7 Ways to Use Fluid DEX: Exchange, Loans, and Double Earnings

- Risks of algorithmic pools (smart contracts)

- High complexity for beginners

- Leveraged trading carries high risks

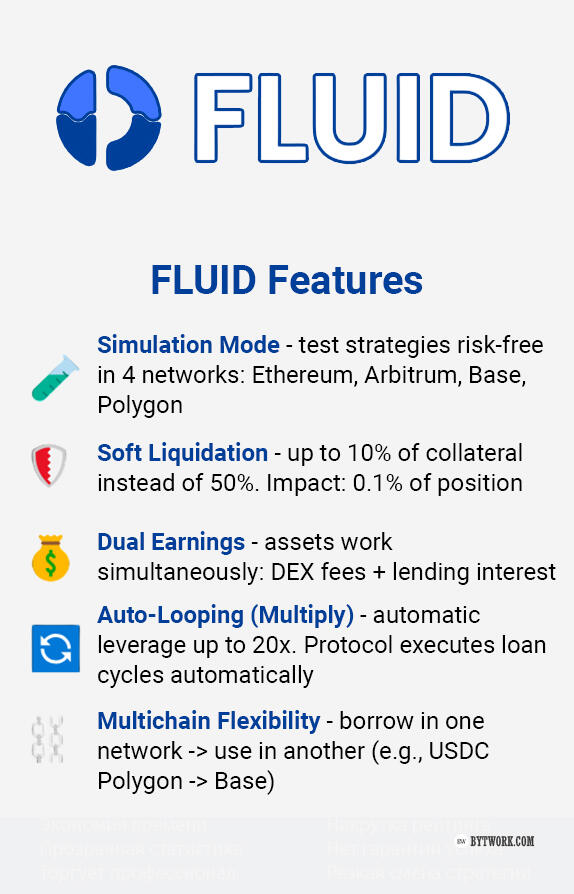

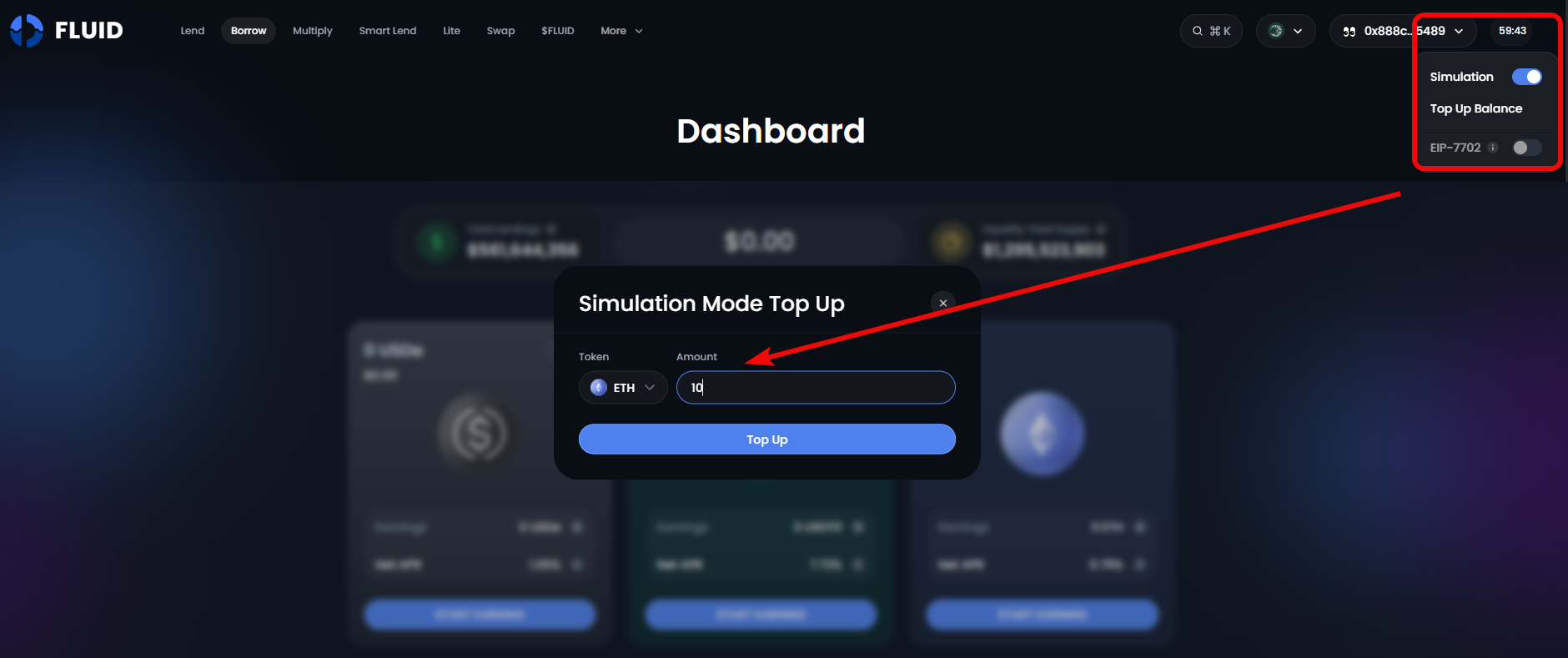

- Simulation Mode - risk-free strategy testing on 4 networks: Ethereum, Arbitrum, Base, and Polygon

- Soft Liquidation - up to 10% of collateral instead of 50%. Damage: 0.1% of the position

- Double Earnings - assets work simultaneously: DEX fees + % lending

- Auto-looping (Multiply) - automatic leverage up to 20x. The protocol automatically manages borrowing cycles

- Multichain Flexibility - borrow from one network -> use on another (e.g., USDC Polygon -> Base)

Fluid is two products in one: a decentralized exchange (DEX) and a lending/borrowing platform. This combined approach allows you to earn both trading fees and lending interest!

As a reminder, being a liquidity provider (LP) is like being a landlord. You provide capital to liquidity pools and earn from fees and trader losses. In the long run, the landlord always wins.

Below, you'll learn all about earning money on this protocol and exchange.

Exchange Overview and Mechanisms

About the Exchange

Launched in October 2023, Fluid DEX became a unique DeFi hybrid of an exchange and a lending market. The image below illustrates Fluid's capabilities.

How does it work? The system uses 2 AMM pools:

- Smart Collateral - allows you to take a loan against your cryptocurrency, which automatically works in the trading pool. While your coins serve as collateral, they simultaneously earn trading fees and lending income.

- Smart Debt - allows you to borrow in such a way that the trading fees themselves cover or exceed the loan interest.

Smart Lend turns borrowed funds into liquidity. The protocol automatically routes trades between pools. Market makers earn income from both fees and lending interest. However, the biggest pain point for traders has always been position liquidation.

Soft Liquidation Mechanism

Traditional liquidation is the forced closure of a collateralized position when the collateral value falls below the required level. It triggers automatically to protect the protocol and lenders from losses by selling the collateral assets.

Simply put, in traditional lending protocols like Aave, liquidation is akin to complete bankruptcy. The protocol can liquidate up to 50% of your position.

