Hyperliquid DEX exchange: Overview, fees & earning – the full guide

closed-source codebase, still a young exchange, and a past incident where the team had to step in and manually override the protocol.

earn by supplying liquidity, copy-trading the best performers, or simply staking your idle assets.

You'll learn three ways to earn money using the decentralized exchange Hyperliquid. We'll show you how the exchange works internally, how to deposit funds, how to choose the right strategies, and how much you can earn.

First, let's look at the exchange's technology.

Exchange Overview and Its Mechanisms

About the Exchange

Hyperliquid is a decentralized exchange operating on its own L1 blockchain and capable of handling up to 200,000 transactions per second with zero gas fees.

The founder is Jeff Yan, a former employee of the trading firm Hudson River Trading, which held a 5% market share in the US.

Difference from Competitors

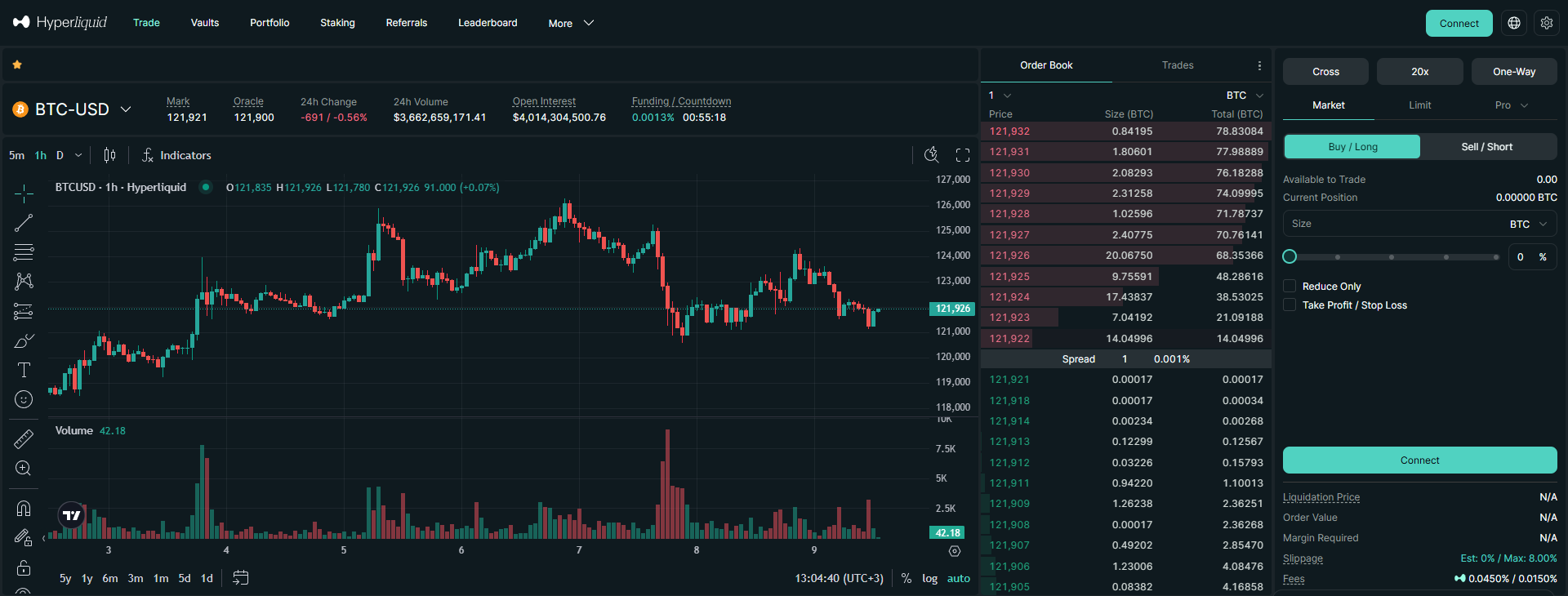

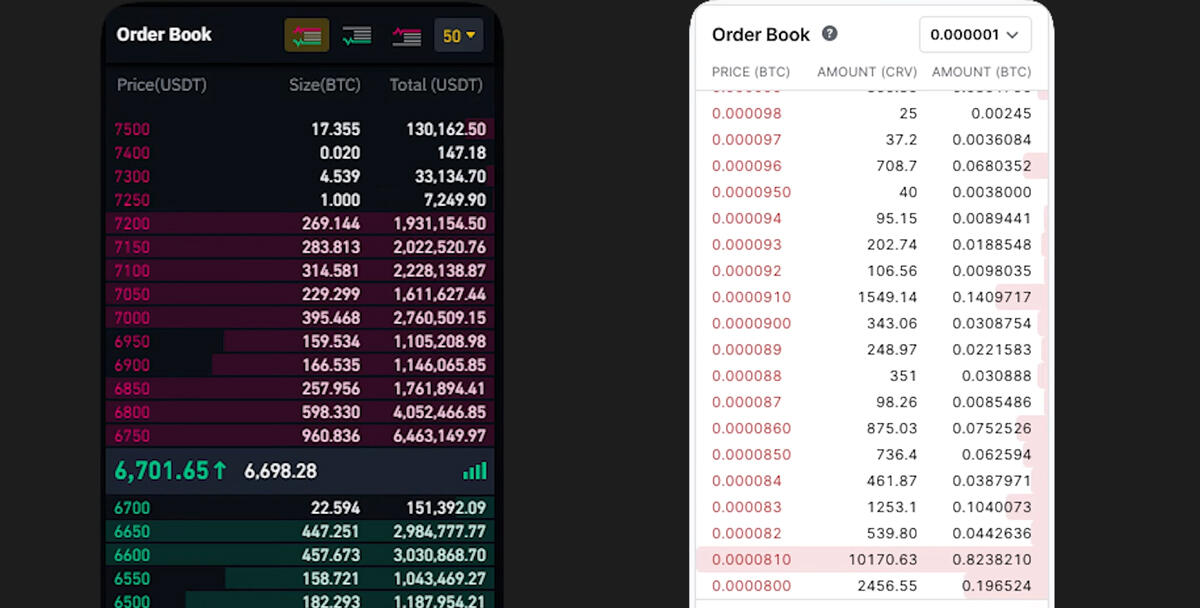

The main difference with Hyperliquid lies in its order matching mechanism. Popular DEX platforms like Uniswap rely on Automated Market Makers, whereas Hyperliquid uses the classic and familiar order book model. It looks similar to Bybit and OKX.

However, trade orders are placed on the blockchain, which prevents the platform from manipulating and deceiving traders. This is because on centralized exchanges, the order book can be "painted" by the exchange itself.

Security and Fund Control

The platform has several advantages over centralized exchanges like Binance.

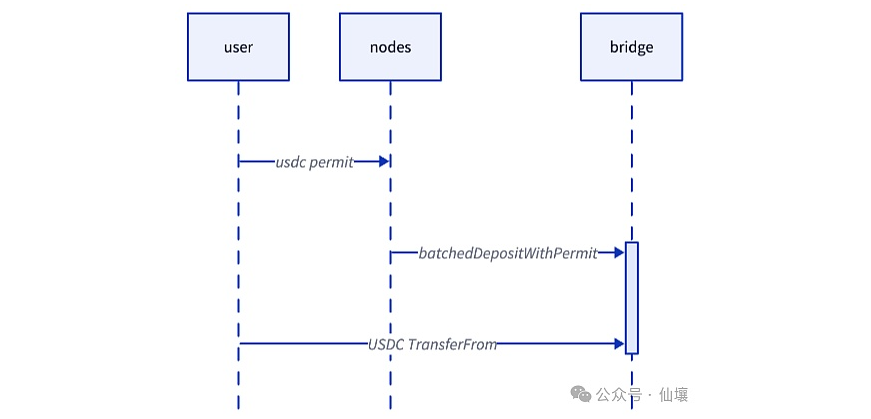

Funds are controlled by smart contracts, and withdrawals involve multiple stages. After a request is initiated, a 200-second dispute-period starts, during which a group of validators can suspend the bridge operation if fraud is suspected.

The ability to freeze funds serves as protection against malicious actors. Although, on the other hand, the existence of such a mechanism implies the potential for fund blocking.

No Verification and Transparency

Another key advantage is the absence of KYC verification. In the era of sanctions, this is extremely relevant - anyone can trade on the exchange.

