Hyperliquid

Useful links

Trading Date | Price $ | Trading Volume | Rate Changes - 24h

What is Hyperliquid for?

Hyperliquid is a high-performance decentralized exchange with a Layer 1 blockchain, designed to combine the best features of centralized exchanges like Bybit and decentralized exchanges like Uniswap.

- A Centralized Exchange (CEX) is operated by a company and holds funds like a bank.

- A Decentralized Exchange (DEX) runs on a blockchain, connecting users directly without intermediaries.

What problems does it solve?

Eliminating Verification and Simplification

Verification (KYC), restrictions, and blocks hinder users of centralized exchanges. This is why the popularity of decentralization is growing - the original idea of cryptocurrencies, which centralized platforms complicate instead of simplifying.

Hyperliquid is unique thanks to 1-click trading with registration via email or a wallet. You are the master of your own account, and the exchange cannot simply restrict your access.

Technology, Speed, and Transparency

The exchange processes up to 200,000 transactions per second with finality in less than 0.2 seconds. This is possible thanks to its proprietary HyperBFT consensus, crucial for high-frequency trading.

Transparency is ensured by an order book that stores orders. Here, all trades are stored on the blockchain!

In other words, on CEXs, the order book is drawn by the exchange itself, and there is no guarantee that the trading volumes are real. In Hyperliquid, all trades are written to the blockchain and cannot be faked or simply fabricated.

Now let's look at why the HYPE token is needed.

HYPE Token and Architecture

HYPE is the native utility token of the Hyperliquid ecosystem.

What does the HYPE token give you?

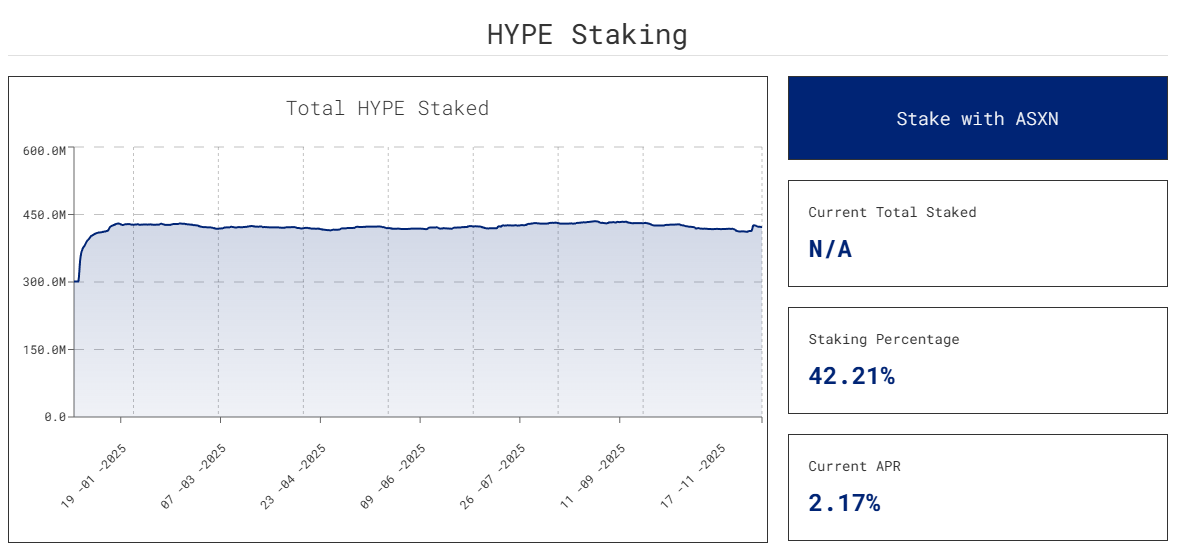

- staking with an APY of ~2.17%,

- the right to vote on network upgrades and parameters,

- reduces trading fees,

- pays for transactions in the Hyperliquid EVM.

Hyper Core and HyperEVM

The Hyperliquid architecture consists of 2 main components:

- Hyper Core includes on-chain order books for perpetual futures and spot trading with transparent orders and trades.

- HyperEVM is a system that allows running crypto applications from Ethereum on the Hyperliquid platform. It works faster and cheaper than regular Ethereum and provides access to funds for trading crypto on this platform.