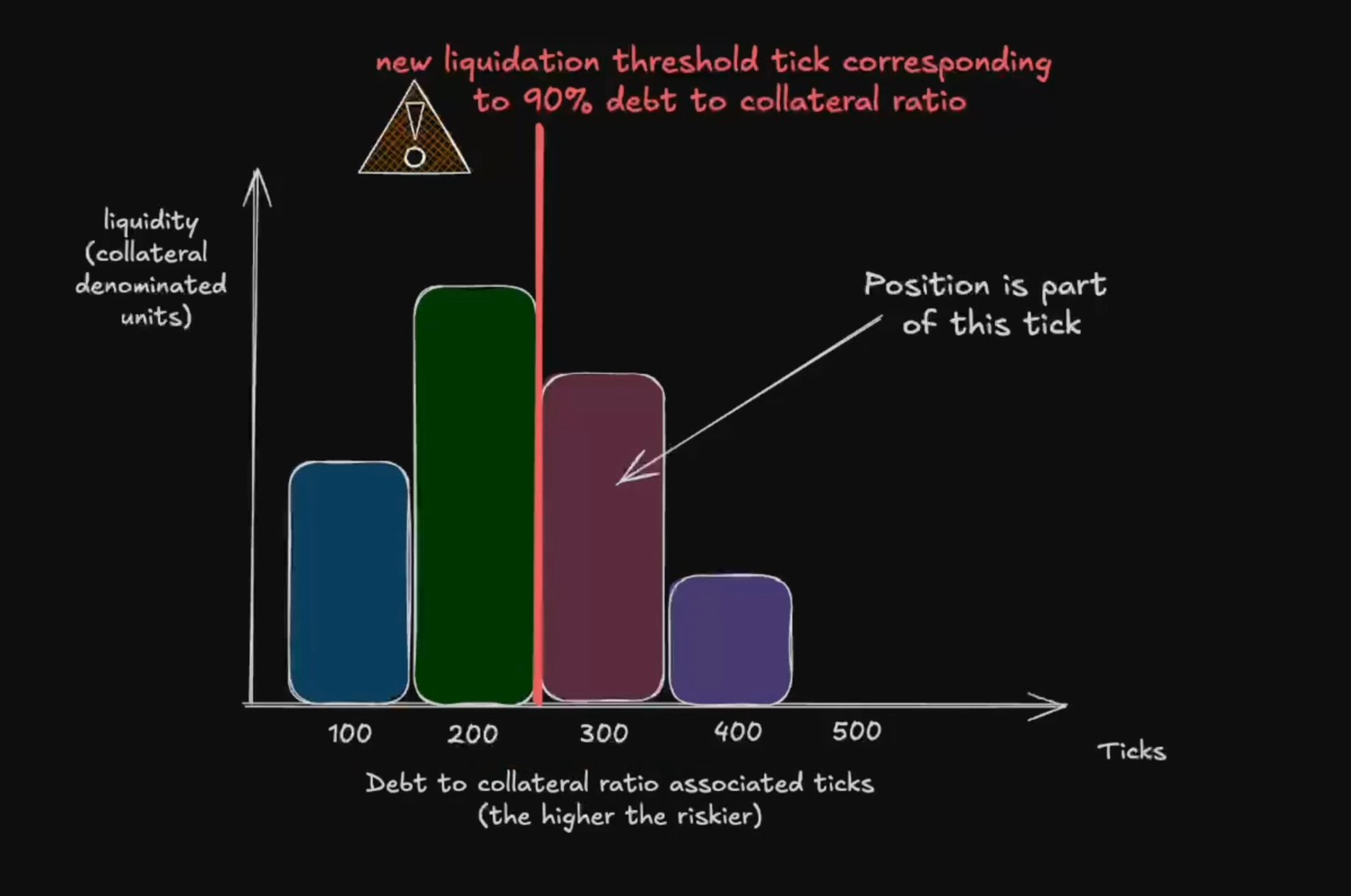

In FLUID, the system liquidates not the entire position, but the minimally necessary part of the collateral to return it to a healthy state. The FLUID liquidation system is based on ticks.

Here, all positions in the protocol are sorted into shelves (ticks). Each shelf is a risk level. Instead of liquidating each position individually, the system takes the entire risky tick and repays the minimally necessary portion of collateral from it to return that tick to the safe zone.

If liquidating only 10% of the collateral is sufficient to fix the position, the penalty is 1% and the user loses only 0.1% of the total amount.

In simple terms:

- The set penalty (e.g., 1%) is a percentage of the liquidated amount.

- The liquidation volume (e.g., 10%) is the portion of your total collateral being sold.

- Actual damage to you = Penalty x Liquidation Volume.

If this seems complicated, you can test everything in simulation mode. We will explain how to do this below.

Looping

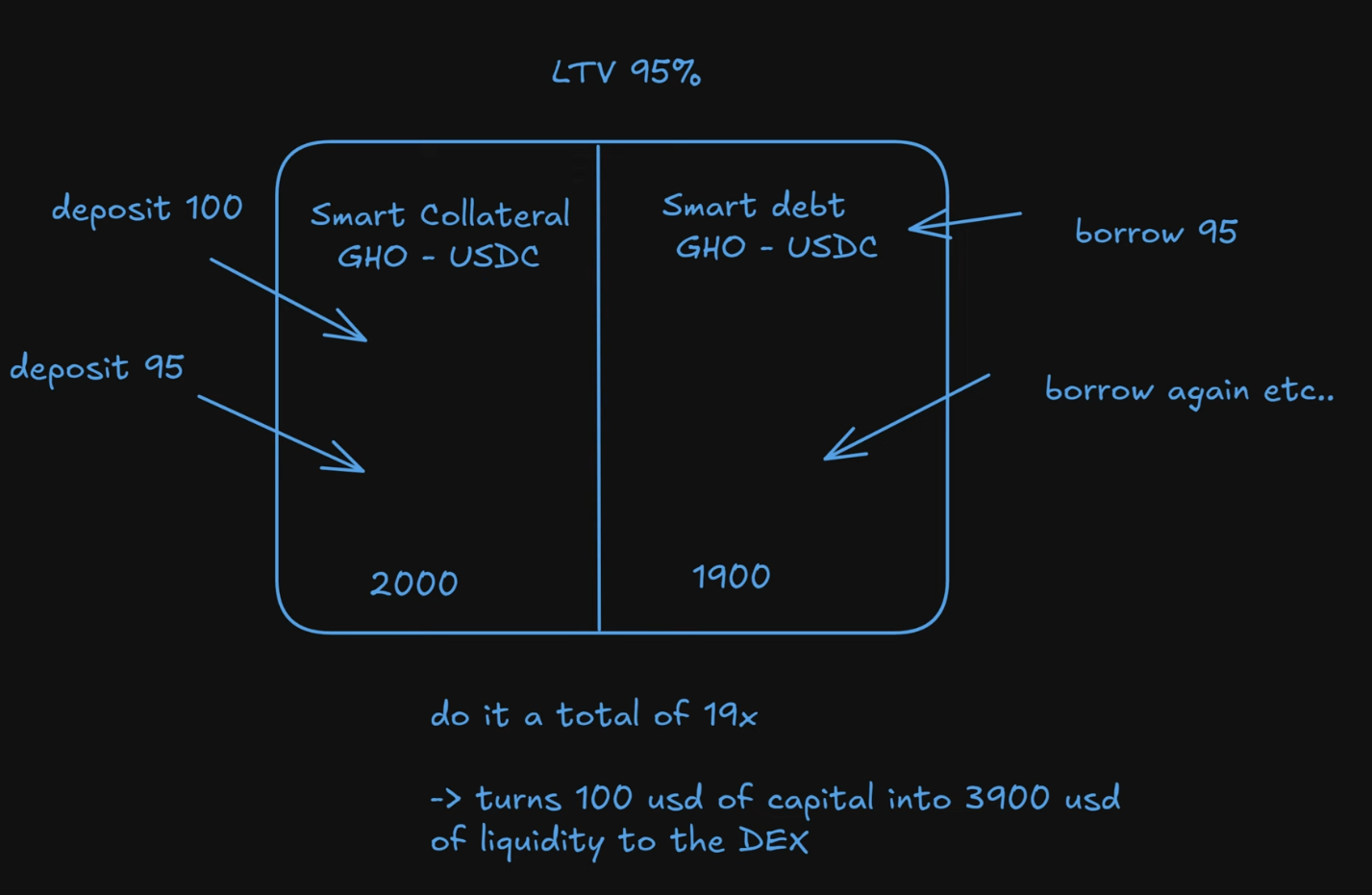

Looping is a strategy of reusing borrowed funds to increase position size and potential yield.

