What is KYC [Know Your Customer]? How to pass the verification procedure (KYC)

Many organizations whose activities are related to finance are required to follow the rules of KYC (Know your customer). Cryptocurrency exchanges are no exception.

KYC rules on the cryptocurrency exchange are a key condition for licensing the platform and an important component of its security. We offer you to learn more about what KYC, AML are and why they are needed

What is KYC and AML on the exchange?

Security services at the state level are trying to prevent the use of money for illegal purposes. The key means of fighting are KYC and AML standards, which oblige financial companies to collect information about customers and identify suspicious transactions.

KYC (Know your Customer) — verification of the customer's identity. The key goal of KYC is to cut off those customers who cannot use the services of the service. For example, it helps to screen out underage users, unregistered migrants or people with a criminal past.

You should understand that most financial regulators require financial institutions to have a KYC system, but they do not specify exactly how it should be done (implemented).

Most often, financial regulators require banks or exchanges to collect a minimum set of documents and personal information. This data usually includes:

- Name

- Address

- Identification number / passport number / license

- Country of residence

- Date of birth

Depending on the exchange (or any other financial institution), additional verification may be required: a selfie with a document, a photo of a document, a small video on a webcam (or phone) via the exchange's built-in application.

AML (Anti-Money Laundering) — measures that prevent the laundering of money obtained illegally. AML is similar in many ways to KYC, but is aimed at tracking the origin of funds and checking for financial crimes.

Why was KYC introduced?

Most states have made KYC and AML a mandatory requirement for financial companies. Using these standards, companies can obtain information about the client and the source of his income, prevent fraud, use of money for illegal purposes. For users, this opens access to the company's services and guarantees the protection of their rights.

Things have been different in the crypto world for a long time. According to Coinfirm research, only 26% of cryptocurrency trading platforms comply with the requirements of KYC and AML regulators, and only 14% have received licenses from the government (USA, Japan, Hong Kong). 69% of trading platforms are licensed by governments with more loyal requirements and comply with KYC and AML requirements only partially.

The need to verify a person in the crypto community is perceived with a degree of skepticism, since this measure contradicts one of the main ideas of the blockchain — anonymity. Meanwhile, verification of identity and source of income allows the exchange to be considered a reliable platform through which no one launders money. For the clients of the exchange, which meets the requirements of regulators, it is also a guarantee of protection of funds, since they can be sure that it works in the legal field.

According to a KickAcademy survey, more and more traders have recently been choosing platforms with KYC and AML:

- 41.9% of respondents choose exchanges with mandatory verification, because they believe that it is important for legislation and security.

- 47% choose exchanges with KYC due to the fact that they provide better financial protection, they can track suspicious actions on the account.

- 42.2% believe that exchanges with KYC are able to provide safer investments due to the fact that they prevent problematic assets from entering the market from countries under sanctions or from suspicious persons.

Thus, for many, KYC is not only a mandatory requirement of regulators, but also one of the advantages.

What data is required for the verification procedure?

Verification is the process of verifying the customer's data to confirm his identity. The Know your customer standard requires the customer to provide:

- full name;

- date of birth;

- citizenship;

- residential address;

- a copy of his identity document;

- a copy of the taxpayer identification number;

- an extract from bank accounts to verify the address of residence.