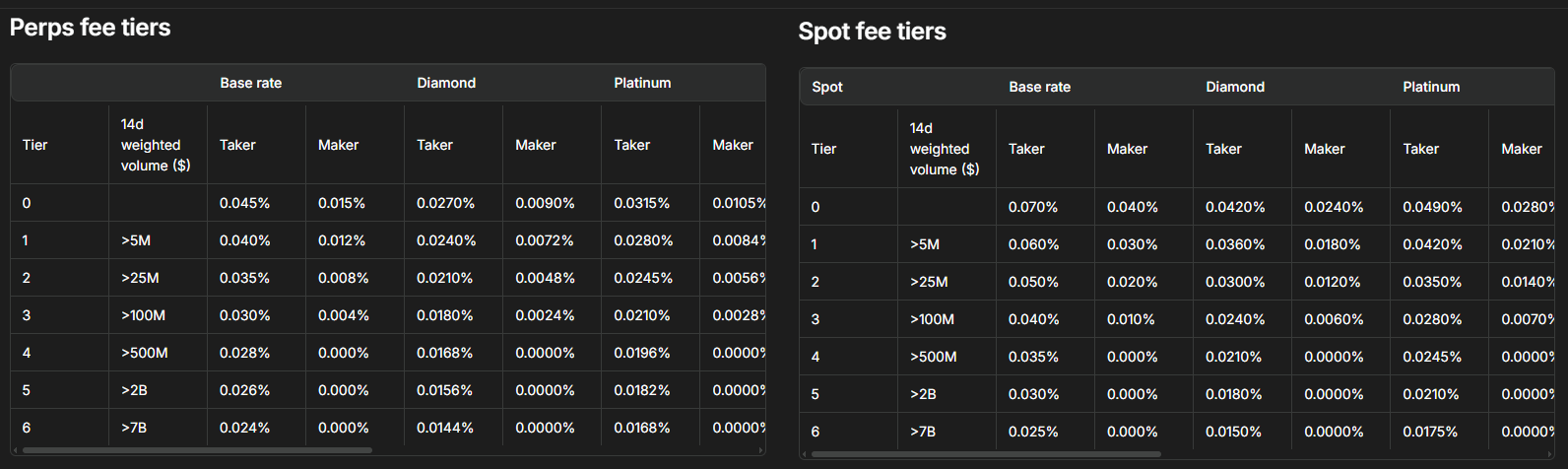

Fees and Staking

Fees here are among the lowest on the market - up to 0.15% for makers on futures and up to 0.04% on spot.

Stakers of the HYPE token are eligible for fee discounts. For example, if you stake 10,000 HYPE, your fee is reduced by 20%. And thanks to the L1 blockchain, transactions are completely free - there is no gas fee.

Liquidity Reservoir

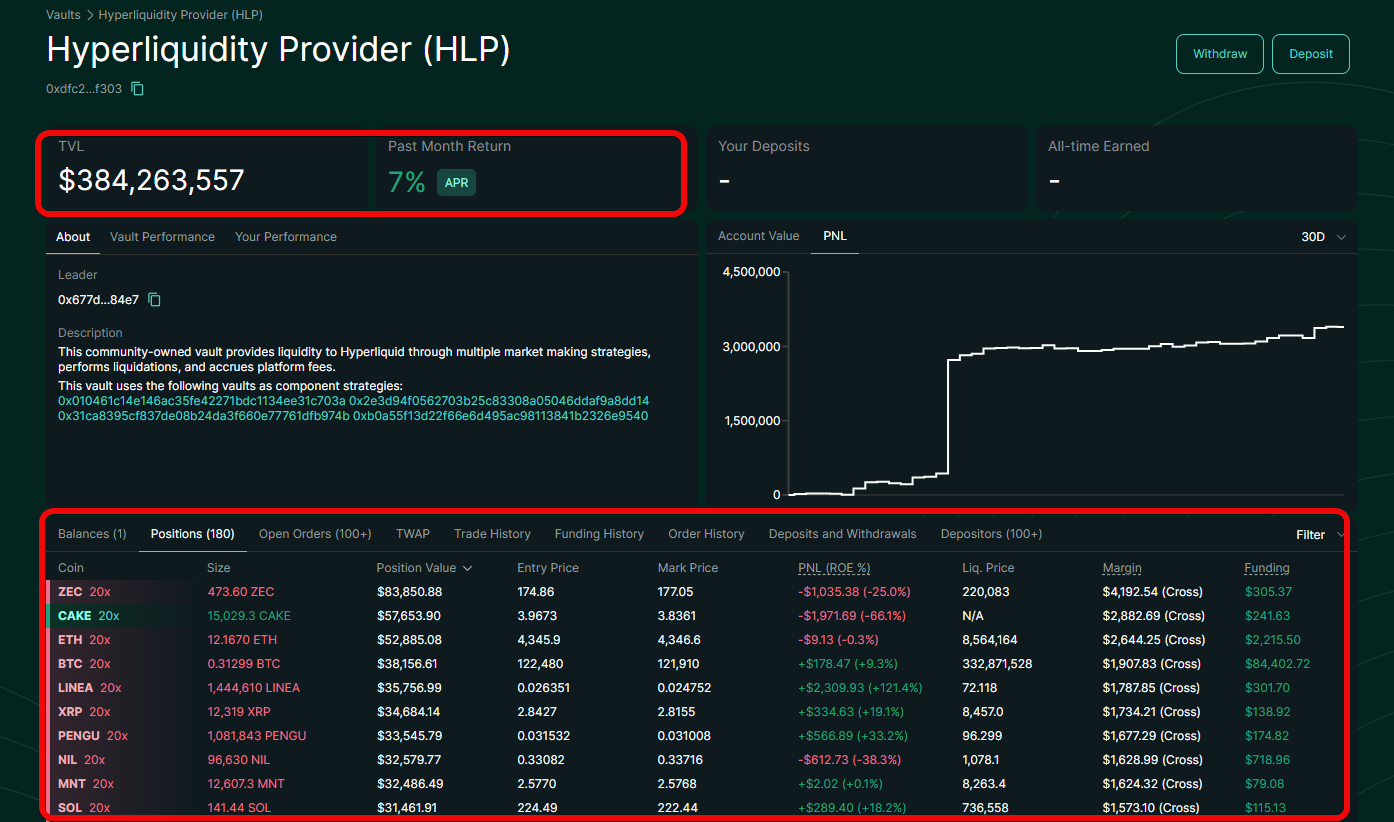

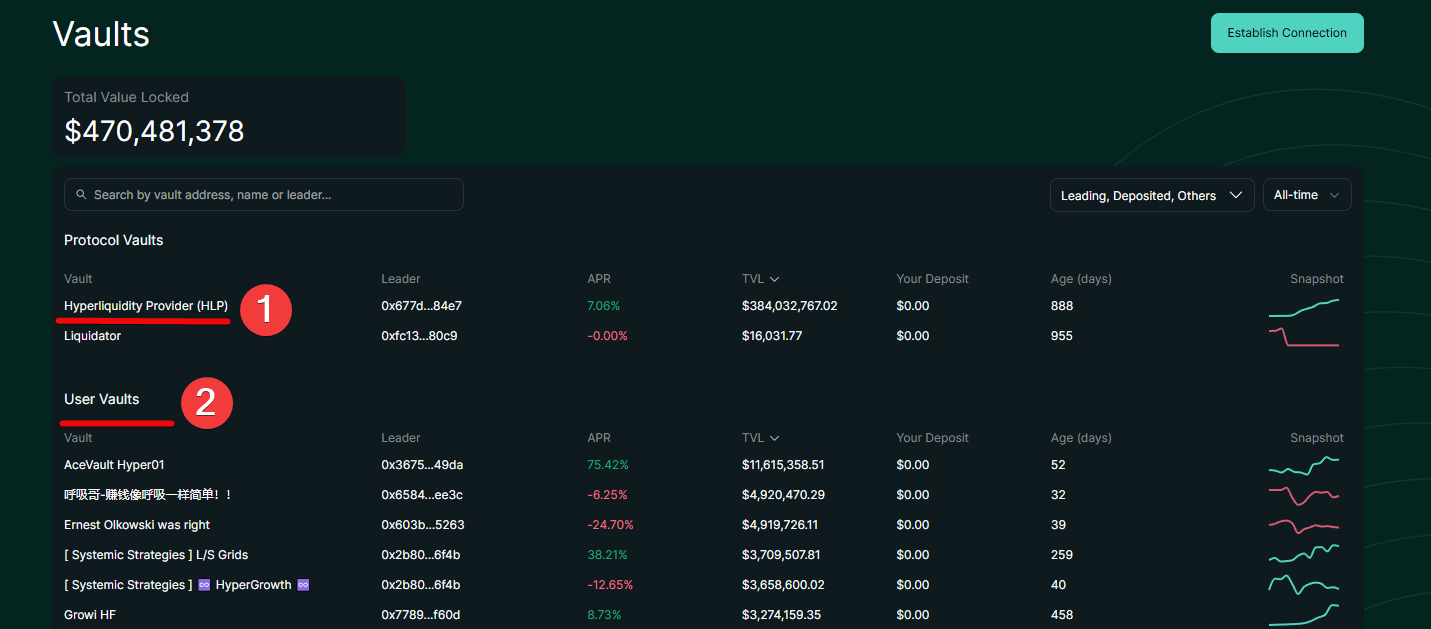

The platform has a very interesting feature called HyperLiquidity Provider (HLP). HLP is a reservoir, or Vaults, managed by the Hyperliquid platform itself, which handles market making and liquidations, earning a share of trading fees. Vaults shares the profit among participants, proportional to your contribution.

