What is DePIN in cryptocurrency? Explained in just 3 minutes

You'll learn what DePIN is, how it works, examples of how to earn money, and what it means for the crypto space.

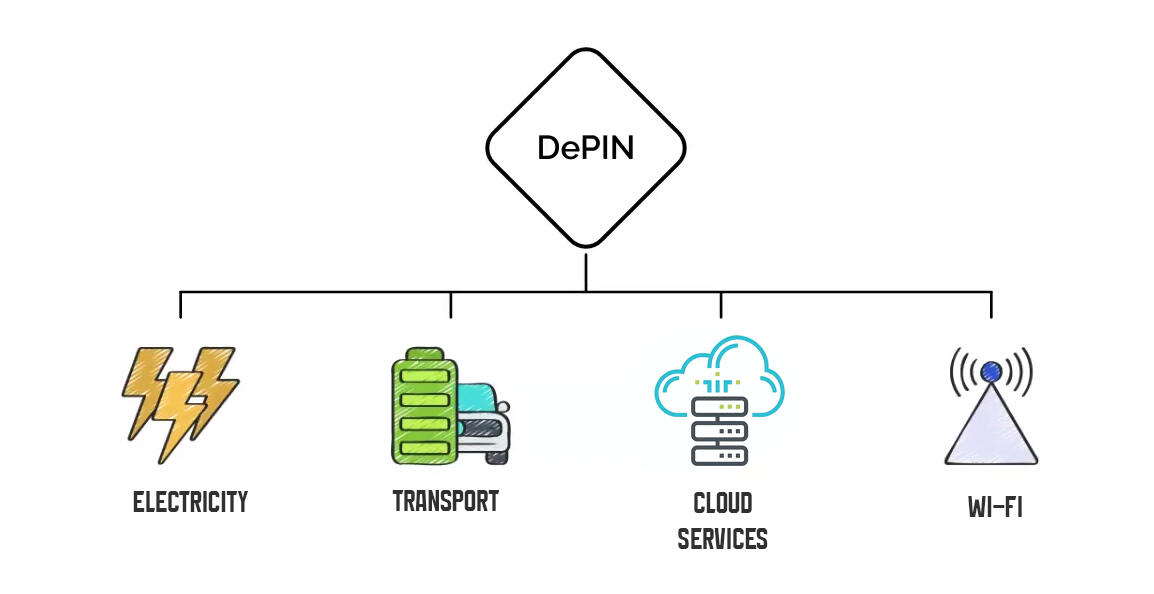

DePIN stands for Decentralized Physical Infrastructure Network. Simply put, DePIN is when people around the world share their real-world assets (internet, hard drives, electricity) and earn cryptocurrency in exchange.

Imagine car sharing, where anyone with a car can sign up to earn money, but now it happens on the blockchain. For example, people rent out the space on their computer's hard drives or the processing power of their graphics cards.

DePIN's applications include Wi-Fi hotspots, cloud services, solar power plants, and transportation networks.

People install hardware and supply services to other participants, forming a people’s network that is supposed to be cheaper and more efficient than traditional infrastructure.

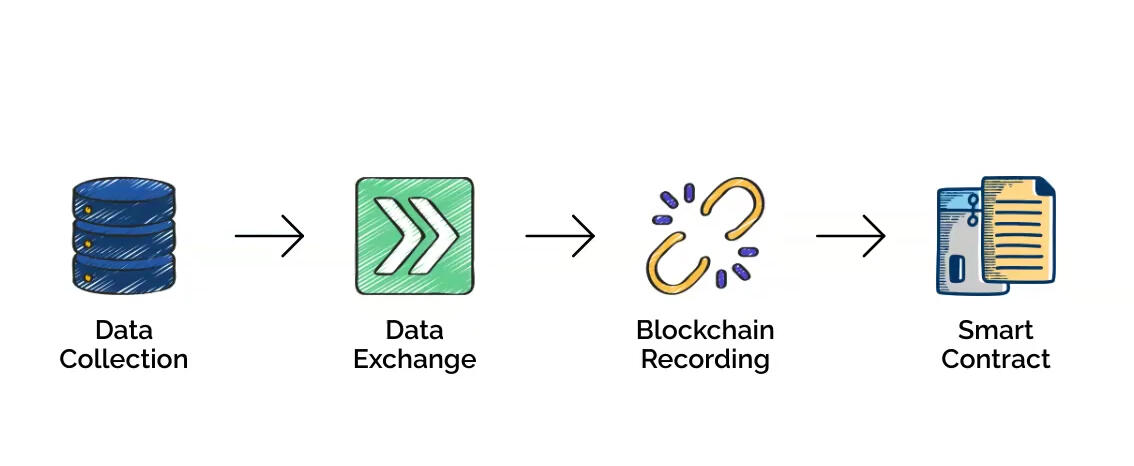

Technically, DePIN works through a non-stop flow of data collection, exchange, on-chain recording and execution of smart contracts. Conditions are hard-coded, which reduces errors and fraud.

