What is Cryptocurrency Copy Trading? A Guide Using BingX as an Example

You'll learn what copy trading is and the principles of choosing successful traders to copy.

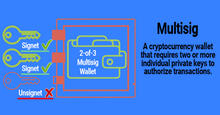

Copy trading is a form of trading where you automatically copy the trades of other traders. Instead of independently analyzing charts, you simply copy all the positions of experienced traders.

When the traders you copy make a profit, you make one too, and when they lose, you lose too.

How copy trading works on exchanges

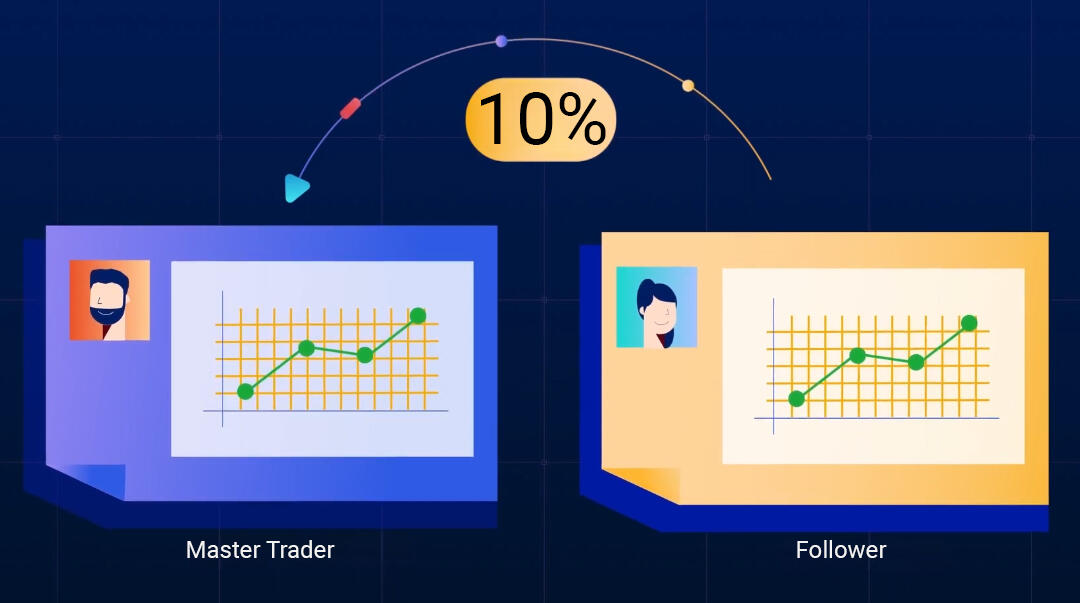

Masters and followers

On crypto exchanges people who copy trades are usually called followers, while those whose trades are copied are called trading masters.

