DeBank: A complete guide to the best cryptocurrency and DeFi analysis service

You will learn how to use DeBank to conveniently track your wallets and whale addresses, find major holders of any tokens, and also how to find the best trading ideas for yourself.

DeBank is a convenient tracker for your crypto assets with a built-in social network. The service helps track balances and assets across all your wallets in one place. Additionally, it allows you to see what others are investing in and communicate with the crypto community.

Let's move on to the overview.

Overview

The Problem DeBank Solves

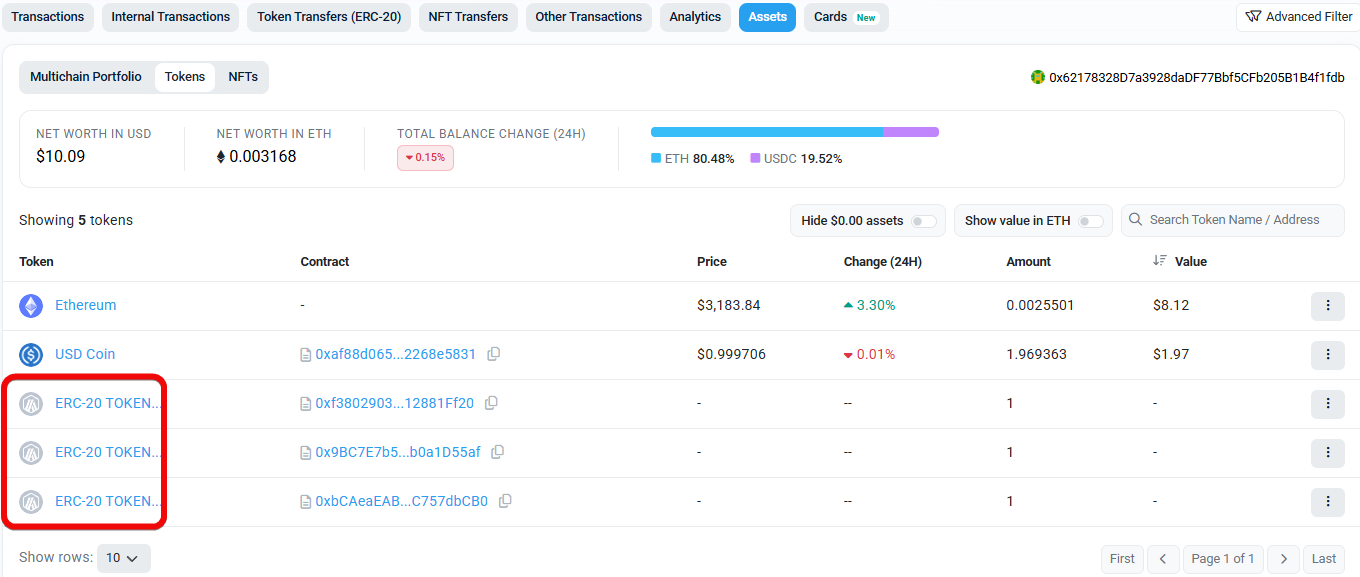

Previously, you used different blockchain explorers to track balances and kept records manually. Each explorer works only with its own network, often doesn't see tokens and protocols, displaying them as regular ERC-20.

Regular explorer

With a large number of networks and positions, manually keeping track of everything becomes impossible.

DeBank solves this problem as a portfolio tracker, displaying all networks and tokens, including small ones that regular explorers hide as ERC. Moreover, it shows DeFi protocols where your funds might be locked.

DeBank explorer - see everything at once.

You could, of course, open each explorer one by one and write down on paper where and how much is invested, but when you have dozens of wallets and positions, it becomes a nightmare!

But DeBank is not just an advanced explorer. Let's see what other benefits this service provides.

| Function | Benefit |

| Portfolio Tracking | Overview of all balances, assets, loans, and yields across all EVM and other networks from 1500+ protocols. |

| Finding Major Holders | Identifying the main holders of any token (wallets and protocols) with convenient analytics. |

| Whale Tracking | Analyzing wallets of major investors - their balances, transactions, and participation in protocols. |

| Finding Investment Ideas | Analyzing strategies of successful investors to find entry/exit points. |

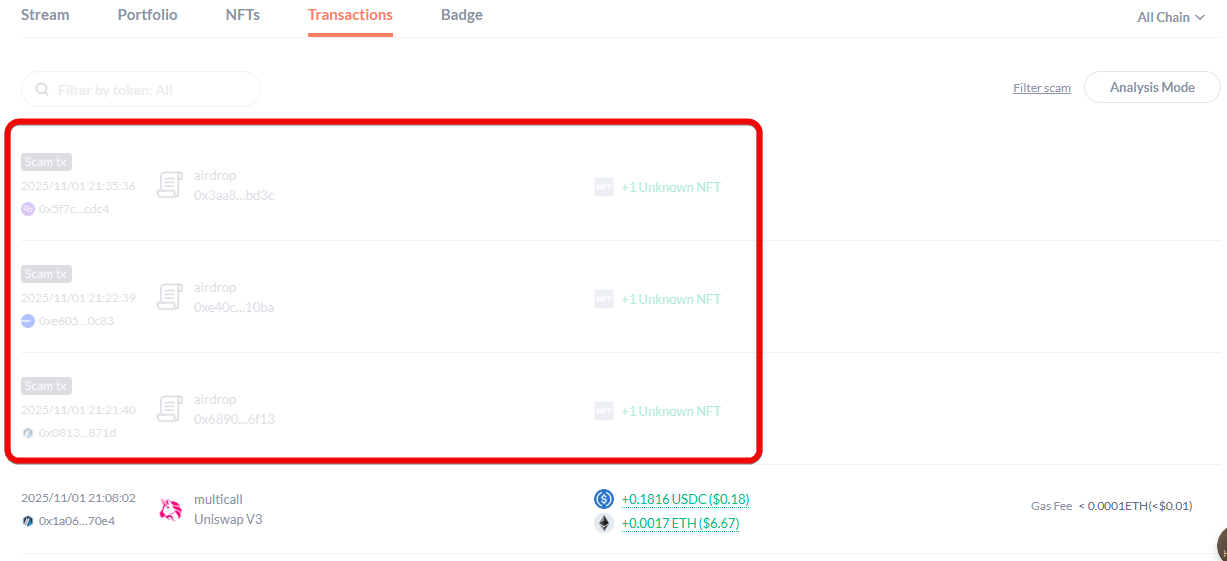

| Protection from Scammers | Automatic filtering and marking of scam transactions and suspicious tokens. |

DeBank also has social network functionality and earning opportunities:

Reward Pools– provides income from a prize fund for reposts, likes, and comments.- Voting – provides rewards for accepted proposals, the size depends on the team's stars.

- DeBank Hi - allows you to message any person by paying a certain amount set by the recipient.

- Saving on bridges (L2 Wallet) - reducing fees for transfers between blockchains.

- Lucky Draws - prize giveaways, often for Web3 ID holders.

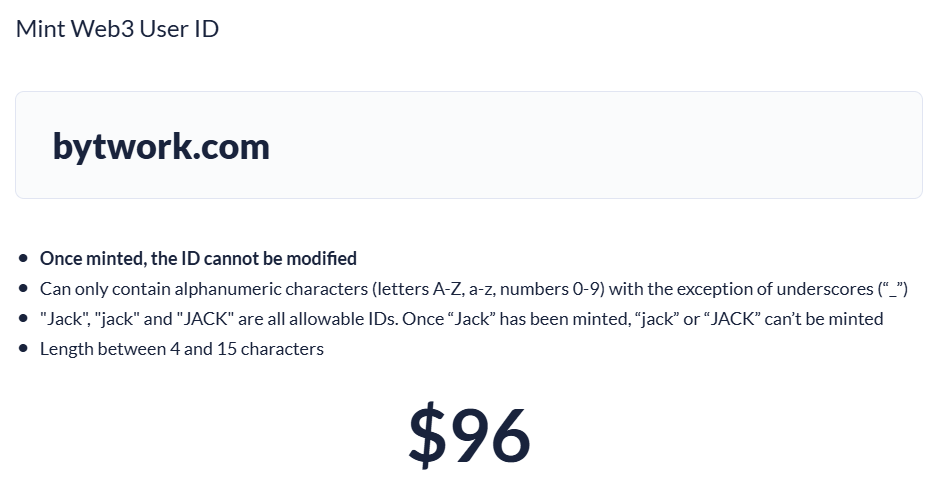

Web3 ID - these are unique account names, issued in a limited edition. It gives you more features and opportunities and is an indicator that the account is not for spam.

