How to Use the Jupiter DEX Exchange? A Simple Guide for Beginner Traders

Complexity for beginners, risks associated with smart contracts and leveraged perpetual futures.

Search for the best exchange rates on the Solana network. Tools available include direct conversion, limit orders, futures, bridges, staking, and lending.

Jupiter is an aggregator that scans all major decentralized exchanges (DEXs) on the Solana network, such as Raydium, Orca, and Serum, to help you find the best exchange rates and minimize price slippage.

Beyond simple swaps, Jupiter offers a range of advanced features: limit orders, Dollar-Cost Averaging (DCA), leveraged perpetual futures (perp) trading, cross-chain bridges, and a launchpad for new tokens.

What Problems Does Jupiter DEX Solve?

Let's recall the differences between crypto exchanges:

- CEX - Centralized Exchange, owned by a company, holding all your funds.

- DEX - Decentralized Exchange, no intermediaries, funds remain with you, trading occurs on the blockchain.

CEXes complicated the use of cryptocurrencies, even though they were created to simplify it. These exchanges began introducing identity verification, limits, and freezes.

Jupiter solves all these CEX problems by removing verification, user account freezes, and withdrawal limits.

Additionally, Jupiter helps you find the best routes for exchanging tokens with minimal fees. Let's take a closer look at this exchange.

Overview

Jupiter supports functions such as swaps, limit orders, Dollar-Cost Averaging (DCA), staking, and is perfectly suited for projects looking to launch and distribute tokens efficiently.

The exchange develops several products mainly in the DeFi space, related to the Solana ecosystem.

| Function | Description |

| Swap | Exchange Solana network tokens at the best rate. |

| Pro | Trading with market, limit, and recurring orders. |

| Perps | Perpetual futures trading (price speculation) |

| Lend | Earn or borrow cryptocurrencies with annual yields up to 7% |

| Predict | Allows placing bets on event predictions. Winners receive payouts for correct events, losers lose their invested amount. |

| Portfolio | Overview of portfolio, positions, and profits & losses (PnL). |

Interesting fact: Jupiter gained unprecedented interest after the launch of President Trump's memecoin.

The exchange's rich functionality can be divided into 3 categories:

- Earning through Lend (APY up to 7%), event betting, SOL/JUP staking, airdrops, native token launchpad, JLP loans.

- Trading through Swap, Pro (limit/DCA/recurring orders), futures. Portfolio (PnL positions)

- For Developers, a plugin for embedding, token verification, and a vesting tool (Lock) are available.

Besides these main features, there are also really great functions for launching trading of a new token on the platform. For example, if you have a new token and want to get it listed. On a centralized exchange, this requires serious verification, paying a lot of money, etc., but here you can easily add your token in 3 steps:

For example, using the article's author from bytwork.com, Maxim Anisimov, we specify the exact time for adding liquidity, pools and markets, and finally, add the new token to the Jupiter list - and that's it, you're in the listing queue.

Team

After getting acquainted with the main products of the ecosystem, let's meet its creator - a person with 740,000 followers under the nickname Meow on X/Twitter.

His ecosystem already includes over 75 projects: data providers, DeFi, bridges, games. Well-known ones include Star Atlas, Gen Pets, Aurora, CoinPay payments, Brave and Coinbase wallets.

He has interesting views on the industry. In his interview he states that:

"All existing forms of money (Bitcoin, gold, dollars) are essentially memes. Their value is based on collective belief and human consensus."

He pays special attention to the gaming sector due to the importance of fast performance on the Solana blockchain with a large user flow.

Getting Started with Jupiter

Wallet Requirements

To use the exchange, you must have a wallet that supports Solana; we recommend using Phantom. We have a detailed beginner's guide for the Phantom wallet that covers installation, funding, and executing transactions.

Registration

For registration, use direct wallet connection. You will need any EVM-compatible wallet, e.g., Phantom, MetaMask, OKX. Or a wallet supporting the WalletConnect option.