Any user can deposit USDC into it to participate in the reservoir's performance. Profit is distributed proportionally to the contribution, no fees are charged, and rewards are automatically reinvested. Funds can be withdrawn along with the earnings 4 days after deposit.

User Strategies and Copy Trading

In addition to the protocol vault, you can create your own strategies called User Vaults and participate in copy trading.

To open your own vault, you need to deposit a minimum of 100 USDC and describe your strategy.

The vault owner trades on behalf of the vault, and all transactions are transparently reflected in its balance. In case of profit, the vault owner receives 10% of the total profit, and the remaining 90% is distributed among the depositors proportionally to their share.

Depositors bear all losses if the strategy is unprofitable - this is a very important point, as if the trader performs poorly, you will also incur losses through copy trading.

Trading Opportunities

Futures (contracts on future price)

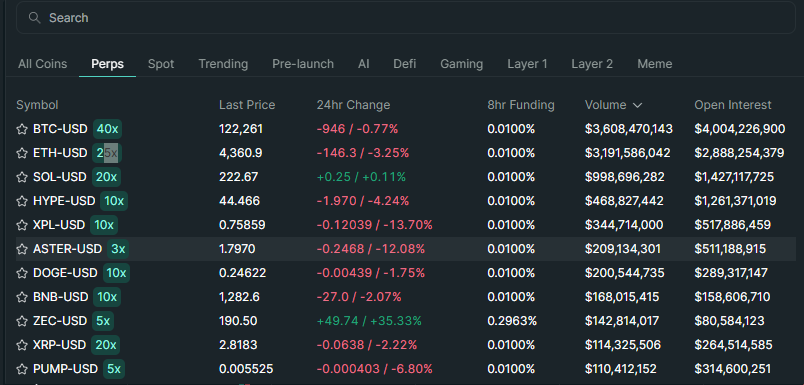

Trading perpetual futures is the exchange's main service. You can place bets on price movements for over 180 trading pairs and use leverage from 3x to 40x,

Leverage allows opening larger positions with less capital.

Spot Trading (at market price)

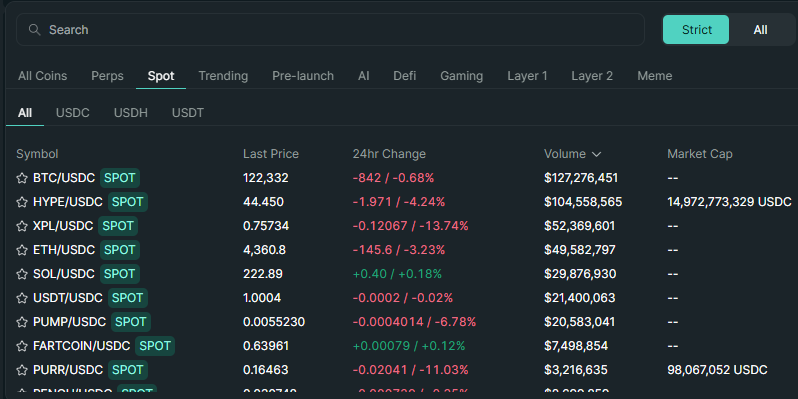

For those who prefer regular buying and selling, Hyperliquid also offers spot trading for over 80 coins.

Let's move on to practice – let's look at registration and funding the exchange.

Registration

Since this is a DEX, direct wallet connection is typically used instead of registration. You will need any EVM wallet, for example, Rabby, MetaMask, OKX. Or a wallet supporting the WalletConnect option.

It's easiest to work in a browser. So, to start using the exchange:

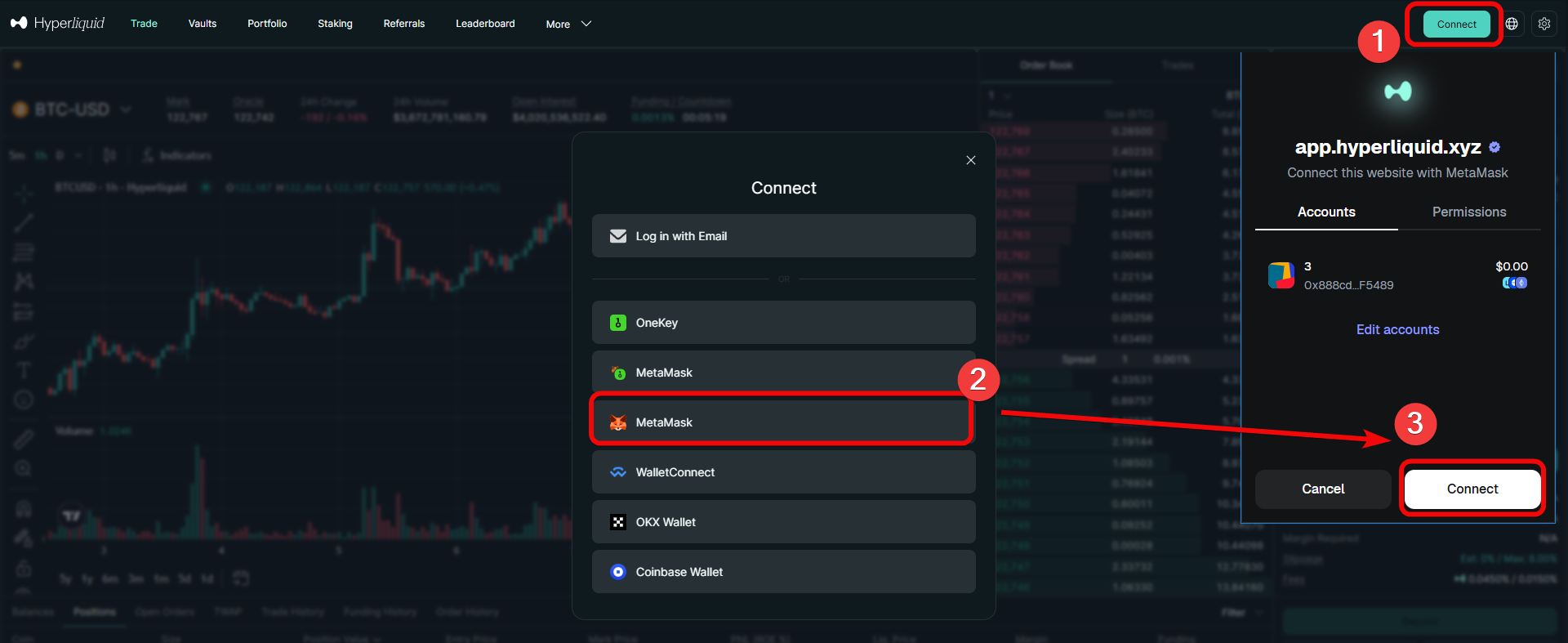

- Click

Connecton the exchange. - Choose a wallet to connect (if you don't have a wallet – install one, e.g., MetaMask)

- A connection confirmation window will appear. Click

Connectin the wallet.