How to Use

A full wallet overview can be obtained simply by entering an address in the search, even without registration. However, registration opens more possibilities.

Registration

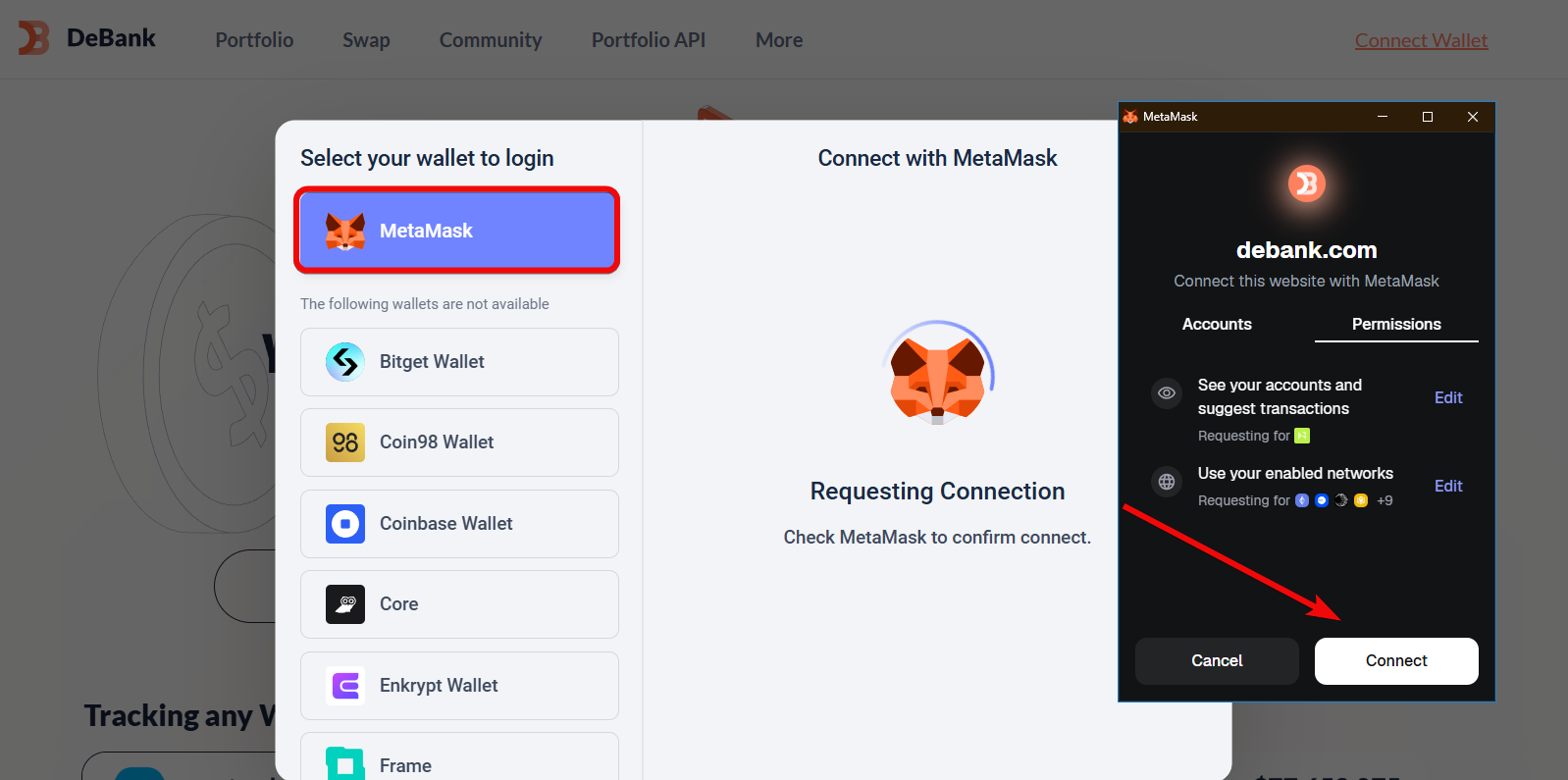

To get started, you need to connect a crypto wallet. Wallets such as Rabby Wallet (DeBank's own development), MetaMask, Trust Wallet, Coinbase, Onekey, Enkrypt, Phantom, Bitget and other browser wallets are supported.

Connecting is simple: click Connect Wallet, select a browser wallet, and confirm the connection in it.

Important: connecting a wallet only grants read permissions! That is, DeBank cannot make transactions without your knowledge.

Wallet Tracking

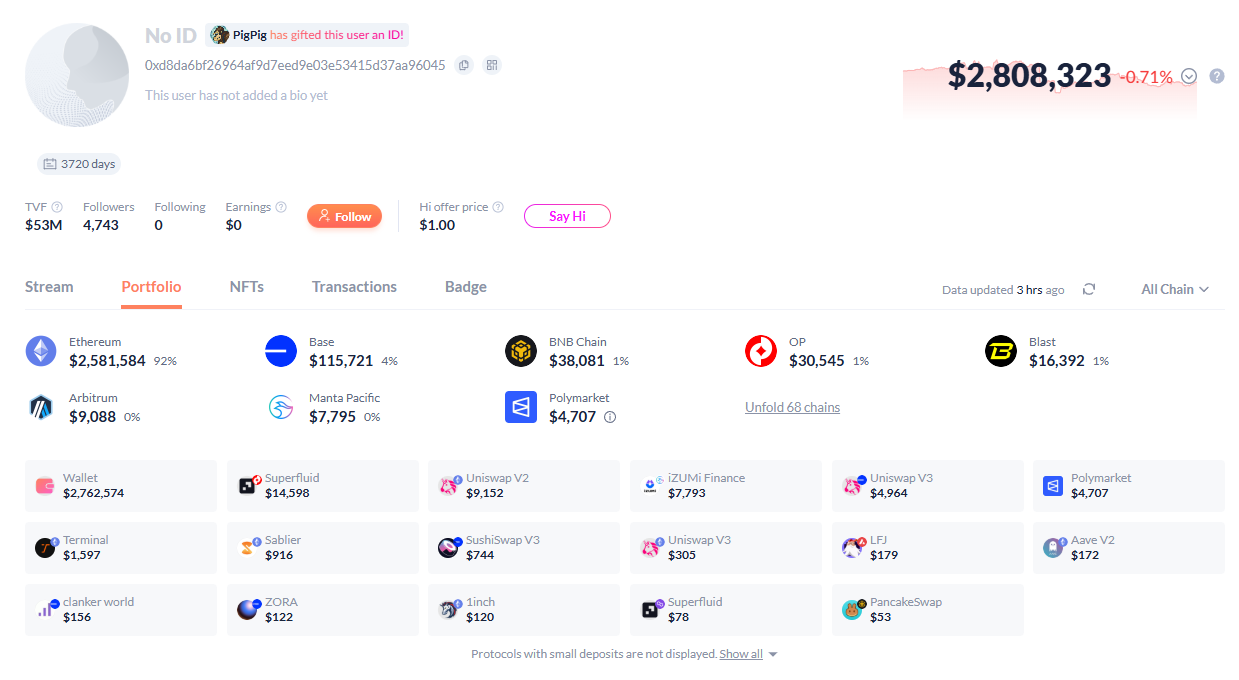

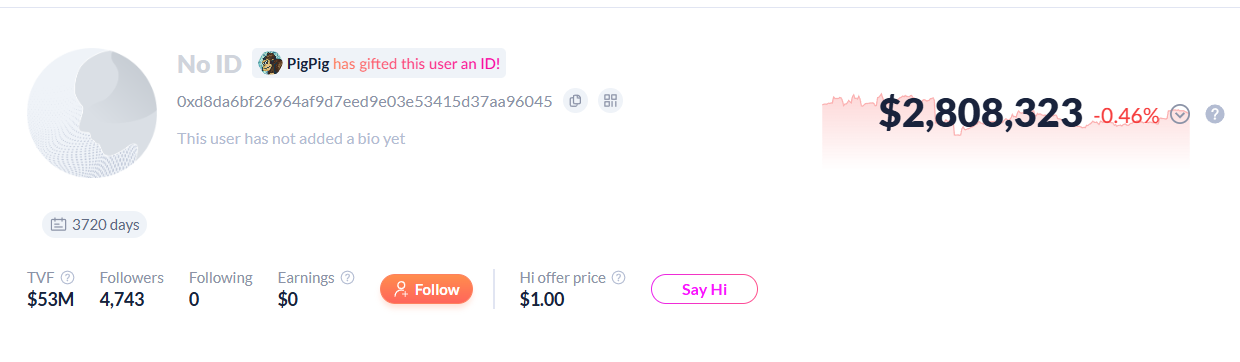

At the very top, the Web3 ID (or its absence) is displayed, the wallet age (from the date of the first transaction), the current balance, balance history with a chart for 24 hours