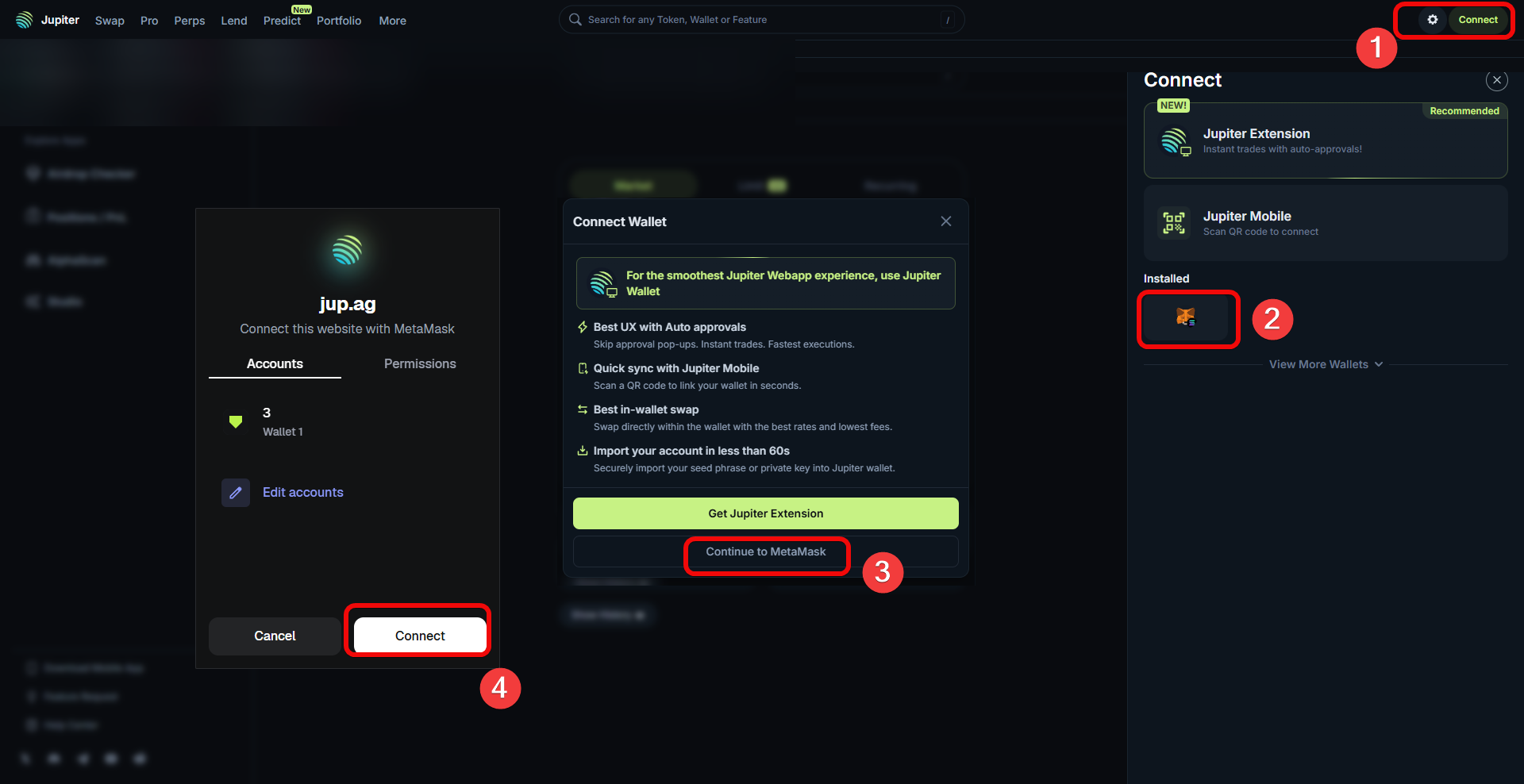

It's easiest to work in a browser. So, to start using the exchange:

- Click

Connecton the exchange. - Select a wallet to connect (if you don't have a wallet – install one, e.g., MetaMask)

- The exchange might suggest using their browser extension, but we will use MetaMask.

- A connection confirmation window will appear. Click

Connectin the wallet.

Congratulations! You have successfully registered.

