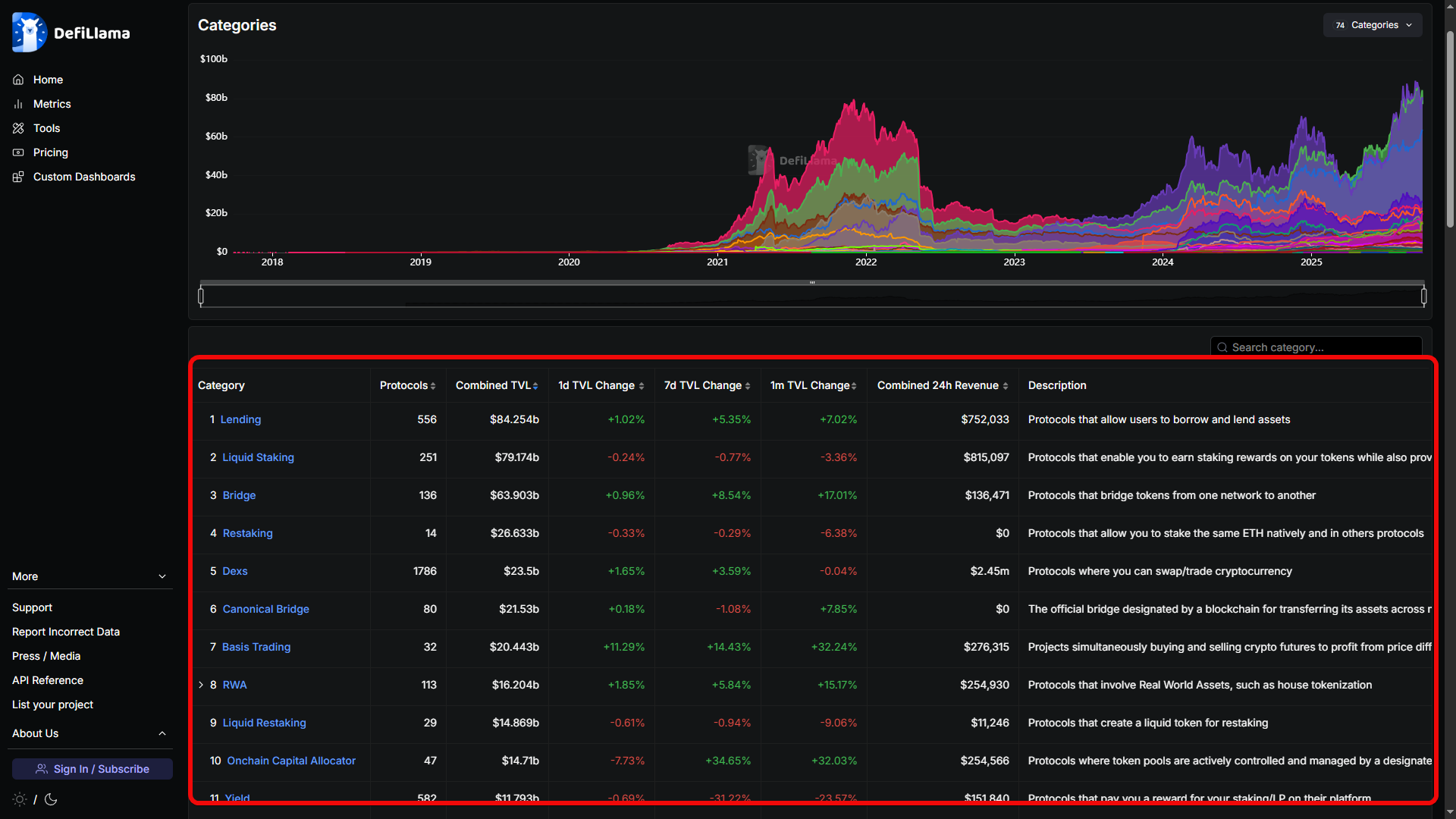

Categories

The category filter helps you quickly find the right platforms (e.g., Lending or DEX) in the desired blockchain network.

The Categories tab.

Selecting protocols is the most crucial part, and below you'll get an idea of how to best choose them across different categories.

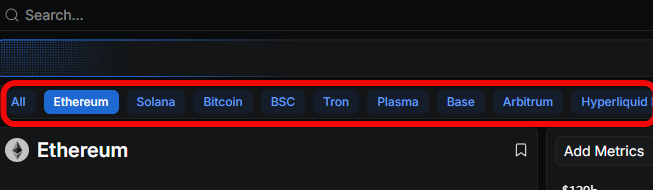

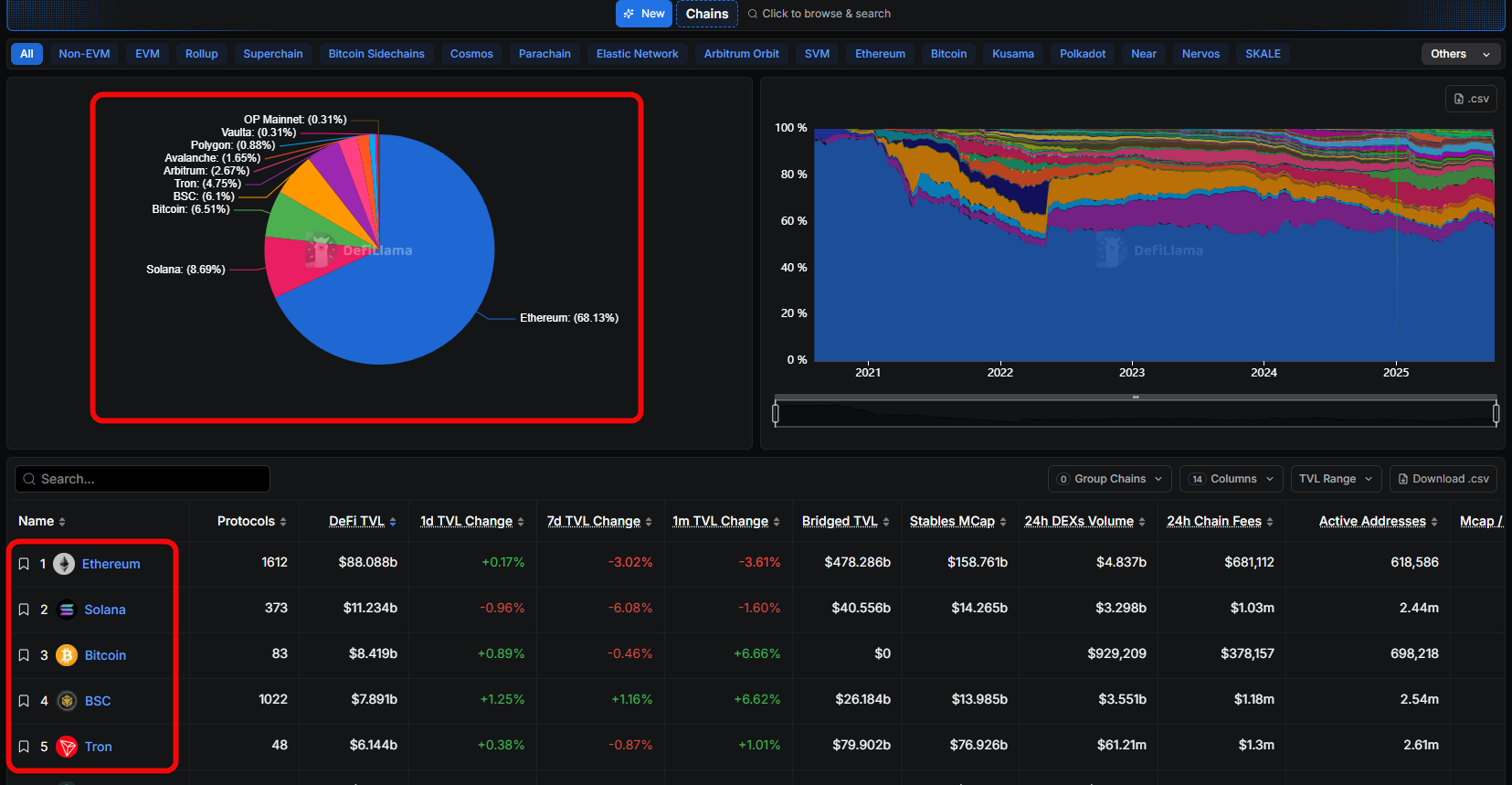

Chains ETH, SOL, BTC, Tron, etc.

DefiLlama ranks chains by TVL size. You can quickly switch between chains at the top

The separate Chains tab clearly displays the networks in a pie chart with dynamics on the right.

The tab with all chains.

Below the chart is a detailed list of chains with the number of protocols, TVL, and changes. Here you can see that the leaders are ETH and Solana.

How to choose a chain?

Each chain is like a city district – some are noisy, some are quiet. In this regard, choosing a blockchain is similar to choosing a location to open a business. Select a chain and protocol based on your tasks and goals. For example, if you need low fees, Solana is a good place. SUI and APTOS are suitable if you're looking for high transaction speed and modern architecture.

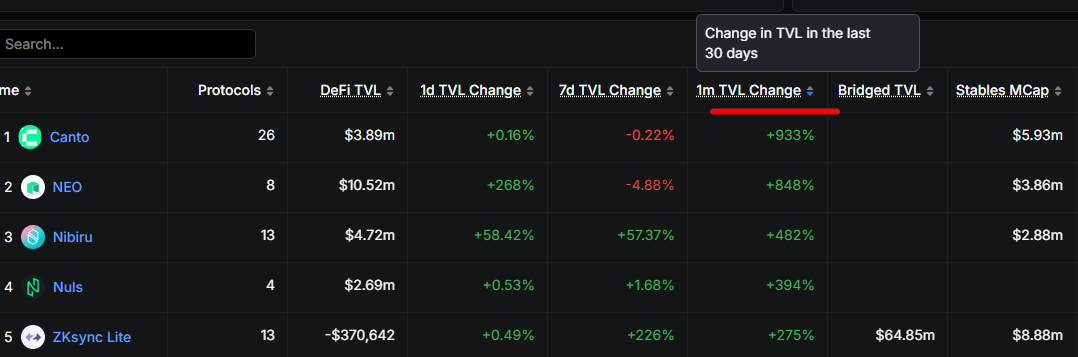

Here you can also see how funds are moving between blockchains. If you need to know which network attracted the most TVL in the last month, you can view and filter out small projects with a couple million dollars.

The comparison tool will also help you choose a chain and protocol.

