What is the Digital Ruble? How does it work? When will it be launched? Is it a cryptocurrency?

Digital Ruble what is it: a quick answer

Highlights:

- The digital ruble is not a cryptocurrency, but it is protected by crypto encryption and created on a centralized blockchain

- The digital ruble is no different from the cash ruble and the modern non-cash ruble (bank transfer)

- 1 Digital ruble = 1 cash ruble (and non-cash too).

- The digital ruble will not replace cash and non-cash payments, but will only complement them

- You will not lose digital rubles, even if your bank closes!

- The digital ruble belongs to the Bank of Russia

- You can pay with a digital ruble abroad

- The digital ruble will be launched in April 2023

- The digital Ruble will not be traded on a cryptocurrency exchange, like, for example, USDT

- Digital ruble reliable, fast and safe

What is the digital ruble?

The Digital Ruble (CBDC) is a new, official and additional form of the Russian national currency, which will be issued by the Bank of Russia in digital form (electronic). The digital ruble will be able to combine the properties of both cash and non-cash rubles.

Like non-cash money (online payment), the digital ruble makes remote payments possible. At the same time, just like cash, the digital ruble can be used offline - that is, even if there is no access to the Internet.

The digital ruble will be available to the following economic entities:

- Citizens

- All types of business

- To all participants of the financial market

- Government

Just like cash and non-cash rubles, the digital ruble will perform all 3 standard functions of money, namely:

- Means of payment

- Measure of value

- Savings

Simply put, a digital ruble is the same ruble as the one used in a bank transfer: it cannot be touched (it has no physical analogue like cash), but at the same time its value is exactly the same as that of cash. It was created as a more convenient, modern means of payment to reduce costs (on logistics, commissions, production, etc.), and most importantly, it is faster, more reliable and safer. Yes, the digital ruble is not a cryptocurrency, but it has a centralized (state) blockchain and is protected by crypto encryption!

Important! If a user starts a digital wallet for a digital ruble only through 1 bank, and this bank eventually closes, then the user will not lose access to their digital rubles! Whatever the amount of digital rubles in the wallet, users will continue to be able to safely use their funds through other banks in which they are serviced!

Each digital ruble will have its own unique number, just like cash, so it will be easy to track their movement in case of theft.

Also, digital rubles can be bequeathed and inherited, while, importantly, close people (relatives) will be able to receive an inheritance from a digital account necessary to pay for the funeral, before the expiration of 6 months from the date of the announcement of the inheritance.

What is the digital ruble equal to?

The digital ruble is the same ruble as cash and non–cash.

Now 1 non-cash ruble = 1 cash ruble, and 1 digital ruble = 1 cash (or non-cash) ruble!

All 3 forms (cash, non-cash, digital) of the Russian ruble will be absolutely equivalent.

Digital Ruble to Dollar

As we wrote earlier, the digital ruble does not differ from the usual cash (and non-cash) ruble. Therefore, a digital ruble will cost the same to the dollar as a regular ruble!

When will the digital ruble be launched?

Initially, the digital ruble was planned to be launched in 2024. However, in February 2023, it was decided that the digital ruble would be launched in April 2023.

On this occasion , the Deputy Governor of the Bank of Russia said:

"The pilot phase will work with real operations for real people, but only for a limited number of them, with 13 banks that have declared their readiness."

List of 13 banks: Alfa-Bank, Sberbank, TKB, Ak Bars, VTB, Dom.RF, Tinkoff Bank, Gazprombank, Rosbank, PSB, Soyuz bank, SKB-bank.

Will the digital ruble replace cash and non-cash payments?

No, the digital ruble will not replace cash! It is considered not as a replacement for cash or non-cash rubles, but as an addition to existing forms of money.

Official response:

Simply put, not all segments of the population will be able to switch to the digital ruble. A vivid example of this is pensioners who will not be able to switch to a new, complex system. Many people are still more comfortable receiving cash and paying only with it.