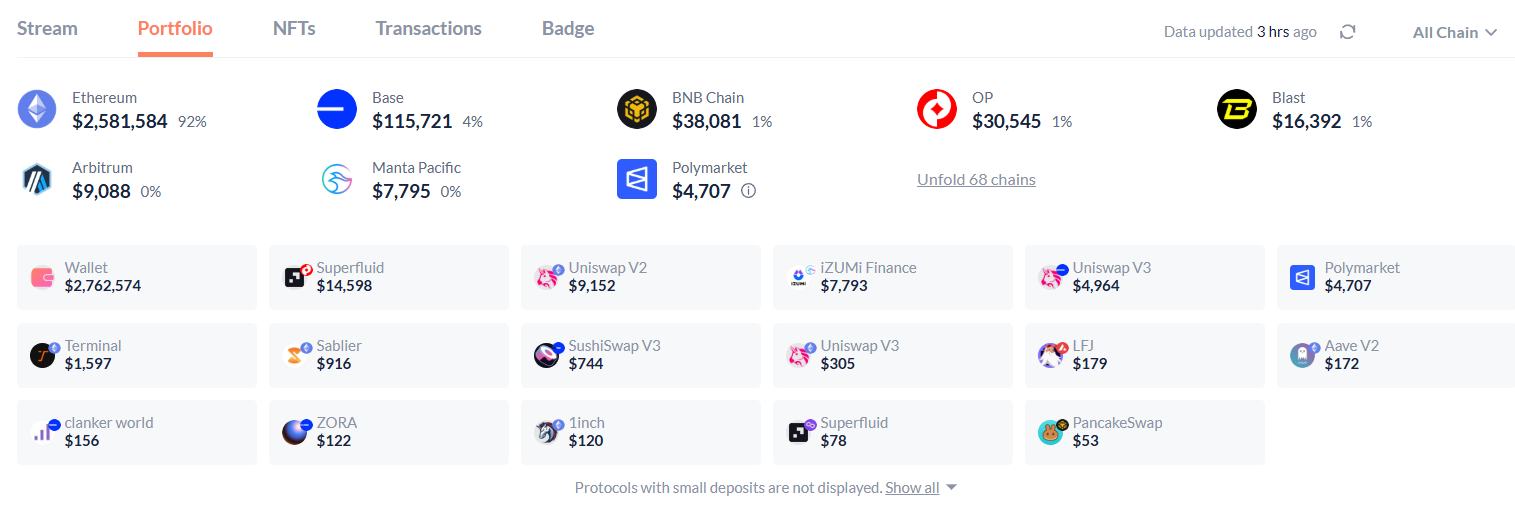

The Portfolio tab displays the balance across all networks and the largest positions in protocols.

The service pulls data from the blockchain, filters scam tokens, and shows only legitimate contracts. Fraudulent transactions, which usually contain phishing links, are displayed here transparently.

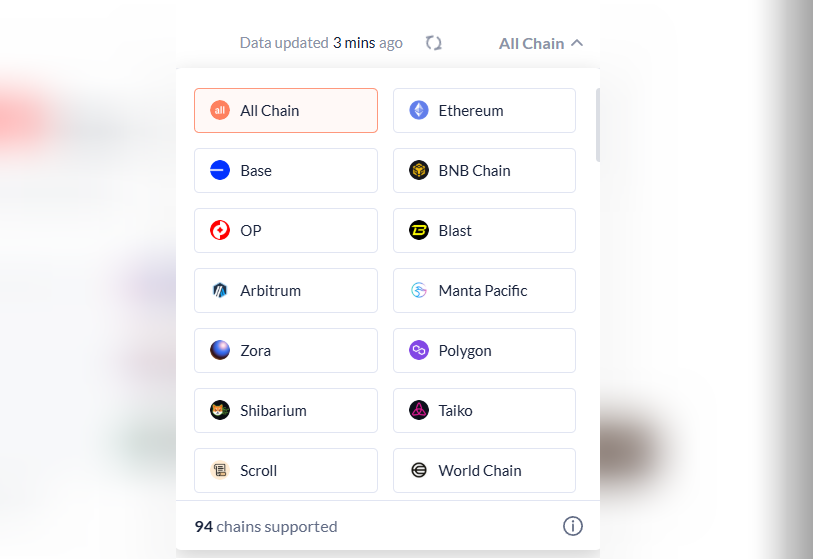

You can also manually filter your own or any other wallet by 94 networks.

Why do we need many wallets? We keep a separate strategy on each to accurately calculate profit and keep records. If you work in DeFi, sooner or later you will also have at least 2 wallets.

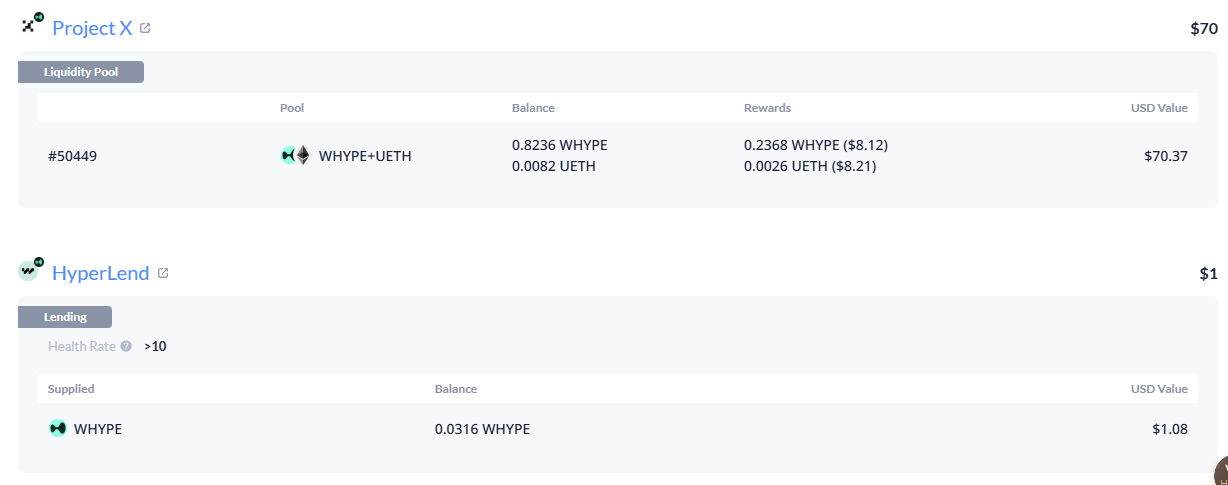

Under each position, the yield is visible: pool fees and lending - all on one screen.

It is a convenient portfolio tracker for all EVM-compatible networks. EVM-compatible are those built on the Ethereum base.

However, the basic explorer is just a small part of the possibilities. DeBank is convenient for finding investment ideas and major players.