Comparing Protocols and Chains

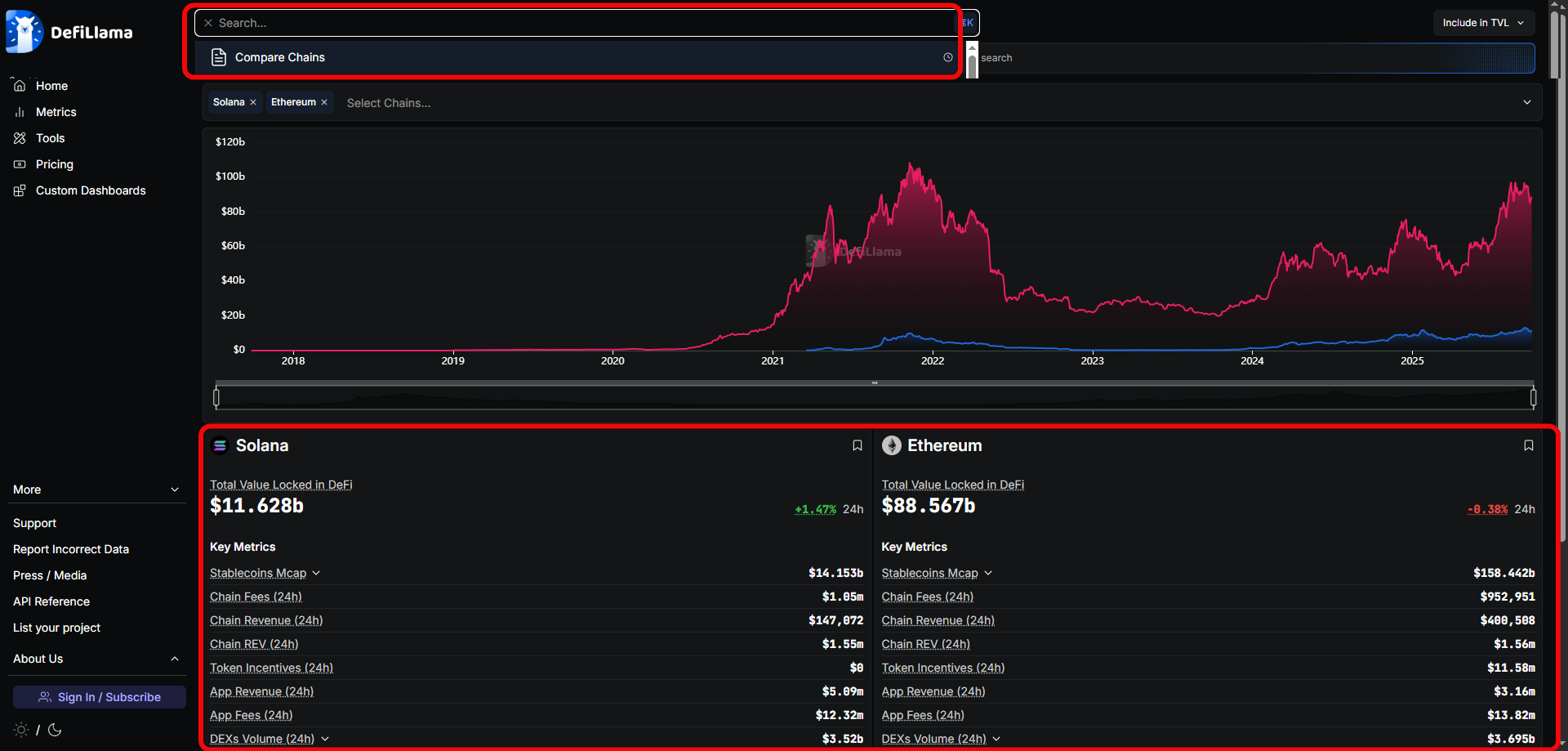

To compare chains or protocols, simply enter the word compare in the Search field and select the desired chains or protocols.

The chain comparison tab.

For example, ETH's TVL is decreasing, while Solana's is growing. By comparing different chains, you see the dynamics, which allows you to better select protocols.

You can also compare protocols themselves. You can plot the TVL and compare daily, 7-day, and 30-day changes. In the example, we compared the protocols Aave, Lido, EigenLayer, Ethena USDe, Binance staked ETH, and WBTC.

Explore the Compare Protocols tab.

Now let's look at specific protocol lists.

Yield Farming

Yield farming is where high percentages live. And DefiLlama's yield rankings are a gold mine if you know how to configure filters and find protocol lists.

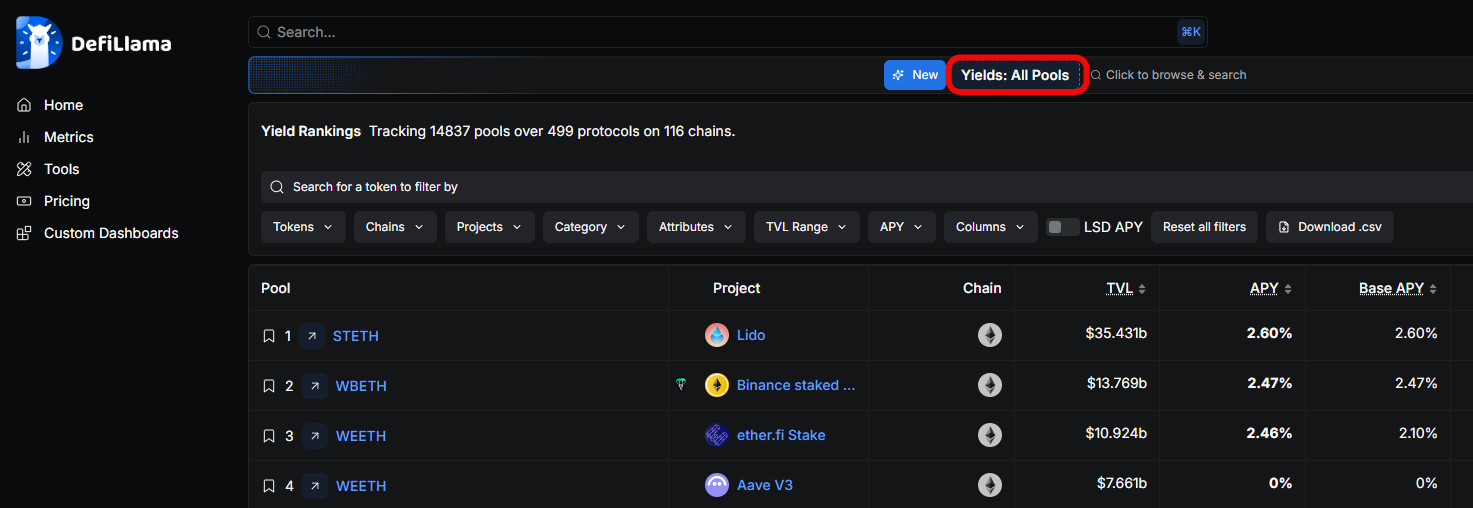

The Yields: All Pools tab shows all available liquidity pools.

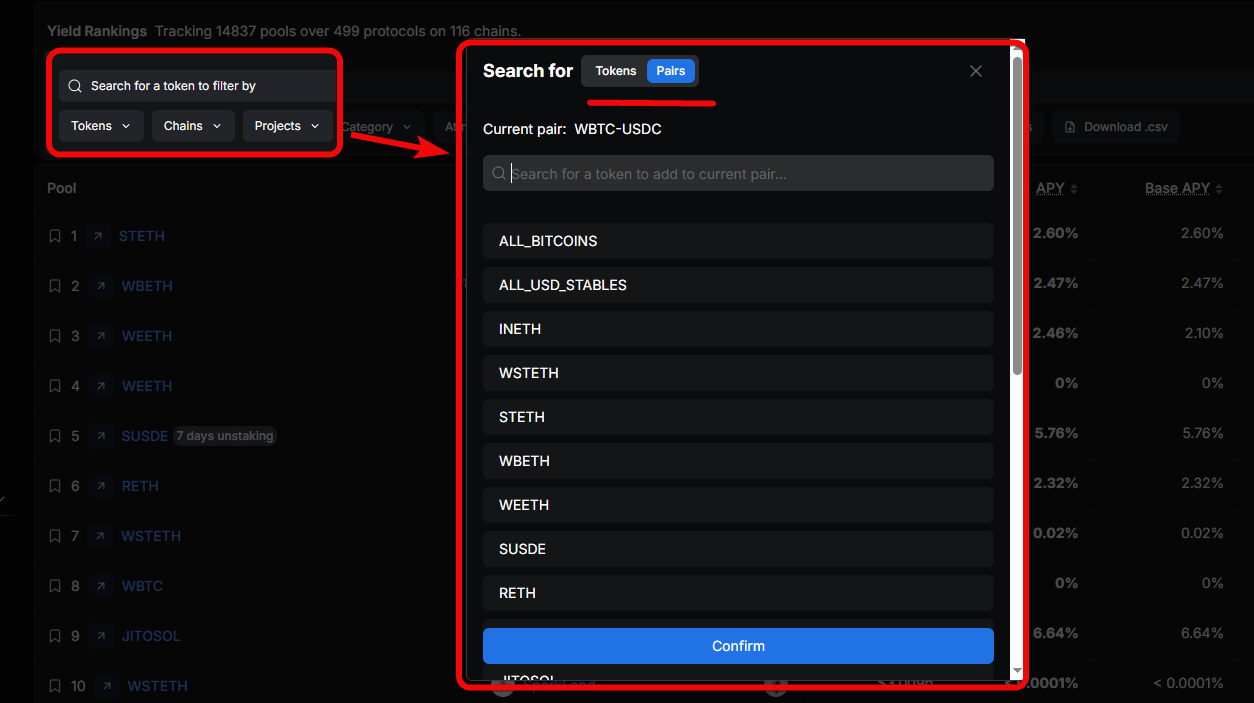

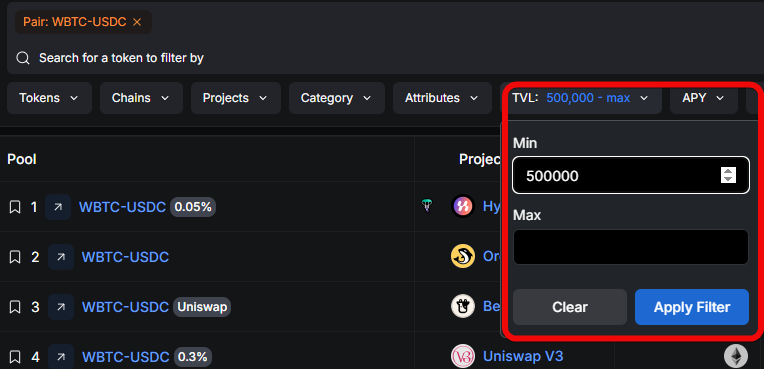

You can specify a particular pair, for example, WBTC/USDC, and set a TVL filter from $500k, then sort by APY.

Click on the Search for a token to filter by field, switch to Pairs, and sequentially enter the tokens you are interested in. For example, WBTC and USDC.

We will also specify a TVL range from $500k to filter out scam protocols.