Trading

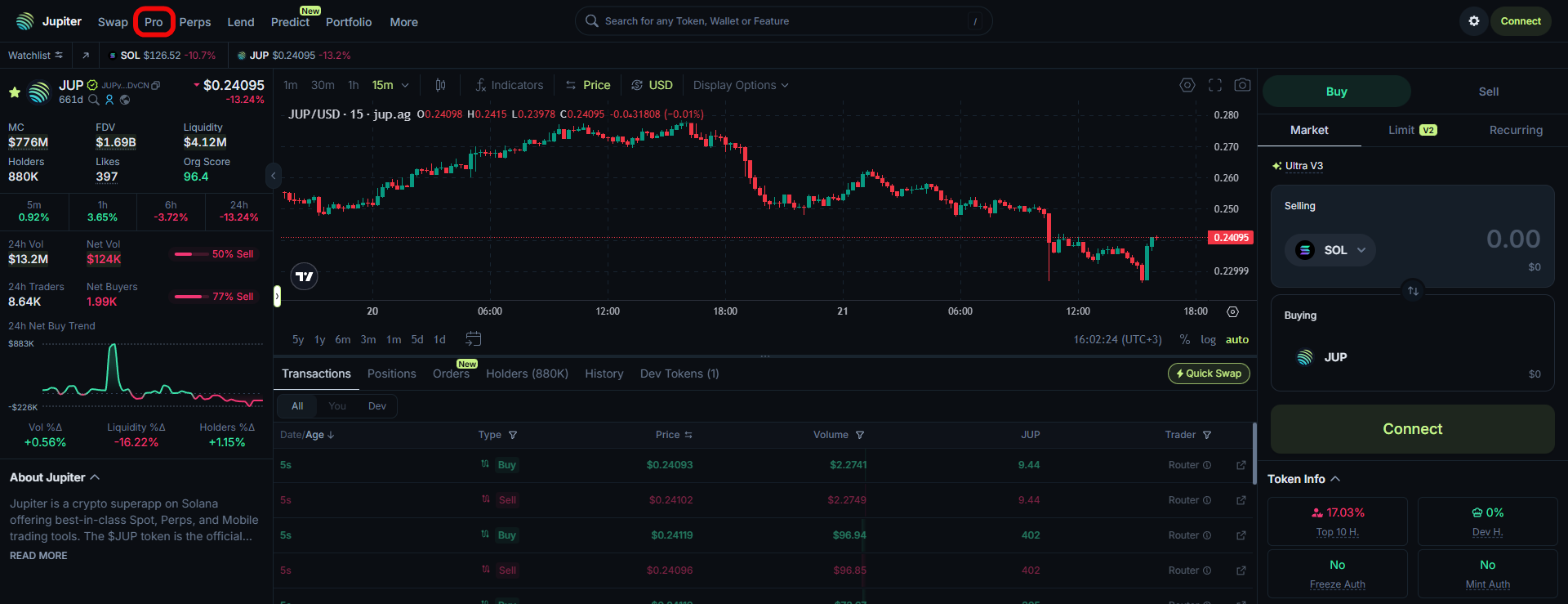

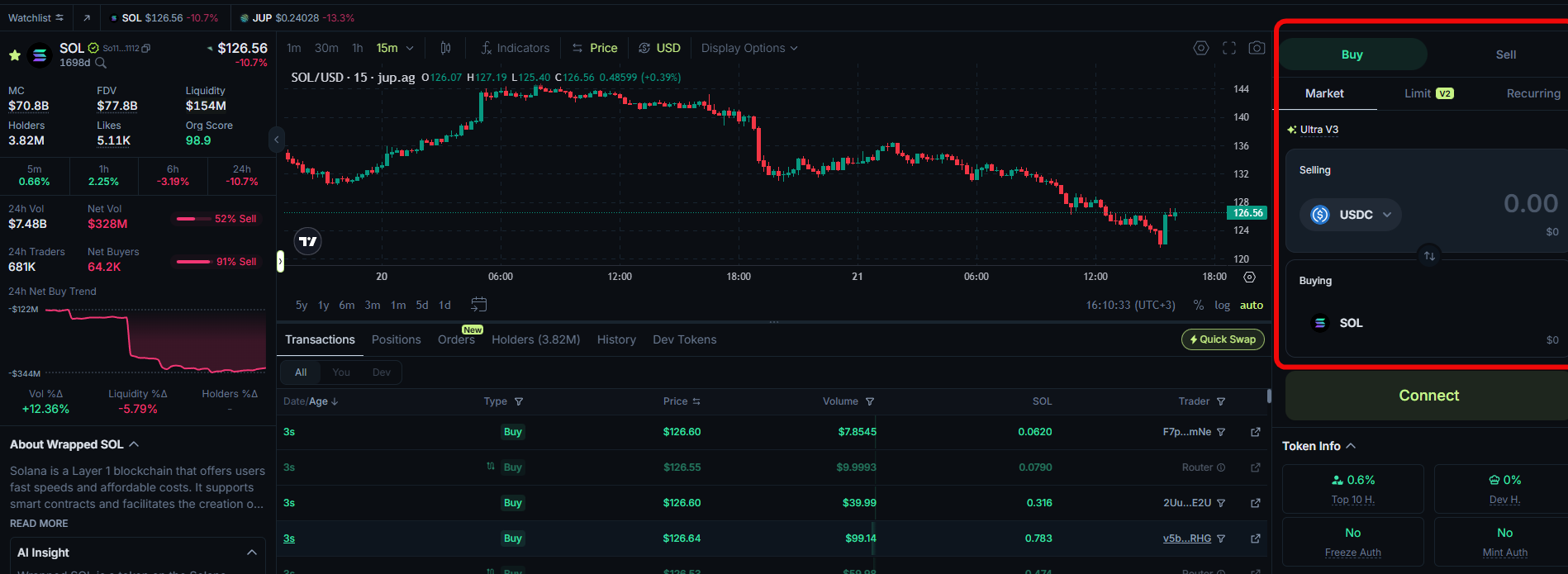

On the website's main page, spot trading is available - trading with funds from your wallet. The trading terminal resembles those on centralized exchanges.

In the center top - a search bar for Solana tokens to select an asset.

For example, on the JUP token page, you can see its name, verification status, organic index (activity without bots, ORG), market capitalization, liquidity, and 24-hour trading volume.

The trading page features an integrated Tradingview chart with indicators, token description, and a buy/sell terminal on the right.

Order Types on Jupiter

There are 3 order types here.

- Market - allows immediate purchase of an asset.

- Limit (v2) - allows setting a price at which you are willing to buy the asset, e.g., 10 or 20% below the current price; when the price reaches the set level, the order executes automatically.

- Recurring - ideal for those using a Dollar-Cost Averaging (DCA) strategy. You can set up automatic asset purchases regardless of its price, e.g., buy $1 worth of JUP token every day/week.

In limit orders, there are two options - Limit v1 and Limit v2. The latter offers more advanced features:

| Limit v2 | Description |

| Price/Market Cap Trigger | Setting a USD price or token market capitalization to trigger the order |

| Take Profit and Stop Loss | Automatic buying above/selling below current price when trigger is reached |

| Batch Orders (OCO) | Simultaneously setting TP and SL; when one triggers, the other cancels automatically |

| Order Editing | Ability to modify parameters without canceling and recreating |

| Volume Guarantee | Not guaranteed - executes when trigger hits, but final amount depends on pool price |

Swaps and Its Modes

The Jupiter exchange ensures the best price route by scanning leading Solana DEXs to find the best exchange rate, lowest fees, and fastest execution time.