Finding Investment Ideas and Whales

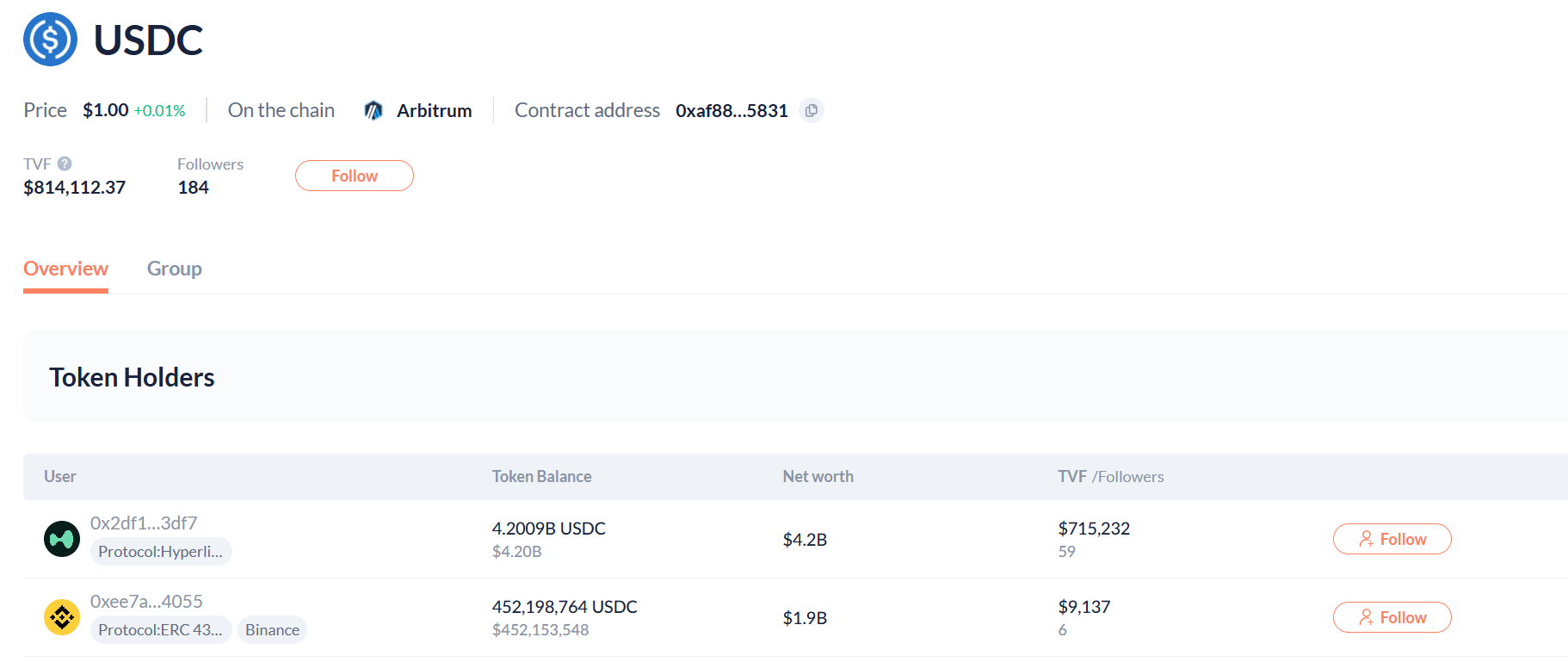

For example, let's take the Arbitrum network and search for major token holders. There are several entry points: let's start with a token search. A page similar to an explorer will open, but with human-readable labels: it is known that this address belongs to the Hyperliquid exchange, and it holds 4 billion USDC.

The first 5 pages of results are usually occupied by giant protocols, and ordinary users have to be searched deeper.

Example with a regular trader

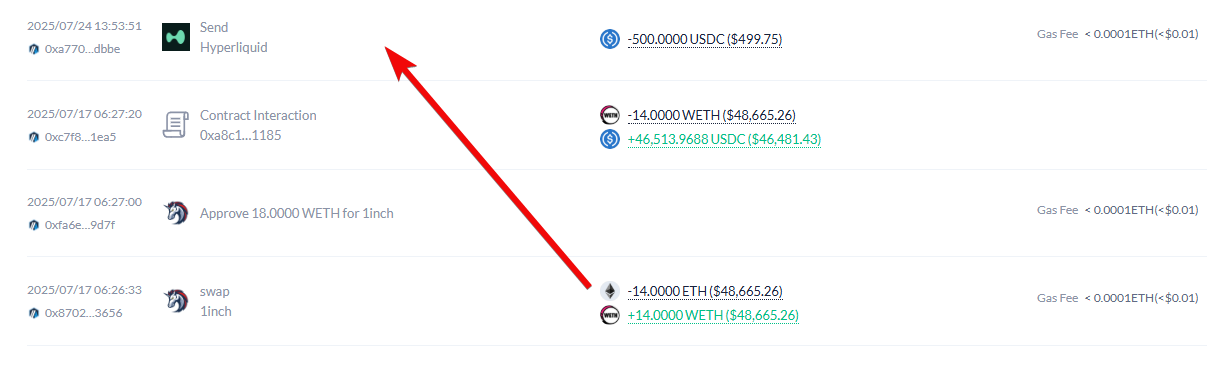

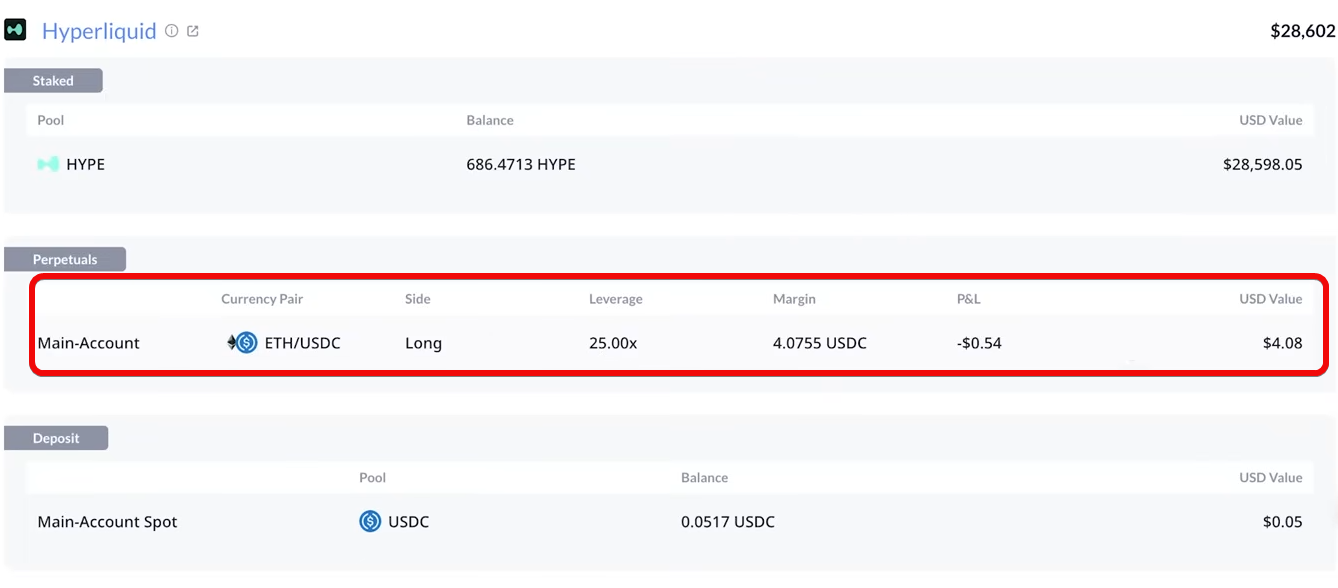

On the last pages, there are smaller wallets - for example, with $1.4 million. From the transactions of this trader, it's easy to reproduce the strategy: the person sells ETH, sends it to Hyperliquid.

Next, he opens a long with 25x leverage, and on the Optimism network exchanges it for USDC.

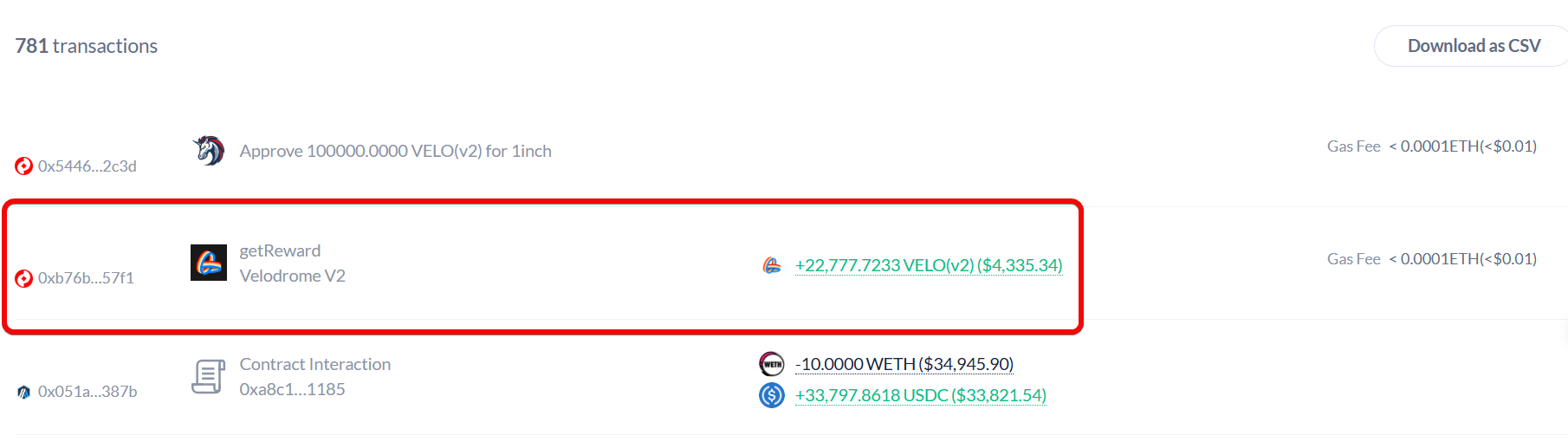

You can track when he entered, how much he has already earned (for example, $4,335 in fees), and decide whether to copy him.