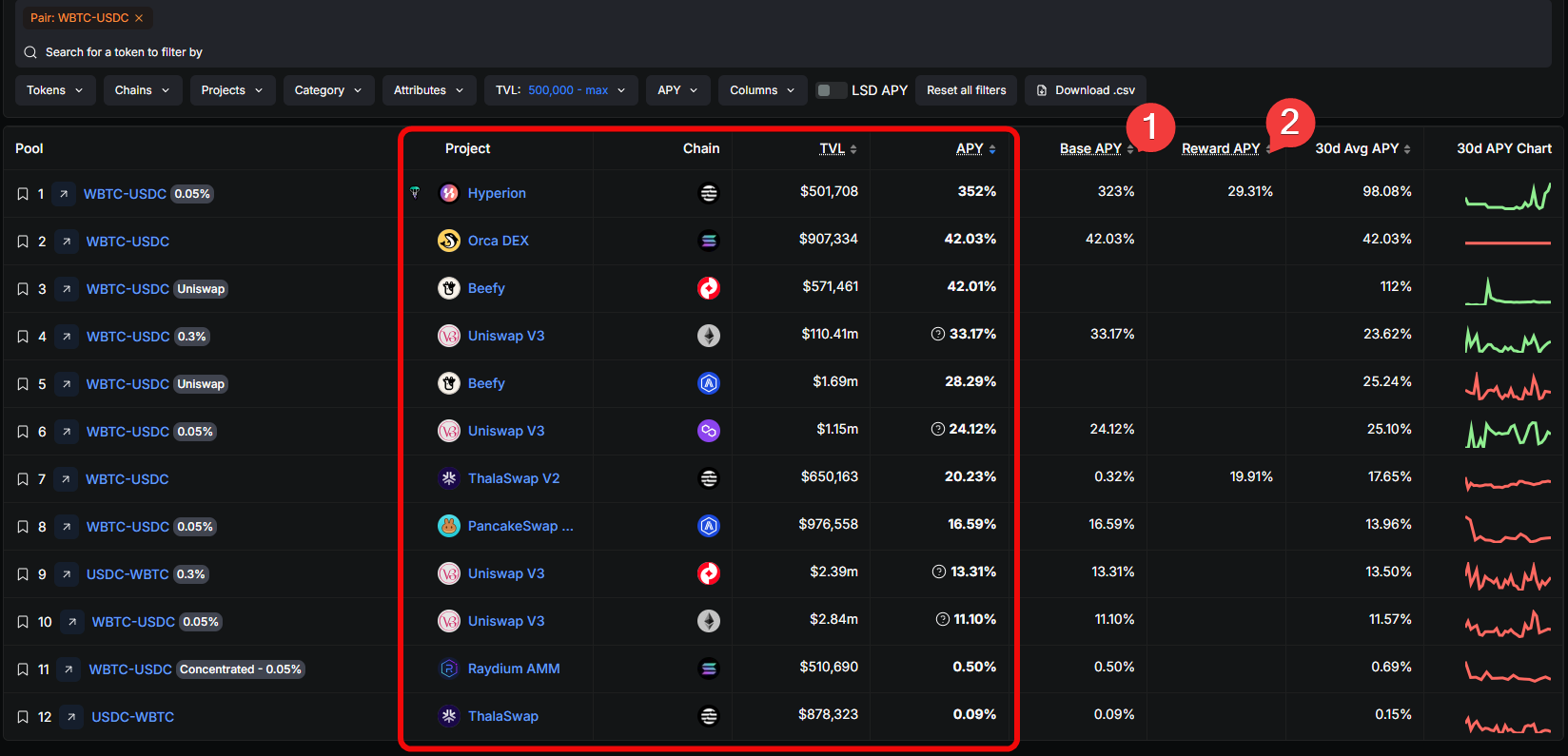

After applying the filter and sorting by APY, we conveniently see the specific pool, protocol, TVL, APY, the chain where this pool farms, as well as fees.

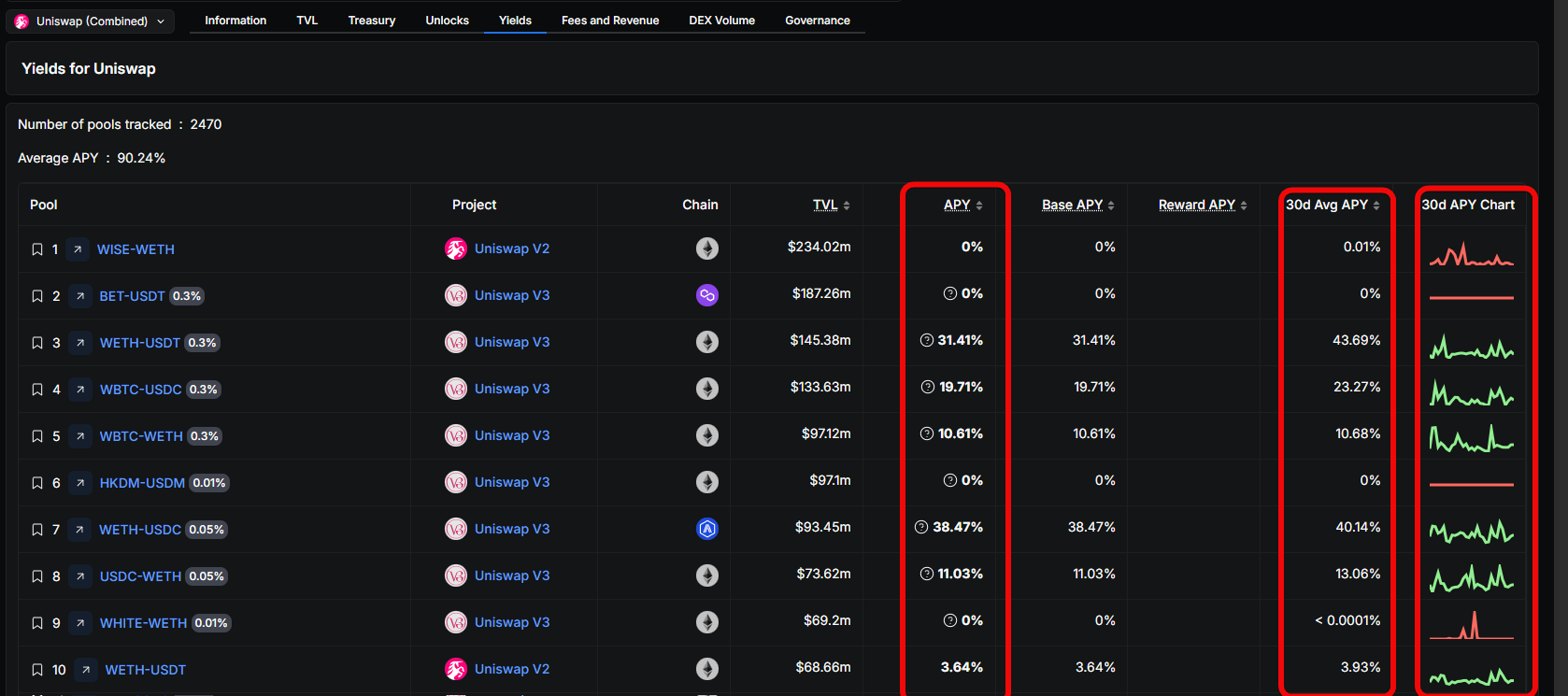

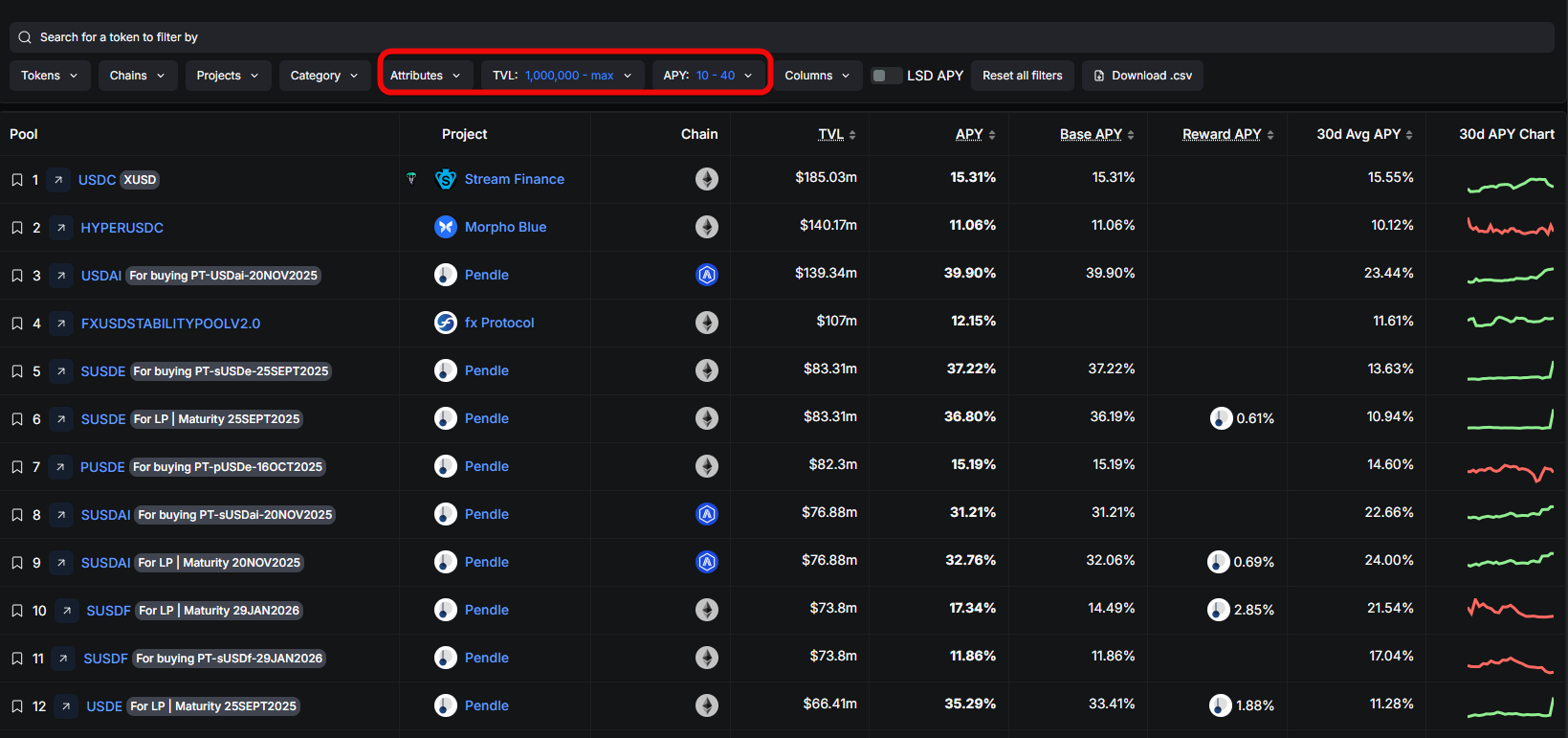

It's important to distinguish between Base APY – rewards from the pool itself – and Reward APY – additional tokens distributed on top.

If these tokens are not locked and can be sold quickly, the proceeds can be reinvested into more reliable assets.

However, high percentages are not always safe, so be sure to check the TVL, audits, and history of the protocol. More on that below.