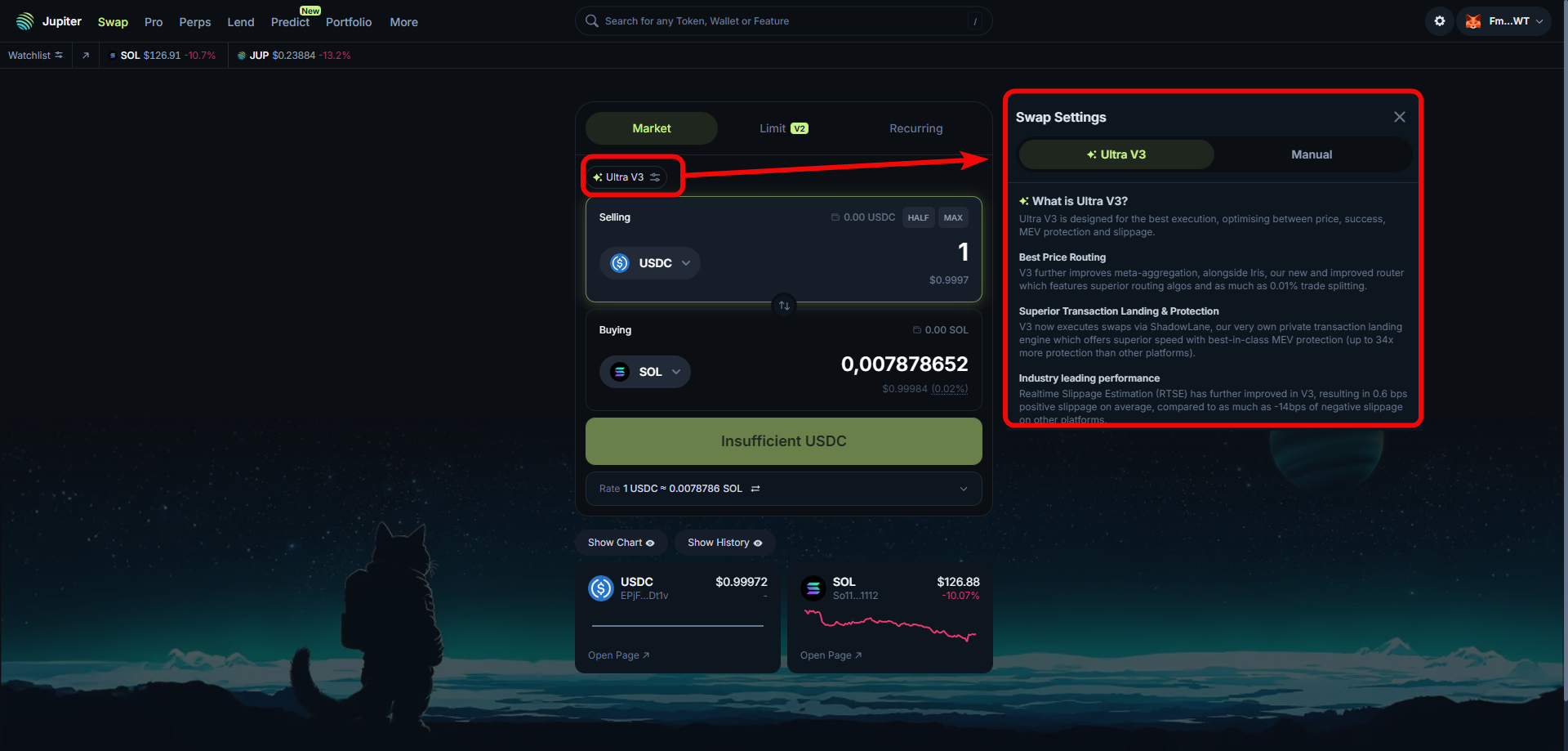

Let's take a closer look at the Swap tab, which allows instant asset exchanges. There are 2 swap modes here.