If this seems complicated to you, start by learning about DeFi:

But the question arises: who exactly should you study? The easiest way to search and view investors is the Web3 Social Ranking tab.

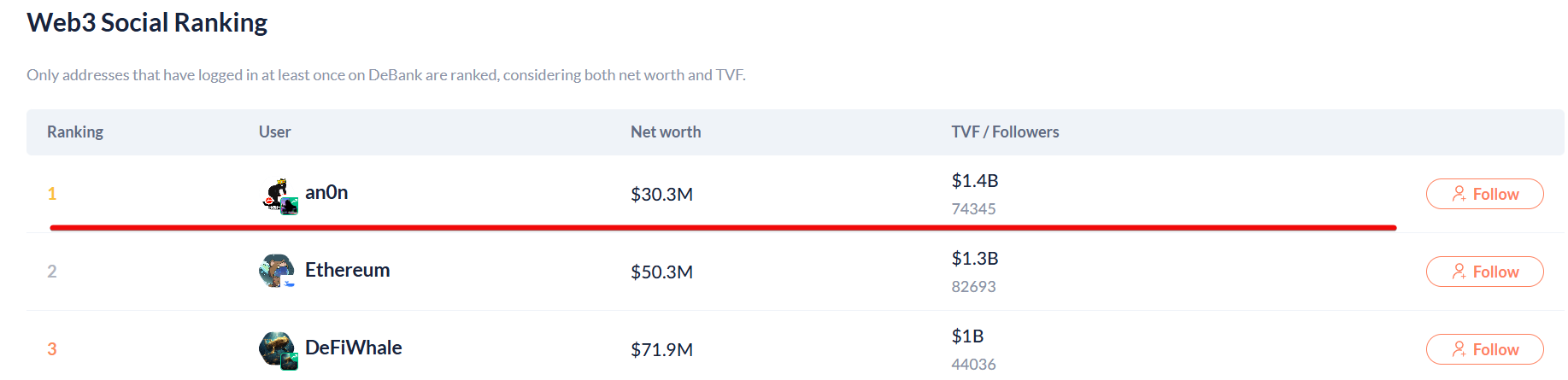

Rankings - Social Ranking

The Social Ranking section provides a list of 200 pages of real investors, sorted not by capital, but by activity and number of followers.

The leader has $30 million, but he is followed by people with capital of 1.4 billion - a clear signal he might know something.

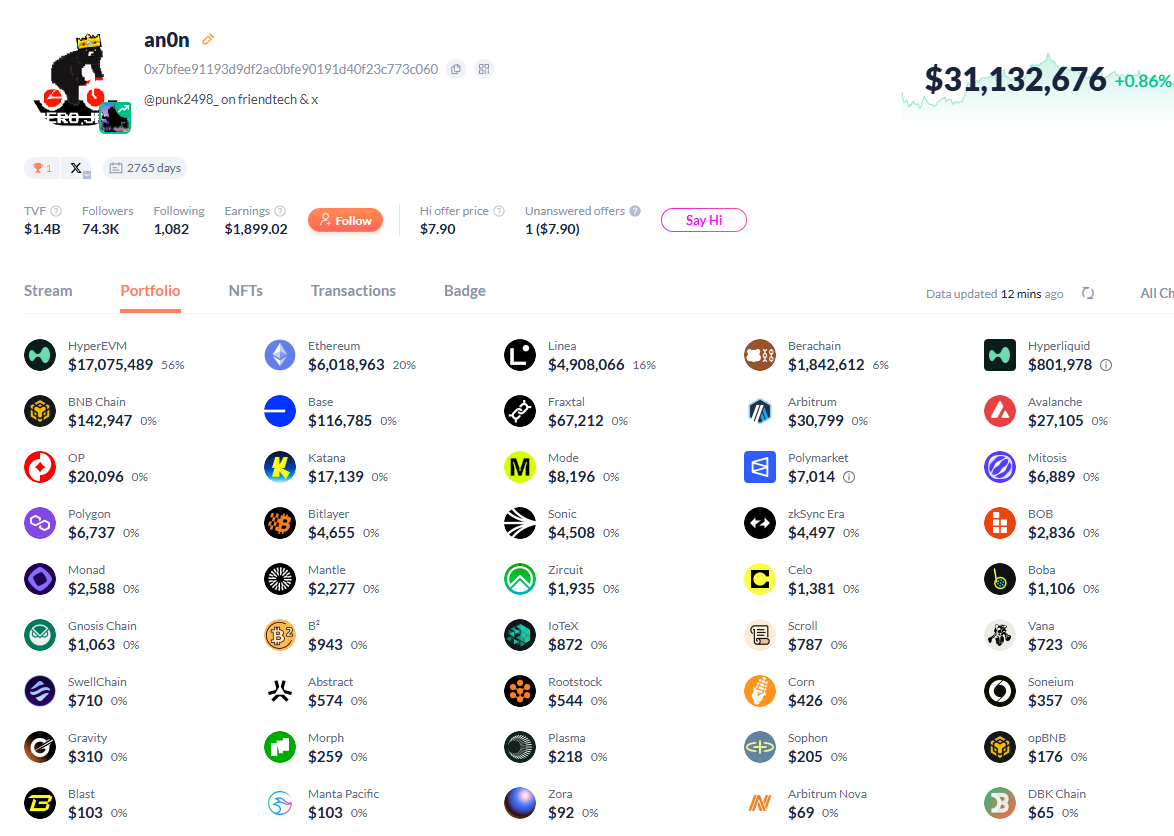

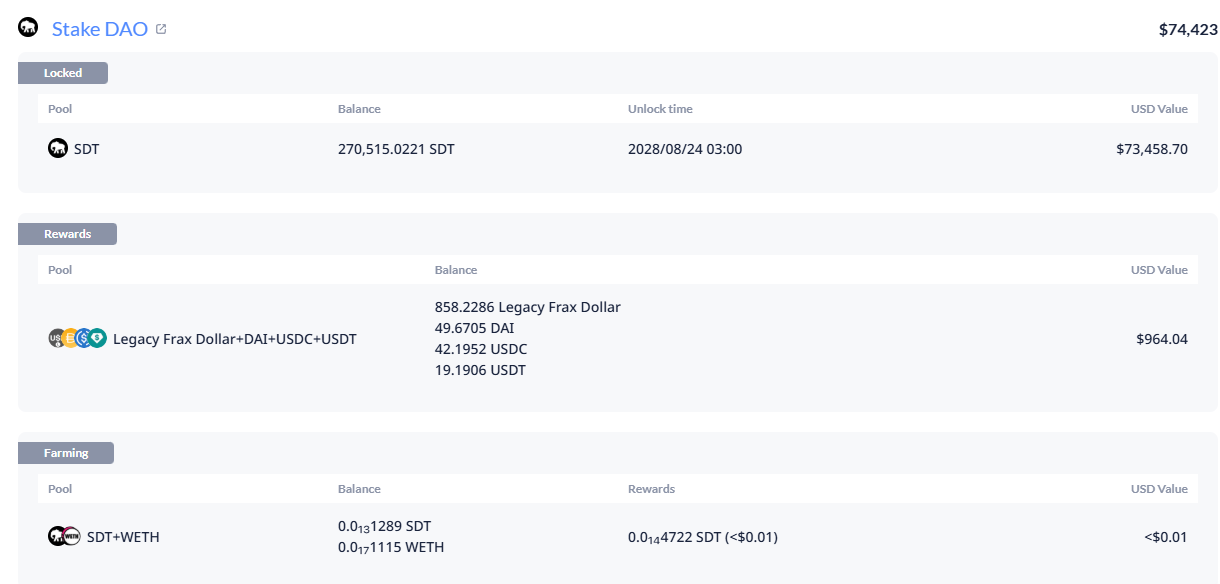

Open his portfolio: dozens of networks and protocols. Let's see what he's doing.