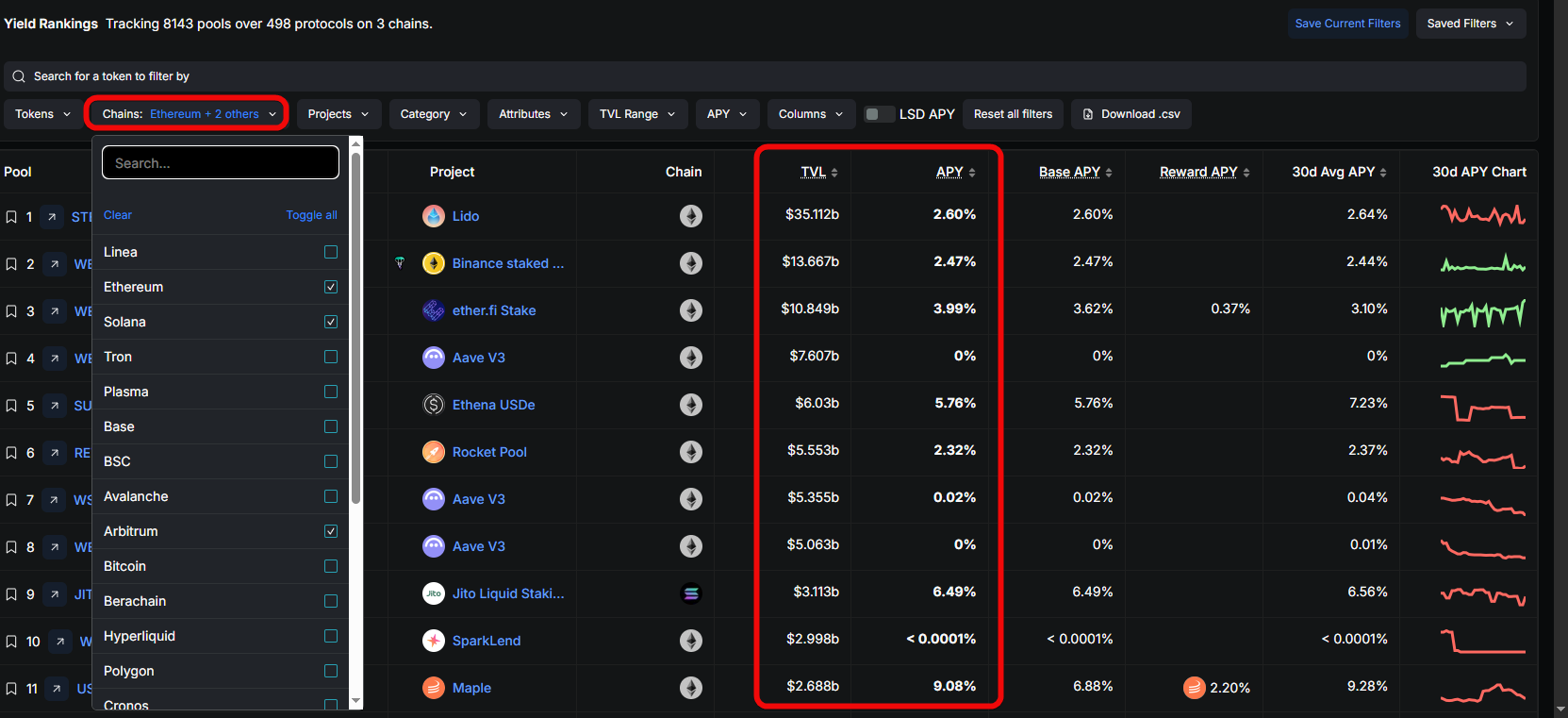

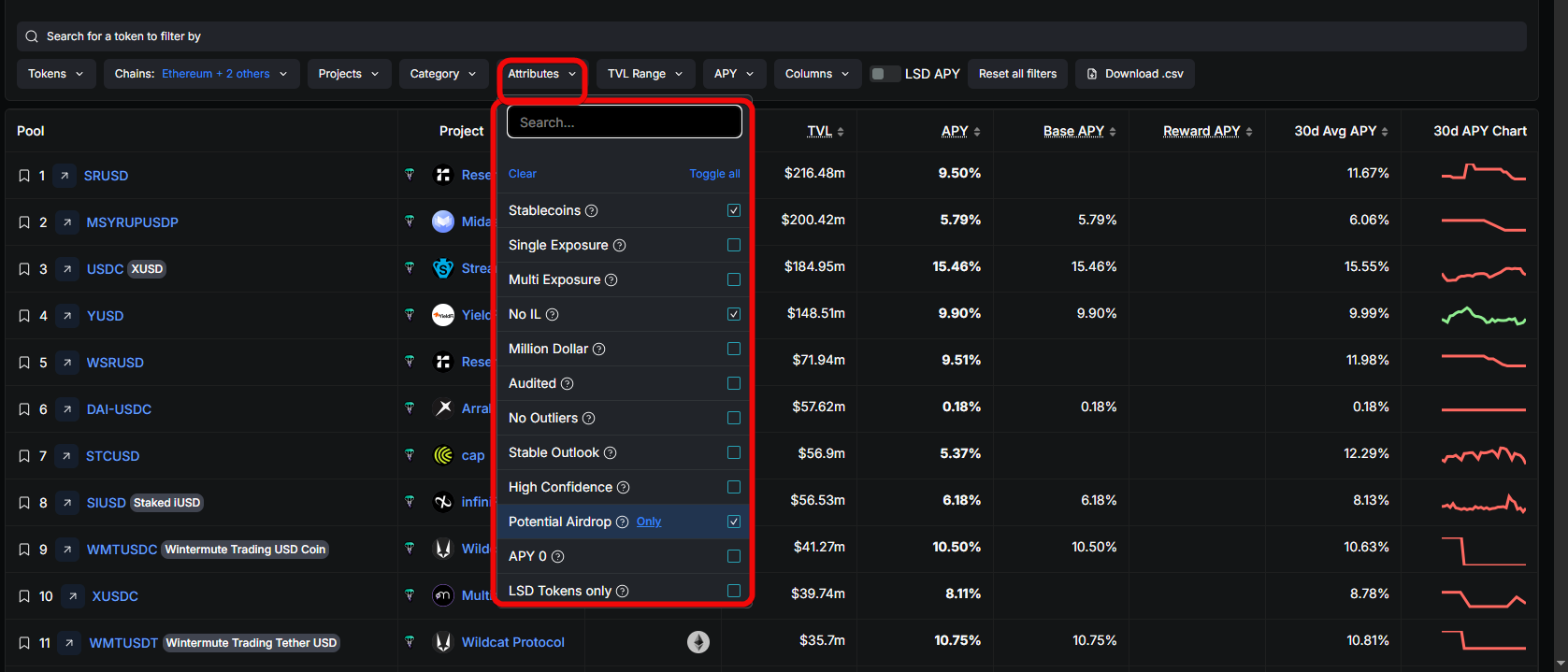

Experienced investors also search for protocols through attributes. First, they select a chain – Ethereum, Arbitrum, Solana – and keep one or several to reduce noise.

Then they open the Category filter and specify stablecoins, pools without impermanent loss, or potential airdrops.

Next, look at the TVL, as high values often indicate reliability. Never chase insane APY on dead blockchains, as high returns always come with the high risk of unsafe protocols!

Checking Protocol Security

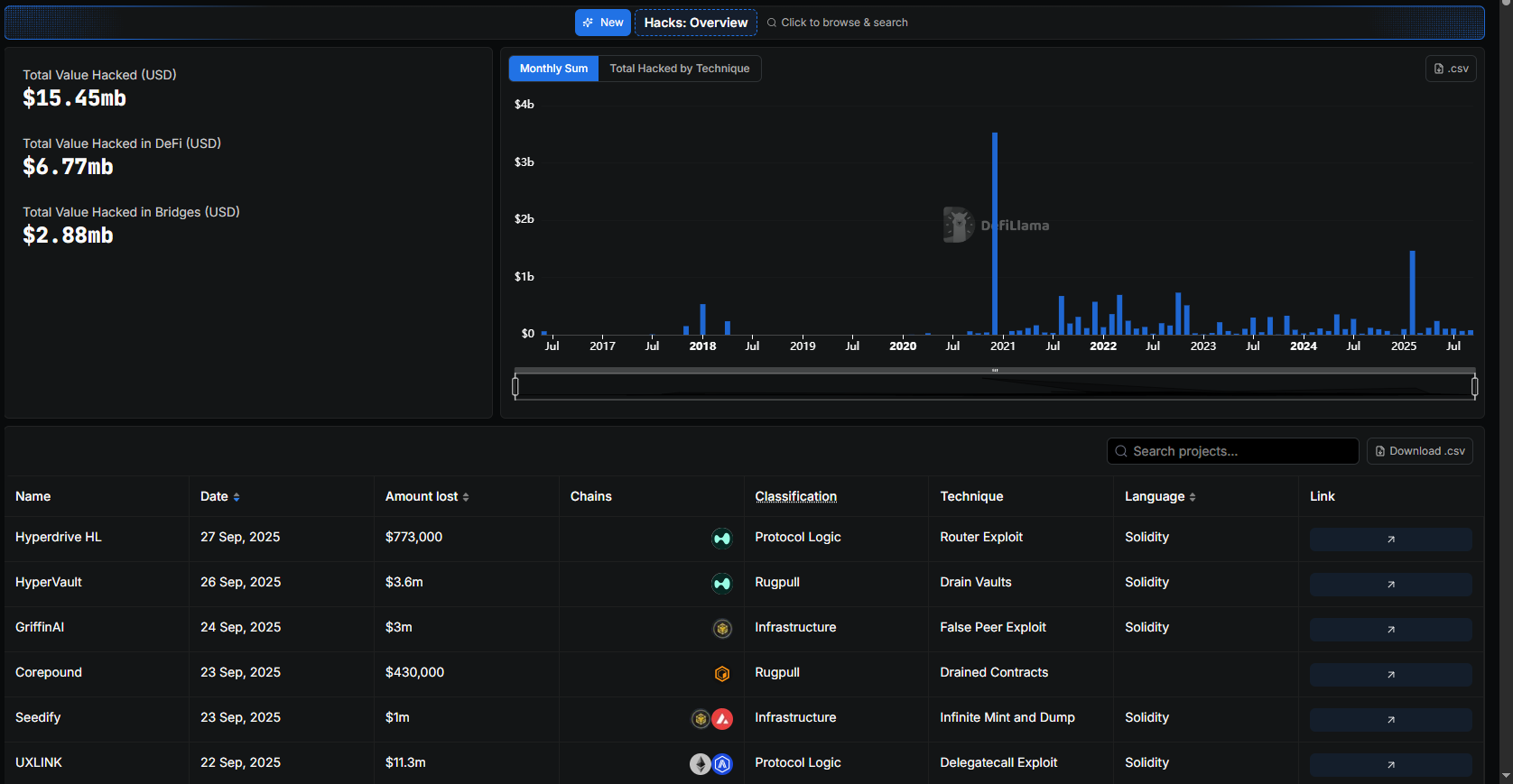

To minimize risks, it's important to regularly check the Hacks tab. It publishes fresh data on hacked protocols, loss amounts, and incident dates.