DePIN Tokens

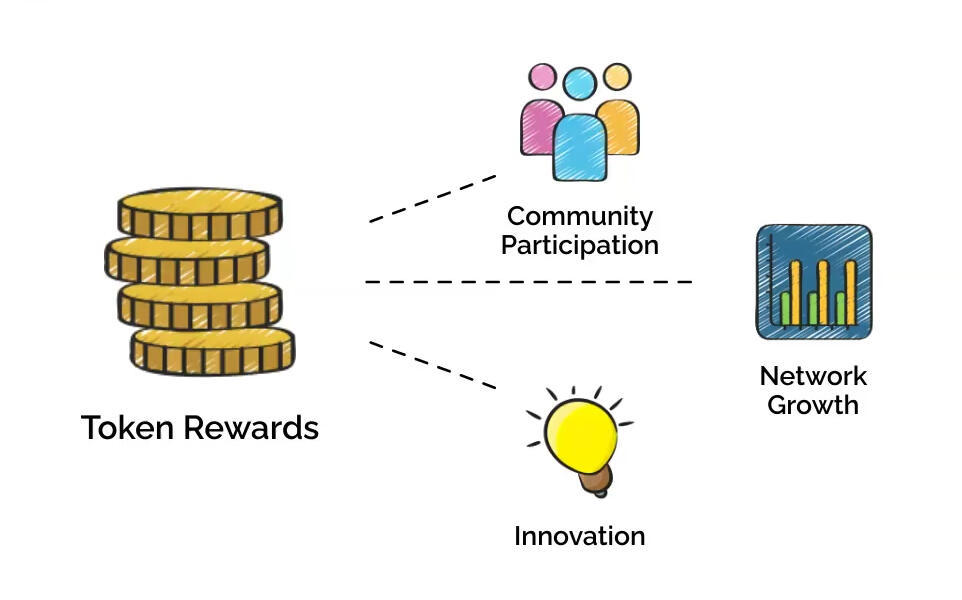

Most DePIN projects issue native tokens to facilitate payments and incentivise participation.

Tokens act as the fuel of the economy: users pay for services, providers earn rewards.

Rewards stimulate active community involvement, grow the network and spark further innovation. Tokens can also be used inside the network to purchase services or traded on major exchanges.

Categories

DePIN can be split into two broad groups—physical and digital (cloud) resource networks.

Physical Resource Networks (PRNs)