It takes a lot of time to replace a cash payment with a digital ruble. At this stage, the digital ruble will be introduced to the masses, and after a few generations, when everyone will be able to use digital money without problems, they will be able to replace cash! But a complete replacement of cash is not yet planned.

What is the digital ruble for?

The most important advantage of the digital ruble over cash and non-cash payments:

- The digital ruble will make payments even faster, safer and easier.

- The development of digital payments will lead to a reduction in the cost of payment services, as well as money transfers.

- The sender will be able to label digital rubles at will, so that the recipient spends them only for certain set goals. This ensures transparency of transfers and circulation of the money supply.

Now let's look at this in more detail.

What is the security of this system? All operations with digital rubles will take place on the regulator's platform, and they are also protected using cryptography. The Bank of Russia will be able to track transactions of digital wallets and guarantees the safety of money.

Why will the digital ruble be faster? Transactions with digital rubles pass through a digital wallet and this happens almost instantly and without pauses — 24/7 (for example, how the Fast Payment System (SBP) works now). This applies not only to transfers between people, but also payments to company accounts.

What is the convenience of the digital ruble over cash and non-cash payments? Anyone can conclude secure transactions (so-called smart contracts) directly on the regulator's platform. Under these contracts, payment in digital rubles will be carried out automatically with the strict fulfillment of the pre-prescribed terms of the contract.

What is the transparency of the digital ruble? The sender of digital rubles will be able to label them so that the recipient spends them only for the specified purposes. For example, parents will be able to label digital rubles that they transfer to their children, and the marked funds can be spent, for example, only on paying for lunches and travel (or something else).

All this will serve as an incentive for innovation both in the field of retail payments and in other areas, and will support the development of the digital economy. Reducing the dependence of users on individual providers will increase the stability of the country's financial system.

Will the digital ruble be able to pay for purchases abroad?

The digital ruble has not yet been put into circulation, so this answer is purely theoretical.

Theoretically, it is possible to pay for goods abroad, moreover, various states are already experimenting with cross-border payments in digital currencies.

But at the same time, when using the digital ruble, the same question arises as when using other types of money.

For example, if a user sends a digital ruble to China, then you need to make sure that the Chinese get the coverage they need for it (in rubles, yuan, gold, etc.). It will be necessary to set exchange rates for such types of transactions.

The main question for many is: "Will digital rubles be able to replace the bank cards or SWIFT bank transfers that are not working abroad?" - they may be able to, but, again, the answer to this question is still theoretical.

Advantages of the digital ruble

Recently, there has been a growing interest in the use of non-cash money.

The digital ruble should become a new, convenient, additional means of payment for both sellers and buyers, especially in remote, hard-to-reach and sparsely populated areas where access to financial infrastructure is severely limited.

Thanks to the digital ruble, the coverage of the population with financial services will increase, which will become more accessible, which will eventually improve the quality of people's lives.

In general, the advantages of the digital ruble are many: from reducing logistics costs to security and increasing the coverage of the population with financial services!

How to use a digital ruble?

Using a digital ruble will be as easy and simple as using a bank card or an electronic wallet (for example, Qiwi).

As we wrote earlier, all transactions of the digital ruble can be carried out both online and offline.

To perform transactions offline, without Internet access, users will be able to pay in advance by reserving a certain amount of digital rubles in their electronic wallet (this is similar to how you just put cash in your wallet at home), in places where cards are not accepted.

In the online mode, transactions are performed similarly by bank transfer (as with a bank card).

The main difference is that you can have any number of electronic or bank accounts, and only one digital wallet.

How to create a digital ruble wallet?

Presumably there will be the following procedure:

- The user creates a digital wallet of the digital ruble using the mobile application of any bank (in which he is registered) participating in the digital ruble program (platform). Then he gets access through the applications of other banks connected to the platform.