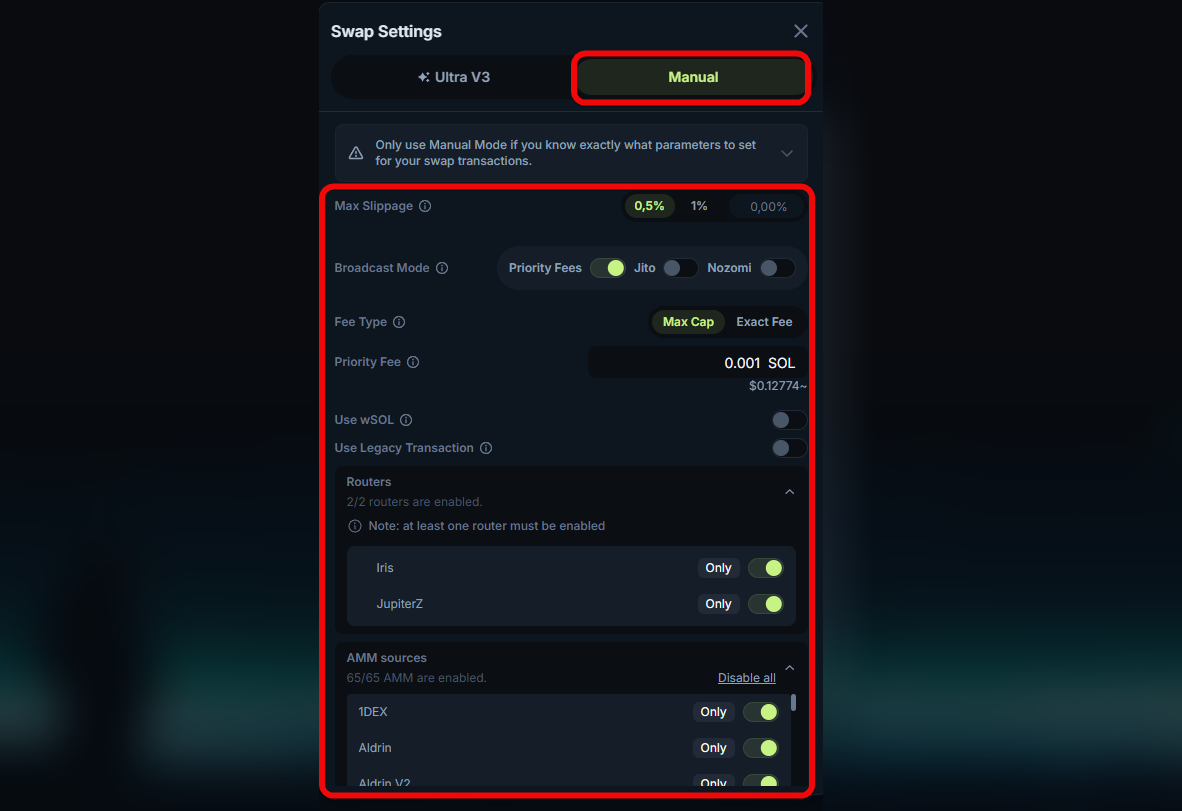

Ultrav3 Mode

The first thing you see are the Ultrav3 or Manual options.

The Ultrav3 mode optimizes the swap process with minimal user input: the interface automatically selects the best routes for the swap, minimizes price slippage percentage, and ensures fast transactions. This mode is ideal for beginners.

Technically, the Ultra V3 mode provides such improvements: better price via Iris, MEV protection 34x via ShadowLane, and positive slippage of 0.6 bps.

Manual Mode

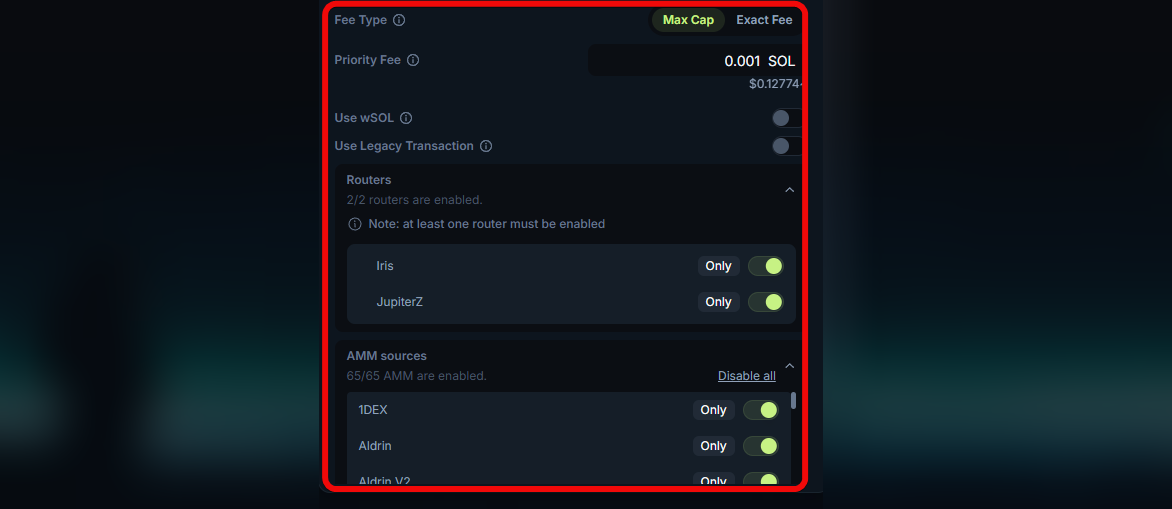

The Manual mode allows you to fully customize swap parameters yourself. It is intended for experienced users who need full control over the trade.

In the manual mode settings, you can set the maximum price slippage percentage (Max Slippage) you are willing to accept.

For example, if you set 0.5%, the swap will only occur if the price deviation does not exceed 0.5%. Note that low slippage reduces the risk of losses due to volatility but may lead to the trade not executing!

Other settings include Broadcast Mode and the choice between Jito or Nozomi.

Jito- the most popular service for fast transaction submission with MEV protectionNozomi- a service (mempool) for fast and reliable transaction submission on the Solana network.

These services increase the chances of your transaction being processed quickly, especially during periods of high network load.

You can also set priority fees to speed up transactions, use only Jupiter-supported routes, use wrapped SOL instead of native, use the legacy transaction format, and exclude certain automated market makers from the swap route.

We recommend using the Ultrav3 mode, especially if you are a beginner, as it automatically applies the best settings for swapping.

Fee Nuance

Attention: to perform any operation on a DEX, regardless of which token you want to swap, you must have a small amount of Solana in your wallet to pay the swap fee!

This is a unique feature of decentralized platforms.