The Hacks tab.

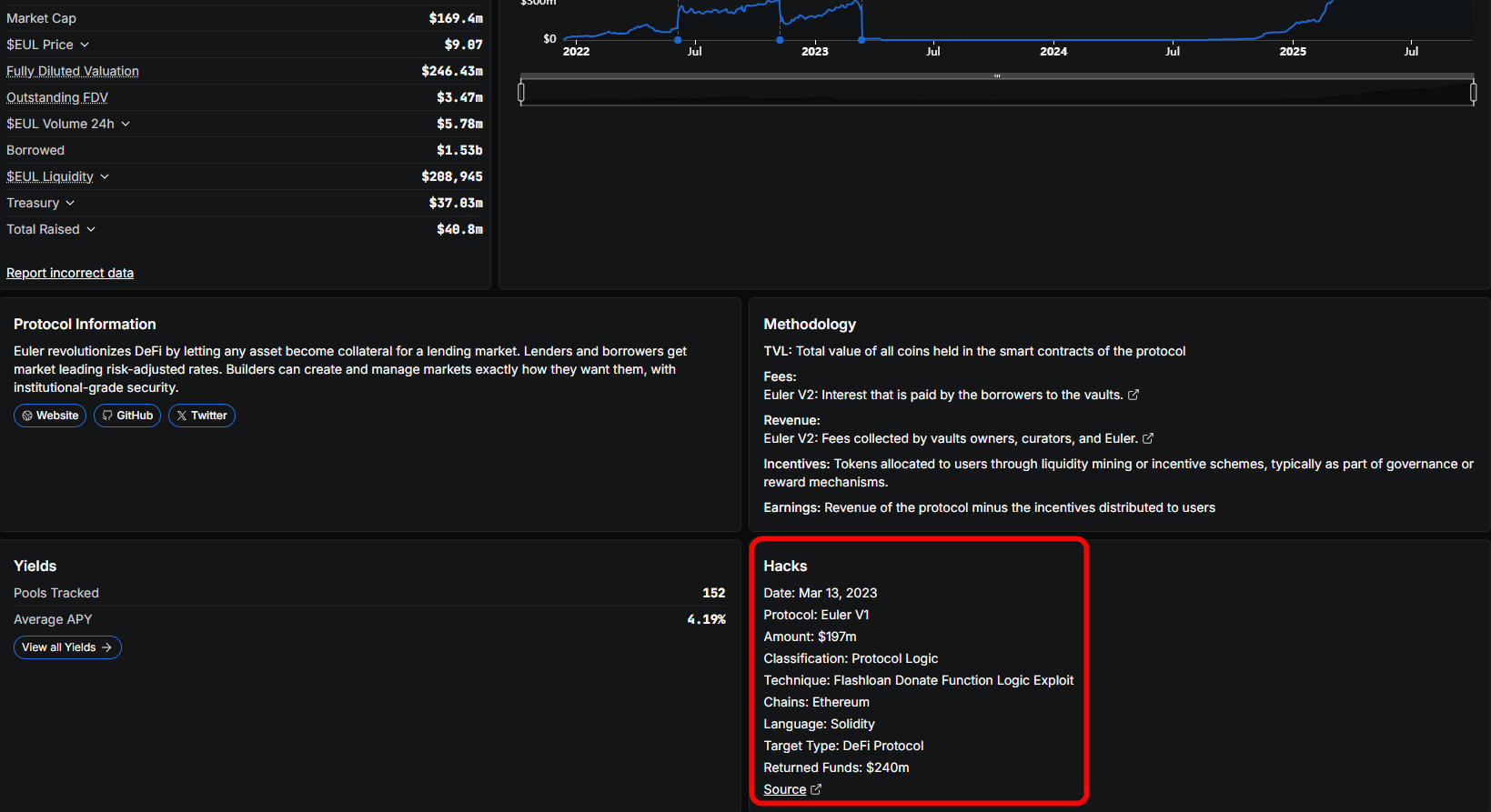

If you open a specific protocol, its hack history will also be shown at the bottom.

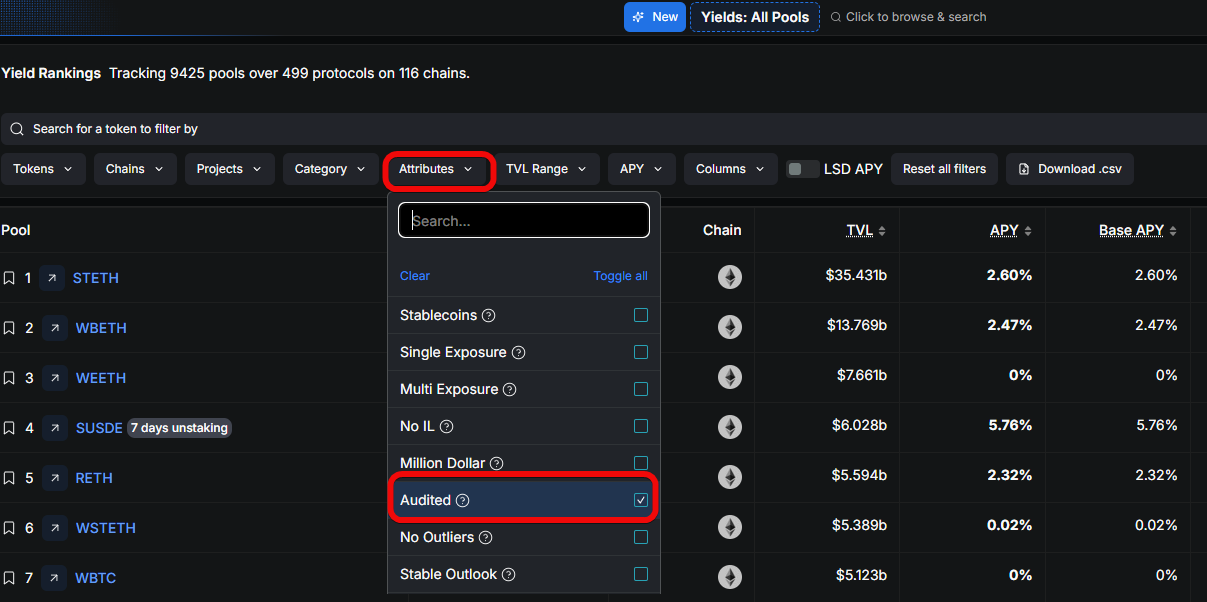

You should also pay attention to smart contract audits. Having an audit is not a guarantee of complete cybersecurity, but it is an important signal that the protocol's code has been reviewed by third-party specialists.

To filter lists of protocols with audits, click Attributes and select Audited.

However, as practice shows, even audited protocols can be hacked if the audit was superficial or did not cover all vulnerabilities.

Let's consider other protocols.

Earning on DEX and Liquidity

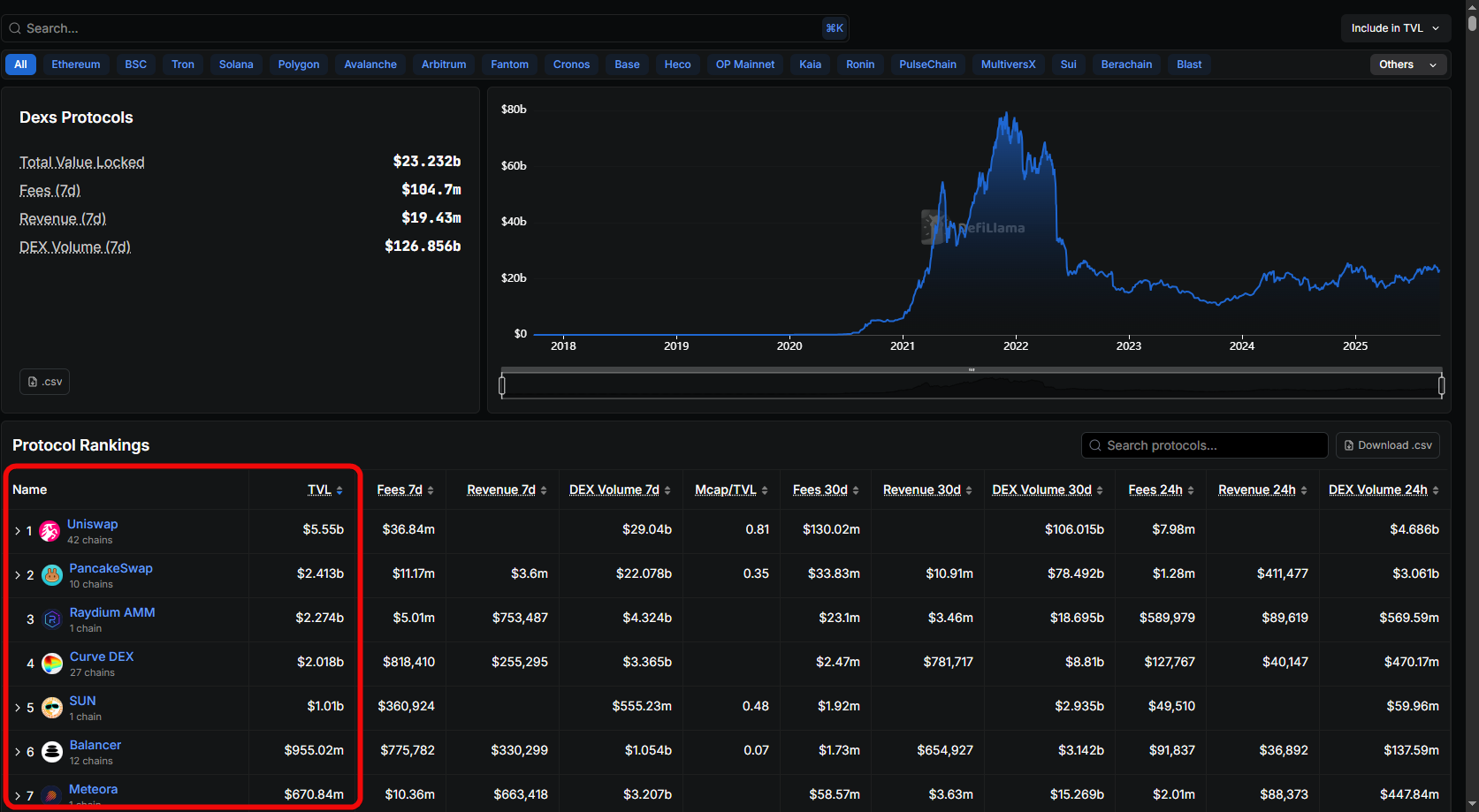

Decentralized exchanges allow you to swap crypto directly between users, and DefiLlama tracks DEX volumes.

List of DEX protocols.

Uniswap leads, gathering $106 billion daily. Clicking on this protocol, we see its yield. This includes the average 30-day yield and a chart. APY is the annual percentage yield, meaning what you would earn over a year.