For example, starting with $100, you deposit it as smart collateral, borrow up to $95 against it, then re-deposit these borrowed funds as additional collateral and borrow again. Repeating this cycle 19 times turns the initial $100 into $2000 of liquidity for the DEX.

When combined with smart debt, where the borrowed position itself becomes pool liquidity, the effect is amplified, and the same $100 provides $3900 of active liquidity! This is called looping, and there is a separate tab for it – Multiply.

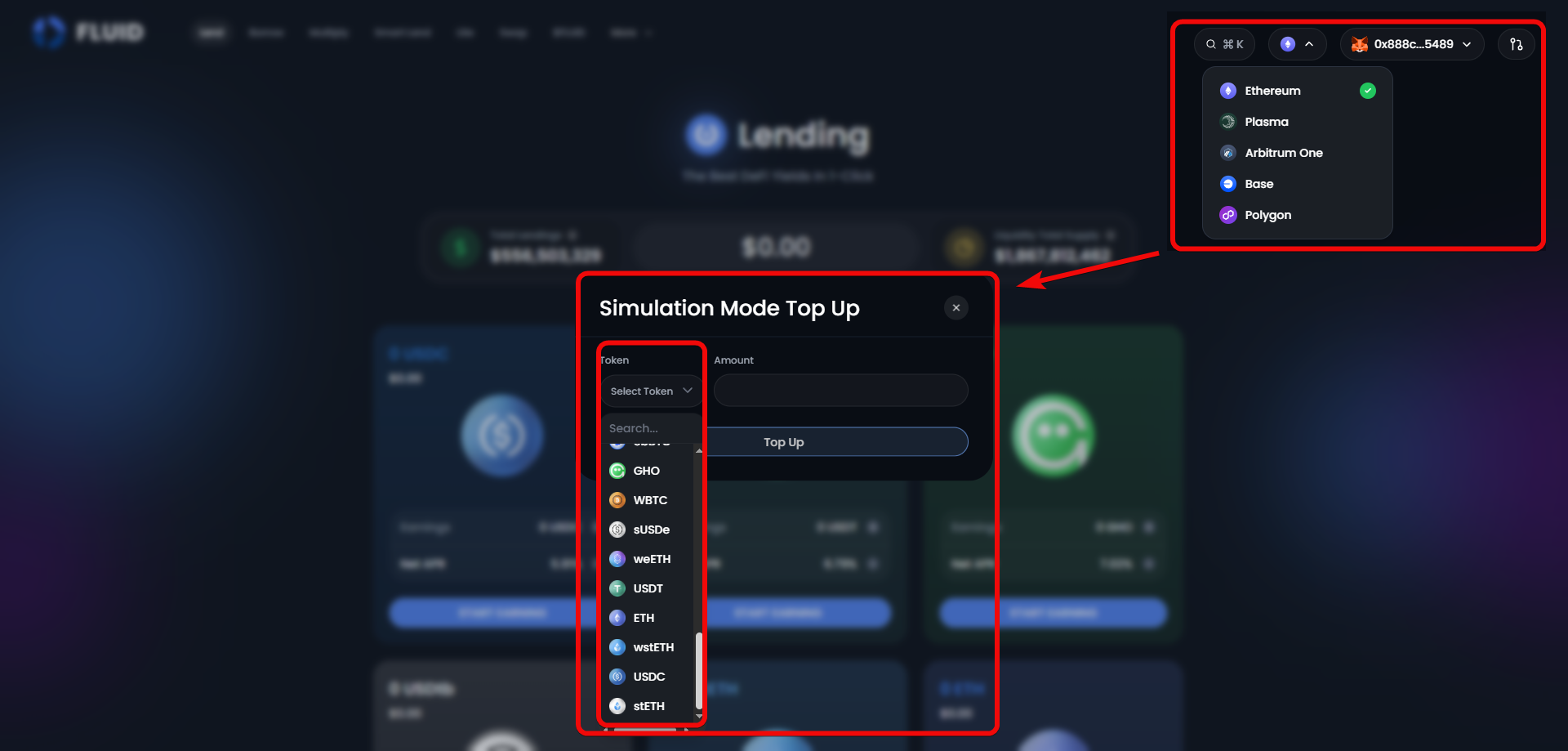

Simulation Mode

You can test different combinations and strategies.

In simulation mode, you can top up your account with test coins on Ethereum, Plasma, Arbitrum One, Base, and Polygon networks.

The general rules remain the same here:

- Low leverage: 2-3x - relatively safe

- High leverage: up to 20x - maximum yield, but high risks.

Let's move on to practice.

Registration

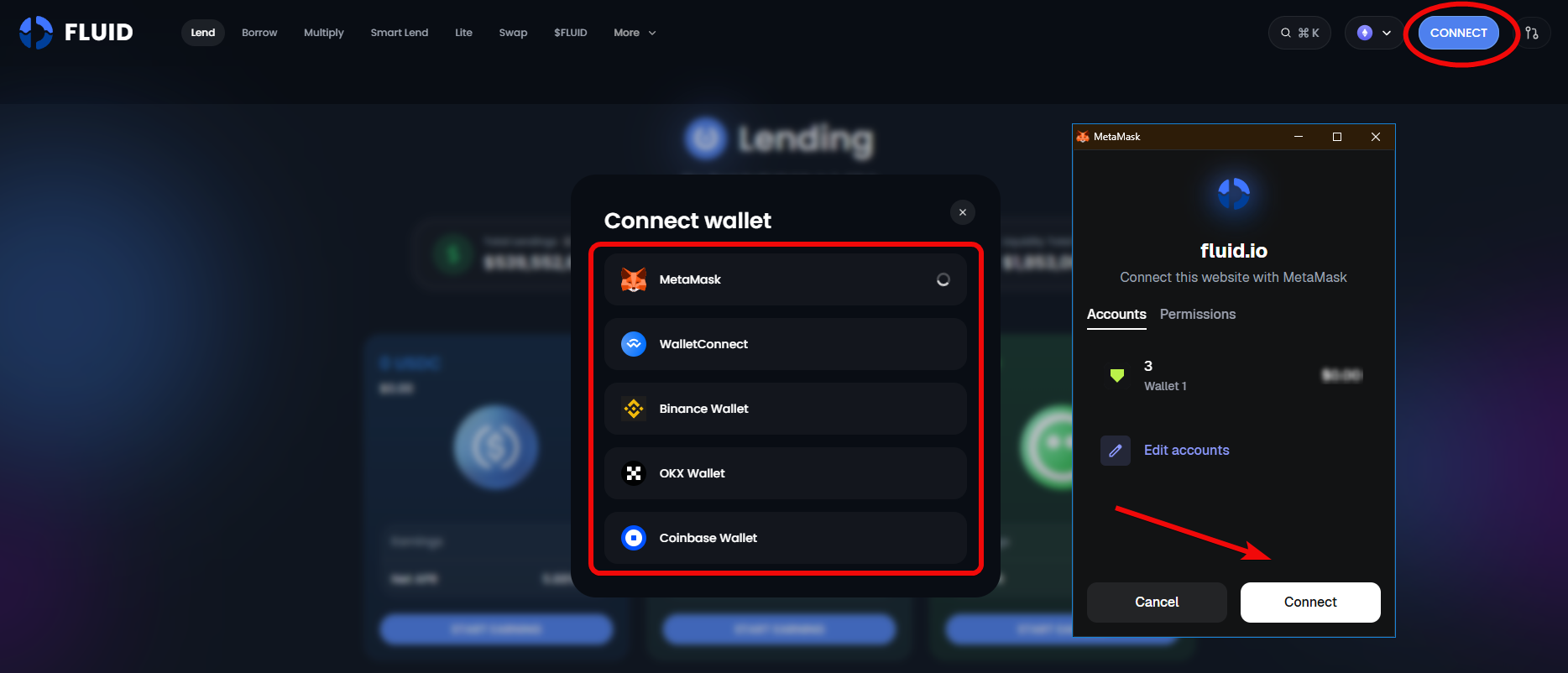

Since this is a DEX, it uses direct wallet connection instead of registration. You will need any EVM wallet, such as Rabby, MetaMask, OKX. Or a wallet supporting the WalletConnect option.