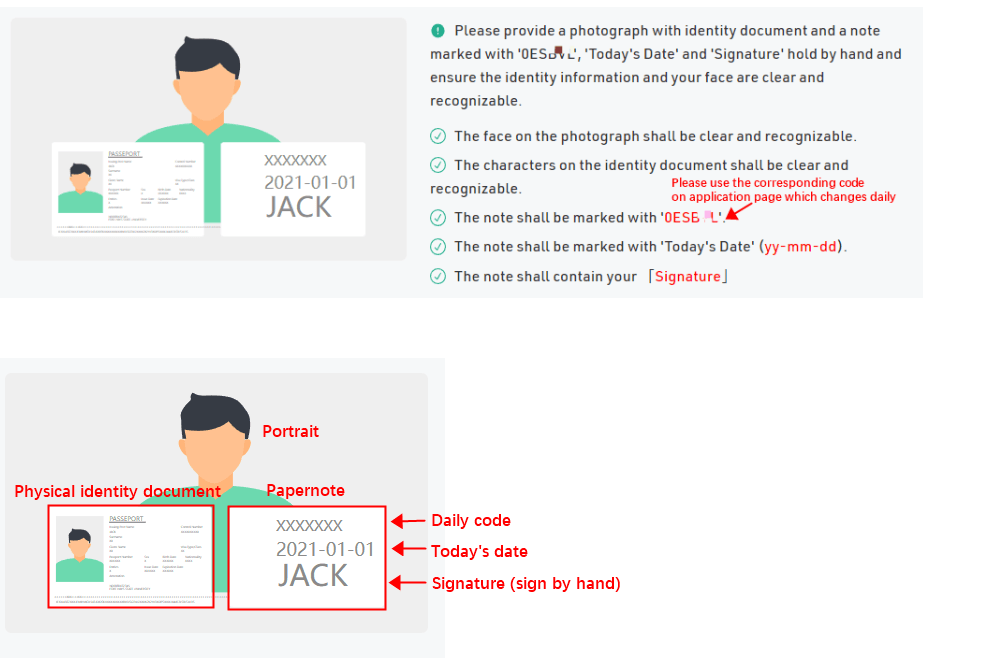

The list of requirements may vary depending on the chosen site. It happens that the exchange also requires you to provide a photo with a passport spread, a photo of a bank card and other information that would allow you to make sure that the provided data and copies of documents really belong to the person on the other side of the screen.

You may also be asked to take a selfie with a document and hold a piece of paper in your hand (with the date and signature).

KYC procedure

Verification of the client's identity is usually requested by the trading platform if the client has exceeded a certain limit, suspicious actions have been detected or a withdrawal of fiat money has been requested. On some trading platforms, verification is a prerequisite for creating an account.

To pass KYC, the user must go to the appropriate section on the trading platform and indicate truthful and reliable data in the proposed questionnaire. Next, the user must attach scans of documents confirming the entered data, agree to the processing of personal data and send the documents for verification.

The documents are checked by the security service of the trading platform. She conducts:

- identity verification;

- proof of residence address and citizenship;

- verification of participation in criminal activity;

- identification of sources of funds and their purpose;

- search for suspicious activity.

Verification, on average, takes from 1 to 5 days, after which the account is granted the status “verified".

Regulatory issues

If cryptocurrency, from the point of view of legislation, is not money, then why KYC? But, despite the differences between fiat and digital money, laws obliging cryptocurrency platforms to comply with KYC requirements are being implemented, so any platform that does not comply with this condition may be:

- blocked;

- her bank accounts may be frozen;

- subjected to a complex check;

- accused of fraud

Another problem is that due to the introduction of KYC, users may lose access to their funds. For example, without noticing in a timely manner a letter from the administration requesting verification. A similar thing happened with the Coinbase exchange, which first introduced very simple requirements for account verification.

To work with fiat, it was enough for customers to provide some personal information. Then Coinbase, without warning, complicated the KYC requirements for withdrawing funds: and as a result, how many funds remained frozen in user accounts is unknown.

Many users for various reasons do not want to provide their data to the platform. Ultimately, KYC can be circumvented only with the help of forged documents.

Exchanges without KYC

Many users prefer to stay in the private zone and choose decentralized exchanges, as well as exchanges without KYC. After all, the key feature of cryptocurrencies is that they can be regulated independently and do not require government approval.

It is quite difficult to find exchanges operating without KYC in 2022.

Here is a list of exchanges without KYC:

- ProBit Global

- Deepcoin

- HolyTransaction

- Kuna

- ApeSwap

- Huobi (the limit without KYC is $ 1500 per day)

And many other decentralized exchanges (DEX).

Pros and cons of KYC

Cryptocurrencies were conceived as an alternative means of payment to traditional money. And the requirements of regulators obliging to comply with KYC prevent the preservation of a decentralized and self-governing structure of cryptocurrencies.

In addition, customer verification on crypto exchanges is still far from perfect. There are no clear rules – how and under what circumstances the exchange should check its customers. Perhaps, in the near future, the crypto community will offer its own regulatory options. For example, today there is already a KYC.

legal platform that allows checking clients based on blockchains. Distribution chain solutions for banks are also being developed.

In the meantime , we can highlight the following advantages of KYC for exchanges:

- the check allows you to cut off minors and suspicious customers at an early stage;

- verified users will always be able to restore access to their account;

- with KYC, the protection of user funds increases;

- customer verification allows the exchange to work in the legal field, and its clients to be sure that their rights are protected by law.

Of the minuses, it can be highlighted that the KYC policy contradicts the main manifesto of cryptocurrencies. By providing their personal data, customers also risk that, in case of hacking of the exchange, this data may be stolen and used for fraudulent purposes.

The KYC procedure remains unacceptable for many cryptocurrency investors. At the same time, surveys and statistical studies show that this opinion is gradually shifting towards acceptance. Almost half of users consciously choose exchanges with KYC, because they are confident in their greater security and safety. At the same time, customers still have a free choice between anonymous and KYC exchanges.