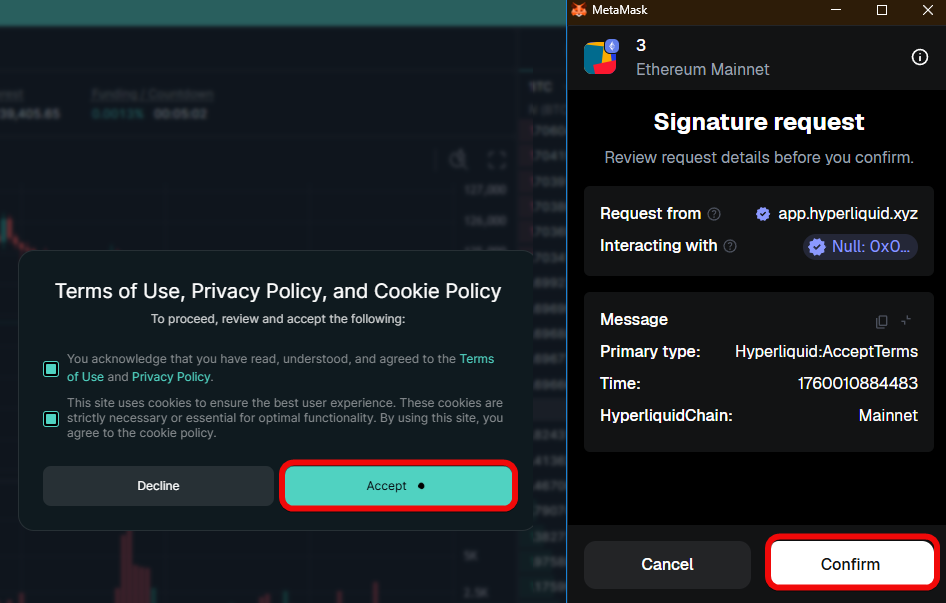

Next, accept the agreement and grant the exchange permissions to interact with the wallet by clicking Confirm.

You have successfully connected to the exchange. Now we'll show you how to deposit funds and how much you can earn.

How to Fund the Exchange?

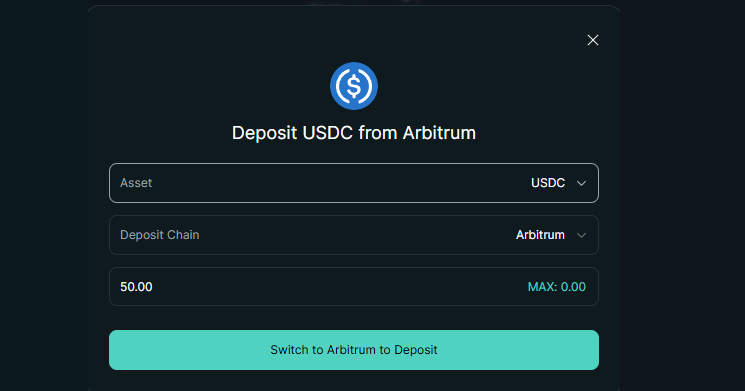

To deposit, click Portfolio → Deposit. Everything on the platform is traded against USDC, so if you have USDC on the Arbitrum network, that's the easiest way! Although other coins are also supported.

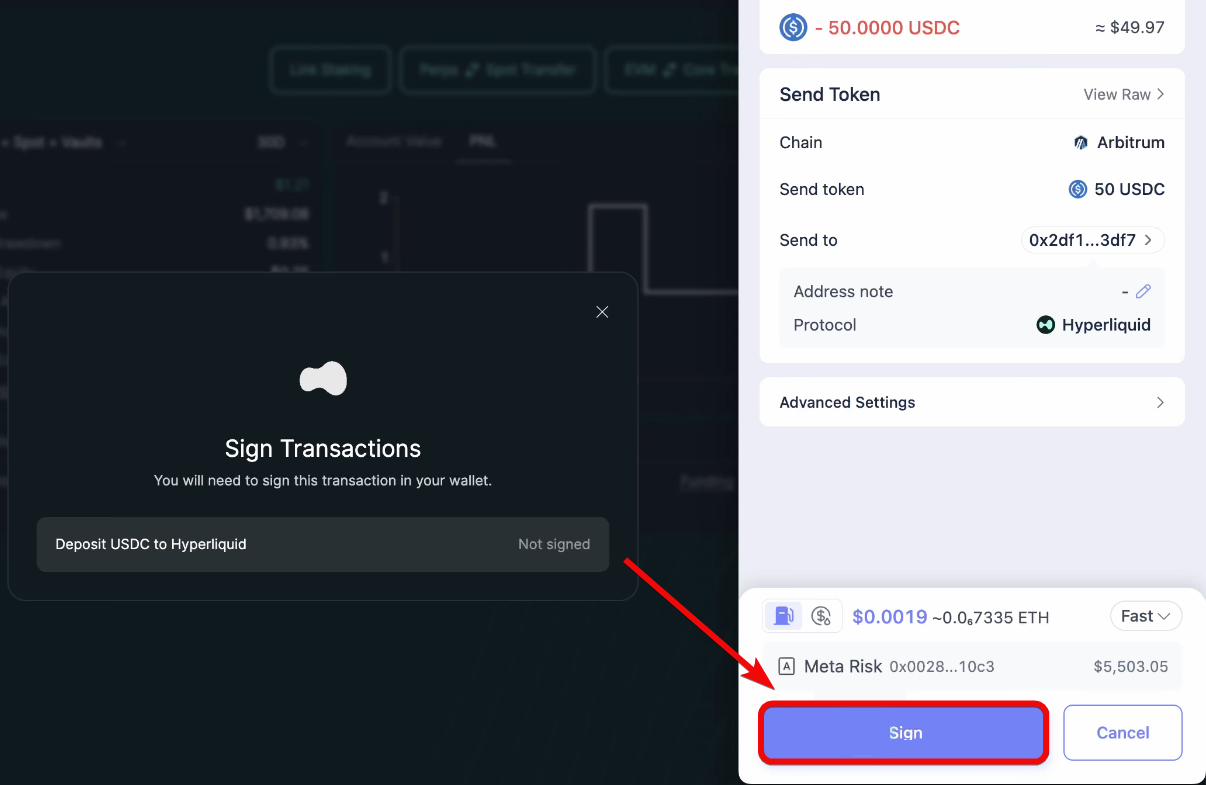

Sign the transaction in your wallet.

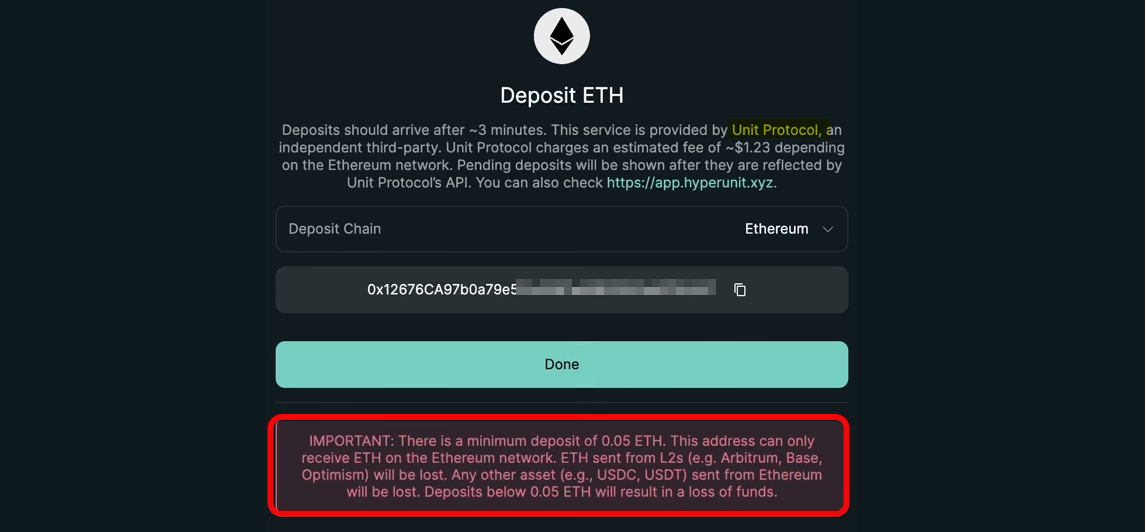

You can also deposit via the Bitcoin, Ethereum, and Solana networks through Unit Protocol.

It's important to send only the specified coins (BTC, ETH, SOL) strictly via their corresponding networks, otherwise the funds will be lost! Minimums: 0.002 BTC, 0.05 ETH, 0.2 SOL.