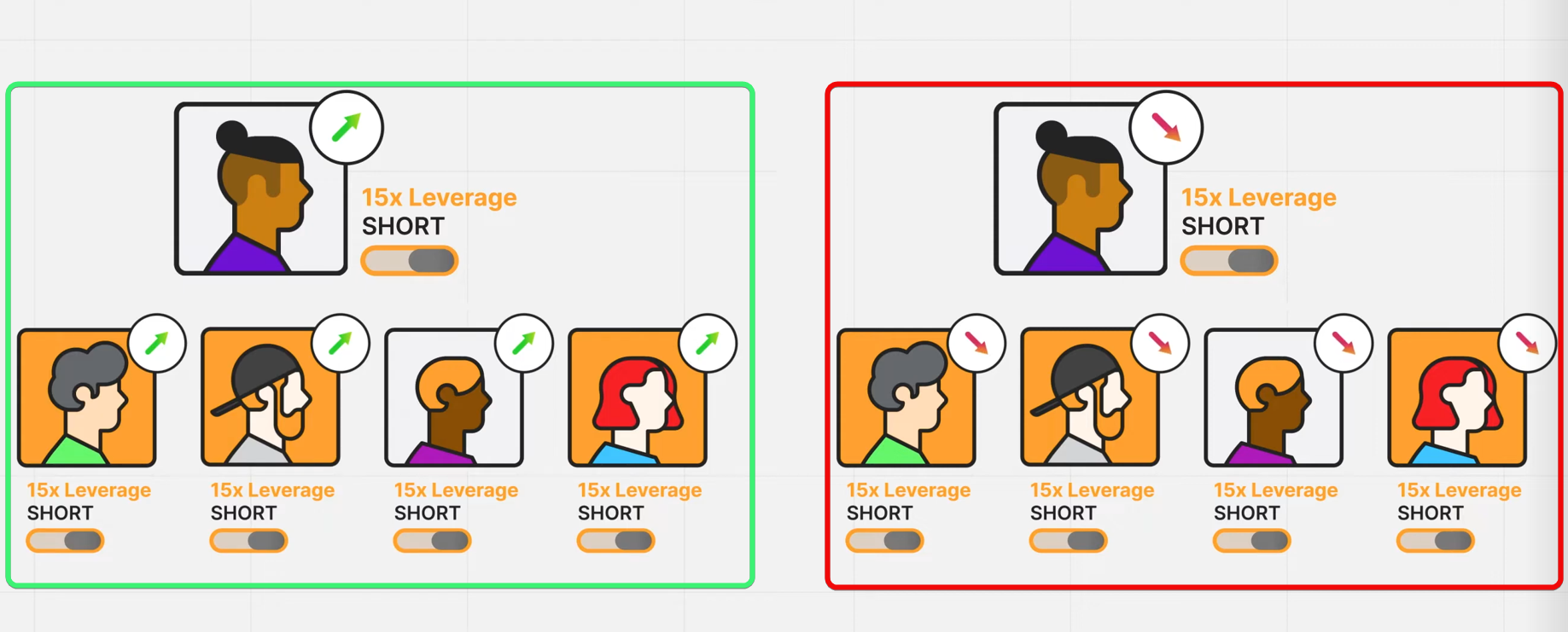

For example, if a follower chooses a Master Trader nicknamed Satoshi, and Satoshi opens a 15× short position on Ethereum, all followers automatically open the same position for the amount they have chosen.

When Satoshi closes the position, all followers close theirs as well.

If the trade turns out to be a loss, the Master Trader earns no performance fee and the followers incur the same loss.

Income and fees

Followers earn from profitable copied trades, while trading masters receive 10 % of the total profit generated by their followers.

In theory you only need to deposit funds and pick a mentor-trader. In practice the difficulty is that there are hundreds of traders open for subscription, and their decisions alone determine whether you profit or lose.

To increase the odds of success you should develop a strict rule set and choose a reliable exchange.

Which exchanges offer copy trading?

|

Exchange |

Copy-trading highlights |

|

Bybit |

Beginner friendly: simple UI, copying available for spot and derivatives. |

|

OKX |

Advanced platform with automated strategies and easy bot integration. |

|

MEXC |

Actively develops futures copy trading, runs regular trader competitions. |

|

Bitget |

Supports spot & futures, easy to use, good for beginners. |

|

Gate.io |

Lets you copy trading bots, including AI algos; built-in strategy marketplace. |

|

Binance |

Supports strategy copying with flexible risk settings (fixed amount, ratio, etc.). |

|

BingX |

Low minimum deposits. |

For copy trading, Bybit and BingX are usually preferred because of their straightforward interfaces.