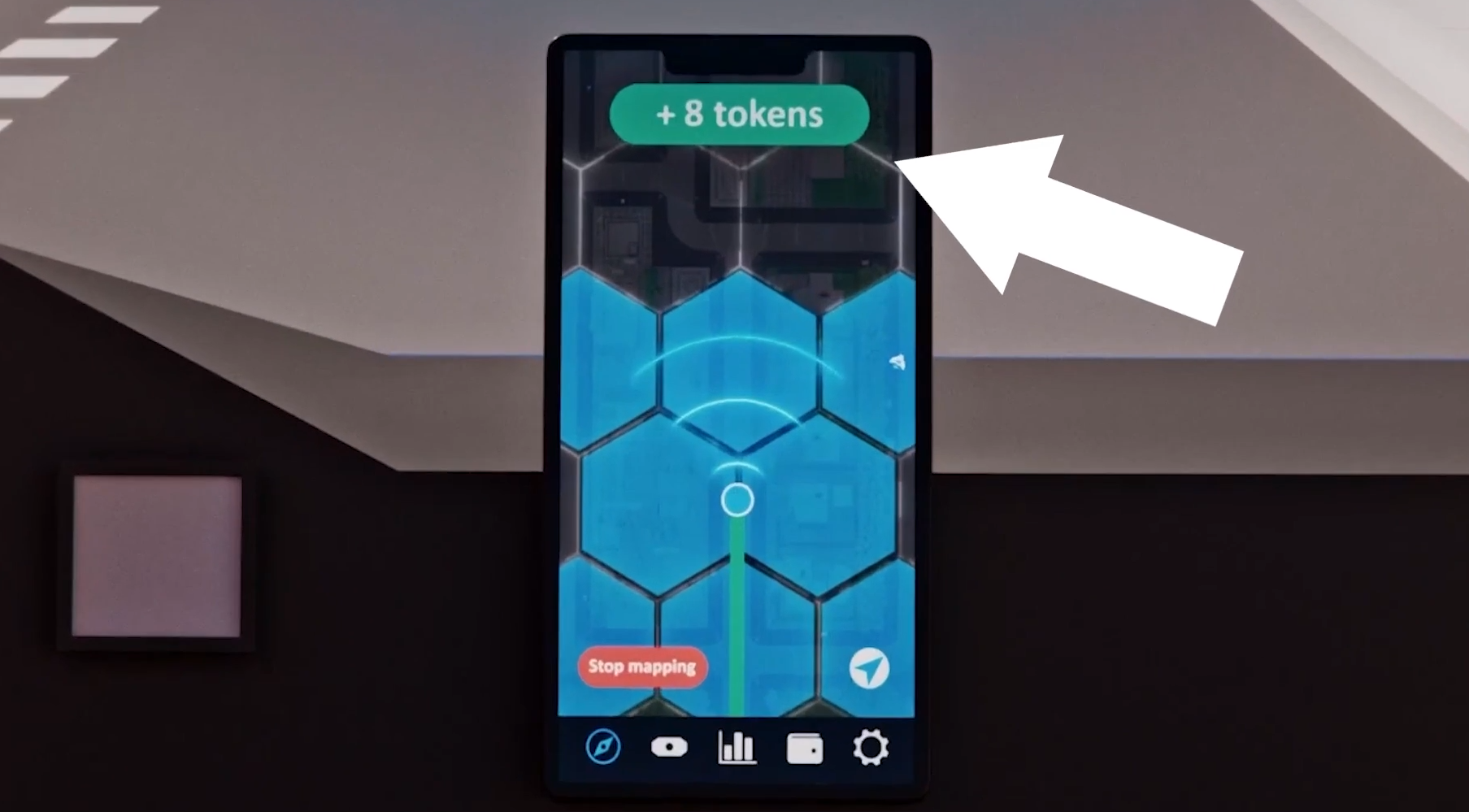

PRNs are sensor networks: interconnected devices with built-in sensors that collect real-world data in real time, e.g. for mapping terrain.

The ROVR project, for example, rewards drivers with tokens for gathering dash-cam data to build maps.

The project creates world maps using ordinary drivers’ dash-cams.

Another example is Fetch.ai, where AI agents automatically perform tasks—booking, trading—via blockchain and tokens.

Or computer-vision modules that analyse visual data, e.g. parking-lot occupancy.

This helps with traffic management and more.

Digital Resource Networks (DRNs)

On the other side are Digital Resource Networks: decentralised cloud storage, file repositories, databases and CDNs.

Overall, DePIN can be classified into six verticals: compute, wireless, energy, AI services, and sensing.

Example Projects

You are probably wondering which projects actually use DePIN—let’s look at some leaders.

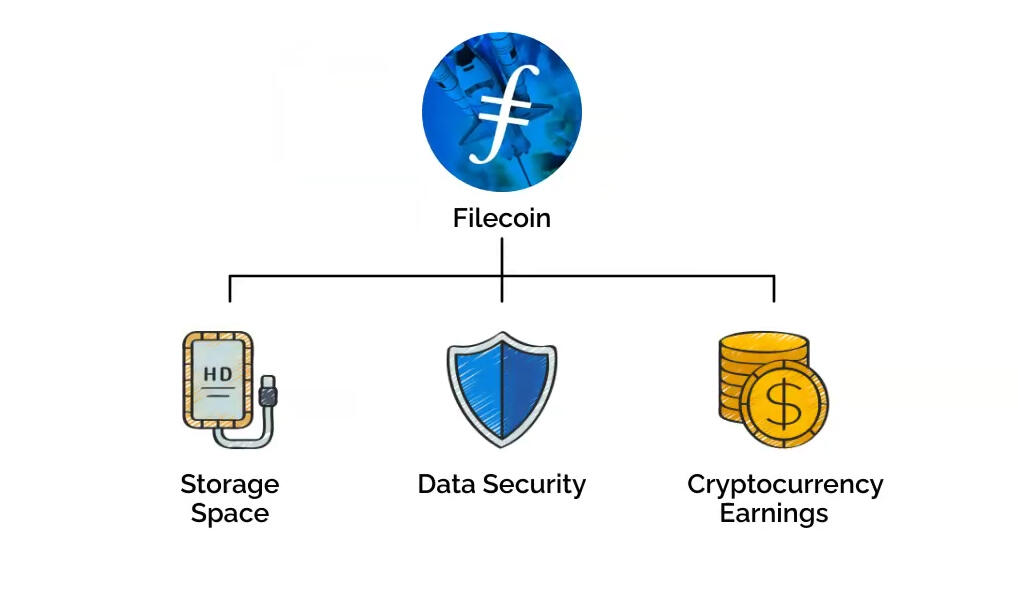

Filecoin

Filecoin is a peer-to-peer storage market. Users pay to store and distribute data, while storage providers earn the native token FIL.