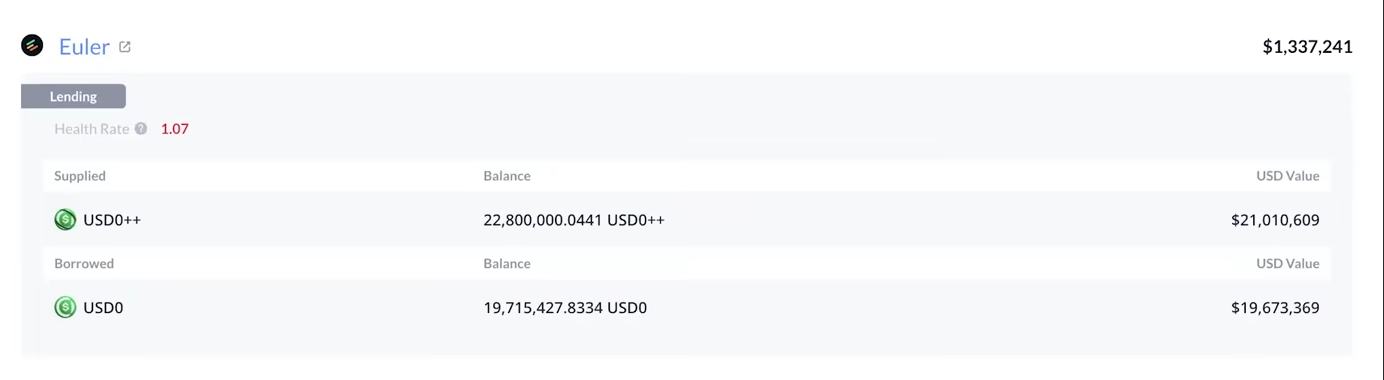

Scrolling down, we see identical tokens USD0 and USD0++ in different strategies - this is so-called looping, where the token spins in a circle: borrowed, exchanged, invested, borrowed again.

We discussed the looping strategy in more detail in the guide about the Fluid exchange, check it out to understand.

You can delve into the details: how much he deposited, when he exited, what the rates are, if there are audits, who else is participating. History is important here – the blockchain cannot be faked, which means any address you like can be taken as an example: look at what protocols, tokens, yields it has, and copy the idea.

Another investor, for example, specializes in DAO tokens: in each protocol, he has liquidity with the native token - he receives a share of the fees for voting.

This is not our profile, but the strategy is transparent and has its place.

Community Social Network

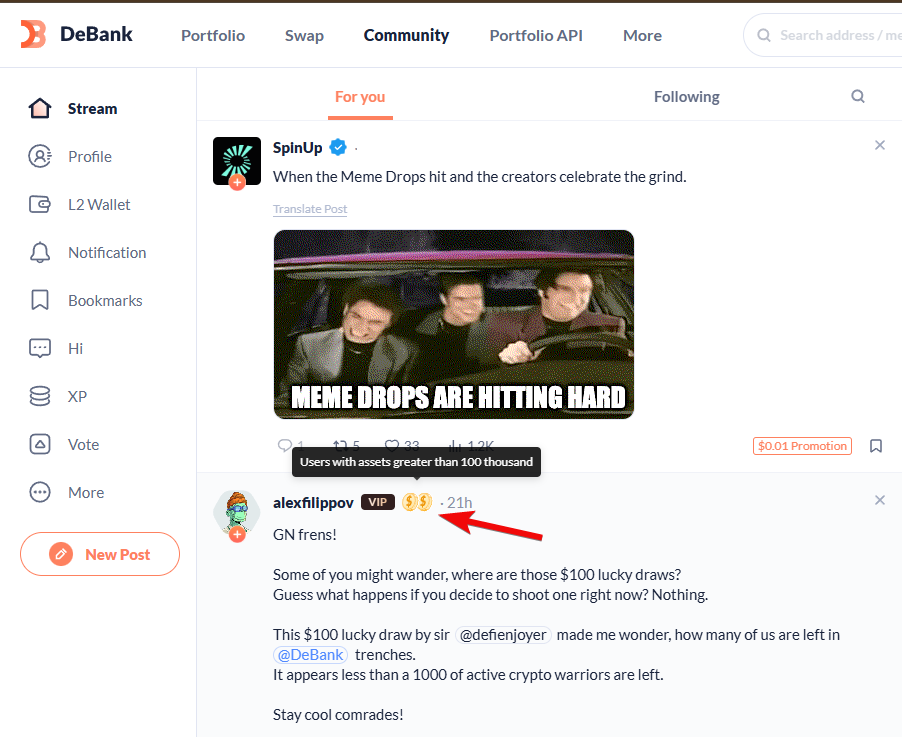

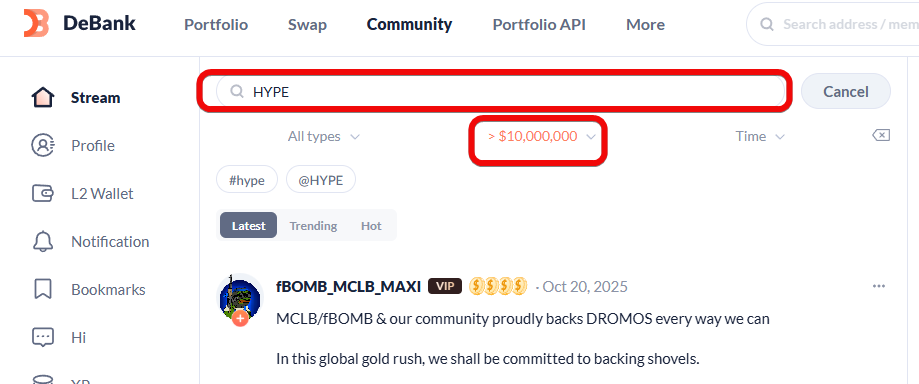

The Community section works as a social network: investors write posts about tokens, and next to it, you can see how much of their own money they have.

But as with any social network, a drawback is immediately visible here: a lot of spam and memes that are not always needed. This is partially solved by search, where you can specify the token and the amount of funds of those who write posts.

Open a liked author - see where they invested, what profits they took, what networks they use. This is a convenient entry point into new protocols: a randomly opened DEX, a new network, an unfamiliar pair - everything can be quickly studied on DeFiLlama and decide whether to enter.

Subscriptions and Personal Feed

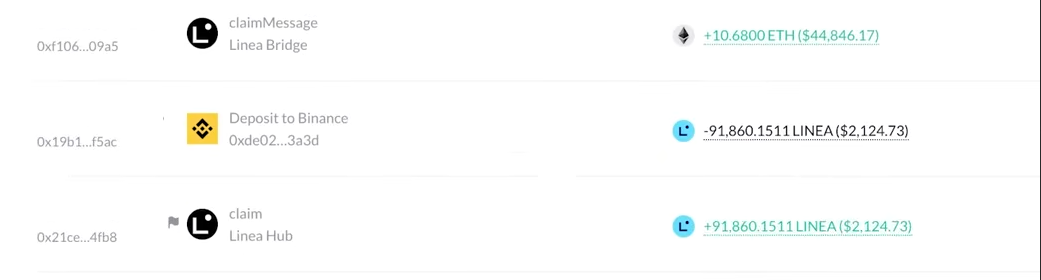

Found suitable investors by style – subscribe. DeBank builds a feed of transactions from those we follow, like X/Twitter, but for crypto!

The next participant just posted: he collateralized ETH and USDT on the Linea network, where there is a bonus program, and has already received 91,000 LINEA tokens worth ~ $2,100. We look at his strategies, evaluate yields, subscribe, etc.

It's important to understand that past yields do not guarantee future ones, but this is a good starting point to look for strategies and protocols.

Activity in this social network also makes sense for a possible retroactive airdrop (retrodrop). A retrodrop is a retrospective reward for early project participants in the form of tokens for their activity at the start.

What does Web3 ID give?

Web3 ID - these are unique account names that were issued in a limited edition. A Web3 ID owner is considered more valuable to the community and is one of the indicators for future airdrops.

This is now a paid feature, and it's quite expensive!