On Uniswap, you can get about 10% annual yield just by depositing BTC into a pool.

Earnings come from providing liquidity. Imagine you are lending your crypto so that trades on these DEXs can happen. Simply put, you give your funds to the exchange, and it pays you interest.

Stablecoins as a Comfort Zone

If you select the Stablecoins attribute, you will find pools with stablecoins – it's like savings accounts in banks.

It's best to set a filter for TVL from $1,000,000 and APY from 10% to 40%.

The tab with stablecoin pools.

High percentages are tempting, but remember, you shouldn't buy unknown tokens just for high yield – it's better to use assets you already have in your portfolio. Or more or less verified ones like USDC and USDT.

Additional Tools

DefiLlama offers a whole range of metrics. Let's look at the most useful ones.

Airdrops

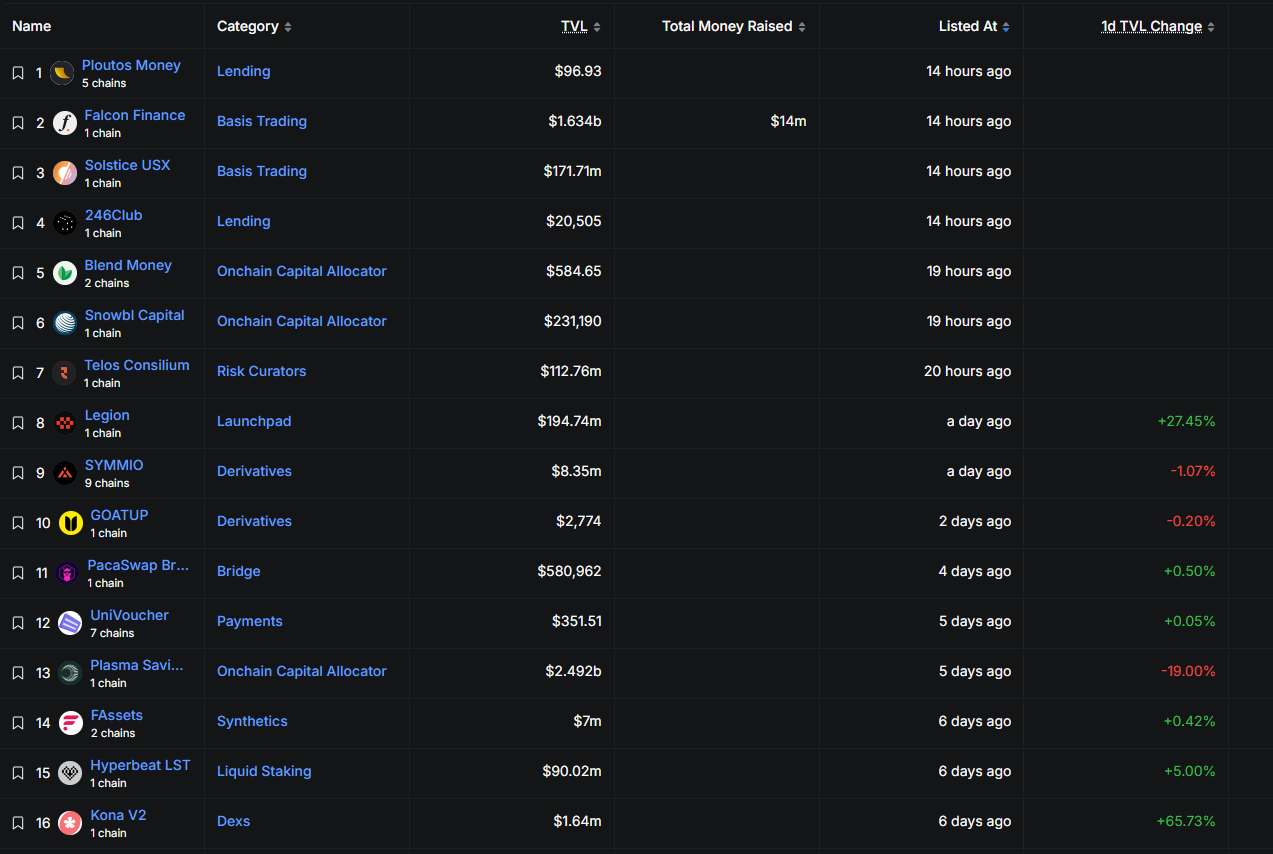

Here you can find recent projects without their own token that, in DefiLlama's opinion, might conduct a token distribution.

The Airdrops tab.

The main filter is the presence of TVL. The higher it is, the lower the risk of encountering a scam.

Treasuries

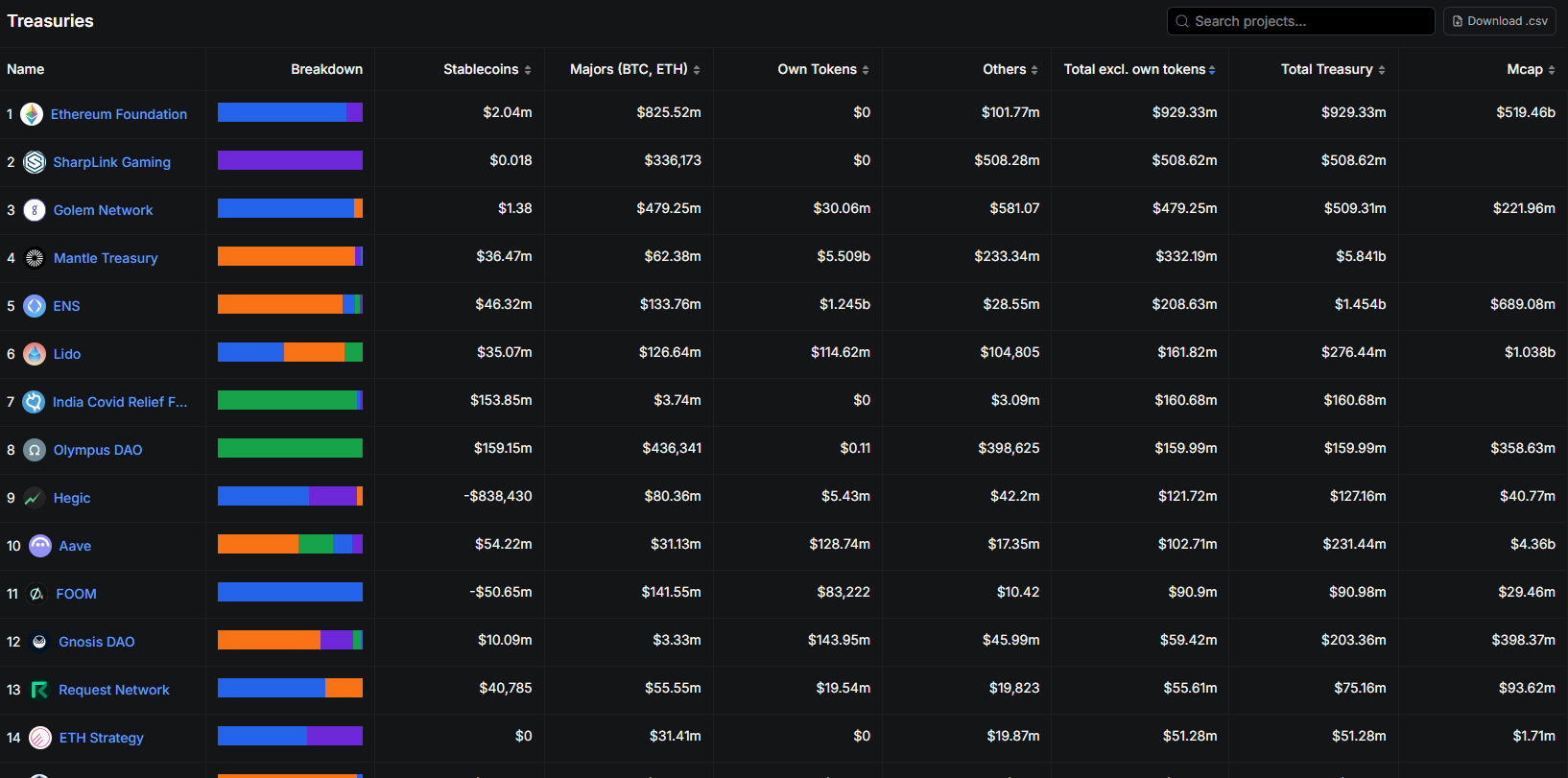

The Treasuries tab shows which assets and in what volume decentralized protocols hold. This indirectly helps assess bankruptcy risks.

The Treasuries tab

You can click on a protocol and see the token distribution, for example, for AAVE or Lido Finance.

Categories

The Categories section collects 73 categories of DeFi protocols, each with a brief description. By studying the basic categories, it will be easier for you to navigate the service.

The Categories section.

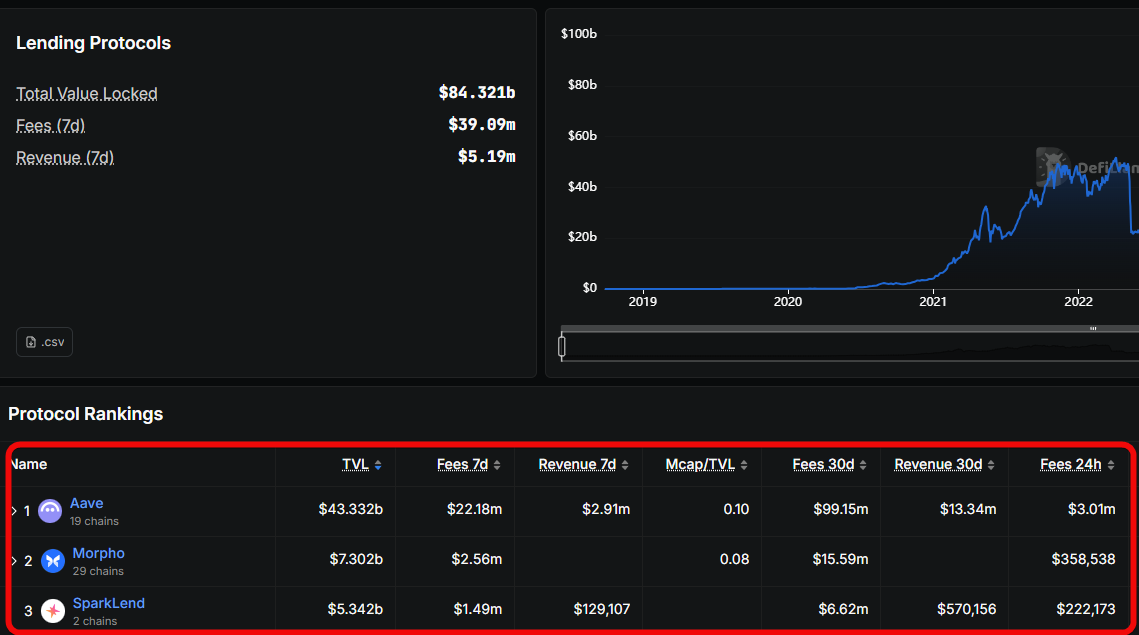

For example, selecting the Lending category, you will see a ranking of protocols by TVL, where first place is taken by AAVE with $43 billion, second by Morpho with $7.3 billion.