Tokenomics and Distribution

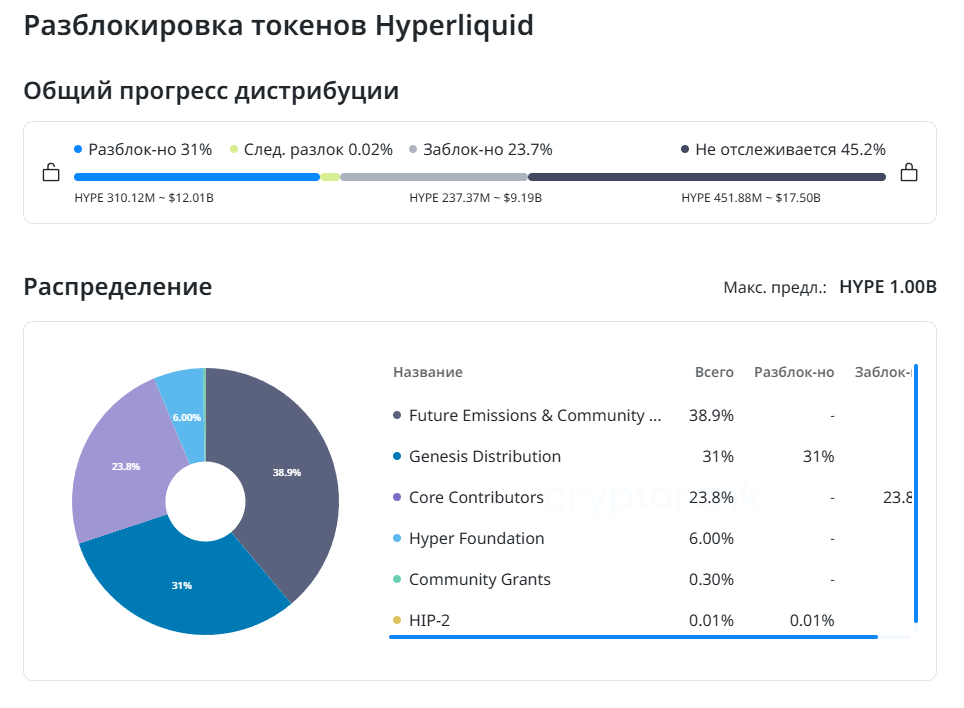

The maximum supply is 1 billion tokens, with approximately 333 million in circulation. The launch occurred without pre-sales or venture funding.

Token Distribution:

- 38.89% - Future emissions and community rewards,

- 31% - Largest initial airdrop,

- 23.8% - Core contributors (locked until 2027-28),

- 6% - Hyper Foundation treasury,

- 0.3% - Community grants,

- 0.01% - For the HIP-2 market making mechanism.

The lock-up of the core contributors' share (23.8%) reduces the risk of insider sales and a token price crash.

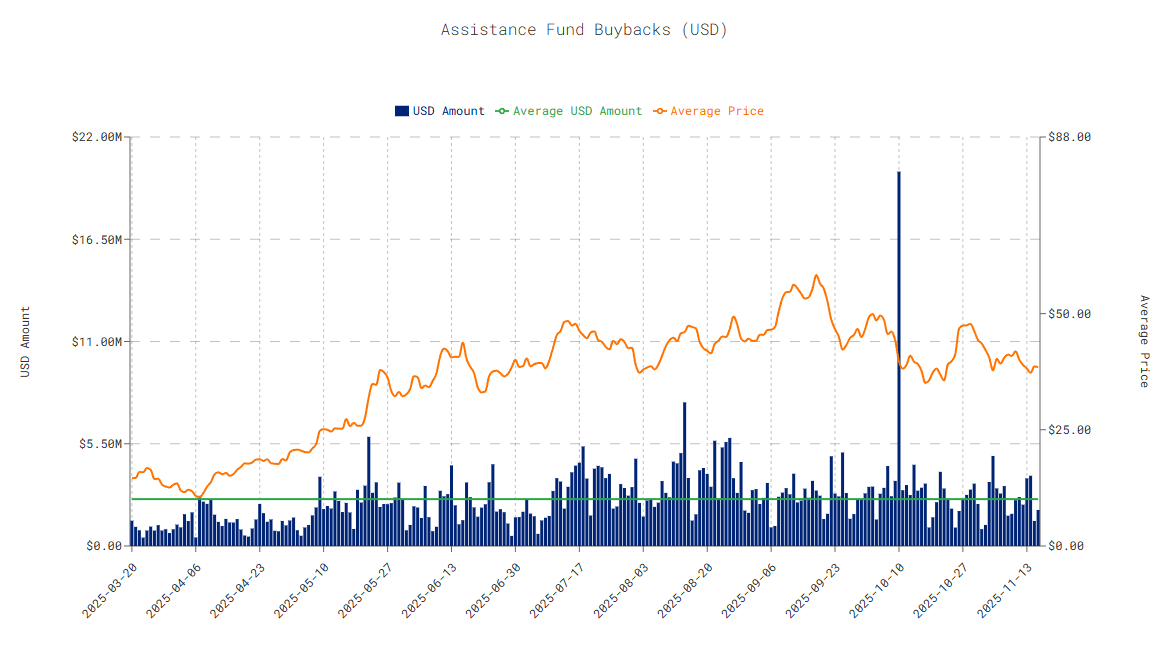

Token Buyback and Burn

The Hyperliquid economic model stipulates that a portion of trading revenue is used for buying back and burning HYPE tokens. Why? This creates constant demand and deflationary pressure to return value to holders.

Such a buyback schedule is a transparency tool that shows investors and the community that the project is fulfilling its token buyback promises.

Thus, 99% of the fees received from the exchange are sent for token buyback and burning.

As you can see, the token looks quite promising. The limited trading volume makes Hype scarce, like BNB in its best years.