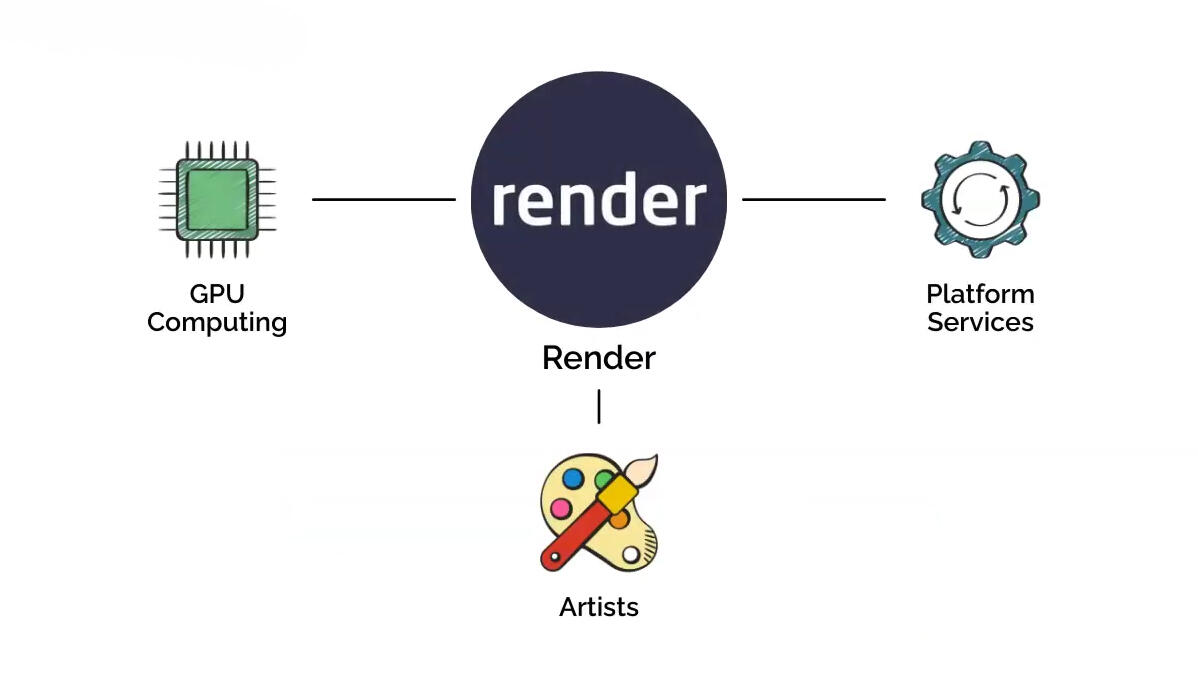

Render

Render connects artists with GPU power suppliers, creating a decentralised marketplace for 3-D rendering. In other words, your home GPU renders interior-design frames and gets paid.