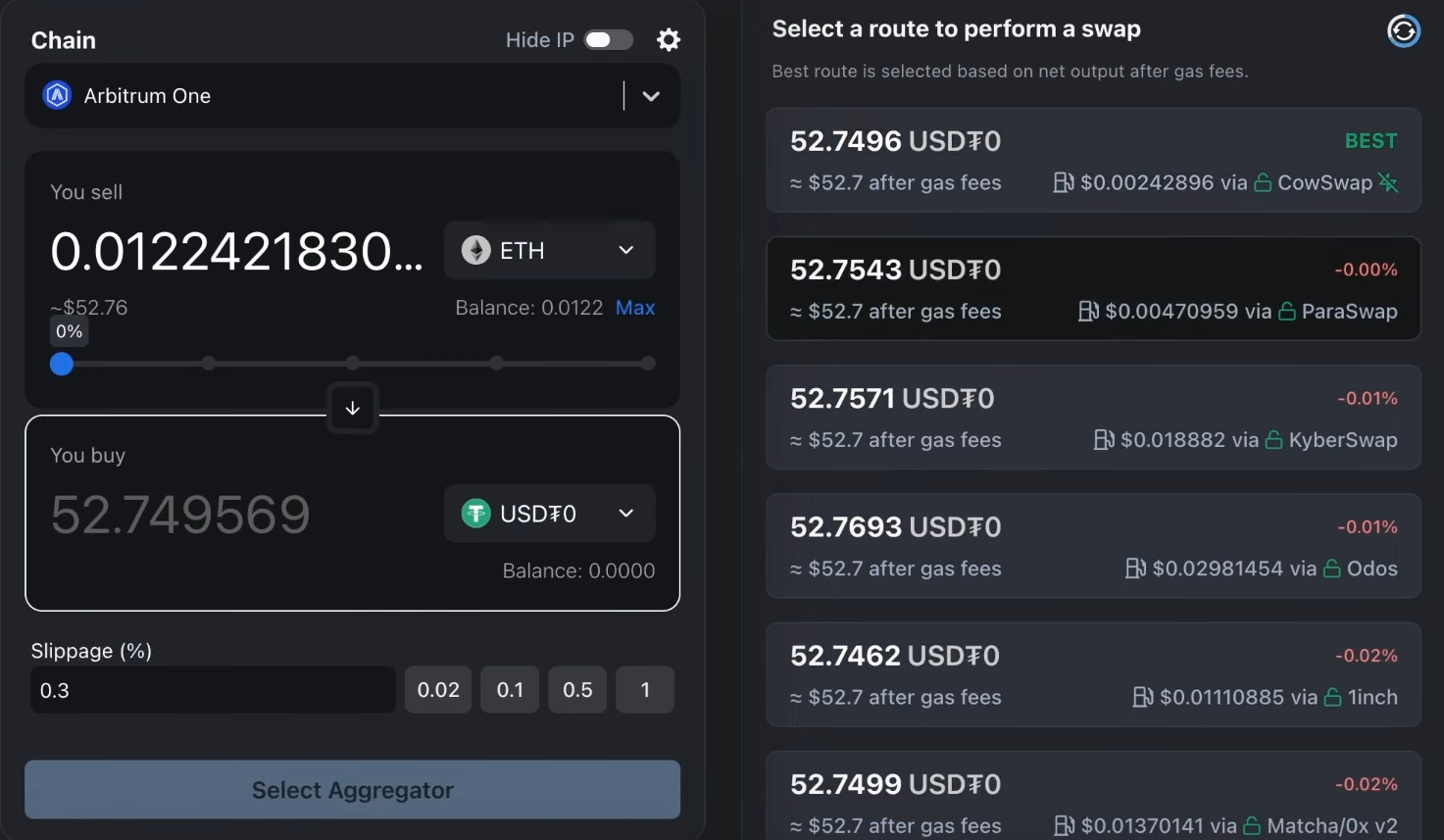

LlamaSwap

The Tools tab contains a built-in swap aggregator LlamaSwap. Often, swapping here turns out to be more profitable than on other aggregators because the service itself finds the best swap route.

By connecting your wallet and selecting a network, you can set the acceptable slippage (Slippage) and get a route that considers the exchange rate and fees from third-party protocols.

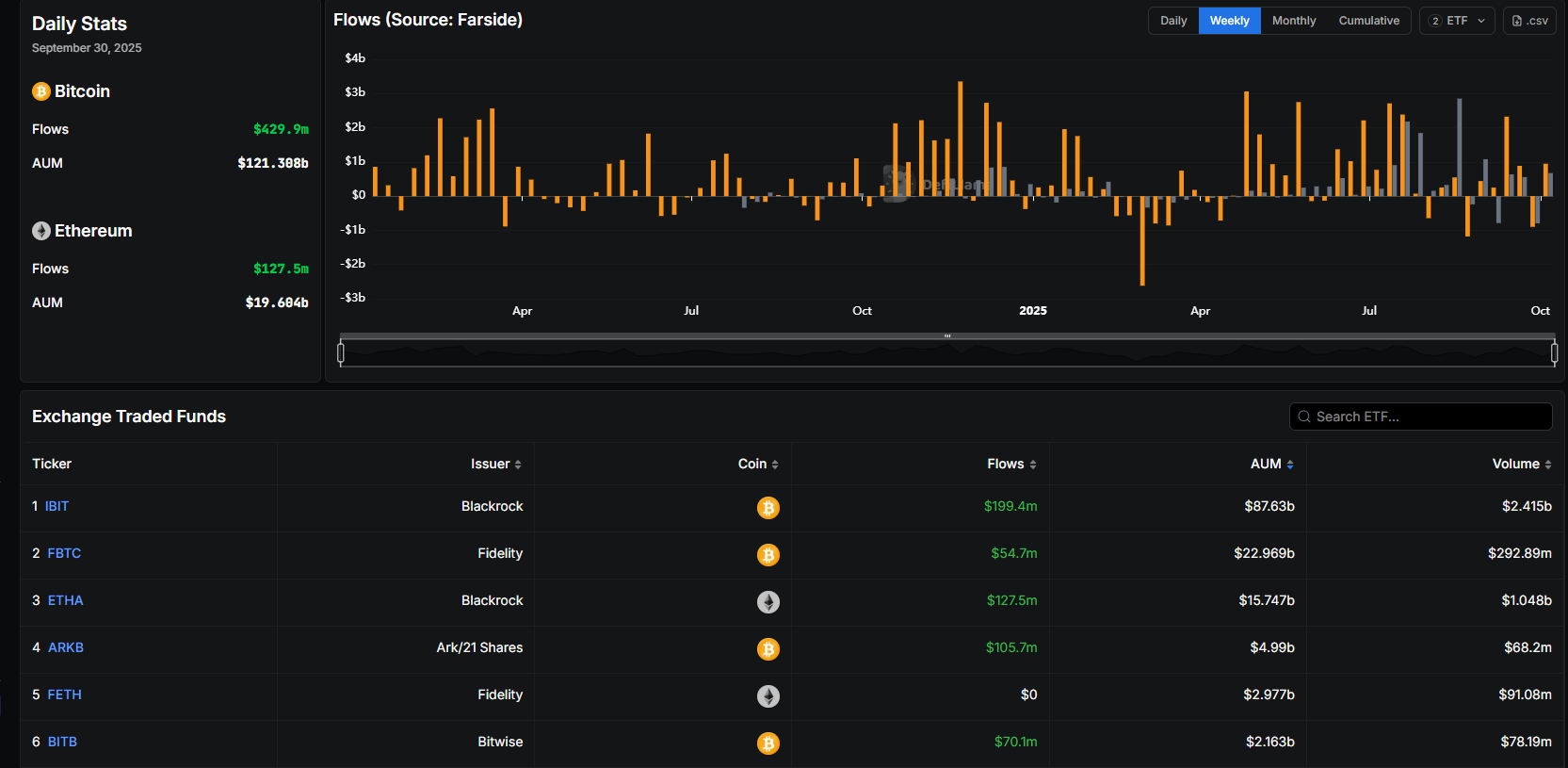

Crypto ETFs

DefiLlama also shows Bitcoin and Ethereum ETFs. These are big money funds buying cryptocurrency and pushing prices up.

The ETF tab.

In other words, ETFs reflect market dynamics as an indicator of market maturity and the inflow of institutional capital.

Correlation Matrix

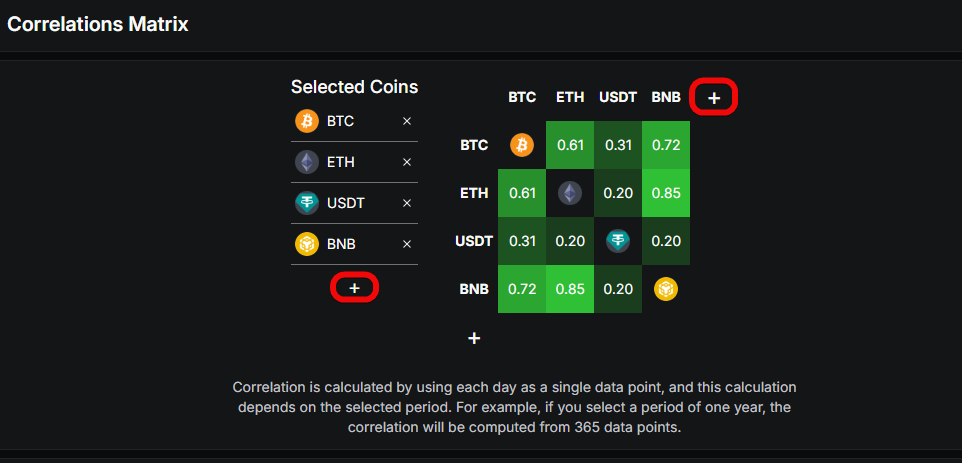

The Correlations Matrix tool shows how the prices of two tokens move relative to each other. This is useful for making informed decisions about which assets to combine in a liquidity pool based on the current market situation.

The Correlations Matrix tab.

By selecting tokens, you can look at correlations to maximize fee earnings and minimize impermanent loss.