To register, simply click the Connect button on the website, then select your wallet and confirm your choice in the pop-up window.

After connecting your wallet, you will see its address instead of the Connect button. Congratulations, you have connected your wallet, and now you can start using the tabs of this exchange!

Let's start with the first tab - Lending.

Lending Tab

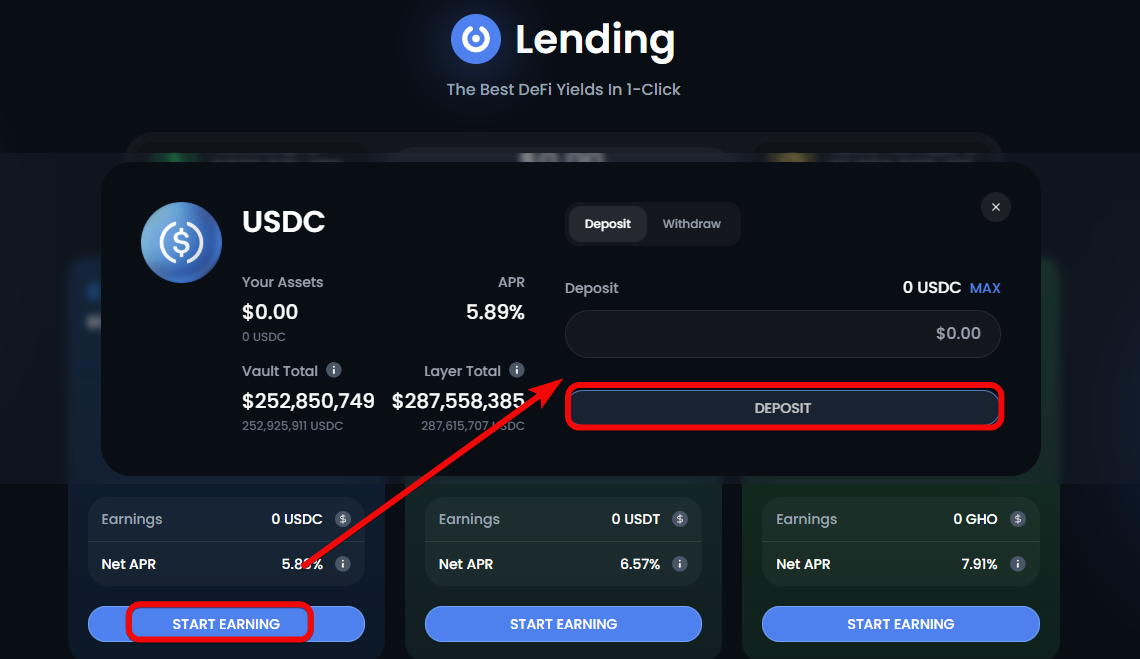

The Lending protocol is the basic component of the Fluid ecosystem: you provide liquidity to the protocol itself, essentially depositing funds into the central liquidity layer, which serves as the foundation for various protocols.

The deposit process is simple: check the interest rates (Net APR), choose a coin, and click Start Earning. Then enter the amount, click the Deposit button - and the funds are already in your balance.

It's important to understand that you cannot take a loan against your assets in this tab: this is solely a deposit for interest. To borrow, you need to go to the Borrow tab!

Borrow Tab

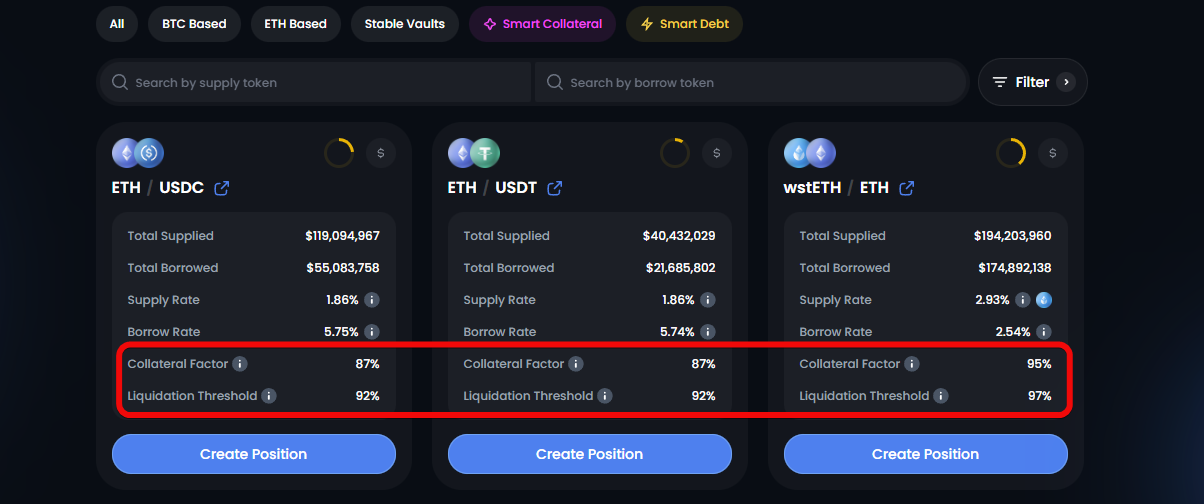

The Borrow tab works based on the vault protocol of the borrowing system. It's important to understand the parameters Collateral Factor (LTV) and Liquidation Threshold here.

Collateral Factor- this is the maximum percentage of the collateral value that you can borrow. For example, with $1,000 worth of ETH as collateral, you can borrow up to 87%, i.e., $870 USDC.Liquidation Threshold– the debt-to-collateral ratio at which the position is considered undercollateralized and can be liquidated. For example, if the collateral value drops to $920 (higher than the $870 debt), partial liquidation will begin.

Simulation Mode

Simulation mode allows you to test the platform risk-free and experiment with looping.

To enable simulation mode, click the gear icon in the top right corner and check the Simulation checkbox.

To open a position, simply click the Create Position button and select a Vault or strategy.