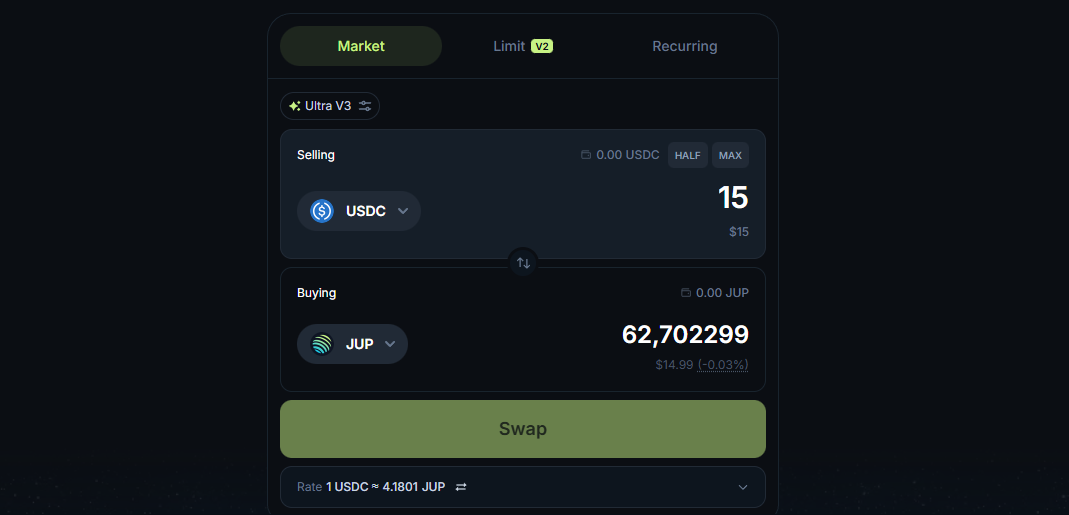

How to Perform a Swap

To perform a swap, let's do a test transaction so you understand the principle, after which we'll move on. First, enter that you want to buy JUP, for example, with $15 worth of USDC; you will immediately see how much you will receive.

Then click the Swap button, and in the pop-up wallet window, confirm the transaction by checking the amount to pay, the fee size, and the final token quantity.

After confirmation, within a few seconds, a transaction confirmation notification will appear in the lower left corner of the screen.

Then open your wallet, and you will see the JUP tokens already there. Most importantly, this is your non-custodial wallet, not an exchange account, meaning these tokens truly belong to you, as you own the seed phrase.

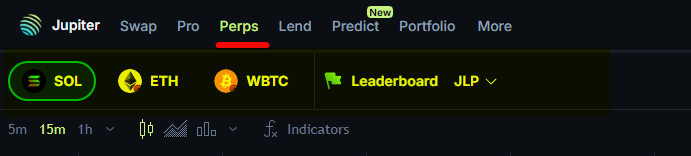

Perpetual Futures Trading (Perps)

Now let's move to the Perps section and explain how futures work on this DEX platform.

Attention! Futures are high-yield but also high-risk instruments, so please do not use them if you are not an experienced trader!

Trading is available for 3 tokens: SOL, ETH, and wBTC.

To the right of the chart, you'll see a terminal very similar to those used on centralized exchanges for managing a futures position.

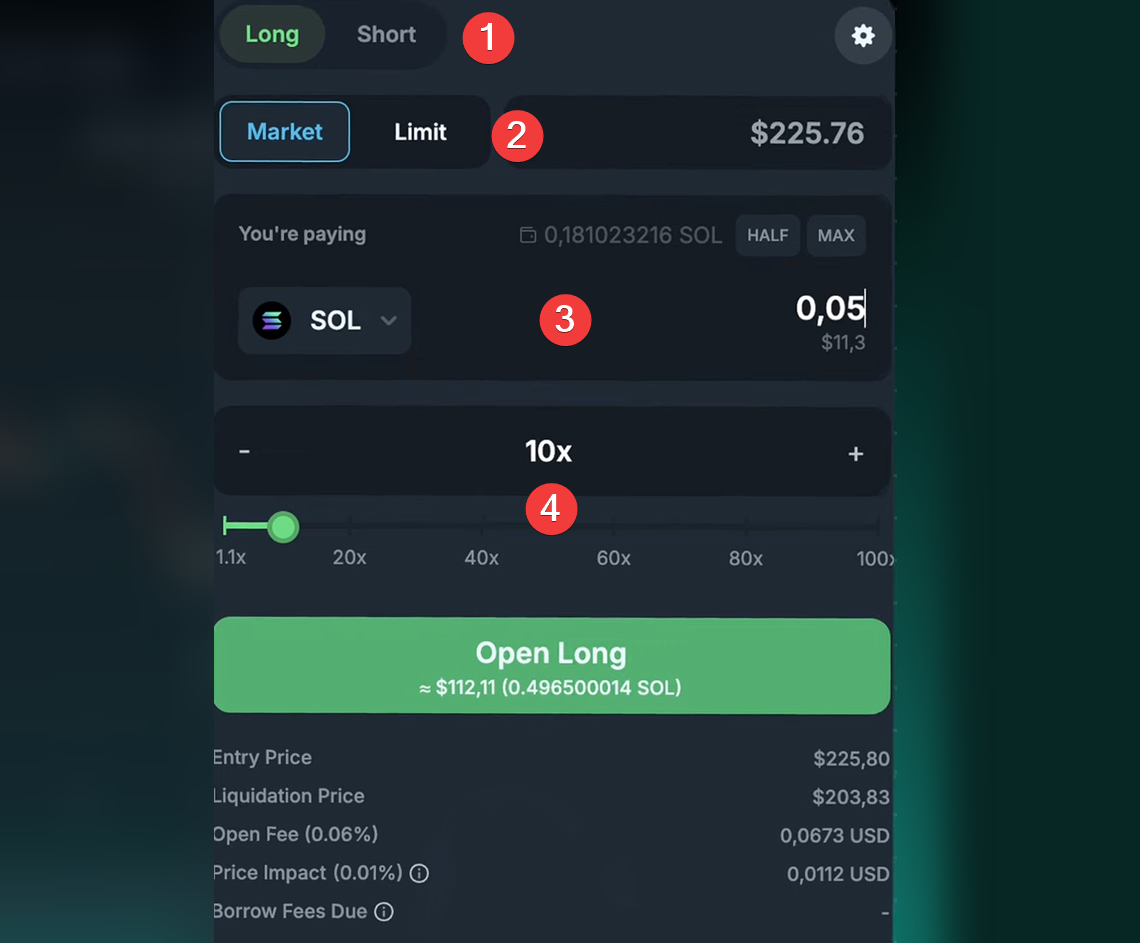

Here you can select:

- position type (long or short),

- limit or market order,

- token (e.g., Solana),

- enter the amount and choose leverage.