- Next, the user puts money in the wallet. Through Internet banking or mobile banking, users will be able to replenish their digital wallet with any amounts they need from their regular (current) bank account.

- After that, the user can make transfers to organizations (online stores and others), ordinary people. To do this, you need to: specify the phone number of the recipient of digital rubles (the owner of another wallet), after which he will receive funds instantly. Please note that it does not matter which bank your recipient is a client of — the money between digital ruble wallets goes through the Bank of Russia platform.

How to pay for goods and services in digital rubles? Everything is simple here: digital rubles are transferred from your wallet to the wallet of the company (store). All you will need to make a payment is to scan the seller's QR code through the mobile application in your bank.

It is also very easy to convert digital rubles back into non-cash money. Digital rubles from a digital wallet can be transferred back to your bank account in any of your banks connected to the digital ruble platform!

What are the commissions of the digital ruble?

Users, sole proprietors and companies have the opportunity to create a digital wallet by signing a standard digital account agreement with one of the banks that is connected to the platform.

The bank, in turn, will charge a commission for transactions. However, these commissions will not exceed the amount set by the Central Bank.

According to the chairman of the Central Bank, digital accounts should reduce the cost of settlements.

The tariffs of the digital ruble will not be higher than in the current "System of Fast payments" (SBP), that is, they will amount to 0.4–0.7% of the amount.

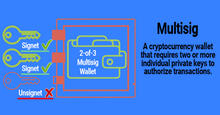

Can scammers steal a digital ruble from accounts?

Quick answer: only by tricks such as social engineering.

The main thing here is to understand that the digital ruble is different from the non-cash payment we are used to, since it has cryptographic protection and is based on the blockchain!

All user data is kept in the strictest confidentiality with the use of the latest cyber defense technologies.

Any transaction in digital rubles takes place only if the user confirms it with his electronic signature.

But at the same time, you should not lose vigilance, since scammers will always try to lure money (for example, with the help of social engineering tricks).

At the moment, if the user transfers funds to scammers himself, or accidentally informs them of confidential information that will give fraudsters access to the victim's accounts, then banks will not always help to return the funds, or help, but the proceedings may drag on for a long time.

In the case of the digital ruble, it will be possible not only to compensate for the victim's losses, but also to quickly track down the movement of funds by criminals. All this is possible due to the fact that all operations with the digital ruble take place on a single, centralized platform of the regulator (centralized blockchain) and the actions of the attackers can be tracked and see which wallet the stolen funds went to.

Can the digital ruble create inflation?

The digital ruble will not create inflation, since more or less money will not appear in the country because of the digital ruble.

The digital ruble is just a new form of money! There will be no additional issue of money due to the appearance of the digital ruble, which means that this will not affect prices and their growth.

What should I do if something breaks?

The Bank of Russia will create a single portal for digital ruble users.

Applications from users will be sent to 2 places at once: to the regulator and your bank, in whose mobile application the user could not, for example, receive a transfer or make it.

Users will be able to ask all these or other questions in real time 24/7 in the CB Online chat.

Now let's answer the question in more detail, what is the central bank's digital currency?

What is the central bank's digital currency?

The central bank's digital currency (CBDC) is money that can be issued by a country's central bank. They are called digital (or electronic) because they are not physical money like banknotes and coins (paper/metal money).

The central bank's digital currency can be represented as an amount on a computer or similar device.

The Bank of Russia is the central bank of Russia, and it is carefully studying the idea of a central bank digital currency for Russia.

The central bank's digital currency is a type of digital money.

How does the digital ruble differ from the cryptocurrency?

Most likely, you have heard about Bitcoin, Ethereum and USDT. These are examples of private digital assets (sometimes called cryptocurrencies or crypto assets). CBDC differs from crypto assets in several important aspects:

- Firstly, crypto assets are issued privately. If something goes wrong with the crypto asset, the central bank or the government will not be able to intervene.