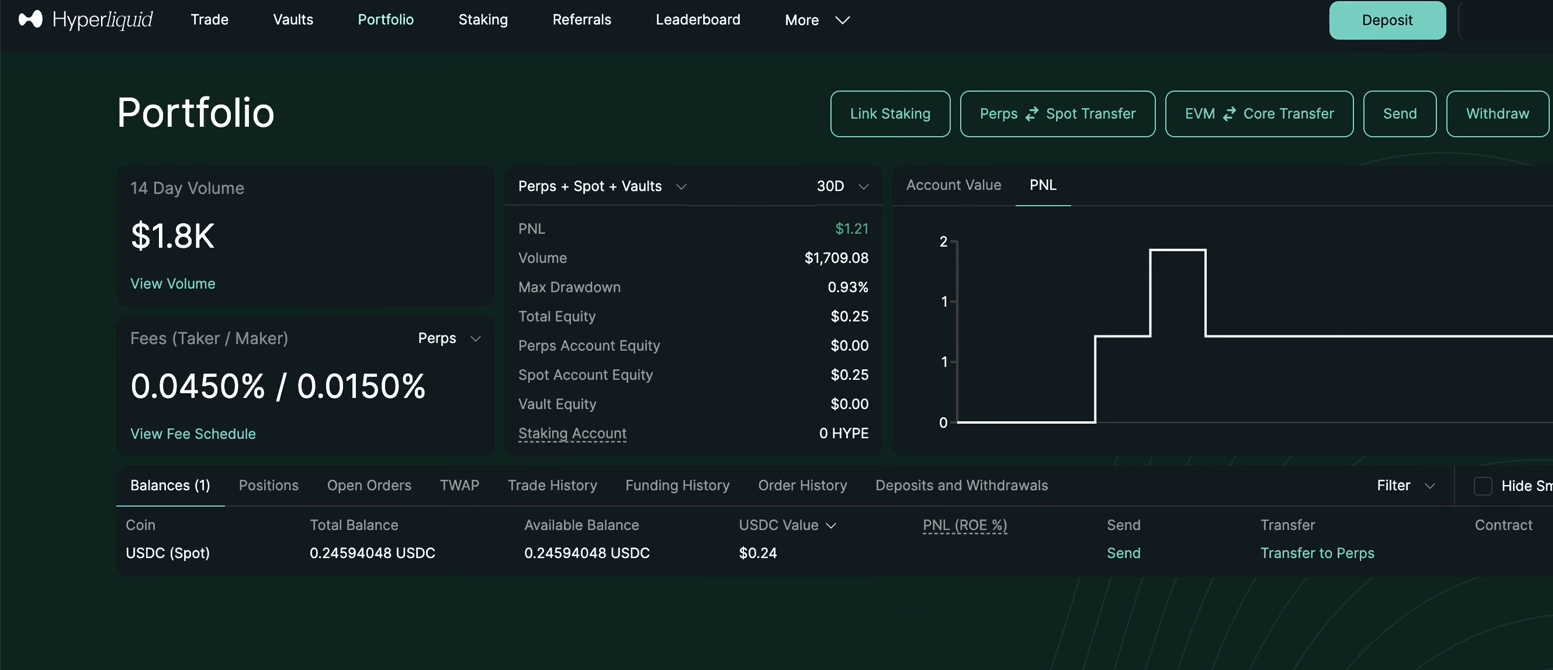

After depositing, funds will appear in the Portfolio tab.

Next question is, how to use the exchange?

Earning Opportunities

Besides trading, there are at least 3 ways to earn here:

- Providing liquidity (HLP Vault)

- Through copy trading (User Vaults)

- Through staking

Let's consider these options.

Earning from Liquidity (Hyperliquidity Provider)

Earning from liquidity involves receiving a percentage from other traders' losses. As is known, most traders eventually lose capital, and exchanges profit from these losses. Hyperliquid shares this profit with you.

The mechanism is this: by depositing USDC into the liquidity pool, you earn when traders lose, and you lose when they earn.

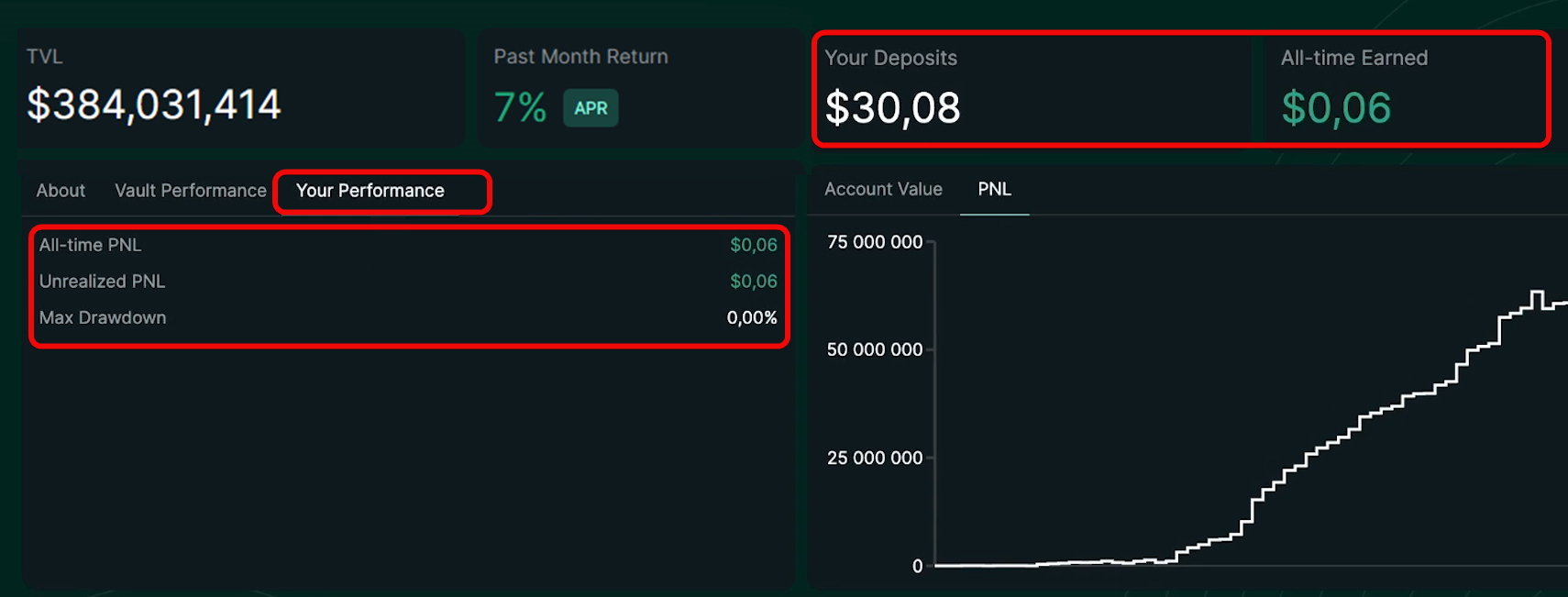

In the long term, statistics are always on the side of liquidity providers because statistically, most traders lose. Over the past month, the annual yield (APR) was 7%, but it changes every day, so you shouldn't rely on these values.

The approximate real value is around 12% annual yield on USDC. In the Vaults tab and the All time parameter, you can see how much the vault has generated - $135 million.

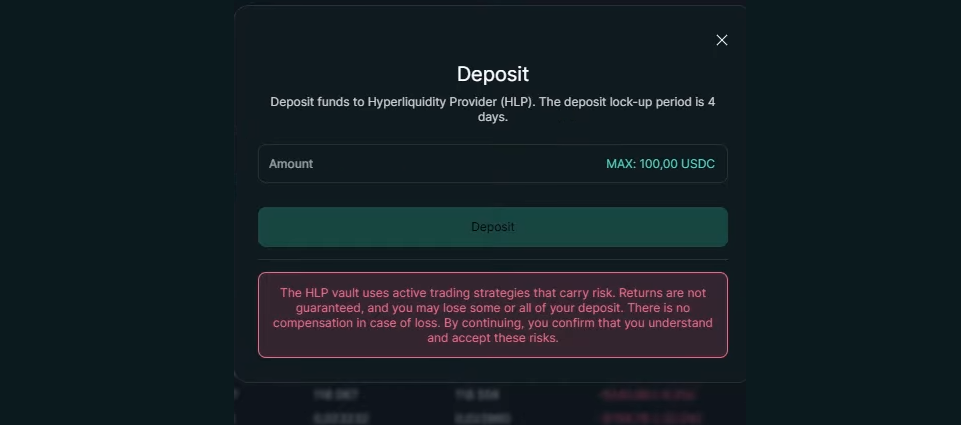

To deposit liquidity, go to the Portfolio section, click Deposit, connect your wallet, and transfer the desired amount of USDC on the Arbitrum network (see the deposit section).

Then go to the HyperLiquidity Provider tab, click Deposit again, and specify the amount, for example $30.

Important: Withdrawal of funds is only possible after 4 days, so consider the lock-up period.

After depositing funds, detailed statistics will open: for example, in January the yield was 1.7%, in February about 1%, and March was unprofitable because traders traded too successfully. However, in the long term, the deposit still grew.