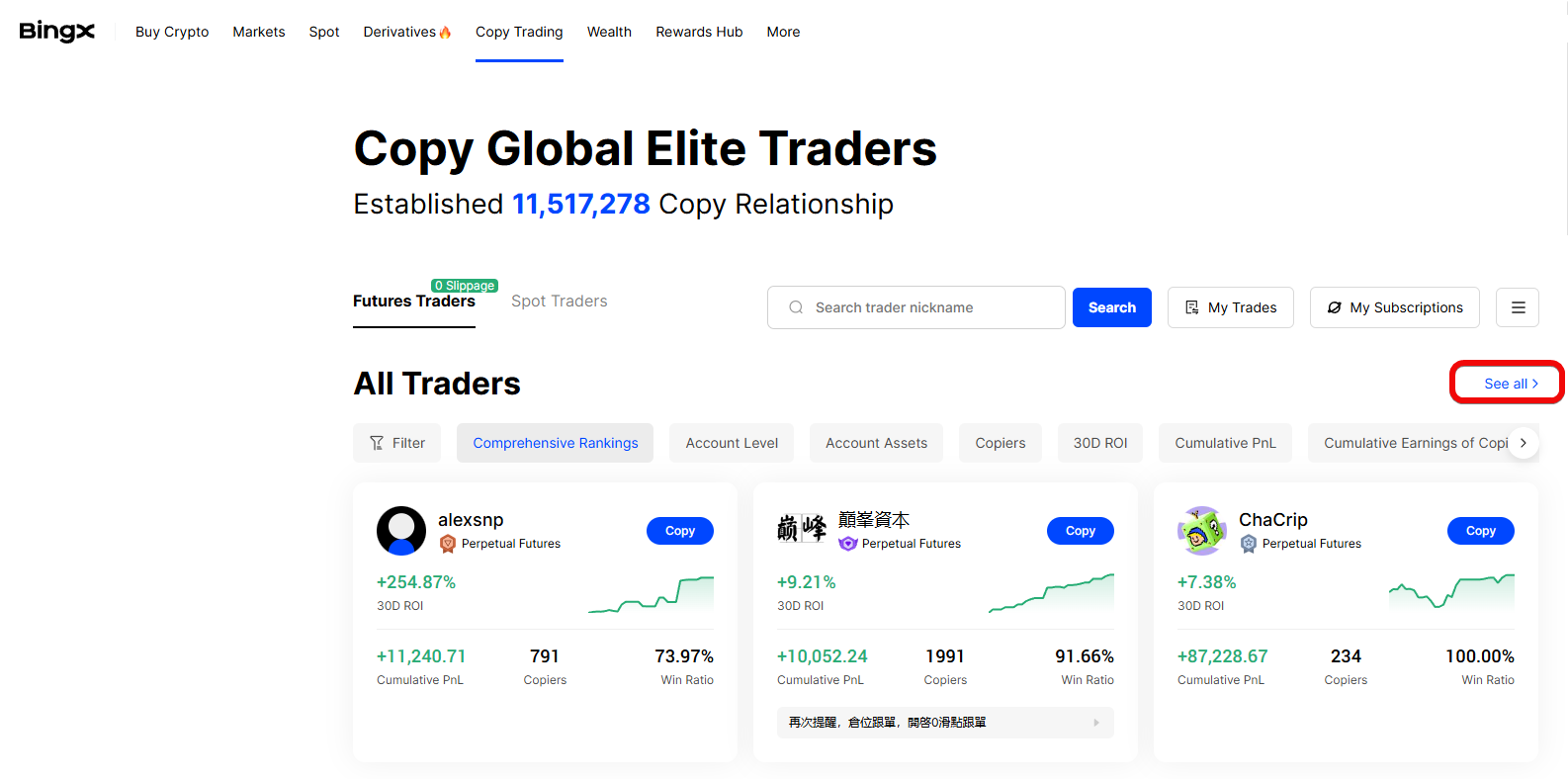

Copy trading on BingX step by step

Go to BingX copy-trading section and look through the offers-there are thousands if you click See All.

But do NOT rush to pick traders shown on the first screen!

Before you start copy trading you must do two things:

- Draft risk-reduction rules

- Select reliable traders

Risk-reduction rules

To reduce risk we look at the profit-to-loss ratio (PnL) and the trading style. So,

- First-strict risk management is mandatory. The reward-to-risk ratio must be at least 1 : 1; i.e. if a potential loss is \$100 the target profit should be no less than \$100.

- Second-the trader should be intra-day, not swing- or scalp-oriented. Scalping on tiny moves suffers from execution delays and slippage, which can make you lose even when the trader’s own trade is profitable.

In other words, even a small copy-delay can defeat the whole purpose-your algorithm simply fails to mirror the trader in time.