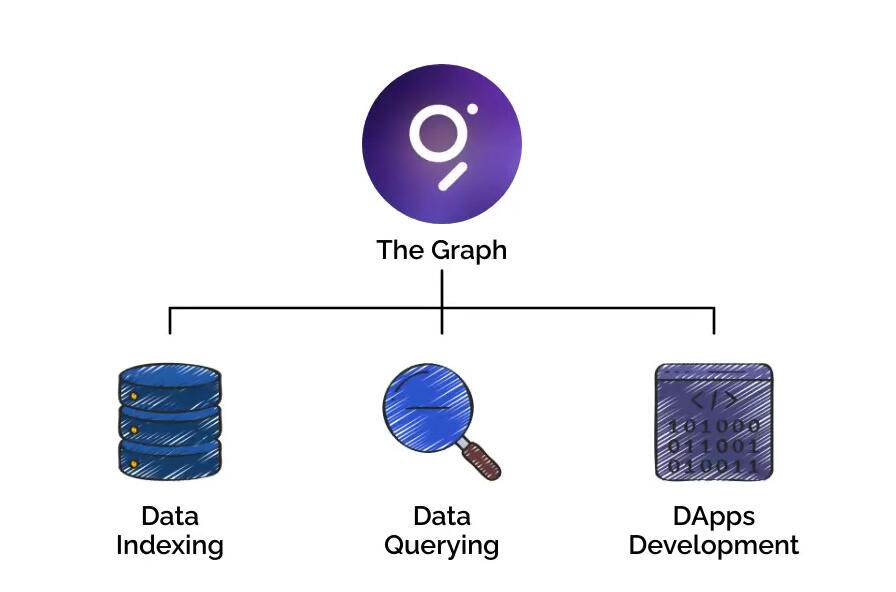

The Graph

The Graph indexes and organises blockchain data for dApp developers, earning it the nickname “Google for blockchains”. It allows fast, reliable queries across Ethereum, Polygon, Avalanche and more.

You can find a full list of promising DePIN projects here.

Advantages

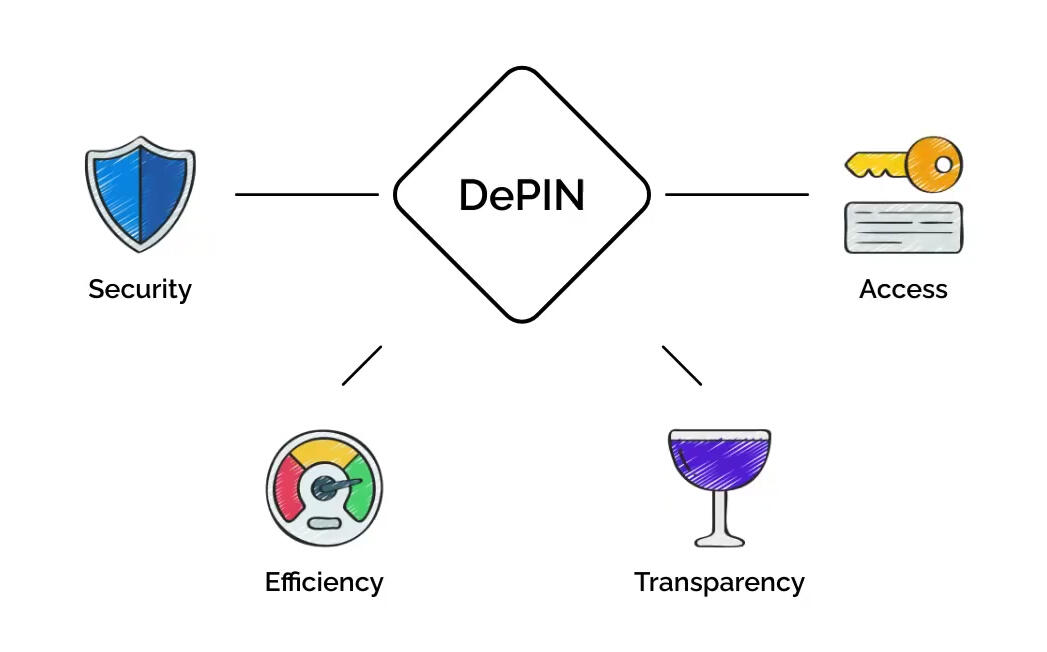

The future of DePIN looks promising. Enthusiasts discuss emerging tech that could accelerate growth. DePIN networks are flipping traditional infrastructure on its head, offering stronger security, operational efficiency, transparent processes and democratised access.

DePIN already integrates hot technologies such as AI, blockchain, IoT and zero-knowledge proofs.

Zero-knowledge cryptography can boost privacy and security when data is exchanged or payments are made.

Yet, despite the upsides, there are also drawbacks.

Drawbacks and Risks

Because the sector is still young, it carries several disadvantages and risks.

|

Risk |

Issues |

|

Regulatory & Technical |

Complex regulation, need for scale, reliance on stable Internet and blockchain. |

|

Economic |

Unclear incentive models, high OPEX, need for self-sustaining economy, long pay-back. |

|

Market & Competitive |

Brutal competition with Web2 giants (Amazon, Microsoft, Google). |

|

Fundamental |

Risk of being a Ponzi instead of a value-creating project, over-valued tokens not backed by revenue, heavy hype dependence. |

So, is DePIN just one big financial pyramid, or are there real use-cases and demand? As usual, it depends on the specifics of each project.

Disclaimer: All information provided in this article should not be construed as financial advice! This article was created for educational purposes.