Rewards can be seen in the same Hyperliquidity Provider section. In the Your Performance tab, you will also see the total and unrealized PNL, as well as the maximum portfolio drawdown.

Rewards are accrued automatically and require no action. After 4 days, you can withdraw funds, however, since the platform is designed for the long haul, a 4-day deposit doesn't make sense!

Risks of Short-Term Investments

The charts often show sharp downward spikes, so investing for a couple of weeks is not the best idea. It's better to consider such a strategy for the long term - from 1 year and more.

Earning from Copy Trading (User Vaults)

Copy trading here is trustless management without intermediaries, operating entirely on smart contracts with full transparency and control.

Copy trading is located in the Vaults tab – vaults for strategies.

There are 2 types of vaults:

HLP Vaults– this is Hyperliquid's own vault, discussed above- and

User Vaults– these are user liquidity vaults

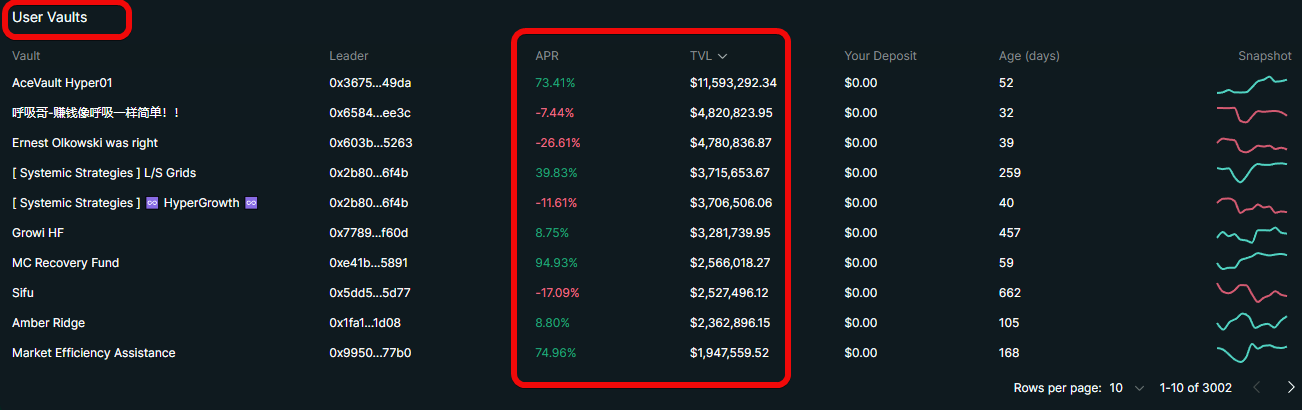

We already talked about HLP Vaults above: it's reliable, but the APR is only about 7%. So let's focus on user strategies.

How do User Strategies work?

A trader creates a vault, deposits, for example, 100 USDC, and describes their strategy. The trader must keep at least 5% of the deposit in their own vault.

All trades here are made on behalf of the vault, and you copy them automatically.

Profit is split as follows: 90% to depositors and 10% to the trader. Losses are also distributed among depositors proportionally to their invested funds. All operations are transparent and visible on the blockchain.

How to Choose a Vault?

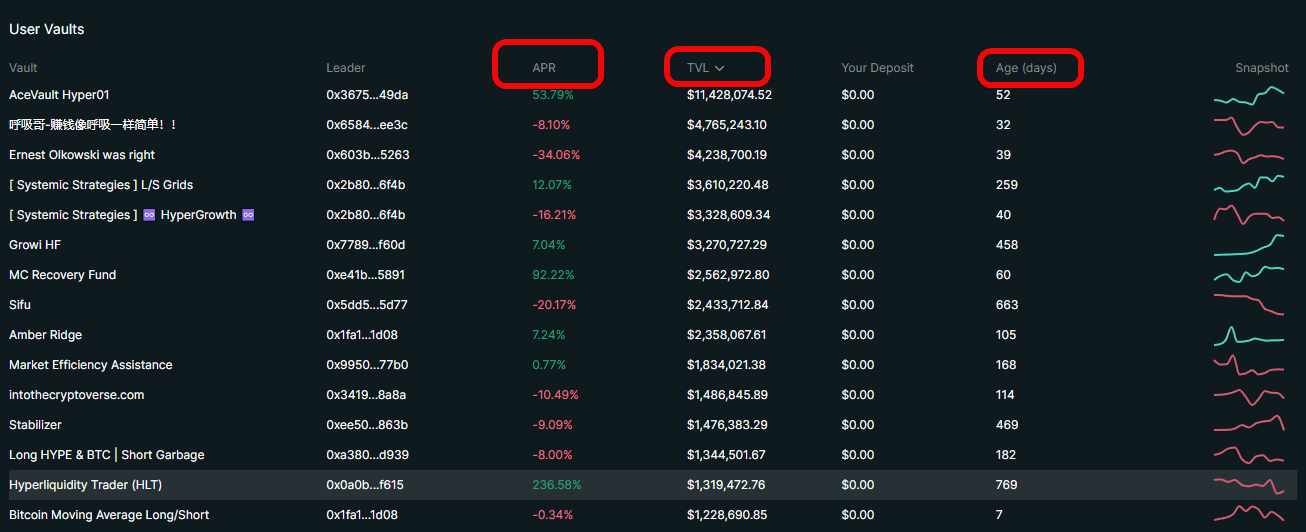

It's better to choose a vault through the Vaults tab, sorting by TVL, APR, and age.

Age is critical: if a Vault was created recently and hasn't undergone any serious drawdown yet, it's wiser to wait for statistics to accumulate.

Pay attention to smooth PNL growth without sharp declines, the number of depositors, and the duration of their participation.