Below the open position button, details are displayed: entry price, liquidation price, opening fee, and price impact.

Opening and Closing a Position

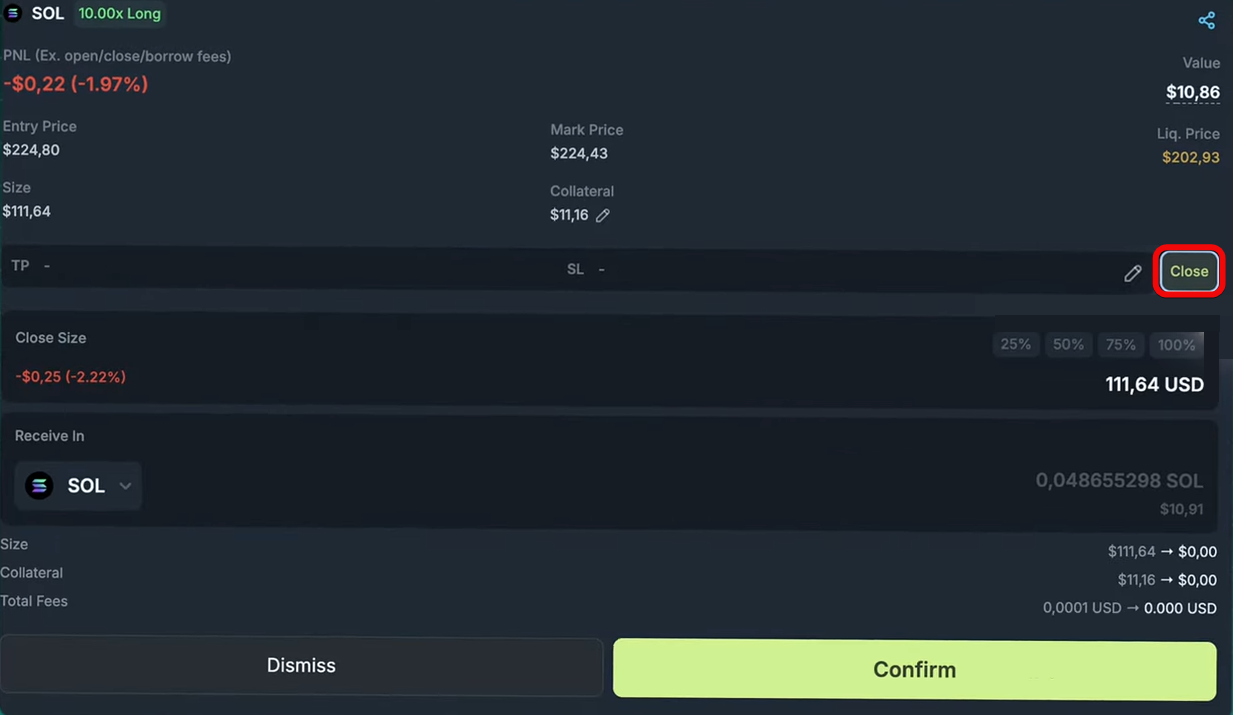

If you decide to open a position, click Open Long, confirm in your wallet, wait a few seconds - and that's it; your position will be displayed right below the chart.

If you decide to close the position, simply click Close, confirm the closure in the pop-up window, and then confirm in your wallet.

The position will close, and your profit or loss will be immediately reflected in your wallet.

Additional Sections

Besides the Pro and Perps tabs, you will see a More tab. Here you will find the following opportunities:

- Positions / PnL – view portfolio positions and their PnL.

- Updates – product updates feed.

- JLP Loans – USDC loans collateralized by JLP tokens.

- Studio – platform for launching your own tokens.

- Stake SOL – staking SOL via Jupiter's validator.

- Mobile – native iOS/Android application.

- Jupiter Send – sending funds without the recipient's wallet (but the recipient must install the app).

Below there are more tabs:

- Verify – token verification for transparency.

- Airdrop Checker – checking airdrops across all wallets.

- Lock – token distribution tool (vesting).

- Stake JUP and Vote – staking JUP for voting and rewards.

- Research – analytics and research on the Jupiter ecosystem.

- Onboard – buying SOL with a card and bridges from other networks.

- Jupiter Guides – step-by-step guides for users.

Finally, at the very bottom, there are tools for developers

- Jupiter Develop – API and tools for developers

- Jupiter Plugin – lightweight plugin for embedding swaps into applications.