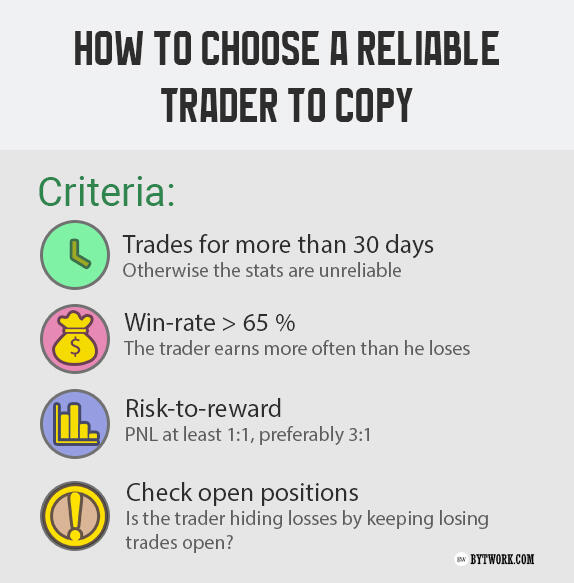

Trader selection criteria

The most important moment in copy trading-deciding whether you will earn or lose-is the choice of a trader to copy.

Evaluate every trader on four points:

- The trader must have traded for more than 30 days; otherwise the statistics are insufficient.

- Win-rate must exceed 65 %.

- Profit-to-loss ratio (PNL) should be at least 1 : 1, preferably higher (3 : 1), so the average win is not smaller than the average loss.

- Make sure the trader’s figures are not distorted by open losing positions that are purposely left unclosed to avoid spoiling performance stats.