- Secondly, the value of the crypto asset is unstable. It can rise or fall quickly in a very short period of time. This is not ideal when making payments. Unlike cryptocurrencies (such as Bitcoin), digital rubles will be stable and retain their value over time!

- Also, cryptocurrencies are decentralized and this is not always good. The digital ruble will be fully centralized and supported by the state.

As we have already said, cryptocurrencies are not regulated and are most often decentralized. Their price is determined by investor sentiment, external political situations, regulations, use and interest on the part of investors.

You need to understand that cryptocurrencies are volatile assets that are more suitable for speculation (earning on the difference in exchange rates, holding coins before the onset of growth - hype, and others). All this makes them impossible candidates for use in a financial system that requires stability.

CBDCs reflect the value of the fiat currency and are designed to ensure stability and security.

How does the digital ruble differ from the modern cashless payment?

From the point of view of the use of bright differences will not be. The digital ruble will be faster than non-cash payments (as for domestic and foreign transfers), and it will also become much safer and more secure.

Also, users affected by fraudsters will now be more likely to return the stolen funds (meaning those that they sent themselves, due to the same social engineering).

In general, all this is very similar to a standard, familiar to everyone, bank account, but with one very important difference.

At the moment, the money of users (enterprises, etc.), lies on accounts in commercial banks. Digital rubles will be stored directly in the Central Bank, that is, with the state, which is more reliable and safer.

Is the digital ruble a cryptocurrency?

Despite the fact that the idea of digital currencies of the central bank (CB) comes from cryptocurrencies and blockchain technology directly, CBDC are not cryptocurrencies.

CBDC are controlled by a central authority - the state, whereas cryptocurrencies are almost all decentralized, which means that they cannot be regulated by one authority, and they also lack guarantees of consumer protection and their value is subject to serious fluctuations (volatility).

On the official website of the Central Bank, there is a detailed answer whether the digital ruble is a cryptocurrency:

"The digital ruble is an obligation of the central bank, implemented through digital technologies and has nothing to do with "cryptocurrencies". This is a fiat currency, that is, a currency whose stability of functioning is provided by the state in the person of the central bank"

How does the digital currency (digital ruble) differ from Stablecoin?

The most important difference between a digital currency (of any country) and a stablecoin is that the stable coin is not official, it was issued by a private company. Yes, most often it is tied to some asset (USD, EURO, oil or gold, and so on), and the digital currency belongs to the state, and it regulates it.

If the stablecoin dies, depositors will lose all funds, and the digital currency is supported by the state, and it will always regulate all processes.

A striking example is the stable TerraUSD coin (USTC), which collapsed in 2022 and all depositors (holders in this coin) lost all their funds!

Also an example of the Tether (USDT) coin, which had courts with the US SEC at the beginning of 2022, because of which the price of the stable coin sank a little.

Therefore, from the point of view of reliability, the digital currency greatly benefits, since it is protected by the state!

Will cryptocurrency exchanges accept the digital ruble?

In our usual understanding for exchange on the stock exchange (example of exchange: USDT / BTC), there will be no such listing, and it is impossible.

Most likely, cryptocurrency exchanges that now allow you to deposit /withdraw Rubles will accept a new type of replenishment with Rubles on their platform – through the Digital Ruble platform.

However, this may not happen.

Is it possible to make money on the digital ruble as a cryptocurrency?

Нет, цифровой рубль, как мы уже сказали, это такой же рубль, как и наличный. Он не подвержен высокой волатильности, как криптовалюты, такие как, к примеру, Bitcoin.

Therefore, you will not be able to earn on a digital ruble as a separate asset (in the usual sense of earning on cryptocurrency), but you can use it as an accumulation!

Conclusion

Цифровой рубль – это будущая ступень развития платежной системы.

This is a really convenient, innovative, modern and most importantly reliable (safe) solution.

The digital ruble has a huge future that will soon affect all of us!