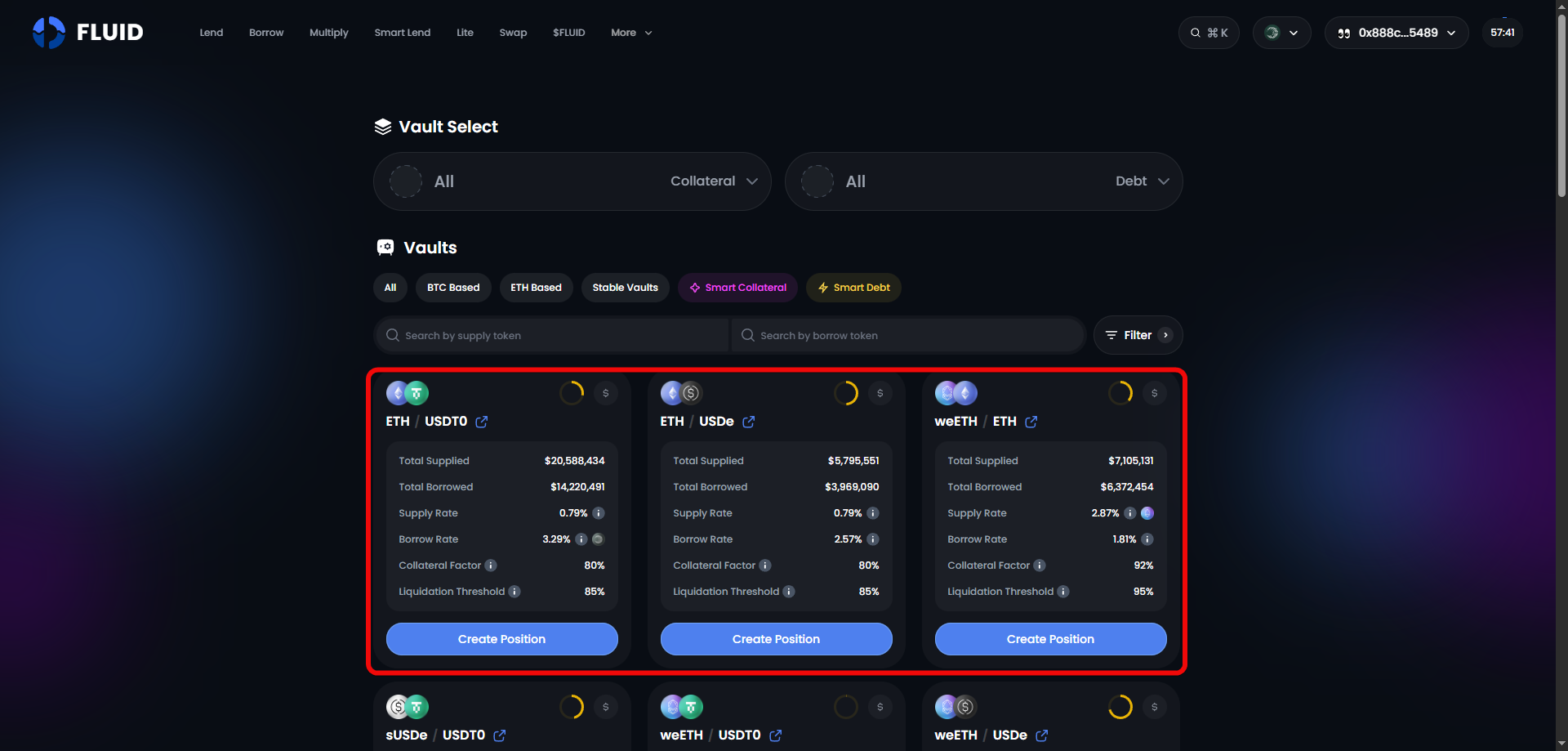

The Vault Select tab will open. Let's click Create Position here.

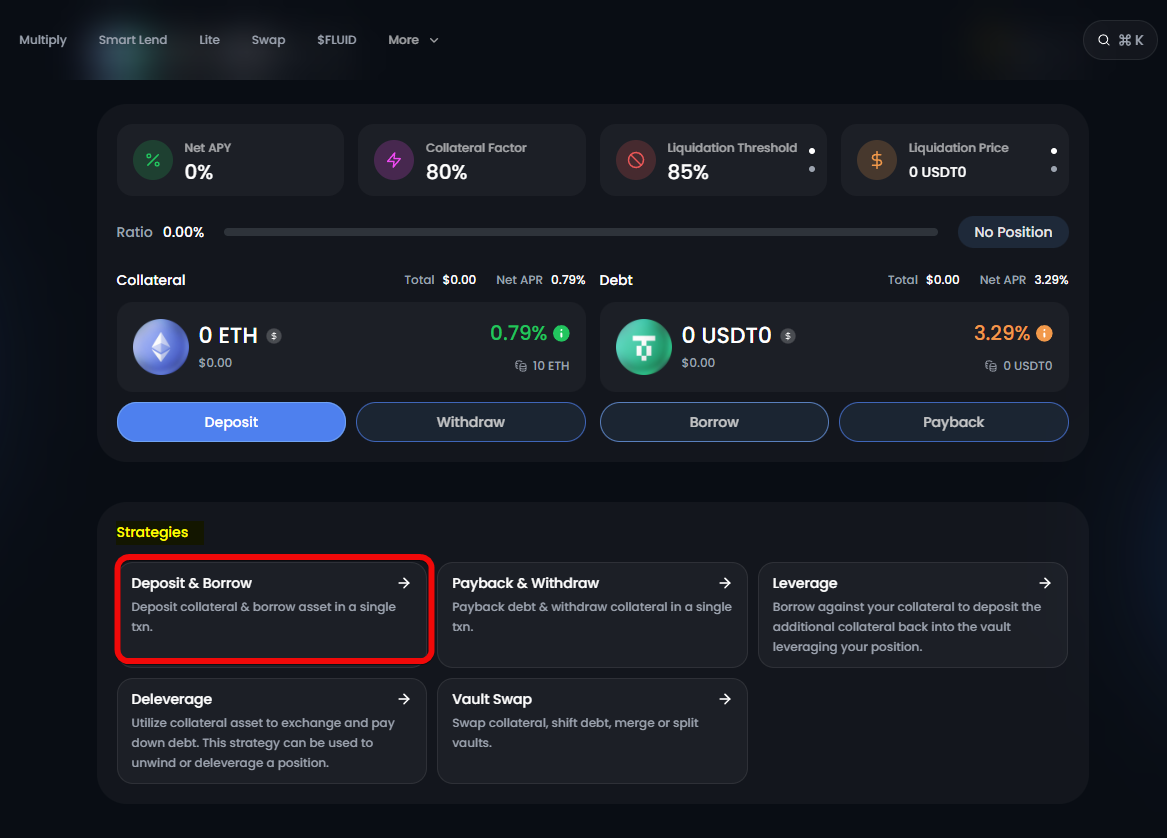

However, if you plan to take a loan against this ETH, it's easier to use the convenient Deposit & Borrow tab.

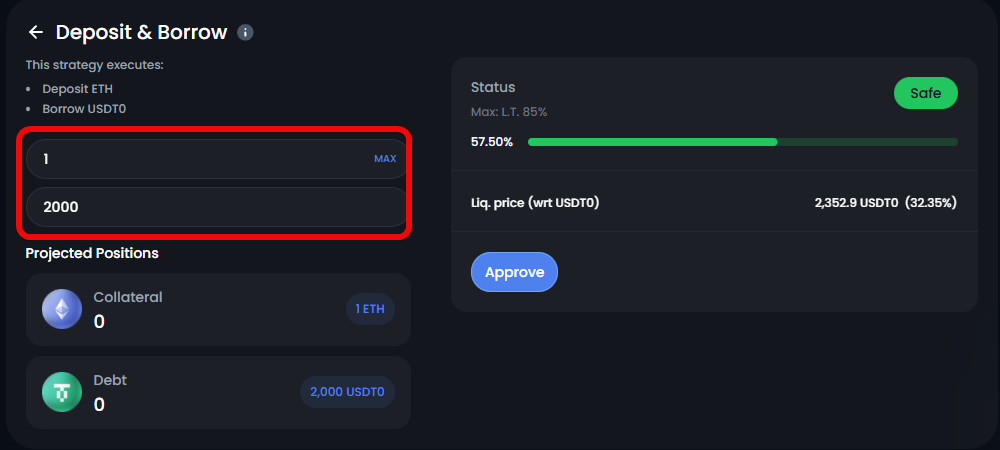

Here you can deposit Ethereum and in the same transaction immediately borrow the desired amount of another coin, for example $2000.