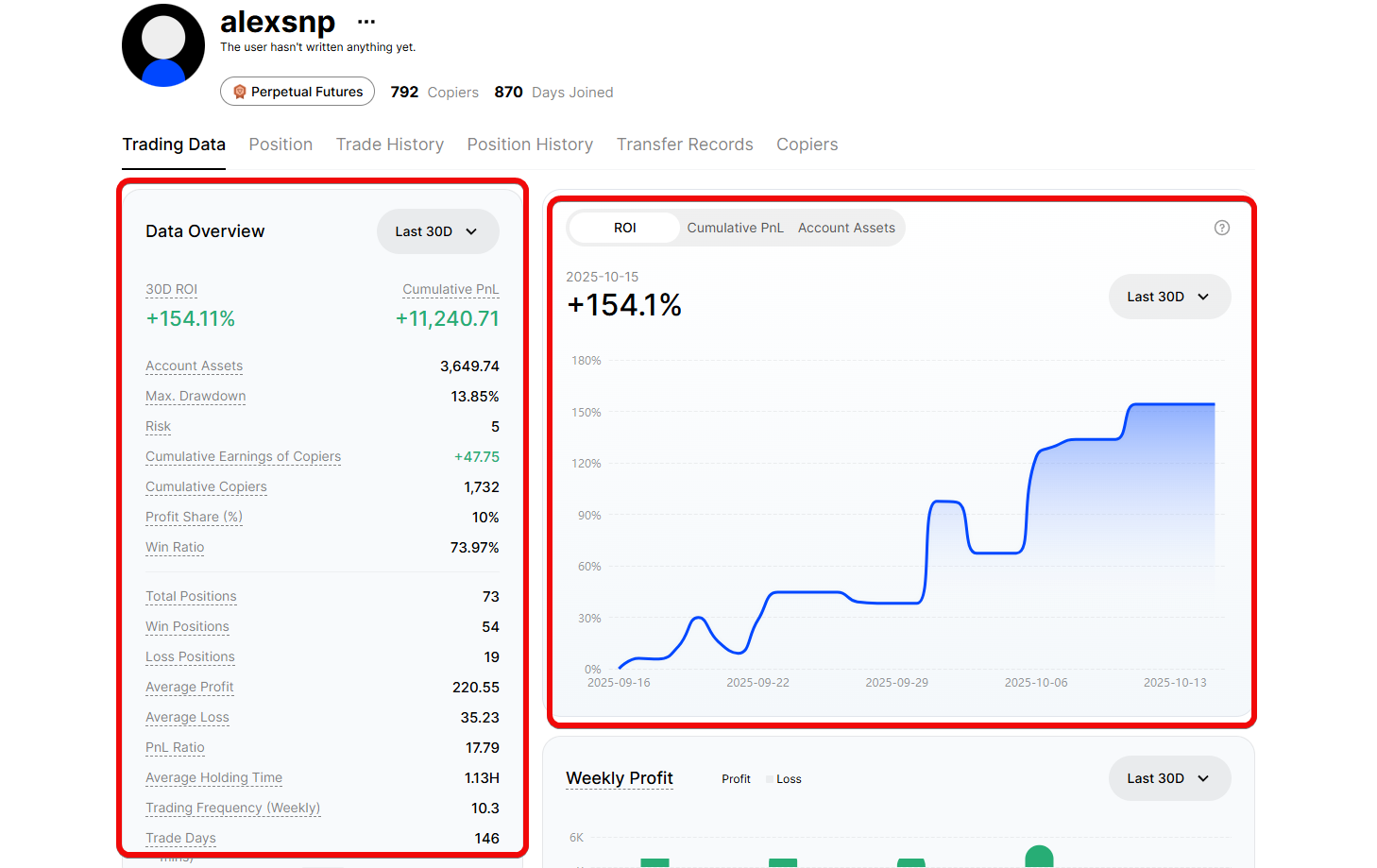

Example of a good trader

Let’s open a good trader’s profile and verify it against our checklist.

PnL Ratioof17.79means the average profit per trade is17.79times larger than the average loss, signalling a highly profitable strategy.- This trader has been active for

146days-great for us. - Win-rate is

74%.

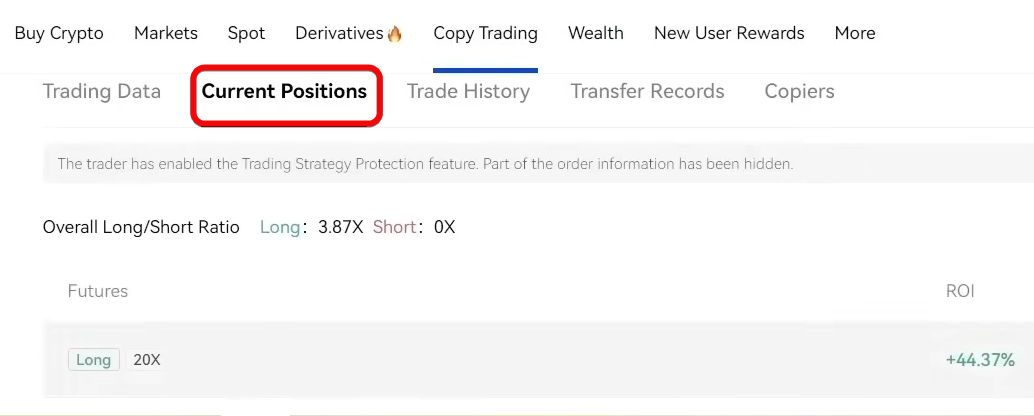

Now let’s check that the numbers are not inflated! Go to the Positions tab and, as we can see, there are no big losing trades-so the data are trustworthy.