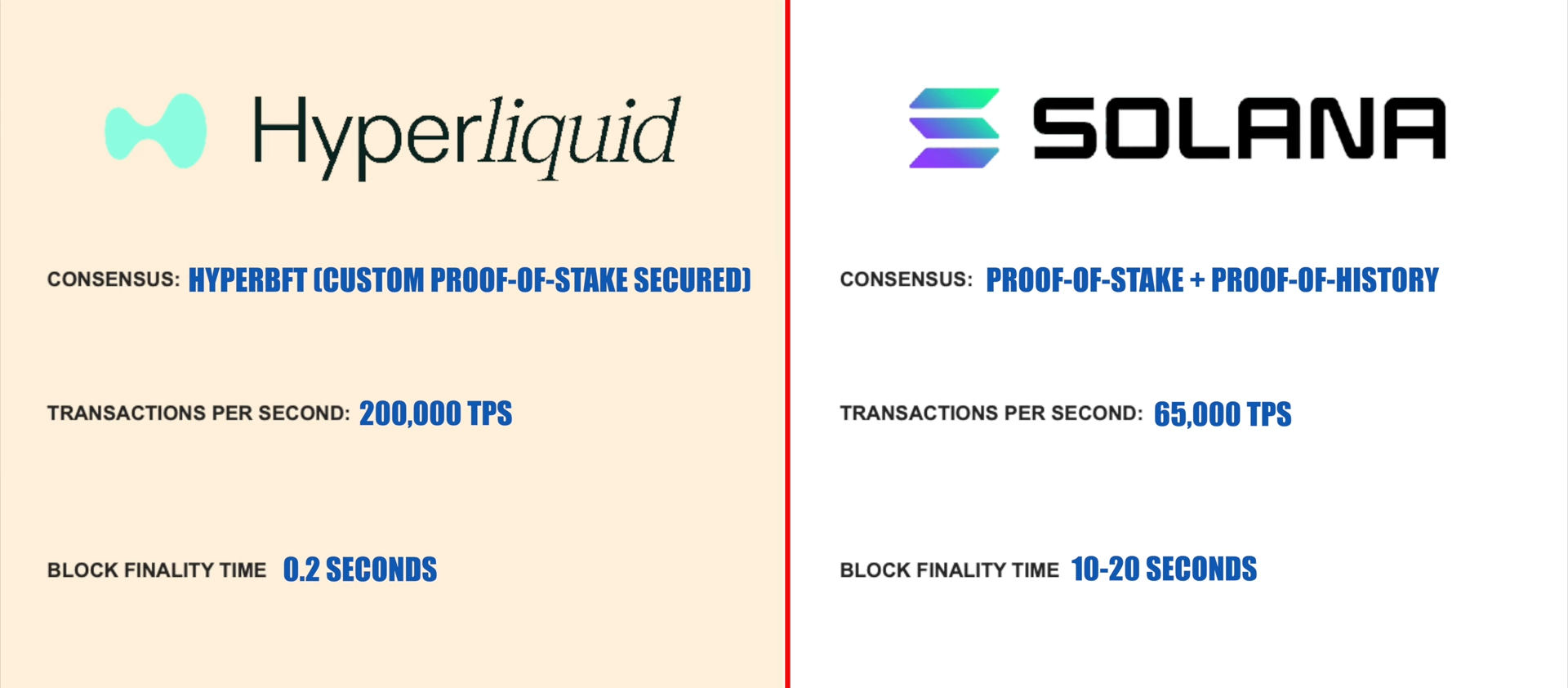

Comparing Hyperliquid and Solana

Comparing Hyperliquid and Solana, we note their different purposes. Solana is more suitable for universal decentralized applications, while Hyperliquid is for advanced DeFi and high-frequency trading.

When comparing the Hyperliquid and Solana ecosystems, both use a Proof-of-Stake consensus mechanism, but Hyperliquid uses its own HyperBFT consensus algorithm, while Solana uses Proof-of-History.

Performance and Decentralization

Technically, Hyperliquid is faster than Solana.

- Solana processes about 65,000 transactions per second with block finality time of 10-20 seconds, while Hyperliquid handles 200,000 transactions with finality in less than 0.2 seconds.

- Solana is more decentralized - with about 1,000 validators compared to Hyperliquid's 16.

- Solana's market capitalization is $134 billion, Hyperliquid's is $18 billion.

Summary: Hyperliquid is faster, but Solana leads in decentralization and capitalization.

Foundation, Decentralization, and Vision

Hyperliquid Labs was founded by Jeffrey Yan, a former Harvard student. It is believed that Hyperliquid was launched after the FTX collapse, as its creators saw a market niche for a derivatives exchange. Jeff sees in crypto "humanity's only hope for reinventing finance."

It is important to note, however, that unlike other decentralized exchanges, Hyperliquid, in our opinion, can currently be considered centralized, as its blockchain is secured by only 16 validators.

For comparison, Ethereum, for example, has over 950,000 validators, and generally, the more validators, the more decentralized the network.

However, the founder claims that Hyperliquid does not compete with Ethereum, but rather works as base infrastructure, a public good, on top of which one can build their own protocols.