Raises

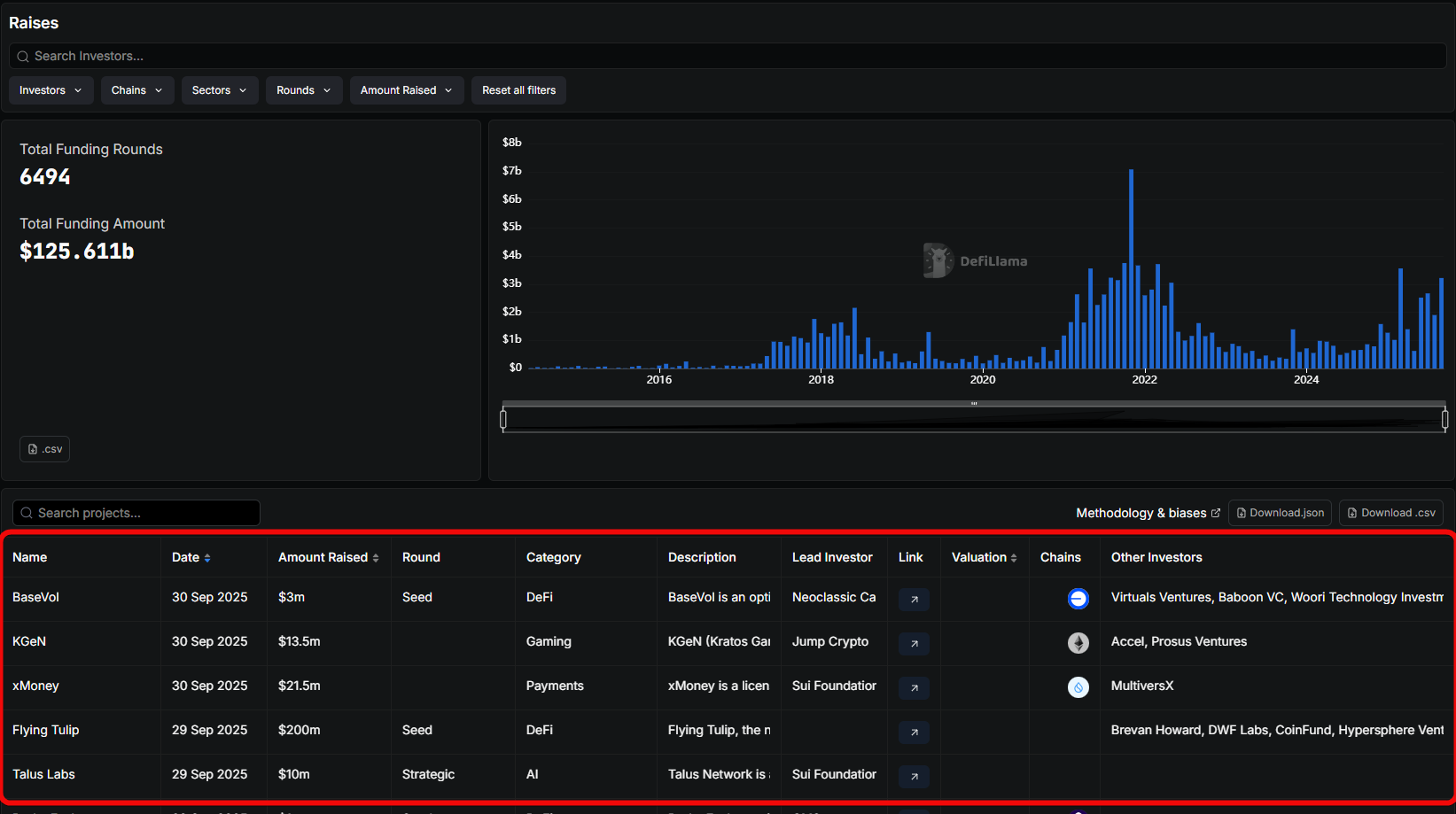

The Raises tab shows which projects have received investments and which venture funds participated.

The Raises tab.

This helps in finding fresh and invested projects that you can study and participate in during early stages, anticipating potential rewards.

Bridges

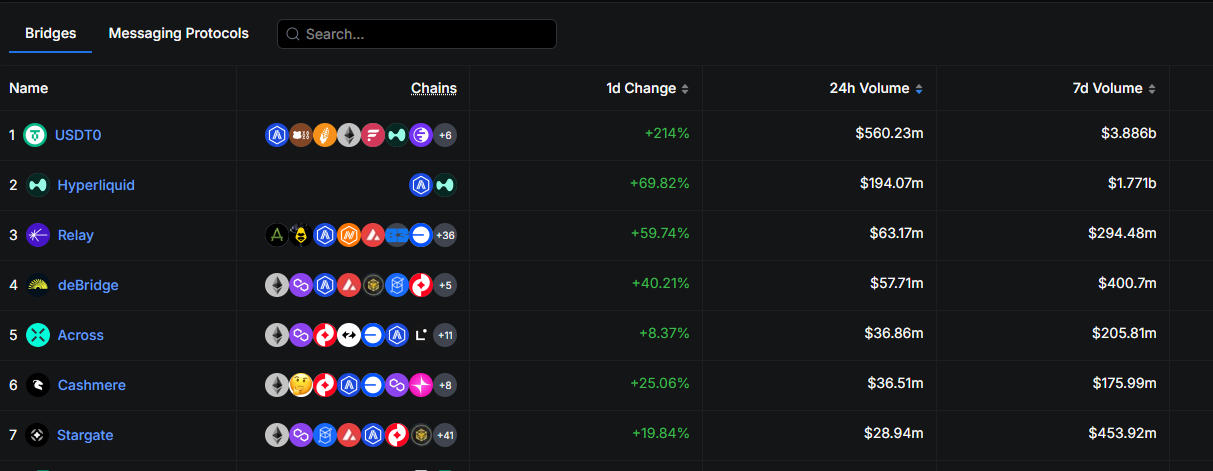

This tab aggregates various bridges and shows which networks they work with.

The Bridges tab

This is convenient for quickly searching and selecting bridges between blockchains.

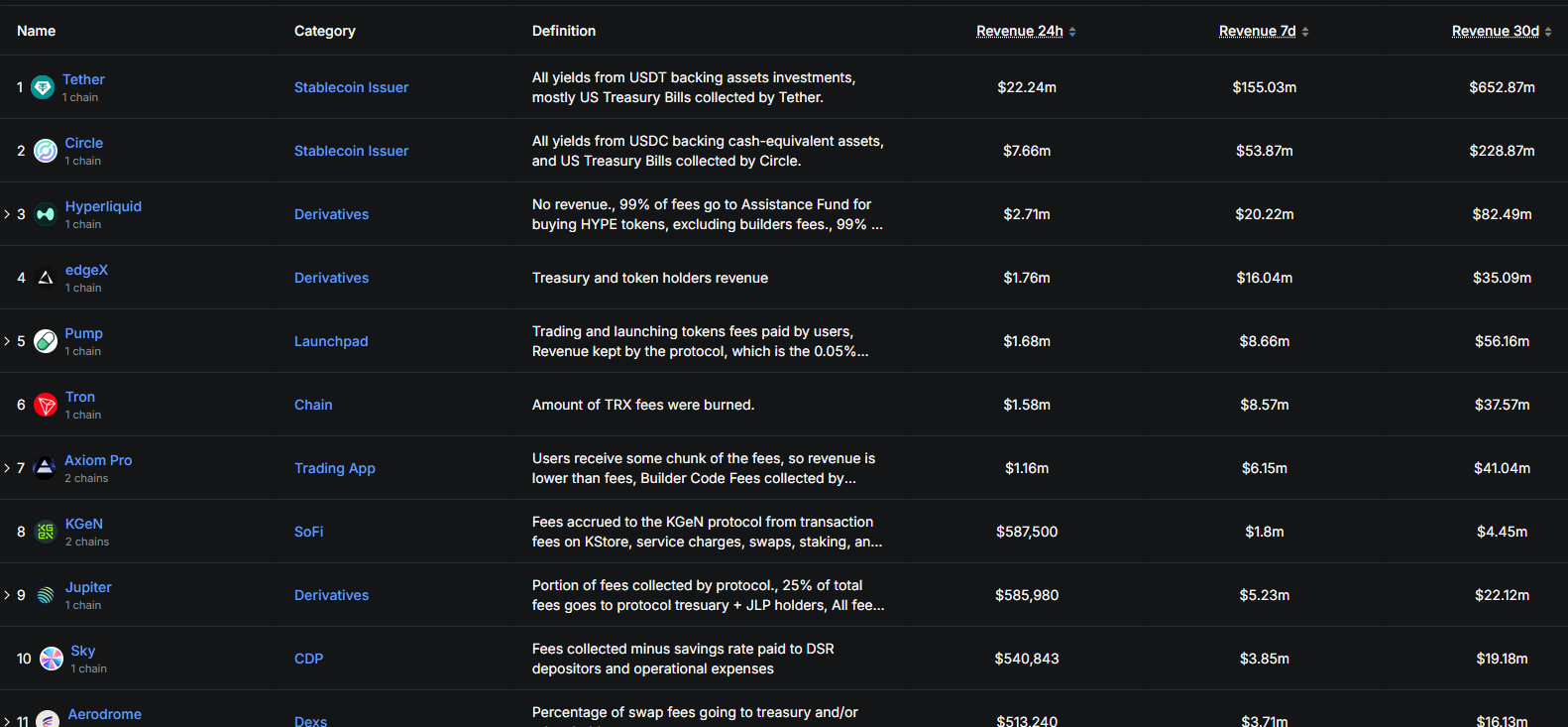

Revenue

Here you can see the monetization models of protocols.

- For example, Tether generates daily revenue by investing USDT reserves in US Treasury bills.

- PancakeSwap earns from trading fees, sharing 50% with users.

Risks, Vulnerabilities

DefiLlama only aggregates raw data from the blockchain, while contract verification, token economics, and off-chain facts you must check yourself. Otherwise, the risk of financial loss increases many times over.

For instance, in Q3 2025, $434 million was lost due to exploits and fraud in DeFi and CeFi, primarily because of access control vulnerabilities and phishing.

Let's consider the most common risks and shortcomings in the table below.

|

Risk/Shortcoming |

What is the danger? |

|

Yield (APY) |

High APY is often achieved through the emission of new tokens, leading to their rapid devaluation. Real profit might turn out to be insignificant. |

|

Protocol Security |

It does not conduct real-time risk assessment. You might enter a vulnerable or fraudulent pool. |

|

Lack of Depth |

Does not display liquidity depth (spreads). High TVL can be deceptive due to one large deposit or speculative farming. |

|

No Off-Chain Metrics |

Lacks key protocol health metrics – number of active users, income, and revenue. TVL without them is a weak indicator. |

|

Complex for Beginners |

An abundance of complex data without explanations can lead to misinterpretation and ineffective investment decisions. |

|

Does Not Account for Dynamics |

Shows only instantaneous rates, not accounting for future token volatility, lock-ups, or penalties for early exit. |

From the risks, it's clear that all figures are taken from smart contracts, but after you enter, the real APY can drop due to an increase in TVL or the end of token emissions, so high rates often turn out to be a mirage of the first hours.

Therefore, it is extremely important to consider all criteria for selecting protocols.

Conclusions

In DeFi, money doesn't just sit idle but works and brings rewards, however, it's important to consider the risks.

If you apply DefiLlama filters by TVL, asset type, and chain, you can quickly cut through the noise and focus on protocols that have already proven themselves as sustainable. This helps reduce the risk of falling for a scam or entering a low-liquidity pool.

Disclaimer – The information provided in this article should not be considered financial advice! This article was created for educational purposes only. Never invest more than you can afford to lose, and seek advice only from your personal financial advisor.