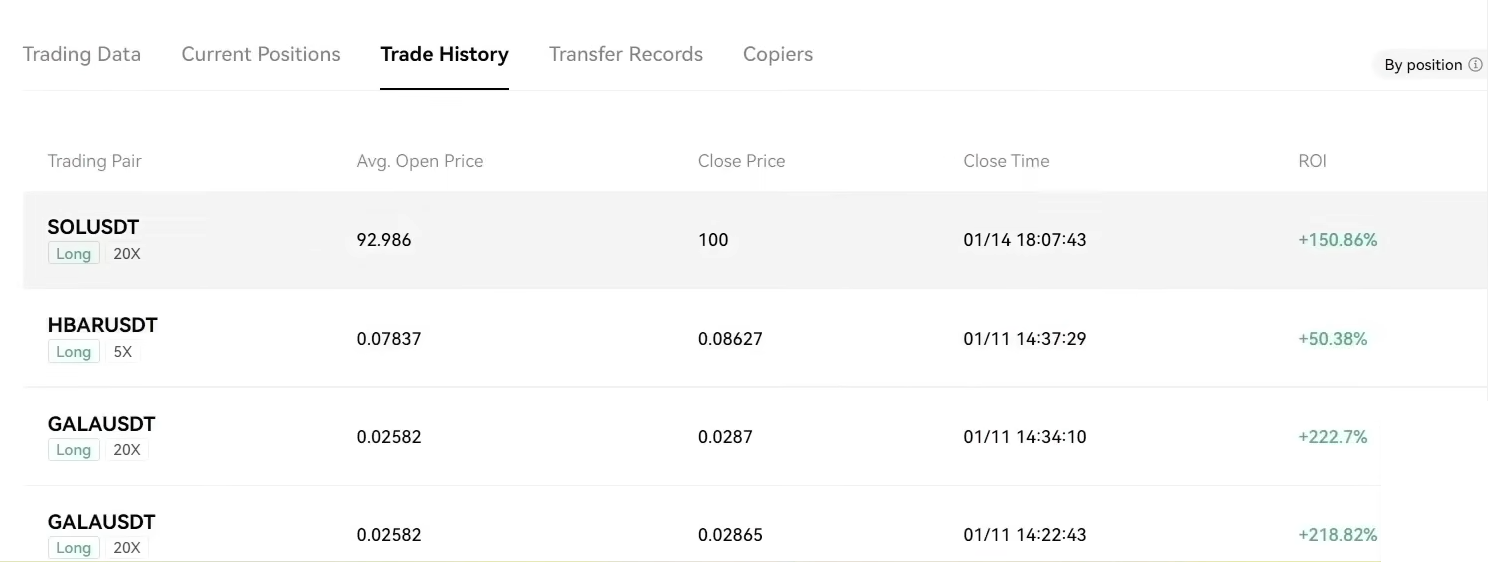

We also look at the trade history-Trade History tab.

Overall this trader is subscription-worthy. It is also useful to look at other metrics-for example a BTC-only trader is often preferable to someone scattering orders across many low-liquidity coins.

Setting up the copy

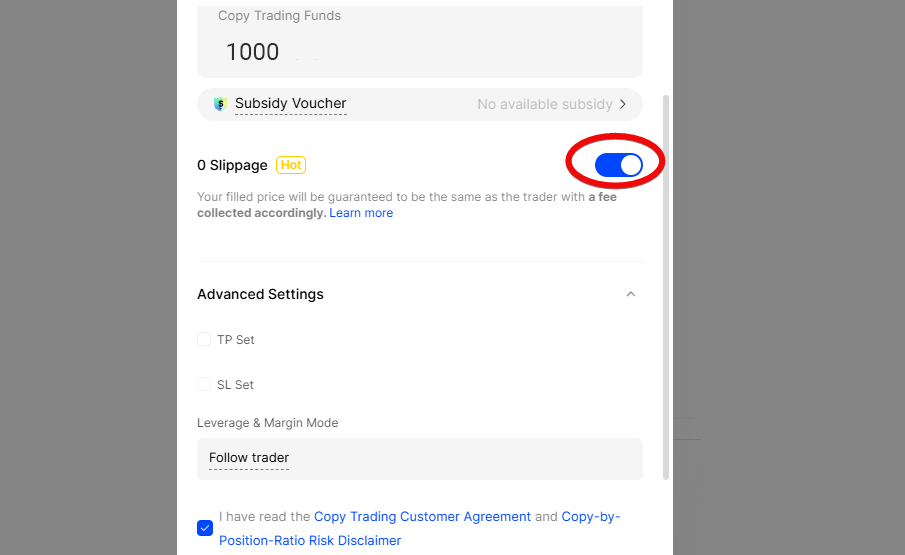

After you find a trader to copy, click Copy.

In the settings choose Copy by position ratio, NOT Per order-this replicates the trader’s capital allocation and risk management proportionally.

In other words, Copy by position ratio is a scaled-down copy of the trader’s portfolio. It lets you automatically mirror the correct position sizes and risk even if your deposit is dozens of times smaller.

Next specify your allocation, e.g. \$1 000, enable zero slippage, and leave take-profit and stop-loss fields empty so that you stay fully synchronised with the trader’s strategy. Enabling zero slippage is important here.

If you want to copy more than one trader (which improves your odds), simply allocate a specific amount to each one and repeat the settings.