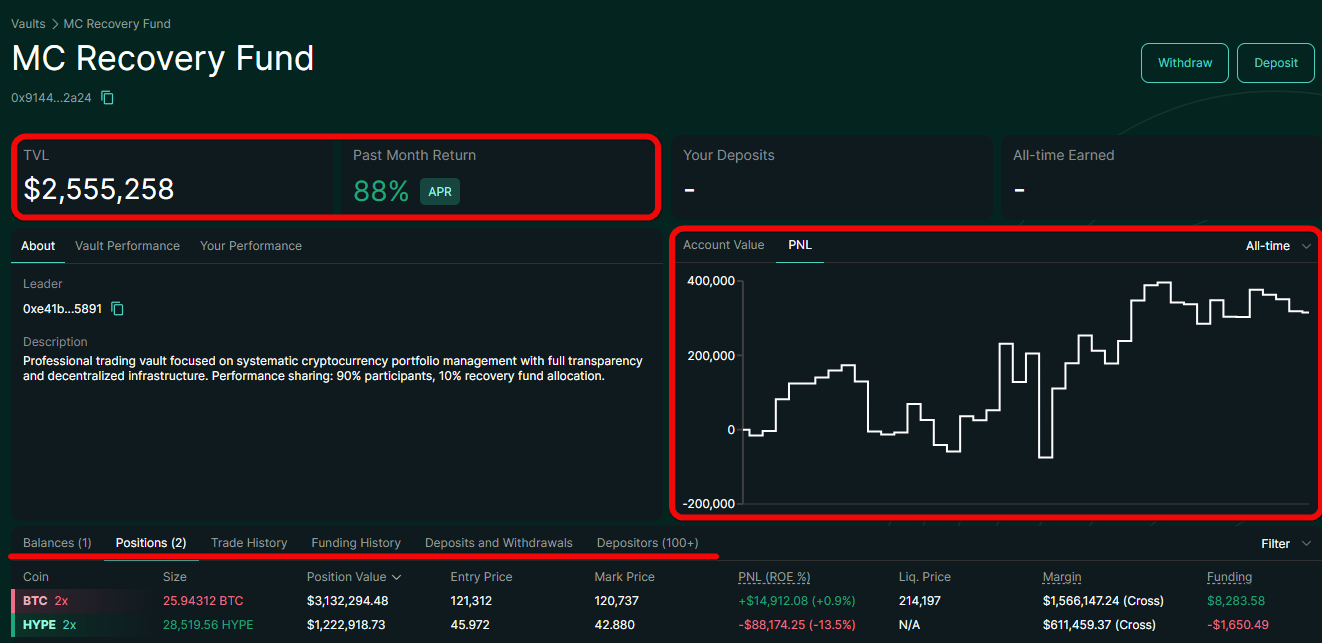

Analysis of a Specific Vault

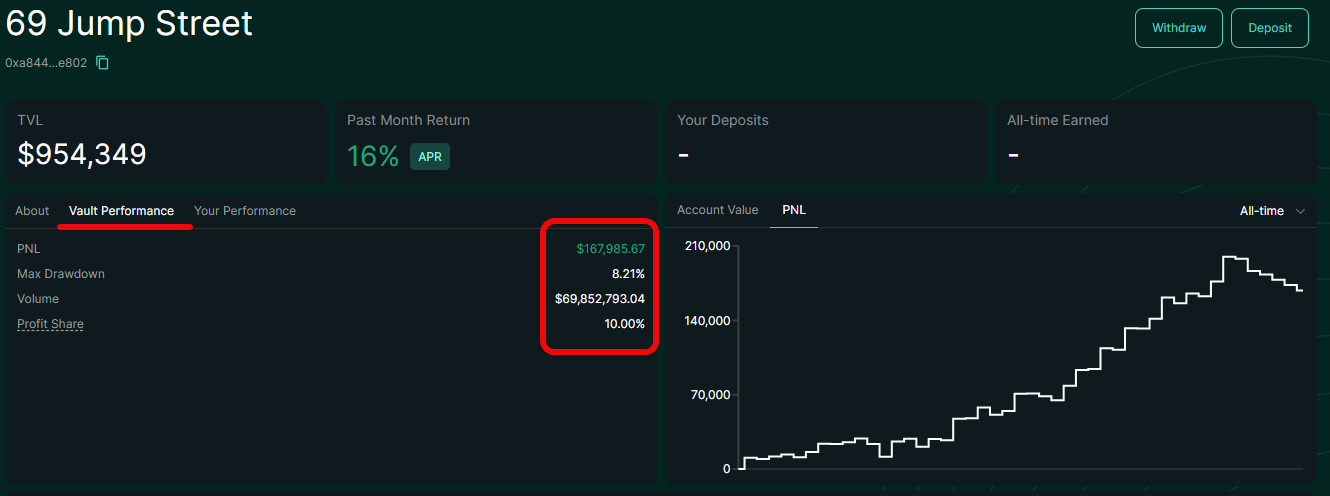

Study open trades and trading history. A good sign is many depositors with long participation periods and a large trader's own capital. A positive indicator is a steady All-time PNL increase with minimal losses.

For example, in the Depositors tab of one of the traders, you can see that someone deposited $1,000 222 days ago and is already up $1,015, i.e., doubled the investment.

Carefully study the statistics of each trader!

Investment Example

The Vault Performance tab shows total profit and maximum drawdown. If the drawdown is small and the profit chart is smooth, then the strategy is quite reliable.

To invest, click Deposit, enter the amount, and confirm. Funds are locked for 24 hours, after which they can be withdrawn at any time, with the unlock date displayed.

Earning from Staking

Before starting staking, it's important to remember that Hype tokens must already be on the platform.

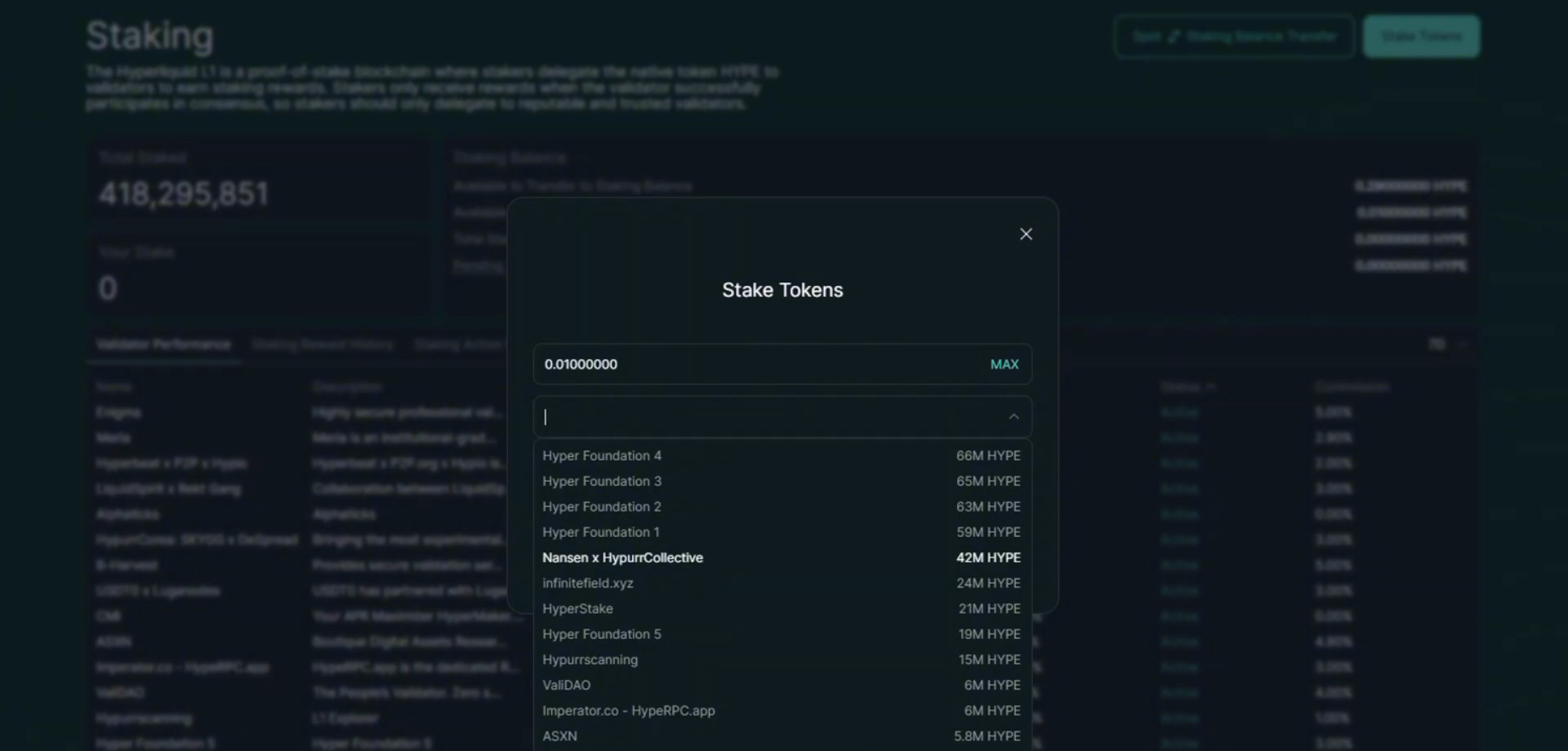

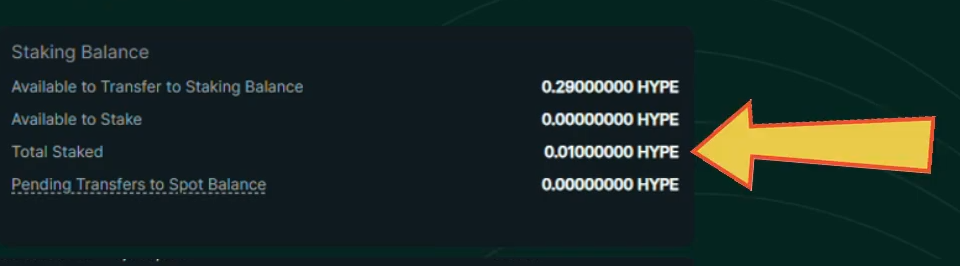

Go to the staking section and transfer the desired amount of Hype from your spot balance to your staking balance. Specify the amount and click Transfer. Sign the transaction in the pop-up MetaMask window. After confirmation, the tokens will be ready for staking. Now click Stake Tokens, specify the number of tokens, and choose a validator.

For example, you can choose Hyper Collective, because it's the largest community in the Hyperliquid network.

Note that the token lock-up period for staking is 1 day. If you're ready, click Stake and confirm the action in MetaMask. As you can see, the total staking amount has updated – this indicates a successful operation.

To unstake, click Unstake tokens. Select the validator you staked with and specify the amount. After unstaking, transfer the tokens back to your spot balance.

How to Withdraw Funds?