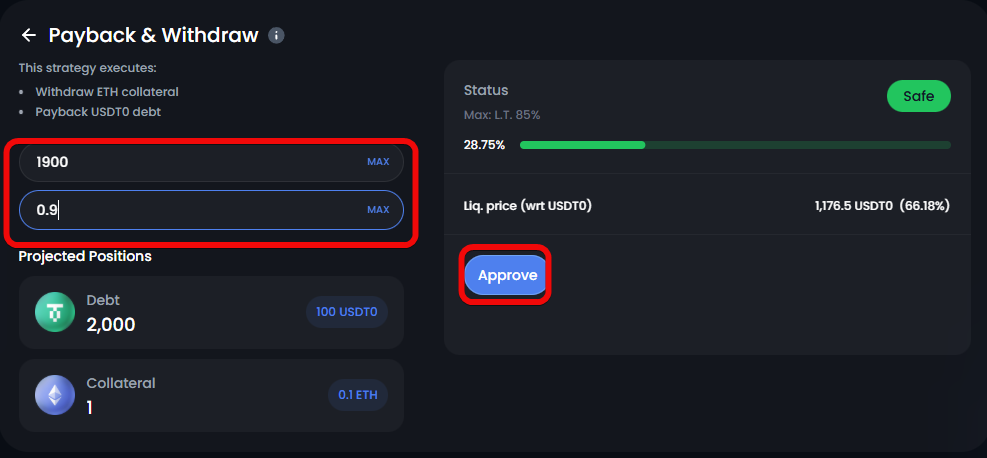

The risk scale is also displayed here. If the terms suit you, click Approve, then Deposit & Borrow.

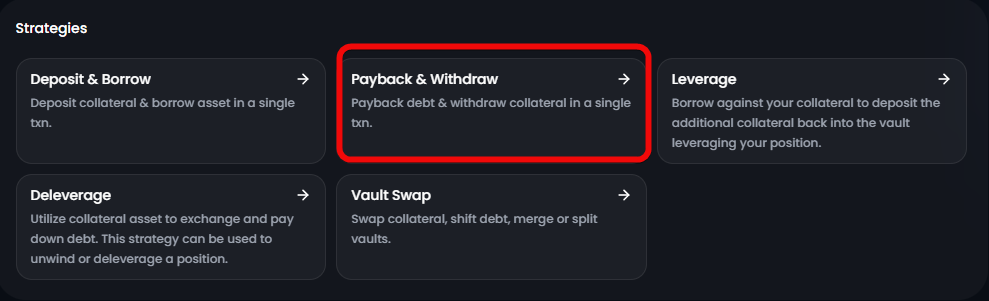

Below is the Payback & Withdraw tab for withdrawing funds and repaying the collateral.

For example, let's withdraw $1900 and 0.9 ETH.

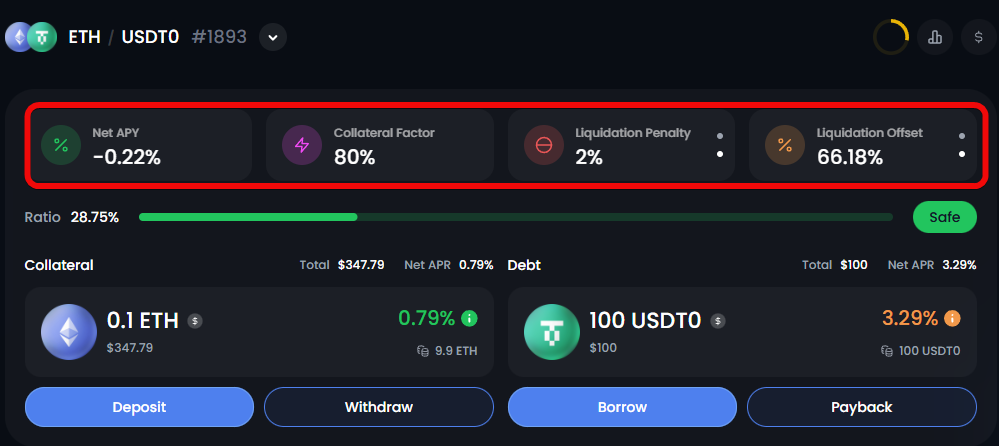

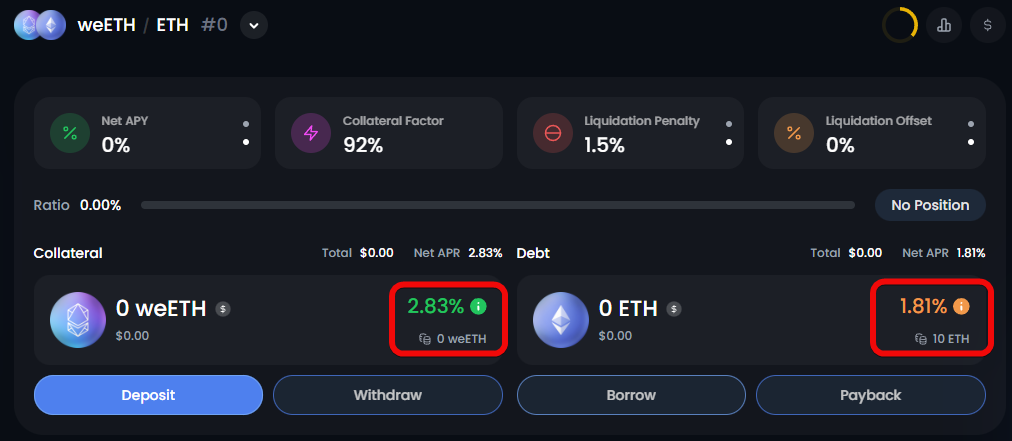

Position Parameters

The Net APY parameter shows your final annual yield or cost, taking into account all accruals: if you deposit assets, it accounts for the interest you earn, and if you borrow, the interest you pay, and ultimately this gives the net APY on your position.

Liquidation Penalty - this is the penalty upon liquidation - if the collateral price drops and your position is closed, an additional percentage will be deducted from you.

You need to be careful because these parameters differ from position to position.

Collateral Factor / LTV- your credit limit. Exceeding this limit leads to liquidation.Liquidation Offset– shows by what percentage the collateral price (ETH) must fall for liquidation to begin. This is the red zone. If the ETH price falls to this level, bots will start selling your collateral to repay the debt.

Flexible Usage

The loan here can be used however you like. For example, if you borrowed USDC on the Polygon network, you can transfer these stablecoins to another network, such as Base, and open a position on Aerodrome Finance.

The previous position, for example, yielded 25%, while this position on Base network on Aerodrome yields twice the return.