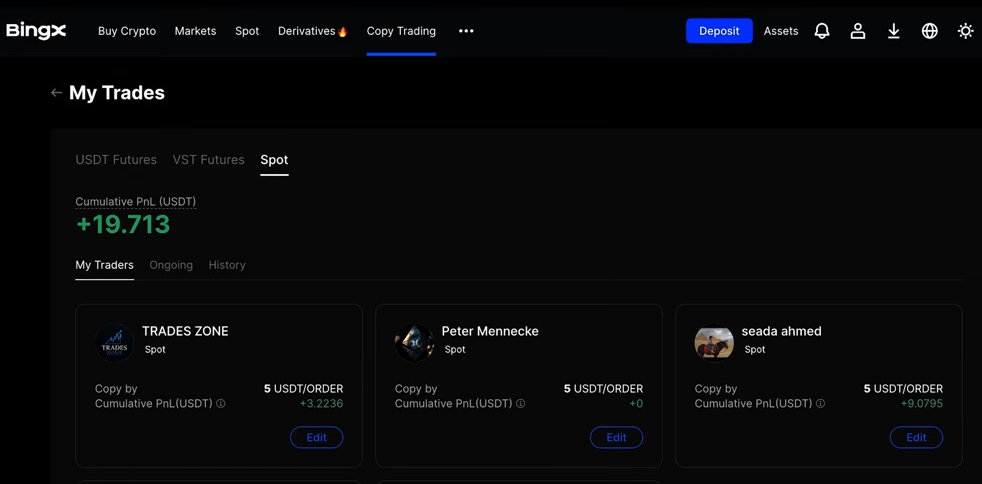

Monitoring results

You can track your trades in the My Trades subsection of copy trading; the overview tab shows daily and total PNL.

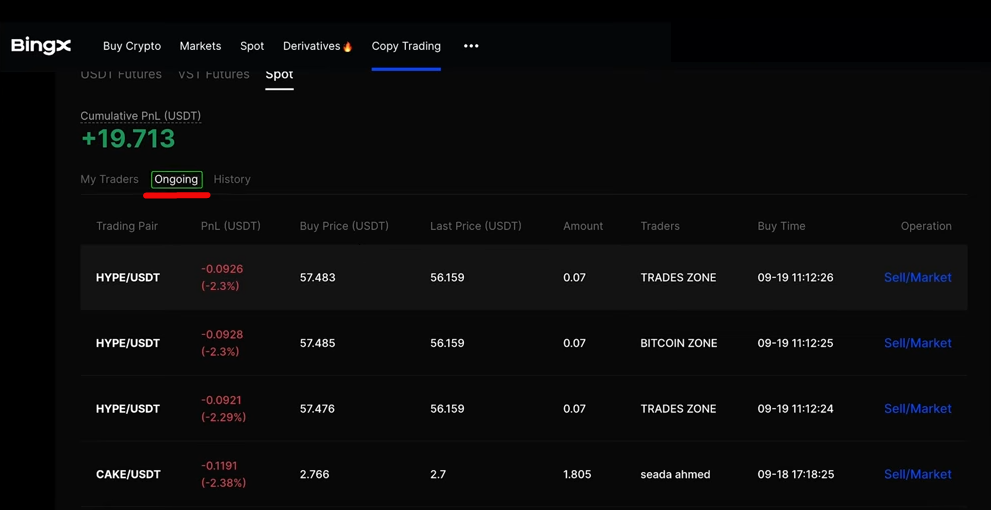

The Ongoing tab lists open copy-positions and lets you edit or stop them.

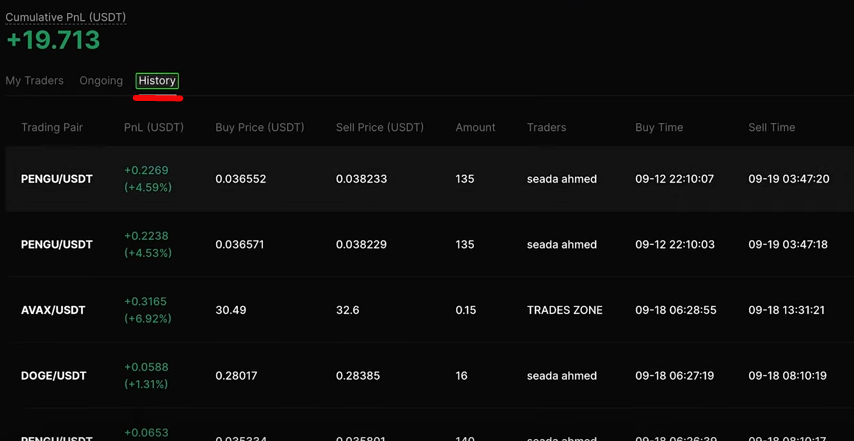

The History section shows closed trades and realised profit.