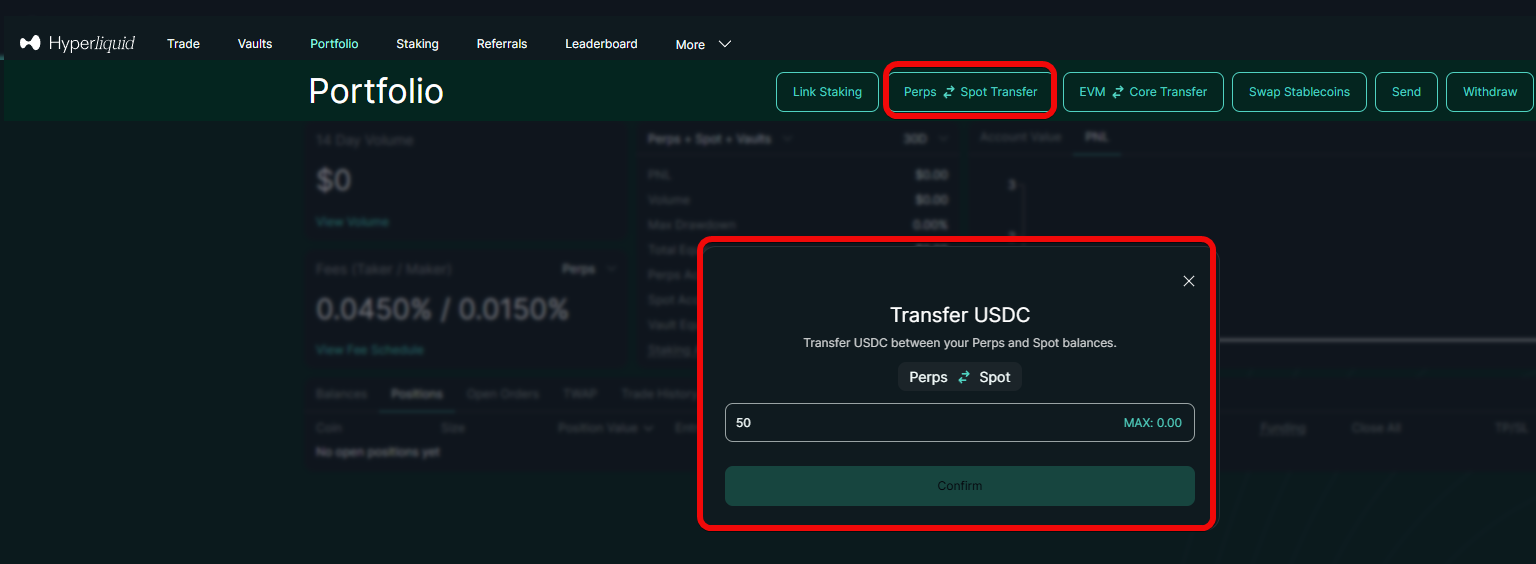

Regarding withdrawal, it's important to remember that withdrawal is made from the Perps account, not from Spot. Therefore, to withdraw USDC, first make a transfer, then click Withdraw, select USDC on the Arbitrum network, click max, and the funds will arrive in about 5 minutes.

The exchange also has its own token. Let's briefly review it.

HYPE Token, Blockchain, and Its Functions

The HYPE token performs 3 functions at once:

- Protocol governance,

- Staking with an annual yield of about 2.37%,

- Receiving discounts on fees and paying for gas in the Hyper EVM.

For traders, gas fees are still absent, but for developers and dApps users, HYPE tokens are needed to run smart contracts. This gives the token additional utility value, and as network activity grows, demand for HYPE will increase, potentially pushing the price.

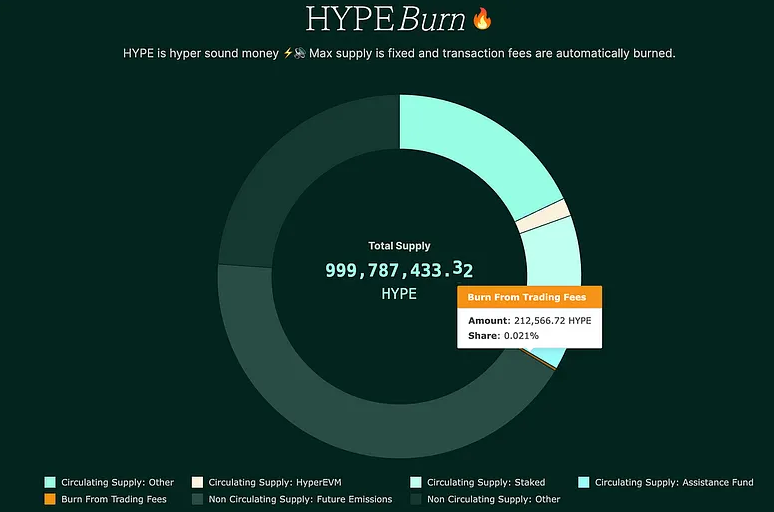

Limited supply makes the token scarce, and the deflationary model involves buying back and burning a portion of fees with each protocol update. 70% of the emission is allocated for community rewards, highlighting the project's user-centric focus.

3 components form the basis of Hyperliquid as a high-performance financial operating system.

| Component | What is it? | Problem Solved |

| HyperBFT | Proprietary asynchronous consensus algorithm | Provides CEX-like speed (finality <1 sec, ~200k TPS) |

| HyperCore | High-performance core (runtime) for financial operations | Synchronizes execution of perpetuals, spot trading, and vaults in real-time, ensuring accuracy and predictability. |

| HyperEVM | EVM-compatible execution environment | Gives developers access to EVM tools (token issuance, listing, and strategy creation in 1 transaction). |

Here, HyperBFT is responsible for consensus and speed, HyperCore for synchronized execution of financial logic, and HyperEVM for programmability and compatibility for developers.

Criticism and Risks

The project also has weaknesses. For example, there was an attack with the JELLY token. Through manipulations with its price, $20 million was withdrawn from the Hyperliquid vault.

- A malicious actor opened a very large short position ($4.5 million) on the low-liquidity JELLY token.

- He then artificially manipulated his own position to trigger its forced liquidation.

- At the moment of liquidation, his accomplice on another platform (Solana) sharply drove up the price of JELLY by buying it on the spot market.

In response, the exchange essentially just changed the price of this market, claiming it was a victim of an attack, and unilaterally adjusted the quotes to reduce its losses.

The exchange annulled trades under the guise of compensation, depriving traders of profits, as if the trades never happened!

Other drawbacks are highlighted in the table below.

| Category | Essence of Criticism | Facts | Risks |

| Validator Centralization | Small set + high entry barrier | 21 active validators, 10,000 HYPE for a seat; foundation nodes hold ~80% of stake | Risk of censorship, regulatory pressure, fault tolerance |

| JELLY Incident | Manually suspended the protocol | The team deviated from its promises | Precedent for centralized intervention, reduced trust |

| Closed Source Code | Single binary for all validators | No public repository, single point of failure | Harder independent audit, risk of hidden vulnerabilities |

| Interface | Centralized order book servers | UI hosted on regular VPS/domains | Domain blocking → loss of access |

| Young Network | Little battle testing | No multi-year history like Ethereum/Solana | Possible unknown bugs and exploits |

Other risks are described in the official documentation.

Comparison with Other DEXs

The main difference between other DEXs, for example GMX, and Hyperliquid lies in the available assets. On Hyperliquid, you can only deposit USDC, while on GMX there are various pools – ETH/USDC, BTC/USDC, BTC/BTC, etc.

For example, if you choose the ETH/USDC pool and deposit $100, then $50 will automatically be used to buy Ethereum. If Ethereum rises - the portfolio grows by half, if it falls - it falls by half, because 50% of the pool consists of stablecoins, and 50% of Ethereum.

Now let's compare different DEXs.

| DEX | Fees (%) | Networks | Features |

| Apex | 0.02% – 0.05% | Ethereum, Base, BNB, Arbitrum, Mantle | Deposit in USDC, USDT; trading like on a CEX |

| Hyperliquid | 0.015% – 0.045% | Arbitrum, ETH, SOL | Deposit in USDC; trading like on a CEX |

| EdgeX | 0.018% – 0.045% | Ethereum, Arbitrum | Deposit in USDT; trading like on a CEX |

| Aster | 0.015% – 0.038% | Ethereum, Arbitrum, BNB, Solana | Deposit USDT; trading like on a CEX |

The lowest fees are with Aster and Hyperliquid - from 0.015%.

Conclusions

Hyperliquid represents the DEX of the future. Its own L1 blockchain, fair airdrop, minimal fees, and cool features like copy trading make the platform interesting. And the high TVL confirms this.

However, despite the advanced functionality, the platform has a number of risks and potential vulnerabilities that need to be studied.

Whether to use this platform or choose an exchange from the comparison rating - the final answer is always up to you.

Disclaimer: All information provided in this article should not be taken as financial advice! The article was created for educational purposes.