Looping Strategy

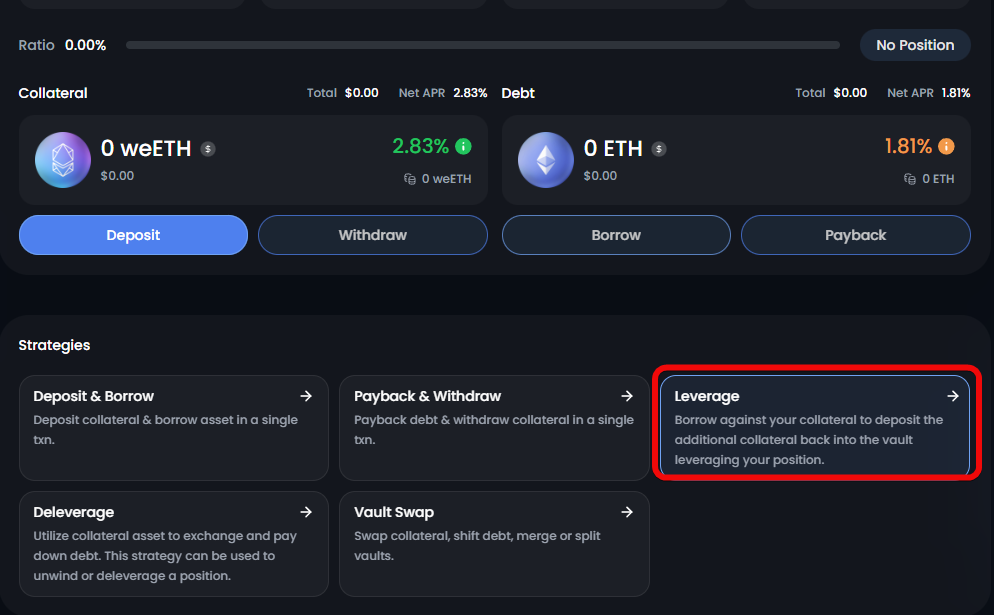

For looping enthusiasts, there is the Leverage tab.

As we can see, the yield on weETH collateral is 2.83%, while we pay 1.81% for the loan.

Here you can deposit weETH or your staked Ether and borrow regular ETH against it; with this loan, you can buy staked Ether again and repeat this cycle several times, which is called looping.

However, it is more convenient to use Multiply, a tab created specifically for multi-level positions.

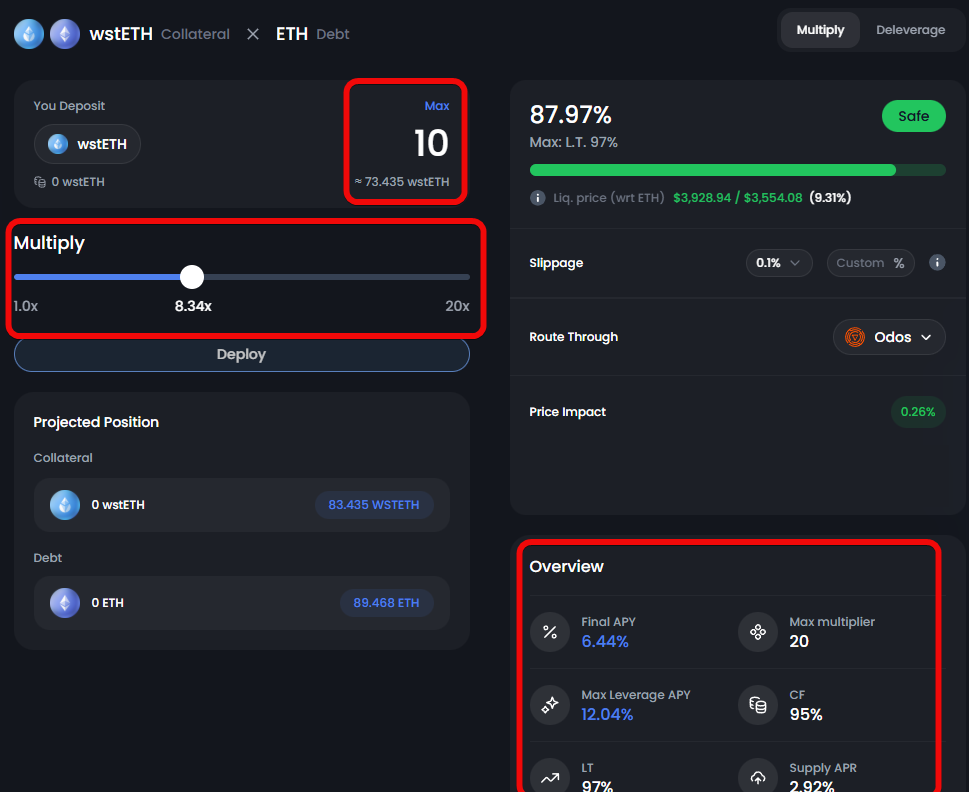

Multiply

The Multiply tab is a tool that automatically creates a leveraged position by repeatedly using your collateral as security for repeated loans, thus increasing your exposure to the asset.

Let's look at the example of a wstETH to ETH position.

By depositing, say, 10 wstETH, you can choose leverage up to 20x, but the higher the leverage, the higher the risk. At 8.34x, the APY reaches 6.44%.

The Max leverage is 12.04%, but these 12% only work at the twentieth leverage level, so it's better not to use this function to the maximum.

Liquidation and Oracles

The liquidation system in Fluid is partial: if the Health Factor drops below 1, the protocol liquidates the minimally necessary part, returning the position to the safe zone, and the rest of the collateral remains untouched. The penalties are lower than in Aave, and no more than 50% of the position is liquidated.

Fluid also uses an advanced oracle system, combining Chainlink data and Uniswap's Time-Weighted Average Prices (TWAP). 3 checkpoints are compared with the current price on Uniswap to exclude manipulation and ensure maximum accuracy.

Alternatives and Comparisons

Similar exchanges or protocols include AAVE, Hyperliquid, GMX, and Jupiter. Although FLUID is more of a lending and borrowing protocol, its core and philosophy are radically different from platforms created solely for leveraged derivatives trading.

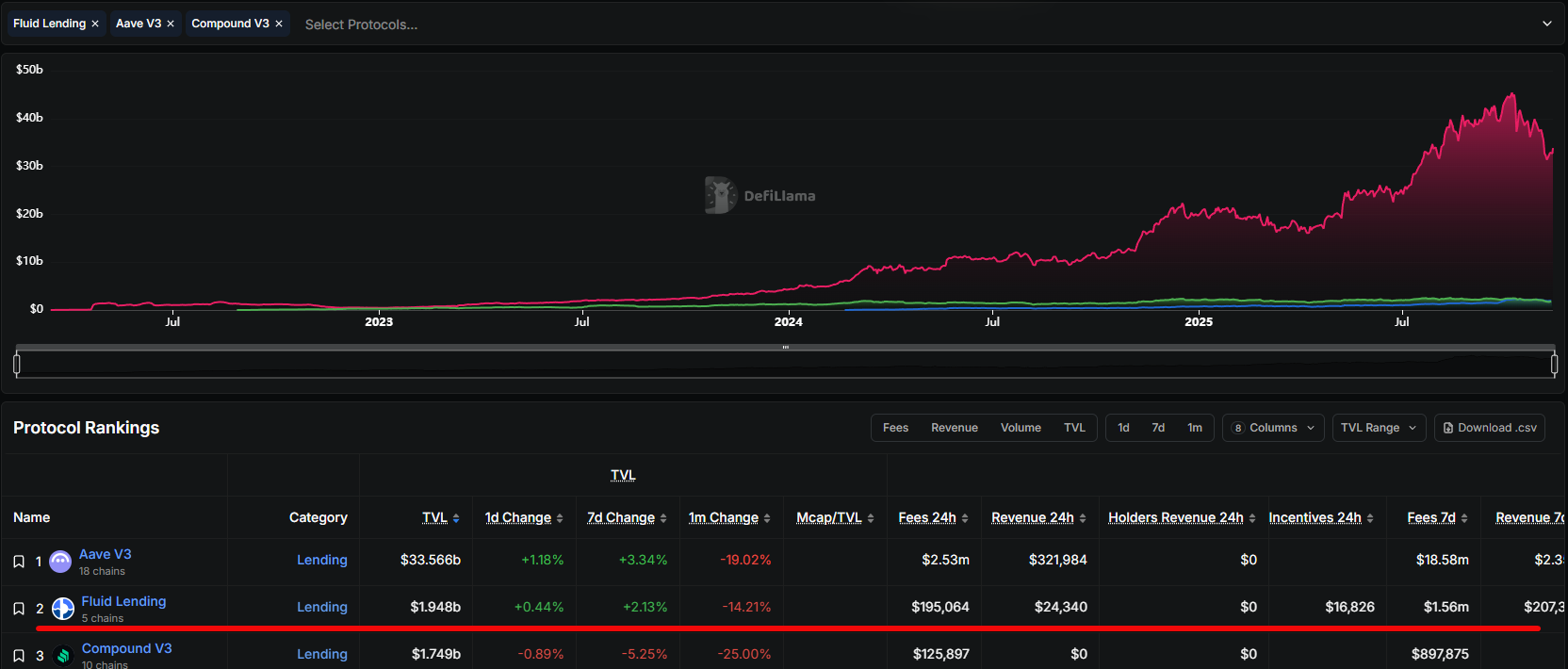

It's convenient to make comparisons through DefiLlama, which monitors 6k+ DeFi protocols, 464 networks, and 19k pools. Read about how to use DefiLlama in a separate guide.