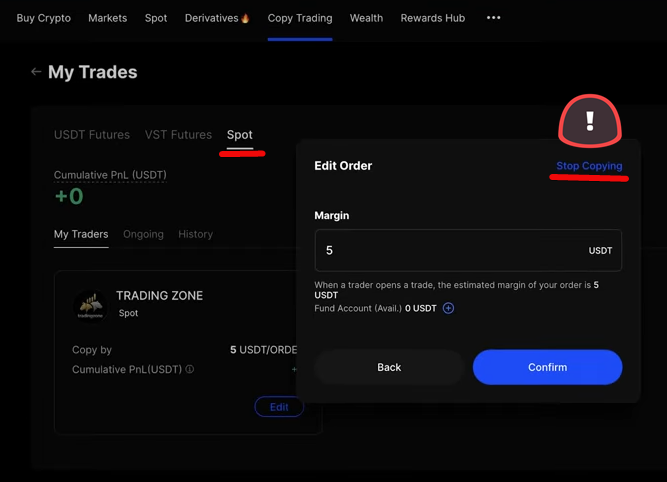

If necessary you can change the amount or margin in the Spot tab, and the Stop Copying button instantly halts copying.

Now you know how to get started with copy trading on BingX.

Read also about copy trading on another exchange in the article "Copy trading on the Bybit exchange - how to choose a trader and start copying."

Types of copy trading – spot and futures

Spot copy trading means you buy and sell actual cryptocurrencies such as Bitcoin, Ethereum and other altcoins-this is a calmer option for long-term investing.

Futures copy trading is riskier but potentially more profitable. Here you trade contracts, opening long (bullish) or short (bearish) positions.

- Long – a bet that price will rise. If you expect the asset to appreciate you open a long and profit from the increase.

- Short – a bet that price will fall. You open a short if you expect the market to drop and profit from the decline.

Nevertheless it is best to start small and learn gradually.

Advantages

Advantages include diversification, learning by watching, and time saving.

|

Advantage |

Description |

|

Diversification |

Split capital among 10 traders: if one incurs a loss the others may compensate. |

|

Learning |

You see every trade of the master and absorb experience. |

|

Time saving |

No need to analyse charts for hours or control emotions-passive income without active work. |

|

Accessibility |

Just register, deposit, and pick a strategy-takes minutes. |

Now let’s move on to the disadvantages.

Disadvantages and risks

There are downsides as well.

|

Risk |

Examples |

|

Unreliable statistics |

Traders can inflate ratings using multiple accounts. Short-term profits (7 days) may be luck, not skill. Historical losses can be hidden simply by not closing losing positions. |

|

Account wipe-outs |

Even successful traders can make fatal mistakes and blow up large portions of followers’ capital. |

|

Strategy drift |

A trader may suddenly switch to a far more aggressive style or trade high-risk assets you never signed up for. |

Other issues include wrong technical settings and copy-specific quirks.

|

Problem |

What it looks like |

How to protect yourself |

|

Slippage |

You enter with 0.5-2 % difference → same trade ends up losing for you |

Enable zero-slippage option |

|

Inflated assets under management (AUM) |

Trader sends himself \$500 k to look big |

Compare number of followers with AUM |

|

Your P&L is not equal to the master's P&L |

Different sizes, early TP/SL → he wins, you lose |

Do not add your own TP/SL unless you are sure |

|

“Limited seats” trick |

Exchange claims only a few copy slots remain |

Better to wait than pick a bad but “available” trader |

|

No copy-size stop |

One bad day wipes out your allocated deposit |

Always set a copy stop-loss (e.g. −20 % of allocated amount) |

Can you actually make money?

With a disciplined approach copy trading can accelerate both your investment skills and your capital growth without constant immersion in market routines. Yet this is still an unpredictable market-even the most experienced traders lose at times.

Q&A

Isn’t social or mirror trading the same thing?

Mirror trading and copy trading are identical. Social trading is slightly broader-you can, for example, chat on an exchange forum and make your own trading decisions.

Disclaimer: nothing in this article should be considered financial advice! It was created for educational purposes only.