Social Capabilities

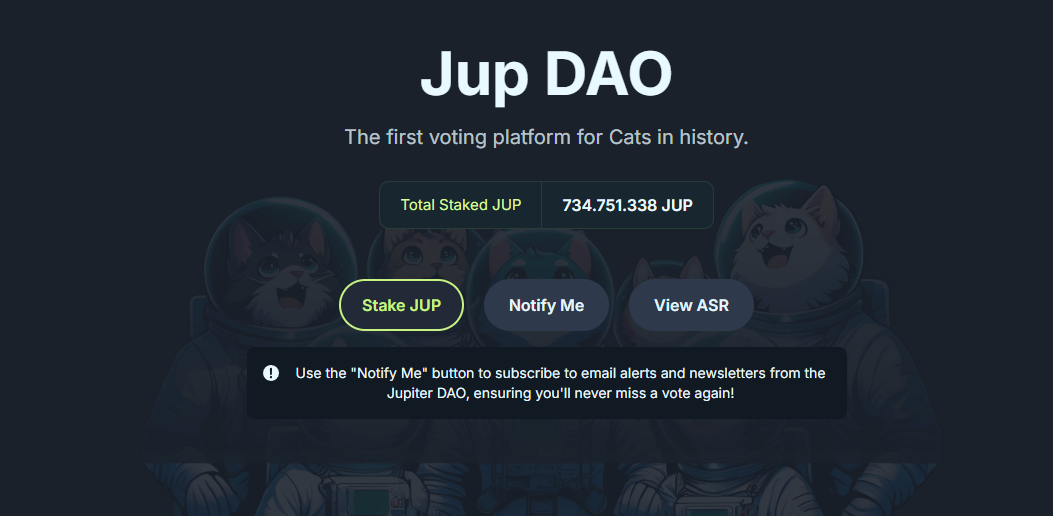

Since this is a DEX platform, all users are equal, and its future is determined by them, not by regulators as on CEXes. The area intended for platform governance through voting and staking mechanisms is located in the Stake JUP and Vote tab.

Becoming part of the platform's DAO is quite simple: you need to lock a certain amount of JUP tokens, and in return, you receive voting rights and the ability to create proposals for implementing various solutions on Jupiter.

The Research section is a kind of forum where you can discuss various issues and problems related to the platform.

The Lock section deals with token locking mechanisms; this tool is often used for managing token distribution, preventing immediate sell-offs, and increasing trust in projects. It is especially useful for those creating their own tokens on the Solana blockchain.

Studio - a section for those who want to launch their own token, attract investments, create liquidity, and manage its launch.

As you can see, most sections in the More tab are not needed by the average user, so we recommend simply not going there.

Comparison with Competitors

Risks for all DEXes with perpetual futures remain high (smart contracts, liquidations, leverage use). Let's consider the main players.

| DEX | Trading Model | Essence of the Exchange | Networks |

| GMX | Liquidity Pools | Liquidity providers earn when traders lose. | Arbitrum, Avalanche, Base, BNB, Sol |

| Jupiter | Aggregator and best route finder for swaps | Leader on Solana, known for swaps, but also offers perpetual futures. | Solana |

| Hyperliquid | On-chain order book | High speed on its own blockchain. | Proprietary L1 Blockchain |

| Aster | Hybrid (Orderbook + AMM) | Rapidly growing player, linked to Binance. | Multi-chain |

| Lighter | Order book with Zero-Knowledge Proof technology | Operates on Ethereum L2 networks. | Ethereum L2, Arbitrum |

| Edgex | Order book | High-performance order book-based DEX. | Proprietary L2 network EdgeX Chain |

| Drift | On-chain order book, cross-margin – entire portfolio for position collateral | One of the oldest and largest DEXs on Solana. | Solana |

| Aevo | Hybrid (off-chain orders) | Specializes in options and perpetual futures. Has Cross-margin | Proprietary L2 (Ethereum) |

Ultimately, we have 2 main models:

- Order Books – trading like on regular exchanges (e.g., Bybit). Leaders here are Hyperliquid, Lighter, EdgeX.

- Liquidity Pools (AMM/pools) - traders trade against a common pool of money, not with each other. Classic examples are GMX and Hyperliquid with its liquidity vaults.

What are the selection criteria?

- If you operate within the Solana ecosystem, then Jupiter (as an aggregator) will be a key player.

- If you value a proven model and "veteran" status, then look at GMX.

- If you prefer speed and a wide selection of liquidity vaults, then explore Hyperliquid.

- If you are interested in new and promising platforms, then keep an eye on Lighter (they use modern ZK technologies).

Criticism and Risks

| Risks | Specific Cons/Risks | Potential Consequences |

| Technical | Recorded incorrect liquidations and failed deals on perpetual futures during peak load periods; dependence on Solana stability | Financial losses; transactions can get stuck |

| Functional Limitations | Only 3 assets available in futures (SOL, ETH, wBTC); risk of selecting fake tokens during swaps | Limited options for traders; less predictable limit order execution; loss of funds due to scam contracts |

| Security | Massive fake versions of the website; risks of smart contract exploits. | Theft of all funds when connecting to a fake site; loss of wallet access; social engineering |

| Risks for Beginners | High leverage (up to 100x) threatens liquidation; tokens locked in DCA/limits; complexity of understanding mechanics |

In conclusion, Jupiter has firmly established itself as one of the leading DeFi platforms on Solana, pushing the boundaries of decentralized trading with next-level aggregation, professional trading tools, and a strong community.

It's not a bad choice for traders and investors. As the exchange continues to expand through cross-chain features, improved governance, and new financial products, Jupiter is poised to continue shaping the future of DeFi.

Stay informed, make balanced decisions, and always prioritize security in your crypto activities.

Disclaimer: All information provided in this article should not be taken as financial advice! The article was created for educational purposes.