A comparison of Fluid with Aave and Compound clearly demonstrates Fluid's growth. Despite the red market, liquidity decreases less in Fluid, even though the total TVL is still lower than competitors.

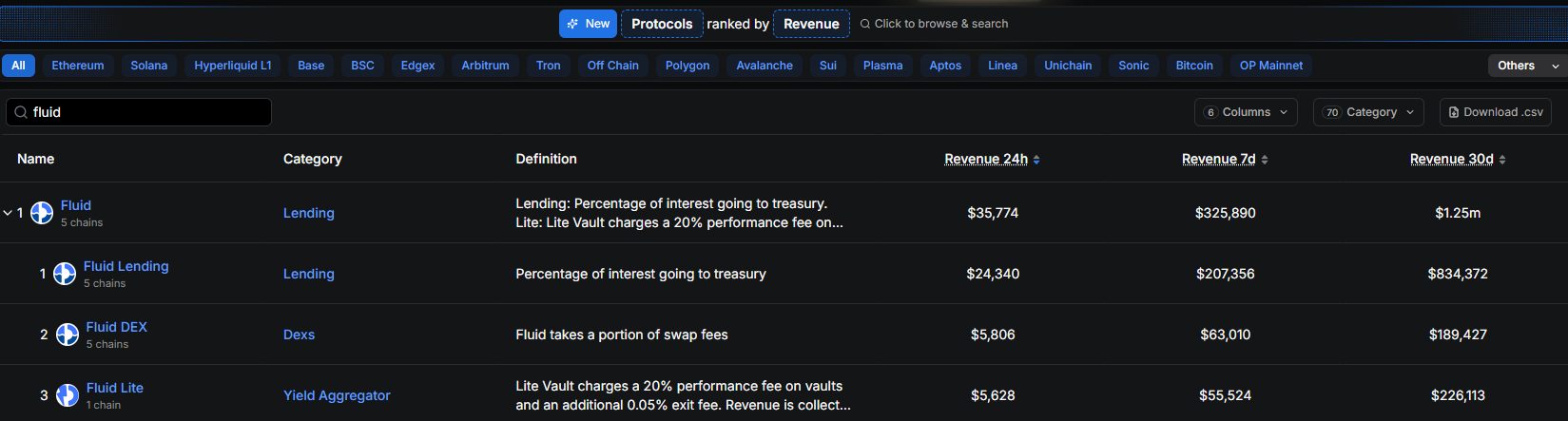

The Revenue by Protocol tab on DeFiLlama shows that Fluid's 24-hour revenue is already comparable to Aave's figures.

A comparison of Perp DEXs is presented in the table below.

| Exchange | How it works | Risk for Liquidity Provider |

| GMX, Jupiter | Single liquidity pool | Medium. Time-tested models. Income depends on the success of all traders on the platform. |

| Hyperliquid | Multiple pools + user pools | High. There is a precedent of pool fraud and forced closing of trades at a loss to traders to save the exchange. |

| Aark (Lighter) | Multiple pools | Medium. A modern platform, but you can temporarily lose money if traders win en masse. |

| Astra, JAX, Extended | Black box – the exchange's earning mechanism is hidden from you | Very High. It's unclear how their earning mechanisms work, high opacity. |

FLUID has a unified liquidity layer, where all funds in the protocol are combined into a common pool, which simultaneously powers the credit markets and provides liquidity for the built-in DEX.

Risks

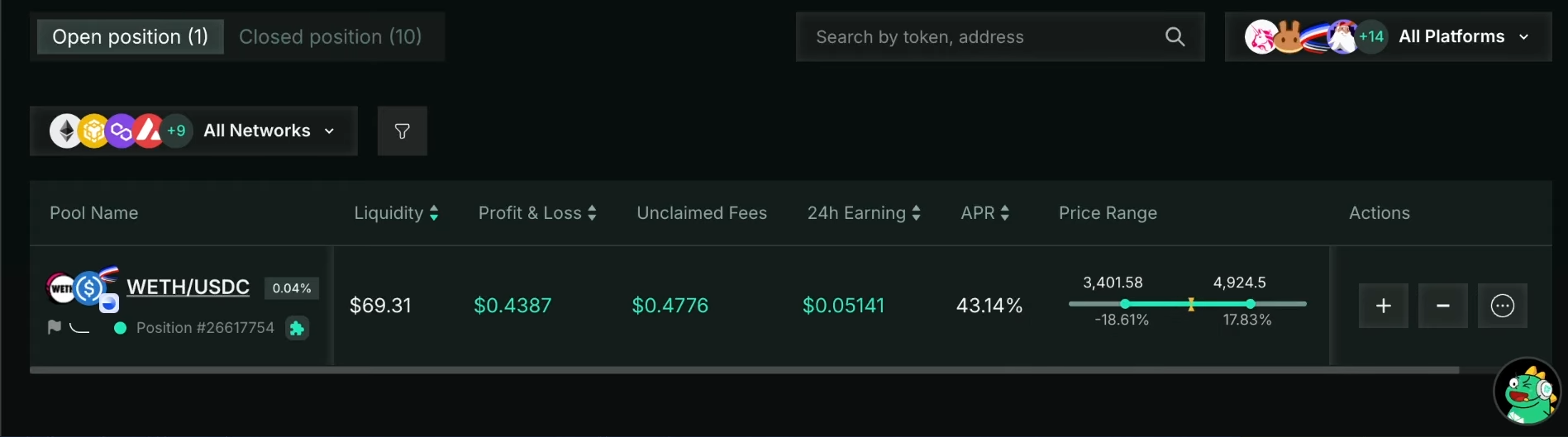

There are also risks that must always be considered. For example, one of Fluid's algorithmic LP pools on the ETH/USDC pair incurred losses due to high volatility. The team acknowledged the problem and accommodated the community by offering compensation.

Other risks are standard for crypto and DEXs: protocol vulnerabilities, token manipulations.

Risks can be grouped as follows:

- Technical - smart contract vulnerabilities.

- Economic - impermanent loss and volatility.

- Operational – regulatory hurdles, fraud.

Summary

Beginners should start with simulation mode and simple deposits in Lending. More experienced users can proceed directly to strategies via Multiply.

Fluid offers softer liquidation terms and high LTV, while Aave attracts with proven reliability, a wide selection of assets, and a simple interface. If you are just exploring lending markets, start with Aave.

Ultimately, traditional lending protocols face a critical vulnerability during market stress - the risk of a liquidity shortage. Fluid has created a balanced ecosystem where the decentralized exchange (DEX) and the lending market complement each other.

Disclaimer: All information provided in this article should not be taken as financial advice! The article was created for educational purposes.