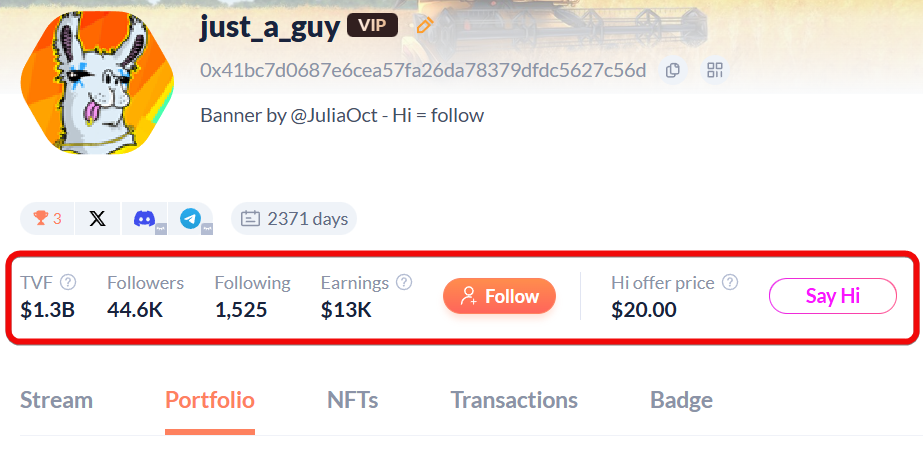

Along with Web3 ID, there is also a rating system. The rating depends on 4 indicators: the monetary value of followers (the TVF indicator), the number of followers, trusts (analogous to likes), and wallet balance.

Users without a Web3 ID have severely limited opportunities for earning and development in the social network. For example, they can only create 3 posts per day, make 10 comments, and 50 trusts. The higher your rating, the more posts and comments you can write.

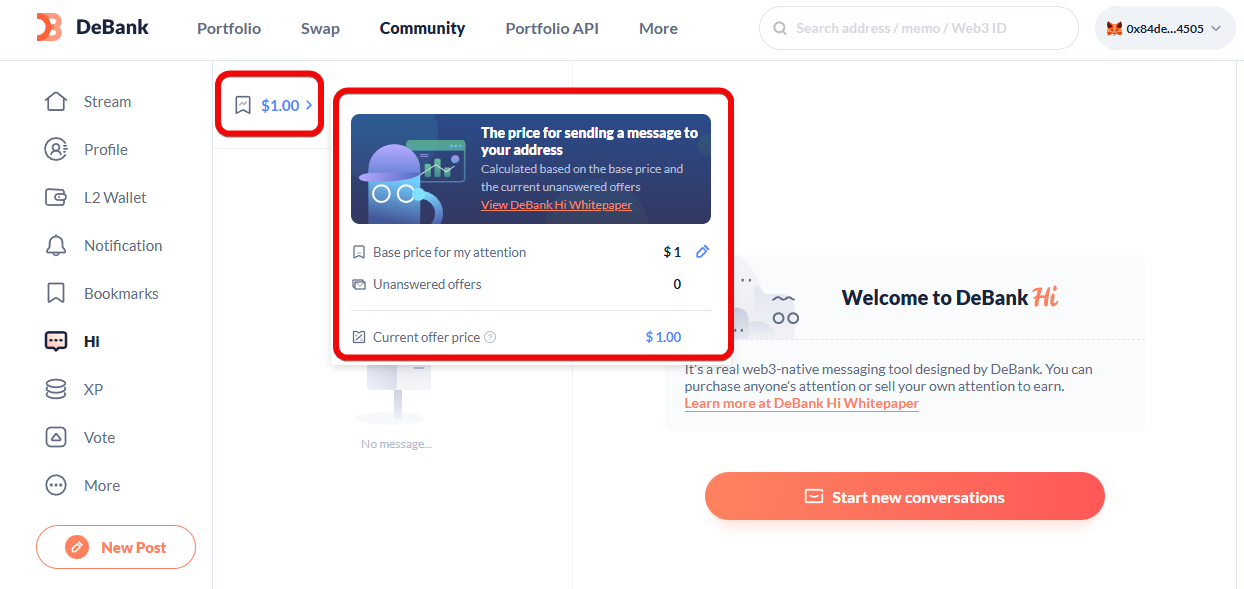

Paid Messages

DeBank also includes a messenger function that allows sending private messages. Sending a message requires payment of a certain amount, which the recipient sets themselves. This eliminates spam attacks, because if a spammer wants to write, you'll earn a little bit from it.

Using this function requires registration in a separate L2 solution from the project.

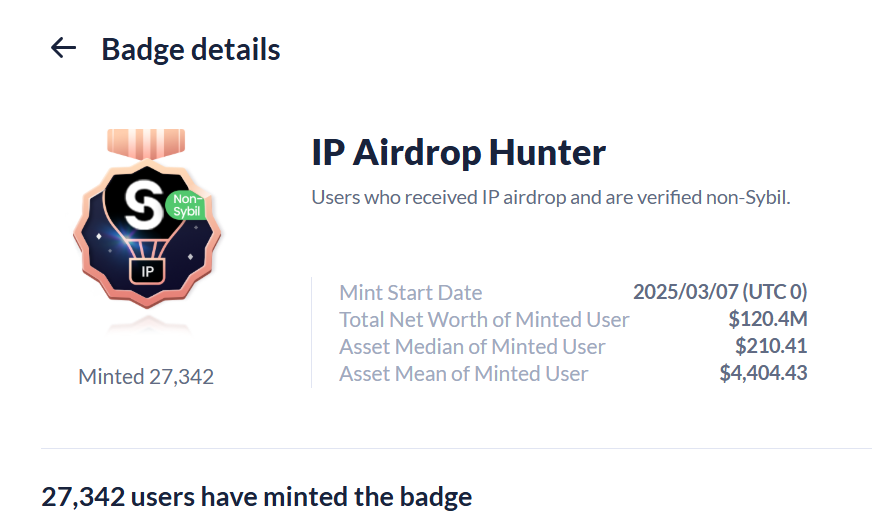

Achievements - Badges

Badges are received for certain activities (for example, 100 days on-chain, Web3 ID Holder, winning a giveaway). Badges increase account trustworthiness and promote it in the overall ranking. Badges are also an important multiplier for a future airdrop.

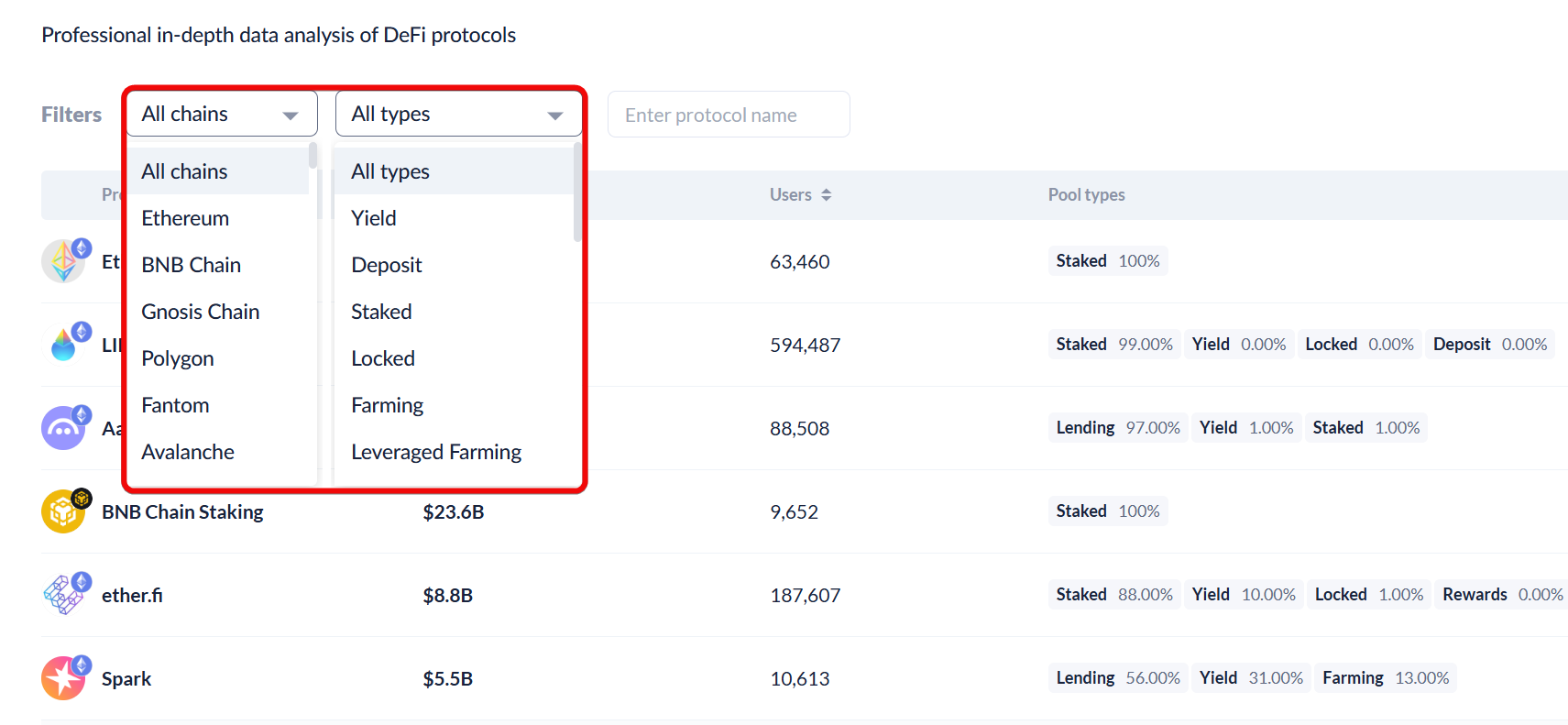

DeFi Protocols for Market Analysis

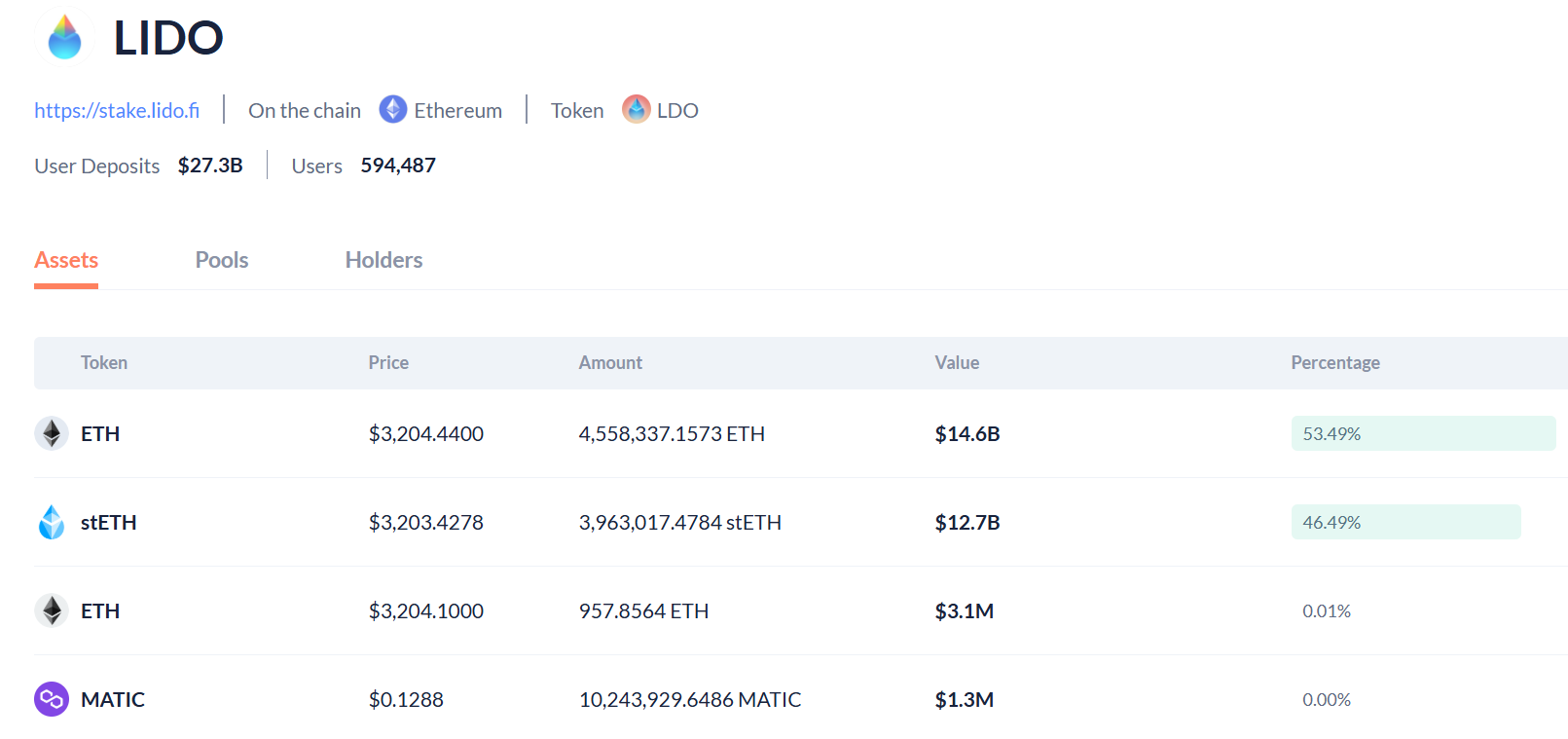

Let's consider the Protocols tab, designed for in-depth DeFi market analysis. Here is a breakdown of all DeFi protocols.

Here you can view the total user deposits, the number of interacting wallets, pool type, and top tokens inside.

Protocols can be filtered by blockchain network and deposit type. You can search for a specific type if you prefer DeFi activities like Lending, Farming, or Yield.

The protocol page shows wallets and amounts, pools, and key participants.

Built-in Exchange

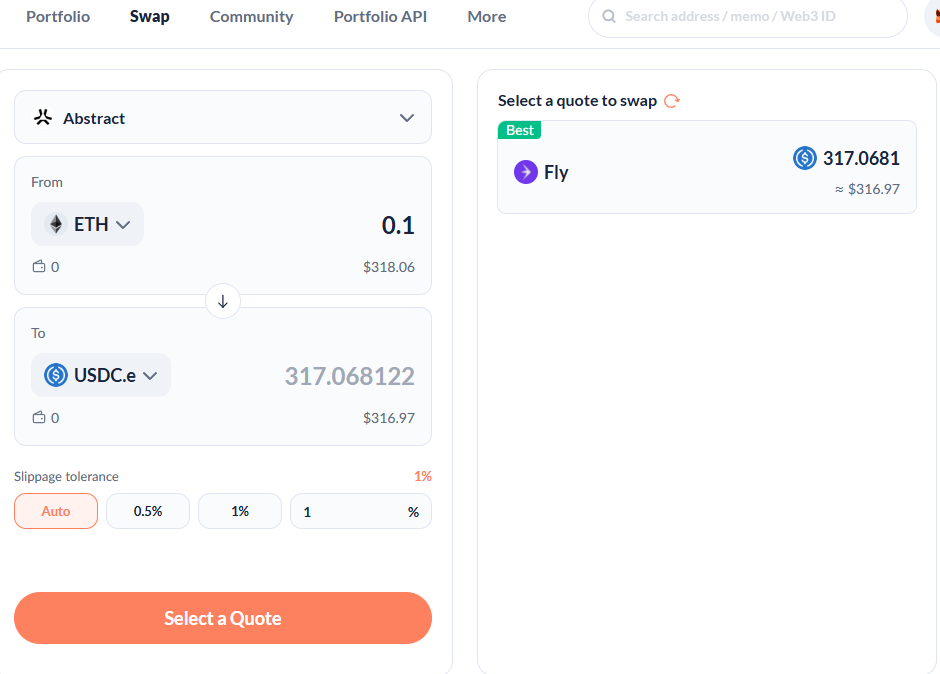

There is also an aggregator, an exchange here, where you can swap certain coins.

However, there are not as many swap routes here as on other aggregators.

Advanced Features

Part of the functionality is only available with a Pro subscription. Among them:

Bundles- managing wallet sets - allows managing groups of wallets and viewing summary information about them. Available for up to 10 groups of 100 addresses each, with total net worth, top tokens, and protocol participation across all addresses at once.- Pro users can also export full

on-chainactivity for analytics. - The

Time Machinefunction allows tracking the balance change of any wallet from an arbitrary date.

Criticism and Drawbacks

We always try to cover the topic from all sides, so let's note a number of negative aspects.

| Area | Drawback |

| Social Network Feed | 90% of posts are memes, whining, copy-paste, and ref links; useful guides are rare |

| Referral Links | Almost every useful post contains a ref link; turns the feed into spam |

| Motivation | Users create content only for the airdrop and rating, not for the idea |

| Rating | Top positions are gained with a large balance, not content quality |

| Interface | The design is outdated in places, no video embedding, no giveaway tracking |

| Paid Features | $96 for web3-ID and VIP functions that do not justify the price |

| Long-term Risk | The platform loses activity as soon as airdrops end |

Also, to get most of the benefits (including access to the Pro version and badges), you need to be a Web3 ID holder, which costs $96.

As a result, platform development gives way to monetization, and thematic narrowness prevents it from becoming a mass social network.

On the other hand, no one is forcing you to use the social network. As a portfolio and DeFi-protocol tracker – it's still an excellent place.

Disclaimer: All information provided in this article should not be taken as financial advice! The article was created for educational purposes.